Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

When you want to get involved in the precious metals industry, you might be tempted to purchase precious metals for yourself. But some people prefer an investment that pays dividends instead of sitting in a vault gathering dust. If that's the case for you, maybe you want to invest in a precious metals company by buying stock.

Yamana Gold is one of several mining companies that trades on the open market. But are they worth investing in? Is the company a scam? What does it offer to its shareholders? And are they a better investment option than the other publicly traded mining companies?

We've taken a look at some of the details of what Yamana Gold has to offer. These are the biggest considerations you should keep in mind when you're deciding whether to invest your money.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if Yamana Gold made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

About Yamana Gold

Yamana Gold is a mining company with headquarters in Canada. They own copper, silver, and gold mines in Argentina, Brazil, Chile, and Canada. The Toronto-based company was first founded in 1994, though they didn't go public with the Toronto Stock Exchange until 1995.

It took more than a decade for them to add their listings to the New York Stock Exchange, but in 2007, New York investors had the chance to make purchases. As of 2020, the company also trades shares on the London Stock Exchange, which opens it up to European ownership and influence.

In 2003, the company was restructured and merged with another mining corporation. It was at this point that they began producing gold. The combination of the existing mining resources with the company's capital allowed it to create the Chapada mine.

The company has gone on to acquire seven other mining companies that were previously listed on the Toronto Stock Exchange. They have expanded their operations exponentially by monopolizing the competition. Because of their strong business approach, investors don't need to worry much about them going under.

Between the years of 2009 and 2016, the company produced more than one million gold ounces every single year. In 2016, Brio Gold was turned into a separate company. The split removed several Brazilian mines and other assets from the Yamana Gold overhead company.

The company did face some criticism for how lavishly it compensated its corporate executives. To mitigate this, the CEO was replaced in 2018. The new CEO was named Daniel Racine. In addition, the company sold two of its mines to pay off its debts.

Like several of the most well-performing modern mining companies, Yamana Gold is dedicated to ESG. They pay close attention to their environmental, social, and governing impacts. This year, Corporate Knights named the company as one of the 50 best corporate citizens in Canada.

Current Mining Operations

Yamana Gold has developed a variety of projects over the years. Some of these were abandoned without ever being realized. Some were mined for all of their worth and then closed up. And some were sold so that the company could deal with some of the debt it had accrued.

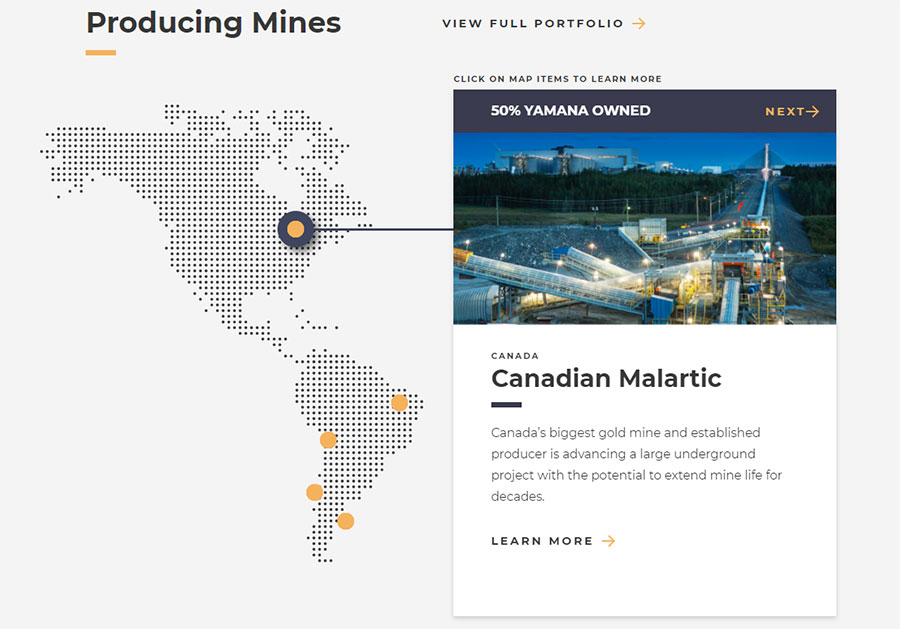

Today, there are five gold mines in operation under the company's management. There are also a few properties that are being explored and considered for potential development.

The Canadian Malartic mine is positioned in Quebec. The company purchased it in 2014 as a 50/50 venture with another mining company. They receive fifty percent of the profits from the assets that are mined.

This open pit mine is home to both gold and silver. It uses cyanidation and smelting to create bars.

The El Peñón mine, located by the Atacama Desert in Chile, is among the biggest gold mines in the world. The mine came into Yamana Gold's possession when they acquired the company Meridian Gold in 2007. This mine uses underground mining techniques to look for specific gold veins.

In addition, this site uses a precipitate furnace and a Merrill-Crowe process to refine the gold into bars.

The Minera Florida mine is also located in Chile. Like the previous mine, it came into the company's possession when they acquired Meridian Gold. The mine targets veins of silver, gold, and zinc. The ore is then processed using a carbon in pulp system, which allows gold and silver bars to be created.

The Jacobina mine was acquired when Yamana Gold purchased Desert Sun Mining in 2006. This mine is found in Bahia, Brazil. The underground operation targets veins of gold, while the findings are processed through carbon in pulp systems. Electrowinning is used to create the gold bars for processing.

The last mine is the Cerro Moro mine, which is found in the Santa Cruz province of Argentina. It was acquired by Yamana Gold when they merged with Extorre Gold Mines Limited. However, the mine itself did not begin production until 2018. The merger occurred in 2012.

This mine is a combination of underground tunnels and open pit operations. It has deposits of both gold and silver. The company uses a Merrill-Crowe process to create gold and silver bars for selling.

Prior Operations

It's worth noting the different operations that the company had in the past. These projects were sold or ended for a variety of different reasons. Understanding the past projects helps you understand how the company handles different project occurrences.

One of the projects was the Chapada mine, located in Brazil. This mine was purchased by the company in 2003 and produced copper, silver, and gold. Yamana Gold operated it from 2007 until they sold it in 2019, a necessary business move to pay off some of their exorbitant debts.

The Gualcamayo mine in Argentina came into the company's possession when they merged with Viceroy Exploration. This mine started producing materials in 2009. It was operated for 10 years and yielded quite a bit of gold. Then in 2019, it was sold in conjunction with the Chapada mine, also to help pay the company's debts.

The Fazenda Brasileiro mine in Brazil was the first mine that Yamana Gold ever operated. They bought it in 2003 from the Vale company. When Brio Gold was turned into a separate company, rather than being a part of the larger Yamana Gold corporation, that mine was relinquished to the Brio Gold venture. This was in 2017.

The Mercedes mine in Mexico was a development project of Meridian Gold. Once Yamana Gold acquired this company, they continued the development and caused the mine to begin producing silver and gold in 2012. In 2016, the company chose to sell the mine to Premier Gold Inc. rather than continue operating it.

The Fazenda Nova mine was a Brazilian gold mine that was one of the first properties Yamana Gold bought when they restructured in 2003. This was the first mine developed solely by the company. The mine opened in 2004, ran for four years, and then the project ended because the resources had been exhausted.

The São Francisco mine was a Brazilian gold mine that was also acquired during the company restructuring of 2003. It began operating in 2006 and then was sold to the Aura Minerals company in 2009.

Is Yamana Gold a Scam?

Yamana Gold is not a scam. They are a legitimate company that has been in business since the 1990s. Their mining operations are legitimate, and they have acquired many other mining companies that trade on the public stock exchange.

You can purchase stock in this company on the Toronto, New York, and London Stock Exchanges. The company is one of the most widespread mining corporations in the world, though they have scaled back their operations some in recent years.

Though Yamana Gold is not a scam, they have received some serious criticisms regarding the use of their funds. Industry analysts have raised concerns that the company was giving corporate executives too many lavish bonuses while taking on too much debt. This could have a seriously negative impact on shareholders.

To help recuperate the company's image, there was a change of CEO in 2018. At this time, the company also sold two of its mines to consolidate its debts. This helped to encourage more activity from shareholders. But it's up to you whether you believe that the mismanagement is truly finished.

Pros and Cons

Pros:

Cons:

Final Thoughts

Yamana Gold is a mining company with publicly traded stocks. If you want a precious metals investment that pays dividends, it might be a solid choice. However, there are a few things you should keep in mind before you make a decision.

One thing to note is that the company is not the largest mining operation in the world. They own several different mines, but if one mine loses its income, you might see a hit to your assets.

In addition, the company has gone through turbulent periods of time with regards to its management. In 2018, the criticism turned into a change of leadership and the decision to sell two entire mines. This helped to reassure shareholders that their money was not being spent foolishly.

There are larger mining companies that trade on the stock exchange. With these, one dried-up mine won't lead to potential financial loss. On top of that, these companies often have fewer scandals with regards to their management.

The management of a company matters to its profits. Because Yamana Gold has been so fiercely criticized, they might not be the right precious metals investment for you. You might choose to go with a larger and better-established company instead.

That's if you choose to purchase company stock at all. Direct purchasing of precious metals is a good idea if you want a stable investment. Precious metals themselves are defined by their market value. You don't have to worry about managerial decisions affecting their worth. But they also don't pay dividends.

Although we do think that Yamana Gold is a solid company, we believe that there are better companies out there to make your investment with (better investment options).

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Or, continue with Yamana Gold...