Have you made the decision to set up a Precious Metals IRA? Are you ready to add some diversification to your investment portfolio and lessen your reliance on the volatile stock market? If so, congratulations. You're following the advice many financial experts are dishing out during these times of economic uncertainty that we’re going through.

Making the decision to open a Gold IRA is, however, just one part of the process. In addition to choosing which Gold IRA company you'll want to work with, you'll also need to decide which gold bars you want to add to your account. With the number of options available, this can be a daunting decision. We're here to share some of the various options you'll find through different companies to help you choose what you want to invest in.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

What are the IRS Requirements for IRA Gold Bars?

The IRS has established clear guidelines regarding the types of gold bars that are eligible to be held in an IRA. Each bar must have a minimum purity rating of 99.5% gold. Any gold bars that are not at least 99.5% pure will not be allowed in an IRA.

What Gold Bars are IRA Approved?

Now that you know more about the high standards that are in place for IRA gold, let’s take a look at some of the different gold bars that meet the IRS’ criteria. While requiring IRA gold bars to be at least 99.5% pure may seem like a high bar to reach, you may be surprised to see just how many different mints create bars that meet, or often exceed, these requirements.

Credit Suisse Gold Bars

Credit Suisse Gold bars are an excellent choice when you’re looking to add gold to an IRA. Minted by the Credit Suisse Group, which is headquartered in Switzerland, these bars are seen as a valuable asset. Each bar has a purity rating of .9999 fine, or 99.99% pure gold and is backed by the respected Bank of Switzerland. Individual serial numbers help confirm the authenticity and uniqueness of each bar.

PAMP Suisse Gold Bars

If you are looking for a solid investment option for your Gold IRA, you cannot go wrong with PAMP Suisse Gold bars. The company is headquartered in Switzerland and has been in business since 1977. During the years that followed, it grew quickly and became one of the top producers of bullion in the world. PAMP offers several lines of gold bars, including Fortuna Gold Bars, Lunar Gold Bars, and Rosa Gold Bars. The line that you are most likely to see available through a Gold IRA company is the Fortuna Gold Bars, since they are the most popular offering from the company. Each bar bears an image of Fortuna, the goddess of fortune according to Roman mythology. In addition to her image on the obverse of the bar, the revers is stamped with the PAMP Suisse logo, an individual serial number, the weight of the bar, and its purity level (.9999 fine).

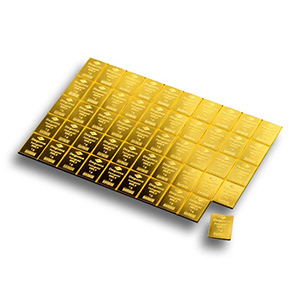

Valcambi Gold CombiBars

Valcambi Gold CombiBars are a bit different from most other gold bars you’ll see. Unlike other bars that are simply one solid piece, a CombiBar offers fractional pieces of gold that one could break off and barter or sell for cash. A 50-gram bar, for example, offer 50 individual sections, each weighing just 1 gram. Each of these sections can be broken off, much in the same way that you would break apart a chocolate candy bar. Valcambi Gold CombiBars are .9999 fine gold and can make a wonderful addition to a Gold IRA.

Engelhard Gold Bars

Engelhard gold bars are also a great option when you want to add gold to an IRA. The Engelhard Company was in business for over 100 years, from 1902 to 2006. During its time, it was known as the largest refiner of gold, silver, and platinum in the world, and the bars it produced are seen as highly pure and extremely valuable. However, in 2006, the company was sold and stopped producing gold bars. This means that no new bars are currently being made, so those that are still out there are likely to be seen as even more valuable as the years pass (especially if they were minted decades ago). The bars are .999 fine and are available in a wide range of sizes.

Royal Canadian Mint Gold Bars

If you’ve been looking into investing in gold, then you’ve surely heard of the Royal Canadian Mint. It is one of the most-trusted and highly-regarded mints in the world and has a stellar reputation for producing high-quality and highly pure coins and bars. The gold bars made by the mint are .9999 fine and are adorned with the logo of the mint. Depending on the Gold IRA company that you work with, you can get these brilliant gold bars in a range of different weights.

APMEX Gold Bars

APMEX gold bars are available in a wide assortment of sizes to help nearly any investors meet their goals. These bars come in sizes as small as just half a gram to as large are 1 kilogram. Each APMEX gold bar is .9999 fine and branded with the company logo. Both pressed and poured options are available to better match your preferences.

Perth Mint Gold Bars

The Perth Mint is responsible for minting currency for Australian (the Royal Australian Mint also products some currency for the country). If you are looking for a gold bar of a particular size, it is likely that you’ll be able to find one minted by the Perth Mint. With its superb history and quality standards, the Perth Mint is among the most respected national mints. Each gold bar has a purity level of .9999. Adding a gold bar made by this mint to your Gold IRA is always a safe and wise investment decision.

Johnson Matthey Gold Bars

For over 200 years, Johnson Matthey has been producing gold products. With their long history, the company has garnered a lot of respect and is highly regarded in the industry. While the 1-ounce and 10-ounce gold bars from Johnson Matthey are the most popular, there are also other sizes and weights available to add to your Gold IRA

Sunshine Minting Gold Bars

Sunshine Minting is one of the most well-known private mints in the country. They offer gold bars in multiple sizes, including options that are as small as just 1 gram or as large as 100 ounces. Each bar is made using .9999 fine gold and displays the logo of the mint. Moreover, each of their bars come with a guarantee that they meet the weight a purity levels stamped on the front of the bar. The individual serial numbers verify the authenticity of the bars.

FAQs

What is the Difference Between Pressed and Poured Gold Bars?

Both pressed and poured gold bars could make a welcome addition to a Gold IRA. However, there are a few key differences between these types of bars that will help you decide which is the right fit for your portfolio. As the name suggests, poured gold bars are crafted by pouring liquid gold into a mold. The resulting bar has more of a classic appearance and looks as if it could have been crafted by hand decades ago. However, due to their design it is possible for these gold bars to be tampered with and for someone to remove (or even add) gold from the bar, thus impacting its weight and value. Poured gold bars do generally cost a little less than their pressed counterparts.

So, how are pressed gold bars different? Rather than pouring the liquid gold into a mold, the gold is pressed down into the mold. The resulting bars look different from poured gold bars. They have raised edges and are much more uniform in appearance and size. This means that they are also easier to store because they will stack together better. And, because of the raised edges, these bars cannot be tampered with. This can give you more peace of mind that your bar will not be altered in any way whenever it is out of your possession.

Are Gold Bars Better than Gold Coins?

Gold bars and gold coins each have their own pros and cons, which can impact whether one or the other is the best addition to your Gold IRA. One of the benefits of gold bars is that you can find a wider assortment of sizes to choose from. This means that your investment options will be more flexible, and you can more easily find the right quantity of gold to match the value you wish to invest. Some gold bars weigh just 1 ounce, while others may weigh up to 1 kilogram.

Gold bars also tend to cost slightly less per ounce than gold coins. With gold coins, you’re paying a premium for their more unique designs. Gold bars will also stack more easily and more neatly than gold coins, which can be important if you’re purchasing large quantities and want to make sure that you’ll be able to easily store them.

However, there are a few advantages to gold coins which you may also want to consider. First, they sometimes can grow in value more than a gold bar. This is because each gold offers unique and attractive designs, which could be even more highly-desirable in the future when they are out of production. Gold coins have also historically been used as currency in several countries, which can make them more appealing to some investors.

The good news is that you do not have to choose between the pros and cons for gold bars and coins. You can add some of both to your account to get the best of both worlds.

How Do You Add Gold Bars to an IRA?

Now that you've learned about a few of the available gold bars that you can add to an IRA account, you may be wondering where to start. The first step is to find a trusted Gold IRA Company to work with. Make sure that you do your research before deciding which company you want to work with. Some have a much better reputation in the industry and with past customers than others. You can search for reviews from past clients to see the type of attention they give each customer and the overall quality of the products they offer.

Another thing to check before deciding who to work with is the specific gold bars that you can add to your Gold IRA. While there are many different gold bars produced by different mints, you won’t be able to get every option from every company. If there are any specific bars that you must have in your account, take the time to confirm that they’re available from the companies you’re considering.

After you’ve taken the time to do some research and have decided which Gold IRA company you want to work with, the next thing you’ll need to do is open the Gold IRA account. To do this, you’ll need to start by filling out the necessary paperwork. You’ll then work with a Gold IRA custodian to set up to transfer the funds from a current retirement account to your new Gold IRA account. After this transfer is complete, the next step will be to choose the specific bars (and coins) that you want to hold in your retirement account.

As with other types of IRAs, you can contribute additional money to your account each year. The IRS recently increased the maximum contribution from $6,000 to $6,500 for individuals under 50 and from $7,000 to $7,500 for those 50 and older.

What is the Best Gold IRA Company?

So, who do we recommend if you’re looking for the best Gold IRA Company? We think you should reach out to Goldco for help setting up your account. Goldco has a decade and a half of experience with helping their customers set up Gold IRAs. You’ll quickly realize just how knowledgeable and ready to help each of the account representatives are.

You don’t have to just take our word for it. Look up reviews from past Goldco customers to see the type of attention and service this well-respected company offers. Moreover, you can also look up ratings from the Business Consumer Alliance and Better Business Bureau, and you’ll see that Goldco has maintained the highest rating offered by each of these organizations.

Goldco has broken down the process of opening a Gold IRA into just a few simple steps. The representative you work with will also be available through each step, ready to offer any necessary guidance or advice as you open your account, fund it, and decide on which gold bars you wish to add to it.

To sweeten the deal (as if what Goldco has to offer isn’t already sweet enough), the company is currently run an exceptional promotion. New customers can earn up to 10% of their new IRA back in free silver. With this promotion, you can receive additional silver pieces that will help add to the overall diversification of your portfolio and increase your net worth.

Don't forget to check out our top recommended companies before investing!