Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

With the economic uncertainty of recent times, more and more people are investing in precious metals. Experts recommend securing a percentage of your portfolio in the precious metals industry. But besides buying actual gold and silver, what are your options?

Some people choose to buy shares in publicly-traded precious metals companies. Mining operations have profits that grow as the price of gold increases. Similarly, precious metals streaming organizations see more profit when the price of gold soars.

Wheaton Precious Metals is a publicly-traded precious metals streamer. But what exactly does that mean? What does the company do, and how does their structure affect their investment potential? Can they provide the returns that they claim they can?

We've taken a look at some of the details.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if Wheaton Precious Metals made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

About Wheaton Precious Metals

Wheaton Precious Metals is a global precious metals streaming organization. To understand the role they play in the industry, you'll first need to understand how streaming works.

A streaming company will strike an agreement with a mining operation. The contract allows them to purchase a portion -- or sometimes all -- of the mine's yield. Wheaton Precious Metals pays these operations some of the cost up front, and then pays the rest when the metals are delivered.

Right now, Wheaton is contracted to stream metals from 24 operational mines around the globe. In addition, they have agreements with eight developing projects that will yield significant returns in the future.

The goal of the company is to amass as many stable, low-cost assets as possible. They have silver and gold streams that allow them to control part of the new supply being released onto the market.

Investors as a Priority

The company's investors are a big part of the picture. When people buy shares in the company, they are able to expand into bigger and better operations. Wheaton states that they want to be the best vehicle for precious metals investment on the market. They also outline points that they use to create value for stakeholders.

Some of these points include:

Business Model for Investment

According to Wheaton's philosophy, their business is structured in a way that provides unique benefits to shareholders.

Since the company is able to acquire precious metals right from the source, they have some control over how the market prices of the metals increase. In addition, the company is constantly expanding by partnering with new operations and budding projects.

Each shareholder is given a percentage of the quarterly dividends. You can reap the benefits of the company profit. In addition, Wheaton works with its mining partners to expand operations and create successful ventures.

It's common for people to invest in traditional mining, if they choose to buy stock in a company. But Wheaton's approach helps to reduce some of the potential downsides to this. Mining operations don't have predictable yields or costs. Wheaton doesn't have unexpected or ongoing costs except for the initial precious metals payments.

Company Management

The president and CEO of the company is a man named Randy Smallwood. He has both a geological engineering degree and a mine engineering diploma. While originally involved in the company's creation, he didn't join full time until 2007. In January 2010, he was promoted to President; in April of 2011, he became the company CEO.

The senior vice president and legal expert is Curt Bernardi, who has been working with the corporation since 2008. His law career began in 1994, when he passed the British Columbia bar. At first, he worked in corporate law and acquisitions. Over time, his work brought him to Wheaton Precious Metals.

The second senior vice president and CFO is Gary Brown, who joined the corporation in 2008. Before he entered the company, he'd worked as a CFO for another corporation and held positions as a senior financial consultant. Overall, he has almost three decades of ongoing finance professional experience.

Company Responsibility

The company takes ethics and responsibility very seriously. They believe that mining operations should be safe, environmentally responsible, and economically sound. In every partnership, they try to enrich the local community surrounding the mining operation.

Since Wheaton works with so many different mining operations, it has a significant amount of sway over their practices. Mine operators know that Wheaton will buy their yields at an agreed-upon price. Wheaton only works with mining operations that adhere to their strict codes of ethics and responsibility.

The company values inform each business decision that both individual employees and the corporation as a whole make. In addition, Wheaton has pioneered a corporate social responsibility program that helps do proactive work in the community.

United Nations Global Compact

Wheaton has been a member of the United Nations Global Compact since 2019. They adhere to the ten strict principles that the organization has in terms of environmental impact, labor rights, human rights, and work against corruption. The company works to help with broad UN goals and increase global development.

Wheaton also adheres to the Conflict-Free Gold Standard and Responsible Gold Mining Principles laid out by the World Gold Council.

The company pays more than lip service to these principles. Every time they consider partnering with a new mining operation, they first go through a due diligence process. This allows them to assess the social and environmental values of the potential partner.

On top of this, the company does regular due diligence reviews of existing partnerships to make sure that the practices still adhere to their standards.

In addition to being a strong ethical stance, the strict due diligence process also helps the company avoid making risky investments. That mitigates some of the potential for shareholders to lose money when projects fall through.

Company Values

The company adheres to certain values in their decisions and operations.

What to Know About Investing

So now you have a sense of how the company operates and what principles they abide by. But how do they actually perform on the market? If you're looking to buy shares in a precious metals company, is this one any better than other traded corporations?

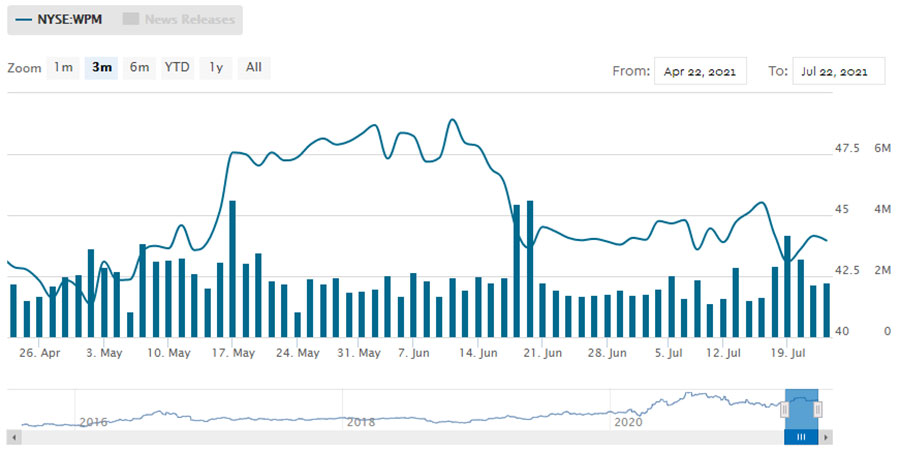

There are quite a few things that make Wheaton Precious Metals a compelling stock option. The company's shares have grown over 500 percent in the past fifteen years. And since the company has eight projects in development along with further plans to expand, those shares are projected to climb even higher.

Higher Margins Than Mining Companies

Wheaton doesn't have the limitations that mining companies do. When a mining company sets up a new operation, they have to deal with major startup costs. Many projects never come to fruition. The financial obligations constrain a mining company's ability for growth.

But Wheaton isn't bound by any such constraints. It purchases the assets that miners have extracted, but it doesn't have to pay the costs of operation. In addition, it can keep expanding to include as many existing mine operations as it wants.

When a mining company needs the capital to start a new project, they come to Wheaton. Wheaton draws up a contract that states that they will be entitled to a certain percentage of the new project's yield. The assets will be paid for, but Wheaton acquires them at lower than market price.

Each contract runs for several years at least. Some contracts continue for the entire lifespan of the mine.

This business model means that Wheaton can sell gold and silver at market value and still make huge returns. If they buy gold at 1/4th of the market price, they'll make their money back fourfold with every sale. Those margins are pretty unbeatable.

Diverse Streaming Contracts

Wheaton works with dozens of operating mines scattered all over the globe. Smaller mining companies can be done in by a single run of bad luck. But since Wheaton's reach is so broad, they won't be significantly harmed if one of their partners struggles to make ends meet.

Another benefit of the multiple deals is that the contracts all end in staggered ways. With traditional mining companies, contracts end all at once when an operation shuts down. That can lead to a sudden sharp decline in your dividends.

If one mine has to shut down its operations, that doesn't necessarily mean that you'll lose money on your investments. The other mining operations can pick up the slack, stabilizing the gains.

Multiple Precious Metals

Instead of investing in gold alone, Wheaton has branched out to more diverse projects over the past several years. During 2021, a little over half of the profits will come from silver sales. When the company first started, silver made up a much larger percentage of the yields.

The company has increased their gold production revenue significantly to fill the gap. Some of their contracts include a 70 percent stream of gold in a Canadian mine or a 25 percent stream of gold in a Brazilian mine.

Tenured Management

Every member of the management team has a long career that involves expert dedication in their field. Each of the vice presidents governs a certain aspect of the business, while the president and CEO oversees company operations as a whole.

Dividends

Dividends are the biggest financial advantage of stocks over physical assets. When you invest in physical gold and silver, you'll be protected against inflation. The assets can be liquidated when you need cash. They might also grow over time, thanks to positive economic projections for precious metals.

But when precious metals sit in your bank vault, they don't do anything. They just sit. They don't accrue interest or dividends. On the other hand, when you invest in an actual company, you get a portion of the revenue they generate based on the amount of shares you hold.

Wheaton offers buybacks when you're ready to cash out your shares as well. Every share comes with a quarterly dividend payment. The company bought back more than 20 million stock shares in 2015, which reduced outstanding shares and allowed for greater earnings per share.

This was a solid economic call because it made the company's value look much better on paper, in terms of the worth of a single share.

Company Valuation

The valuation of a company makes a big impact on whether it's a good investment. There are several factors that make Wheaton an ideal choice.

Because Wheaton's margins are so much higher than those of traditional mining companies, they have a higher price-to-cash-flow than the average. In fact, they're consistently about 25 percent higher than typical industry averages.

In addition, economists predict that gold and silver will continue to rise in price in the coming months. The recent impacts to the global economy were so severe that they may fundamentally alter how people think about precious metals stocks. The precious metals industry is in much higher demand than it used to be.

Is Wheaton Precious Metals a Scam?

Wheaton Precious Metals is not a scam. This is a legitimate company that you can purchase shares in if you want to reap the benefits. You can't buy actual gold and silver through them, but you can get dividends from your stock holdings.

It's true that Wheaton is able to maintain bigger margins than other precious metals mining companies. They do this by partnering with mining operations and buying a stream of the partner's revenue at a fraction of the market price. This lets them amass and sell for a huge profit over the years.

Pros and Cons

Pros:

Cons:

Final Thoughts

Wheaton Precious Metals is an interesting choice if you want to invest in a precious metals company. Rather than operating like traditional miners, they provide capital to mining operations in exchange for some of the yield. This lets them expand to cover the globe while maintaining huge margins.

If you want to invest in physical gold and silver, this is not the company for you. They don't have a marketplace where they sell their assets to individuals. Instead, the option you have is to buy stocks that will pay shareholder dividends over time.

There are more risks to investing in stocks than investing in precious metals. But since Wheaton's operations are spread over the globe and diversified, there are fewer risks with this company than with other miners.

Overall, we consider Wheaton a solid investment choice if you want to buy stock in a precious metals streamer. Their unique business model makes them more attractive to investors than traditional mines.

Although we do think that Wheaton Precious Metals is a solid company for certain investments, we believe that there are better companies out there in most investment scenarios.

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Or, continue with Wheaton Precious Metals...