Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

EXTREMELY IMPORTANT: Since writing this review, Regal Assets has had a TON of negative feed. Over the second half of 2022 there have been many extremely negative and disturbing reviews about the Regal Assets company. We will be stripping ALL links to Regal Assets and we DO NOT recommend them at all. It's very obvious that something big changed with this company (the owner has disappeared). IGNORE all information about Regal Assets in this review until we are able to change it. Again, do NOT do business with Regal Assets.

Have you been wondering how to diversify your retirement portfolio? Or are you maybe concerned about the recent volatility of the economy? A silver IRA is an option for you. You can invest your money in IRS-approved precious metals like silver and gold, and you'll receive the same tax benefits as with any other IRA.

Silver IRAs are a type of self-directed IRA, which means they aren't managed by a third party. You choose what assets you use and how to allocate them.

That can seem like a daunting task if you don't have a financial background or tax expertise. This is where silver IRA companies come in. These companies specialize in helping people open and maintain precious metals IRAs. Their main source of income is from selling you the silver that will be held in the account.

We've taken a look at the top five silver IRA companies on the market. Here's what you should know about them.

Best Silver IRA Companies

#1. Goldco

Goldco is the top recommendation on the list because of their consistent excellence in every regard. They provide stellar education, great customer service, excellent products, and all with competitive pricing. Whether you're a beginner or an expert, they will make the silver IRA process completely free of hassle.

The company charges 80 dollars in annual fees, plus the cost of storage and maintenance. Storage is 175 dollars for accounts under 100,000 dollars. Once you reach that threshold, the annual payment increases to 225 dollars

These flat fees are very competitive, especially compared to percentage-based fees that punish investors for having large accounts.

A minimum investment of 25,000 dollars is required, which can be funded through existing retirement account rollovers. They are also waiving the first year of fees for new clients, plus offering silver coins as a bonus for new signups.

IRAs are the company's main specialty, but they also offer other services. One example is the market system. When you invest, you're given access to Goldco's high tech market system, which gives you updates and predictions and information about different economic factors.

Since Goldco specializes in IRAs, their products are compliant with IRS regulations. They are also experts in the paperwork required to set up an account, as well as the requirements for custodians and storage. They handle the entire process so you never need to speak to another third party.

The company doesn't own any storage vaults of their own. However, they partner with several security companies that operate IRS-approved storage vaults. They also work with financial institutions that can function as account custodians.

Goldco's consumer reviews have been overwhelmingly positive. They also haven't been plagued by some of the red flags that less reputable companies might have. Complaints have been quickly resolved, and most seem to be due to consumer misunderstandings rather than poor business practices.

The exact prices for products aren't listed on Goldco's website. Precious metals change in value from day to day, and sometimes even from minute to minute. Goldco also considers other economic factors when setting their prices.

However, their pricing is fair, and their representatives are informative. The reps will happily explain all the factors and numbers that go into pricing calculations.

More importantly, they aren't pushy and don't upsell. They genuinely try to help you find the best solution for your investment needs, rather than trying to get you to spend as much money as possible.

Pros:

Cons:

Augusta Precious Metals has been in the industry for almost 50 years. The company is family-owned and has grown substantially over the past several decades. Ever since the IRS approved the use of precious metals in IRAs, Augusta has specialized in silver and gold IRA setups.

In addition to helping with setting up and maintaining silver IRAs, the company allows people to make non-IRA purchases for their investment portfolios. These are subject to the same taxes as any other purchase, since they aren't covered by the IRA.

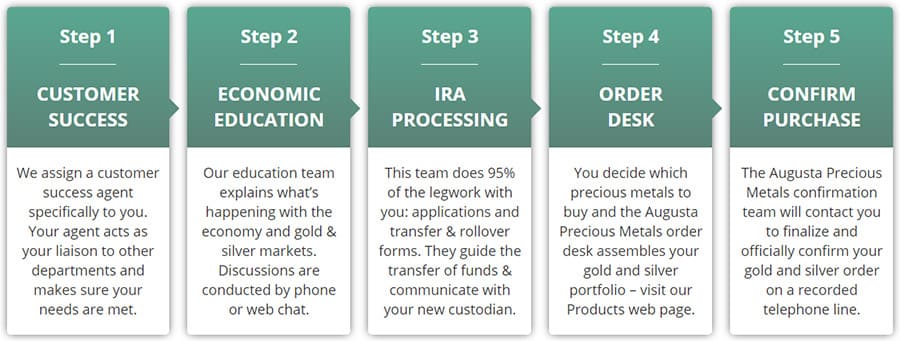

When you decide to open an IRA with Augusta, you will be given a dedicated customer service representative. This agent will not only facilitate the entire process of opening your account, but also work with you personally for the entire time you're with Augusta.

That's great news, since IRAs are long-term investments. You want to work with a dealer that you can foster a long-term relationship with. It's possible to use a different dealership if you decide you don't like your original one, but it's a bigger pain than it needs to be.

You'll open the IRA account and choose a custodian. If you don't have one in mind already, Augusta has several that they recommend. Different custodians have different fees and policies, so you'll want to compare your options.

Your customer service rep will take you through the paperwork, communicate with your custodian, talk to the IRS, and talk to the bank. They'll help you get the new account funded by using a wire transfer or a rollover. Then they'll make suggestions for what kind of silver purchases would be best.

Immediately upon confirming your premium metals order, you'll be granted the 7-Day Price Protection guarantee. This is a special extra that other firms don't offer. If the value of your investment lowers at all in the week after the purchase, you'll be able to pay the lower price instead.

With bullion, your price is locked as soon as payment is received. But if you order a lot of bullion in bulk, you can get significant discounts.

When you open your silver IRA, the company will give you a maximum of 2,000 dollars in bonus silver, depending on the value of your investment.

There are seven different storage options, all located in different regions of the US or Canada. You can arrange to have your metals shipped and stored in whichever one you want.

Setting up your account costs 50 dollars. You can also expect to pay about 180 dollars annually in custodial fees, depending on the custodian you choose.

Pros:

Cons:

#3. Birch Gold Group

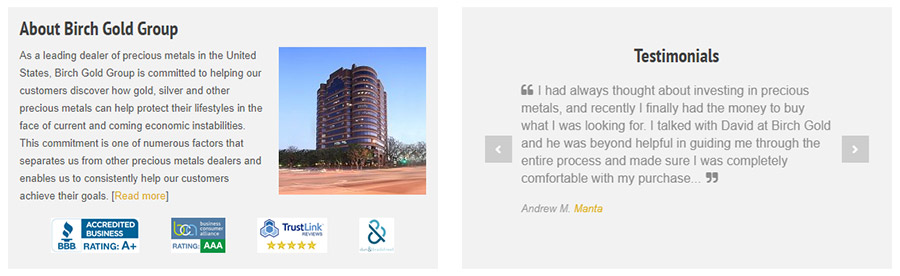

Birch Gold has been in operation since 2003. Today, they serve clients all over the country, managing silver IRAs for thousands of people. The company is staffed by experts, many of whom have decades of industry experience. In fact, some senior management officials are part of the Forbes Finance Council.

Birch Gold specializes in gold and silver IRAs, though they also sell palladium and platinum. You can purchase precious metals as a personal investment through their dealership as well, though this isn't their main area of focus.

The company has created their own IRA Department. This group of experts is made up of accountants, tax specialists, former IRS agents, financial advisors, and other financial gurus. Everyone understands the legal requirements for IRA contributions, and they also know how to give good investment advice.

When you open an IRA through the dealership, you'll work with the IRA Department. The specialists will also educate you every step of the way, empowering you to make your own precious metals decisions. Even if you don't choose to use Birch Gold as your broker, their website has valuable educational materials for use.

The signup process is simple. The company will help you choose a custodian and communicate with them on your behalf. Birch Gold usually works with Equity Trust when clients don't have their own preference. You'll fill out your account paperwork and fund the new account.

Then you'll purchase precious metals. The experts will advise you on which metals are approved with IRS regulations. After you've completed the transaction, Birch Gold handles all of the storage and shipping components, ensuring a smooth transition.

The company provides ongoing communication and updates on your investment. You will be given a dedicated specialist who is available whenever you need a financial update or have questions. Not only is this an important component of the company, it's part of their policy.

When you invest at least 50,000 dollars, the company will waive your fees for a year.

Pros:

Cons:

#4. Regal Assets (NO LONGER RECOMMENDED)

Regal Assets is an unusual member of this list because of the assets they offer. In addition to helping people set up silver IRAs, they also help people invest in cryptocurrency. Most precious metals dealers don't have any familiarity with the crypto market.

Customer reviews for the company are glowingly positive. In addition, they have high markings with third party watchdogs like the BBB and BCA. Though they're not the oldest company on the market, they have quickly established themselves as industry leaders. Experts both old and young recognize them as experts.

Another positive aspect of the company is that you can get started with your application online. You'll fill out information about yourself, your goals, and your assets. This form will be securely sent to the team of specialists.

Doing this saves a huge amount of time, since you don't need to dictate everything to your specialist. Once you apply, a specialist will call you and gather the information needed to create your account. Then you simply fund it and make your purchases.

With IRAs, there are four different portfolio types to choose from. Each is designed for a different purpose, and each has a different minimum investment threshold. The lowest minimum investment is 25,000 dollars.

If you want to purchase precious metals as a personal investment, there are two "survival" packages. One is made up of 5,000 dollars of hand-picked precious metals, while the other costs 10,000 dollars instead.

The dealership pricing is competitive. In addition, many people have stated that they paid lower storage and maintenance fees with Regal Assets than with many other brokerages. And if you want to invest in both stable and high-risk ventures, you can purchase both silver and cryptocurrency.

Pros:

Cons:

#5. Noble Gold

Noble Gold is a silver IRA company that's all about ease of use. They make it simple to roll over your existing retirement funds into a self-directed IRA, and they also make it easy to liquidate your assets when you need money.

In addition, the company partners with financial experts with a variety of investment expertise. If you need advice that's outside Noble Gold's usual purview, they can put you in contact with one of their consulting firms.

Unlike a lot of silver IRA companies, Noble Gold actually publishes their prices on their website. You know right from the get-go how much you're going to be investing, rather than needing to wait for a quote.

Fees are similarly straightforward. Sometimes companies obfuscate their fees, but Noble Gold posts theirs directly on their website. There is an annual fee of 80 dollars to maintain your account. You also have to pay 150 dollars for storage, including insurance.

The storage options are all segregated. That means your assets are held separately from other people's, so no one has access to them except you and your custodian. Depending on the custodian you choose, you might need to pay an additional annual custodial fee.

To open your account, you have to call the company and speak with a representative. Before you make any decisions, the representative will ask you questions to determine whether this type of IRA is a good choice for you. Then they'll walk you through the process of getting set up.

Pros:

Cons:

Final Thoughts

Overall, when you're looking for a silver IRA company, we recommend Goldco. They are the top business in the industry, and they have excellent customer feedback. Experts and beginners alike have been impressed by their streamlined approach, amazing customer service, and dedicated investment style.

Augusta Precious Metals is the one company that can compete with Goldco's customer service. Their employees all specialize in one of five key areas. This means that you can always talk to an expert who knows the answer to your questions, no matter what those questions are. And you get a dedicated customer service agent through the whole process.

Regal Assets may intrigue people who are interested in investing in both silver and cryptocurrency. Silver is a more stable investment, while cryptocurrency is a riskier venture. The company allows you to diversify more than you can with many precious metals dealers.

Birch Gold Group has the stamp of approval from industry experts and talk show hosts throughout the country. They also have great onboarding deals. For example, if you transfer at least 50,000 dollars into your new account, they will immediately waive all fees for an entire year. That saves you hundreds of dollars.

Finally, Noble Gold is a great choice for people who want a no-hassle experience. They make it easy to buy from their wide range of products. In addition, they have a transparent buyback program that lets you liquidate your assets for market price whenever you want. The only potential drawback is a lack of international storage.

These are all reputable companies that make the self-directed IRA process easy. There are a lot of other companies that have shadier practices, doing their best to take your retirement assets without paying you dividends. We highly recommend doing business with one of these dealers, but if you go elsewhere, always research first.

Frequently Asked Questions

A silver IRA is a type of self-directed retirement account that's filled with silver. If you decide to open this type of account, you will need to purchase assets that comply with IRS silver regulations. In addition, you can't use existing silver of yours, even if it is IRS-compliant.

On top of investing in silver, you can also invest in the precious metals gold, palladium, and platinum. Self-directed IRAs are accounts that are managed by the investor instead of a third-party broker. You choose all of your own assets and distributions. Some people also purchase real estate and cryptocurrency for their IRAs.

Normal managed IRAs typically hold a combination of paper assets and stocks. The advantage of a silver IRA is that your portfolio becomes more diverse. In addition, silver has the potential for growth as demand increases across different manufacturing industries. Precious metals hedge against inflation.

Silver IRAs are given the same tax benefits as any other IRA. That means you don't need to pay taxes on any of your contributions until you start taking distributions.

Gold and silver both have advantages and disadvantages. Each has the advantages that comes with precious metals investment, including:

Most precious metals companies sell both gold and silver. Several specialize exclusively in setting up gold and silver IRAs. You can talk to a customer service representative to learn about your options and understand what the best choice for you is.

The right investment for you will depend on your current assets, your timeline, your goals, and your risk tolerance. Gold and silver might respond differently to different market factors. An expert can explain how different economic situations affect your potential financial future.

As a general rule of thumb, silver has these advantages:

Gold, on the other hand, has these advantages:

Both metals have been prized worldwide for centuries. In many cases, the best option is to invest in a combination of silver and gold. But how much to invest in each metal will vary from person to person.

Not at all!

Self-directed IRAs are self-directed, that's true. You have complete control over your investments, as long as they comply with IRS regulations. You don't need to work with any pre-approved stock options or pre-approved percentages for your asset allocation.

Now, that level of freedom can be a bit intimidating, especially if you don't know much about investing. Investment brokers have studied the market for their entire careers. Their education is based around fluctuating market factors. They've made a science out of diversifying portfolios for maximum growth with additional stability.

If you don't have a background in investing, you may not know where to start with a self-directed IRA. That's why silver IRA companies were created in the first place.

These companies employ a combination of financial advisors, precious metals experts, and tax experts. They streamline the process of setting up the IRA account and funding it. And perhaps most importantly, many of them offer solid advice for how to allocate your assets.

Every investment advisor has a slightly different philosophy. That's true of precious metals dealers as well. But the best experts can tailor their approach to make a plan that suits your exact goals. If you work with a reputable company that has good consumer reviews, you'll find it much less overwhelming.

Of course, it's also good to do your own research. There are a lot of free resources available including eBooks and articles that explain what silver IRAs are, how to invest in precious metals, what advantages and risks there are to precious metals investment, and how to determine whether a silver IRA is the right choice for you.

Every silver IRA investment company will have a pretty website that explains why they're the best option for your money. It will tell you about the services they provide, the way their company is set up, and the principles that they're founded on.

Every company is supposed to look wonderful when you browse their website. So if you want to separate the actually wonderful companies from the pretenders, you have to do a little digging.

These are some key pointers that you can use when comparing different investment companies:

A good company will be active online, with helpful educational resources and enthusiastic representatives. Their reps should be comfortable answering your questions and making suggestions. You should receive responses to email queries within 24 hours.

One thing to note is that the best companies will not try to upsell you. The conventional wisdom is that only a small percentage of your total portfolio should be invested in precious metals. A knowledgeable company representative can make suggestions for how to allocate your assets, and they shouldn't try to pressure you into investing more than is wise.

On a similar note, you should feel comfortable with the dealer you choose. Trust your gut. IRAs are managed for decades, and you'll have an ongoing relationship with your dealer as the years go by. Make sure it's one you're happy to be working with.