Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Have you been trying to find new ways to make money? Are you disappointed in the returns you're getting in the stock market or worried about having all of your money invested in the same place? If so, you may be looking for the best gold investment company to help you diversify your portfolio and ensure your future financial success.

If anything written above describes you, you've come to the right place. We've compiled a list of the five best gold investment companies and written a review for each company. You'll be able to learn more about the company's history, the various investment options they offer, and other useful information to help you make a decision about which gold investment company sounds like the perfect fit to help you begin your investment journey with precious metals.

Gold Investment Company Reviews

#1. Goldco

There are a lot of reasons we selected Goldco as our top pick for the best gold investment company. Keep reading and they should be pretty clear!

Goldco was founded in 2006. Trevor Gerszt, the founder, wanted to create a company to help clients invest in precious metals to save up for retirement and set themselves up for financial security in their futures. Goldco is trusted by many satisfied clients as well as larger review companies. Their customers have awarded high reviews, the Business Consumer Alliance has given Goldco a Triple A rating, and the Better Business Bureau has given them an A+ rating.

One of Goldco's specialties is helping their customers set up a Gold IRA. Whether you are looking to open an IRA for the first time or would like to rollover an existing retirement account into an IRA, trust Goldco. They are highly experienced with setting up Gold IRAs and will work with you to ensure that everything is done by the books and you won't face any fees or penalties from the IRS.

Visit the website to begin the process of setting up or rolling over an IRA. Then, a member of Goldco's team will contact you to help you complete the steps. Once the funds for the account have been transferred to Goldco, either from your bank or from an existing retirement account, you can add the gold coins and bars you would like to your account.

The following coins and bars meet the IRS-required purity level of at least 99.5% pure for gold held in an IRA. The American Gold Eagle coin is 91.67% pure, but it is the only coin that an exception has been made for.

Coins

Bars

Setting up a Silver IRA is another option to consider with Goldco. Much like a Gold IRA, a Silver IRA is an opportunity to diversify your portfolio and invest in precious metals to prepare for retirement.

If you're interested in setting up a Silver IRA, follow the steps outlined above to work with a member of Goldco's team to either open a new IRA or rollover funds from an existing account into a new Precious Metals IRA.

The IRS requires silver coins and bars to be able least 99.9% pure in order to be held in an IRA. Goldco's clients can choose from the following coins and bars for their Silver IRA:

Coins

Bars

While you may want to invest in only gold or only silver, many individuals choose to hold a mix of gold and silver coins and bars in an IRA. Doing so can help further diversify your holdings and may allow you to hold more physical metals in your account since silver costs significantly less than gold.

Goldco takes are of shipping your precious metals to an IRS-approved depository. Each shipment is insured, and your metals remain insured once they arrive at the depository, so you can rest easy knowing your investment is safe.

If you think you may be interested in investing in precious metals through a Gold or Silver IRA with Goldco, but still have a few questions left, request their free Self-Directed IRA guide. This guide includes helpful information about Precious Metals IRAs, the process of getting one set up, and the different coins and bars you can add to your account.

Pros:

Cons:

Augusta Precious Metals should also be high on your list when you're comparing the best gold investment companies. While this company hasn't been around as long as some of the other choices on our list, their reviews from satisfied customers should speak for themselves. And, if that's not enough, Augusta Precious Metals has also earned the highest rating possible from the Better Business Bureau (A+) and the Business Consumer Alliance (Triple A).

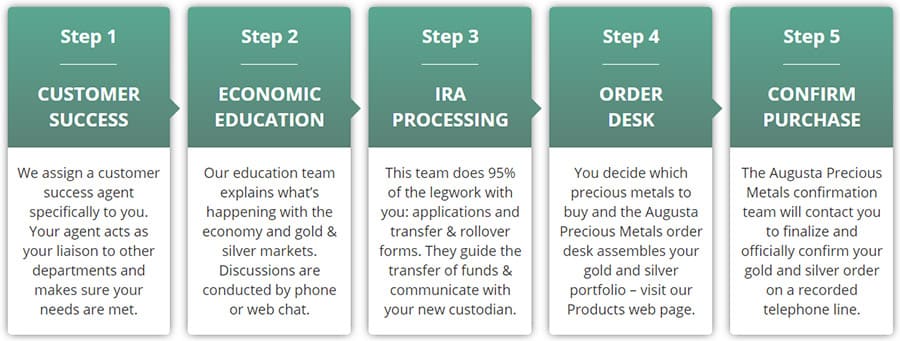

Augusta Precious Metals has worked hard to develop the positive reputation they have. On their website, you can read more about the different characteristics they lay out that help differentiate them from the other gold investment companies and make them a great choice to give your business to. These different standards include:

Augusta Precious Metals has helped numerous clients set up a new Gold or Silver IRA. Setting up a Precious Metals IRA with Augusta Gold will allow you to reap the rewards of investing in precious metals, while also enjoying the tax benefits of opening an IRA. It really is a win-win situation.

You'll work closely with a member of the Augusta Precious Metals team to get your new IRA account set up, funded, and filled with the gold and silver bars you select. The team member will be available to answer any questions you may have, address any concerns, and help you select the right precious metals to add to your account that will help you meet your retirement goals.

In addition to setting up a new Precious Metals IRA, you may be able to rollover an existing retirement plan into a Precious Metals IRA. If your plan type is eligible (which a member of the Augusta Precious Metals team can help determine), they'll help you work with a custodian to transfer money from your account to fund your new Precious Metals IRA.

The rest of the process will work the same as opening up a new account. After the money arrives to Augusta Precious Metals, you can select the coins and bars you wish to hold in your account.

You can contribute up to $6,000 the year you open your account and up to $6,000 each year after that (if you're older than 50, these amounts increase to $7,000). It is important to make sure you stay within these limits to avoid paying any fees or penalties (these are the maximum combined amounts across any IRAs you have).

Here are the IRA-approved coins you can add to your account when you work with Augusta Precious Metals:

Since IRS regulations prohibit store precious metals for an IRA in your home, you will need to store your metals in an IRS-approved depository. Augusta Precious Metals can help you set up storage in a variety of locations across the United States. Some of these locations include:

Each IRS-approved depository uses top-notch security to guarantee your investment will remain secure and safe until you reach the age of retirement. Augusta Precious Metals handles all shipments and fully insures all of your precious metals as they travel to the depository.

You may also be interested in investing in gold or silver pieces aside from or in addition to a Precious Metals IRA. This is another option you can take advantage of when you work with Augusta Precious Metals.

Some of the various gold and silver pieces you can choose from include:

Common Gold Bullion

Premium Gold

Common Silver Bullion

Premium Silver

The benefit of purchasing gold and silver for a person investment is that you don't need to worry about IRS regulations. You can store your gold and silver wherever you'd like and don't need to worry about purity levels when choosing coins to purchase.

Pros:

Cons:

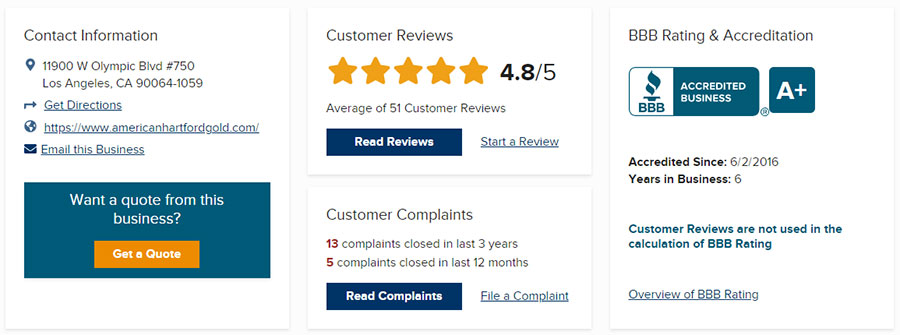

American Hartford Gold is a family-owned and operated business that was started by Sanford Mann in 2015. Headquartered in Los Angeles, California, the company is now one of the most trusted providers of precious metals. They aim to help each of their customers realize the potential that precious metals offer through personal investments in gold and silver as well as setting up a Gold IRA.

Several celebrities and media personnel recommend working with American Hartford Gold. Some of these individuals who have endorsed the company include Dave Rubin, Bill O'Reilly, Rick Harrison, Lou Dobbs, Megyn Kelly, Rudy Giuliana, and Joshua Phillip. Beyond the endorsements from these media personnel, American Hartford Gold's past customers have also shared a lot of good things about their experiences working with the company. Take a look at review sites, such as Trustpilot and Google, and you'll see that most of the reviews are very positive.

Other reasons to consider working with American Hartford Gold include the company's ranking on the INC 5000 as one of the most quickly growing private companies, their A+ rating from the Better Business Bureau, and the 100% satisfaction guarantee that backs of all the products and services they offer.

If you'd like to add precious metals to your retirement account, and enjoy the tax benefits that IRA holders receive, then you may be interested in working with American Hartford Gold to set up a Gold IRA. They will work with you and a Gold IRA custodian to ensure that your account is eligible for a rollover and set up the transfer of funds. The representative that you work with will be available to offer support, guidance, and to address any questions that come up during the process. They'll also support you in completing the paperwork required for the transfer.

After all the necessary forms are completed and the funds arrive from your new account, you'll be able to select which precious metals you want to hold in your account. American Hartford Gold offers a wide selection of silver and gold coins and bars.

All of the precious metals listed below satisfy the minimum purity requirements outlined by the IRS for IRA eligibility (99.5% minimum purity level for gold coins and bars and 99.9% minimum purity level for silver coins and bars).

Gold

Silver

Other Precious Metals Available To Purchase

While setting up a Gold IRA is an excellent option to help you diversify your portfolio, it is not the only available choice when you're looking to invest in precious metals. You can also purchase gold and silver coins and bars to hold as a personal investment. All of the coins and bars listed above are also available for personal purchase.

In addition to those options, American Hartford Gold also offers a few other rare and collectible coins for their investors to choose from. Some of the available coins include:

Gold

Silver

Do you like what you've read about American Hartford Gold so far? If so, their current promotion may just be the icing on the cake. When you set up a qualified IRA, you'll be eligible to receive up to three years with zero IRA fees and up to $5,000 in free silver. To determine whether you qualify for this promotion, contact a member of the American Hartford Gold team today.

Pros:

Cons:

#4. Birch Gold Group

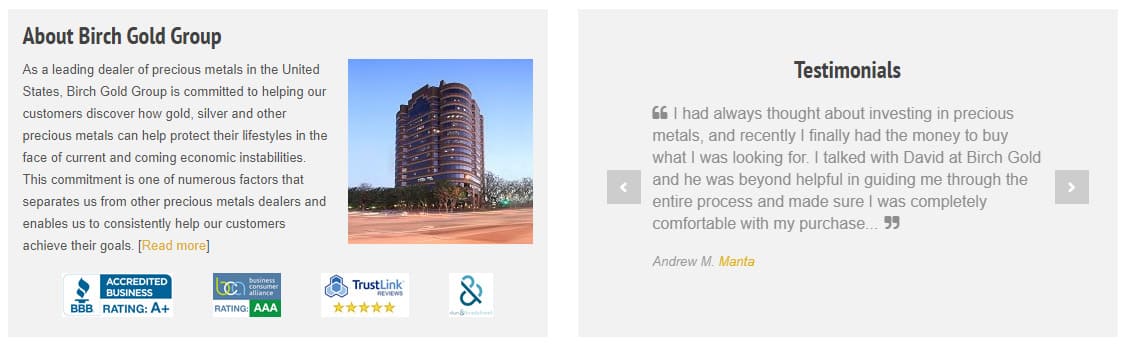

Birch Gold Group is another highly-trusted name in the precious metals investment industry. Since 2003, when they were first founded, they have worked hard to build rapport with customers and offer excellent customer service. This has helped them to grow to be one of the top precious metals dealers in the country.

In addition to the largely positive reviews the company has received from customers, they have also received an A+ rating from the Better Business Bureau and a Triple A rating from the Business Consumer Alliance. Birch Gold Groups puts a high emphasis on using business practices that put their customers first. They have developed standards to lay out their beliefs and philosophies. These include: customer empowerment, education, empathy, efficiency, transparency, and ethics.

Birch Gold Group has a knowledgeable team available to help individuals open a new Precious Metals IRA or rollover an existing retirement plan into a Precious Metals IRA. Opening a new IRA is simple; you'll just need to work with a member of the team to set up a transfer of funds from your bank account. Then, once the money has arrived to Birch Gold Group, you can select the mix of gold, silver, platinum, and palladium bars and coins you'd like to purchase.

If you are interested in rolling over an eligible retirement account, this is also something that Birch Gold Group can help with. They will connect you with an IRA custodian from Equity Trust, STRATA, or one of the other companies they trust (with A+ ratings from the Better Business Bureau). The custodian will help you make sure the transfer of funds is initiated correctly to prevent any fees or penalties.

Then, once the funds have been transferred, the representative from Birch Gold Group can work with you to select the precious metals you wish to add to your account. If you are not sure which coins or bars are the best choice for you, don't hesitate to ask questions. The team is there to help and brings a wealth of experience investing in precious metals, so who better to ask!

Each year you can contribute a maximum of $6,000 to your IRA accounts (this is the maximum amount spread out between all of your accounts). If you're 50 or older, this amount increases to $7,000 each year.

Unlike many other precious metals investment companies that only offer gold and silver coins and bars, Birch Gold Group also offers individuals the opportunity to invest in platinum and palladium. Here are some of the different precious metals that meet the IRS requirements to be held in an IRA:

Gold

Silver

Platinum

Palladium

Secure storage is essential with precious metals. Birch Gold Group offers their customers the choice between two different IRS-approved depositories for storage of the precious metals in the IRA. The first storage option is the Delaware Depository which is one of the most trusted and secure locations in the country. It offers state-of-the-art security, insurance, and much more to ensure all of your precious metals remain safe and sound.

The other available option for IRA storage is through Brink's Global Services. Brink's is also a highly-respected name when it comes to storage and protection of assets. If you choose to store your precious metals with Brink's Global Services, you can choose from one of their many locations in the United States. All precious metals are also fully insured during the shipping process.

If you'd like to purchase gold, silver, platinum, or palladium pieces instead of, or in addition to, setting up a Precious Metals IRA, this is another service offered by Birch Gold Group. Any of the IRA-approved precious metals are available, but they also offer additional gold and silver coins you may purchase. The benefit of purchasing coins for a personal investment is that you don't need to worry about any IRS regulations regarding storage or purity levels.

Here are the additional gold and silver coins available for purchase.

Gold

Silver

Pros:

Cons:

#5. Noble Gold

Noble Gold has been around a lot longer than many other precious metals investment companies. In fact, they have over 20 years of experience with help individuals diversify their portfolios and start taking the important steps of preparing for an enjoyable retirement. When you choose to work with Noble Gold, you'll notice how knowledgeable and helpful each member of the team is thanks to the experience they bring to the table.

As a member of TrustLink, the Royal Canadian Mint, and the Business Consumer Alliance, Noble Gold is a company you can trust. Taking just a few minutes to look through different review sites will also help you to see that this company puts its customers first, and, because of this, has tons of happy past clients. Noble Gold is also able to offer some of the most competitive prices for the precious metals they offer due to their connections with different gold, silver, platinum, and palladium suppliers.

If you're looking to open your first IRA or want to rollover your current retirement plan into an IRA, don't hesitate to contact Noble Gold. They can work with you to help you achieve either goal.

The first step in either case will be to line up the funds for your new account. If you are setting up a new IRA, this is as simple as transferring the funds from your bank account to Noble Gold. If you are rolling over an eligible IRA account, there are certain procedures outlines by the IRS that will need to be followed. While these can be a bit confusing, you won't need to worry about it since a member of the Noble Gold team will work with you to make sure everything is completed correctly so you won't face any fees or penalties.

Once the funds arrive to Noble Gold, either from your bank account or your precious retirement account, the fun beings. You will be able to select the various gold, silver, platinum, and palladium coins and bars you'd like to add to your account. Despite the IRS regulations regarding purity levels, Noble Gold still offers a nice selection of coins and bars to choose from:

Gold

Silver

Platinum

Palladium

With Noble Gold, you are also able to purchase rare coins for a personal investment. These historic artifacts are not only interesting, but also valuable due to their rare status. Noble Gold offers investors the option to purchase the Four-Piece Indian Saint Gauden Set, the 1854 Kellogg $20 coin, and the Morgan Silver Dollar.

If you purchase a rare coin from Noble Gold, you can be confident that it is the real deal. The rare coins are each independently graded and certified by the Numismatic Guarantee Corporation (NGC) or the Professional Coin Grading Service (PCGS).

One thing that makes Noble Gold stand out against many other companies is the opportunity to purchase one of their Royal Survival Packs. These packs include a mix of different precious metals to help individuals prepare for a financial emergency. They are priced to meet the needs of different individuals and families.

There are eight different Royal Survival Packs to choose from. They are:

Pros:

Cons:

Buying Guide

Choosing a gold investment company can feel like a big decision. And, truth be told, it is. You're looking for a company you can trust to sell you genuine precious metals at a fair price. You also want to find a company that will securely ship items to you, one that offers a selection of coins you're interested in, and one that feels like the right fit overall.

Below, you'll find more information to help guide your search for the right gold investment company. Keep these factors in mind to make sure the company you select will meet your expectations.

Available Precious Metals

One of the first things to look at when choosing a gold investment company is their selection of precious metals. Some companies only offer gold and silver, while others also offer platinum and palladium coins and bars.

The individual selection of specific coins and bars can also vary from company to company. While the IRS does impose regulations regarding the purity levels for precious metals in order for them to be held in a Precious Metals IRA, there are still a number of coins and bars that meet these requirements. However, every gold investment company doesn't offer every approved coin, and some definitely have a larger selection than others.

If you are interested in holding a specific coin in your portfolio or would like to hold a mix of lots of different coins, be sure to closely preview the types of gold, silver, platinum, and/or palladium coins that each company offers. This information is generally listed on the company's website, but you can always follow up with a phone call to a representative from the company if you have further questions.

In addition to offering precious metals, some gold investment companies may also offer other investment opportunities, including cryptocurrencies. If you think you may be interested in diversifying your portfolio even further, choosing a company that will allow you to also invest in cryptocurrencies may be the best way to go.

Fees

When you invest in precious metals, especially for an IRA, there will be fees associated with your investment. This is pretty standard from company to company. However, the exact amount of the fees can vary from one company to another, so doing some research to find out what you'll be responsible for paying with each option you're considering is a good idea.

If you can't find information clearly laid out on the company's website about the fees they charge, send a message or make a phone call to a representative. You want to feel confident about your choice and not discover hidden charges after you've already made a decision.

Support and Assistance

Choosing a gold investment company that offers excellent customer service is essential. The rules and regulations for investing in gold or setting up a Gold IRA can be confusing, and you don't want to have to deal with any penalties from the IRS.

When looking for a gold investment company, choose one that has an experienced and helpful customer service team that will be there to offer assistance as you need it. It will also be nice to find a company with a team that can help you explore your investment options and decide which coins or bars would be the best investment option to reach your goals.

Experience

Finally, choosing an experienced and reputable gold investment company is also important. Some things to look for include the number of years the company has been in business, the reputation their CEOs hold, and their ratings and reviews. You can consult customer reviews on Google, TrustLink Facebook, and other review sites, but you should also look for the company's ratings from the Better Business Bureau and Consumer Affairs.

Top Pick

You really can't go wrong with any of the Gold Investment companies we recommended above. However, if we had to choose one as our top pick, it would have to be Goldco.

We like how easy Goldco makes it to set up a new Gold or Silver IRA or rollover an existing retirement plan into an IRA. The company has been in business since 2006 and has a stellar reputation in the precious metals investment industry.

Goldco's selection of gold and silver coins and bars offer you numerous options to fill your Precious Metals IRA. You'll be able to choose a nice mix of coins and bars to grow in value, so one day you can either sell your investment to fund your retirement or a large purchase, or possible pass on to a loved one to set them up for success.

When you choose to work with Goldco, your precious metals for a Gold or Silver IRA will be securely stored in an IRS-approved depository. Goldco also offers additional coins and bars for purchase for those looking to increase their personal investment holdings.

There are a multitude of reasons to give Goldco a try. If you're ready to start investing in gold or other precious metals, visit their website today to get started!

Frequently Asked Questions

Yes, investing in gold is a good idea. It can help diversify your portfolio and prevent you from having all of your money invested in the volatile stock market. If you have some money invested in gold and some invested in the stock market, you'll be in a better position should the value of one investment decrease when you're looking to withdraw some of your money.

Gold is a very solid investment. It has held its value over the years. Since it is such a highly sought-after precious metal, when you're reading to sell your gold and receive cash for it, you should have no trouble finding a buyer.

The demand for gold only continues to grow across the globe. This should give you peace of mind that you are making a sound financial decision and that the value of your investment should go up over the years until you are ready to cash it in or pass it on to a loved one.

Gold, silver, platinum, and palladium are the four metals that are considered precious metals. These are rare metals that have a higher value. Their high value is tied to their scarcity, their usefulness in different areas, and their history as being used as money or a basis for money.

There isn't necessarily one 'best' precious metal to invest in. All four of the precious metals, gold, silver, platinum, and palladium, are valuable and offer their own sets of benefits. The demand for all of these metals is high and is only expected to continue to rise, so investing in any of them can be a good financial decision.

The amount of money you have to invest may impact which precious metal you would like to purchase. An ounce of silver, for example, is much less expensive than an ounce of gold. So, with the same amount of money, you'd be able to purchase considerably more silver than you would gold.

Also, keep in mind that there is no reason why you can only invest in one particular precious metal. Just as you may want to diversify your investment portfolio by holding precious metals rather than all stocks and bonds, you can diversify it even further by holding a mix of precious metals.

Gold IRAs are a type of Self-Directed IRA. Self-Directed IRA s offer an alternative to traditional investment methods for an individual's retirement account. Rather than keeping all of their money invested in stocks and bonds, the IRS allows people to invest some of their money in other assets, such as precious metals.

Gold IRAs may hold gold or other precious metals, rather than stock and bonds. Individuals may choose to set one up instead of, or in addition to, a traditional IRA.

Like traditional IRAs, Gold IRAs offer a variety of tax benefits. They may have some slightly higher fees than other types of IRAs, but the ability to diversify your portfolio and hold money in other areas will almost certainly pay off when it is time to retire.

The terms Gold IRA and Precious Metals IRA are often used interchangeably. Both of these terms refer to a type of Self-Directed IRA that holds precious metals. Gold IRA may only refer to Self-Directed IRAs that hold gold, while Precious Metals IRA is a broader term to refer to a Self-Directed IRA holding any type of precious metals.

No, investing all of your money in precious metals is not a good idea. Precious metals should be used to diversify your portfolio. If all of your money were invested in precious metals, it would leave you at a greater risk than if some of your money were held in different types of investments.

There is no set answer for how much of your portfolio you'll want to hold in gold or other precious metals. It can vary based on your comfort level, your age, the amount of money you have, and how close you are to retiring.

In some ways, precious metals are seen as a riskier investment, so if you're very close to retirement age, you may not want to invest as much. However, if you're still years away from retiring and have room to be more aggressive with your investments, you may find that you want to hold a larger percentage of your portfolio in precious metals.

There are a few different ways to purchase gold for an investment. One of the easiest ways is to find an online gold investment company. These companies will securely ship you the precious metals coins and bars for you to hold, or you can arrange for secure storage.

You may also be able to find a local coin shop that sells gold, silver, platinum, and palladium coins and bars. This may make it easier for you to see the physical pieces before purchasing them, but you'll want to verify the shop's reputation and make sure you're knowledgeable about the current prices of the various precious metals.

Like any other investment, the best time to purchase gold is when its value is lowest. Generally speaking, the value of gold tends to decrease during times when the stock market over performs. While this may not be easy to predict or time, the price of gold is often lower during the months of January, March, and April.

Yes, a gold coin's value should increase. While there may be a value printed on the coin, the actual value of the coin will increase as the price of gold increases. Rarer coins will be worth even more than other coins, and are definitely worth more than simply their weight in gold.

Yes, in the 1970's, the IRS relaxed the rules on IRAs to allow individuals to hold their funds in other forms of investment aside from stocks and bonds. Gold, silver, platinum, and palladium may be held in a Self-Directed IRA, commonly referred to as a Gold IRA or Precious Metals IRA.

No, the IRS created strict rules regarding the storage of precious metals for Gold IRAs. Metals must be stored in an IRS-approved facility until individuals are old enough to begin making withdrawals from their retirement account.