Investing in a gold IRA can be a smart financial move, but it's important to understand what you're getting into before committing. That's why it's important to research and read honest reviews.

Vantage Gold IRA is a popular provider, offering various products and services to help you invest in gold. In this review, we'll look at what to consider and what to expect when investing in a Gold IRA with Vantage.

We'll discuss the company's history, products and services, fees and customer service ratings. With this information, you can decide whether Vantage is the right provider for you and your retirement portfolio.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

Vantage IRA Background

One of Arizona's most trusted names in self-directed IRA custodianship is Vantage IRA, formerly Entrust Arizona. Since its founding in June 2004, the Phoenix, Arizona-based company has amassed more than 6,500 customers.

With First Trust Company of Onaga (FTCO) as its partner, Vantage IRA is a TPA that manages individual retirement accounts. Financial advisors at Vantage IRA help clients set up and manage self-directed IRAs.

Vantage has been at the forefront of the retirement account market in promoting investment diversity since 2004. Their target market consists of wealthy individuals in the United States who may not be keen on investing in the stock market.

Investing your money wisely requires knowledge of several options, such as custodial accounts and alternative asset IRAs. When you work with Vantage, you'll have access to a group of experts who are prepared to see you through the process quickly and easily.

If you're an alternative asset investor looking for a helpful, personable and easily accessible account administrator to oversee your portfolio, Vantage is here to serve you.

Vantage is dedicated to protecting your retirement investments. They work hard to provide you with various investment options that are both malleable and promising so that your money may be put to work just how you want it to.

Vantage Self-Directed IRA Management

Currently, Vantage manages retirement funds totaling over $2.5 billion. Vantage is one of the preeminent administrators of IRA accounts in the US. They assist savers who wish to diversify their retirement funds into private companies, real estate and promissory notes.

J.P. DahDah, who earned degrees in finance and marketing from the University of Arizona is the company's founder and chief executive officer. In 1997, he began working as a financial advisor for American Express Financial Advisors, a reliable Fortune 100 firm.

Mr. Dahbah's tenure in the banking sector spans a whopping 26 years. He has received numerous honors and distinctions throughout his career, including the prestigious "Entrepreneur of the Year" award from the Arizona Hispanic Chamber of Commerce.

In addition, he was recognized as one of Arizona's most promising young business leaders by being named to the inaugural class of "Forty Under 40" by the Arizona Hispanic Chamber of Commerce and the Phoenix Business Journal. He was named one of the 25 "Most Admired Leaders" in 2020.

Advantages of Investing In A Gold IRA

With a Gold IRA, you can benefit from the potential for appreciation of physical gold while also enjoying some additional tax advantages due to its status as an IRA. Here are some of the key benefits of investing in a Gold IRA:

Diversification

A gold IRA offers a great way to diversify your retirement portfolio by adding a tangible asset that has proven to hold its value over time. Gold exposes you to an asset class that has historically moved independently of stocks and bonds, reducing your overall portfolio risk.

Tax Advantages

With a Gold IRA, you can defer or even eliminate paying taxes on the profits from investments until you start taking distributions from the account. This can help you maximize your savings, as any gains will be untaxed until you withdraw them.

You can deduct your contributions to a Gold IRA from your taxable income every year, which can lower your tax bill and give you more money to save for retirement. Also, when you eventually take distributions from your gold IRA, they will be taxed at the lower capital gains rate instead of your income tax rate, which could save you a significant amount of money.

Stability

A Gold IRA allows you to hold physical gold bullion as part of your retirement portfolio, giving you the added benefit of diversifying your investments and protecting your assets from market volatility.

Gold is considered a safe-haven asset and has been used to hedge against stock market volatility and economic uncertainty for centuries. Gold has maintained its purchasing power over long periods, providing stability and security for investors in times of turmoil.

Liquidity

One of the most attractive aspects of investing in a Gold IRA is the liquidity it provides. With a Gold IRA, you can easily withdraw or exchange your funds when needed, allowing you to take advantage of profitable opportunities or cover unexpected costs.

Liquidity also makes it easier to use your gold IRA to supplement other retirement and investment income forms.

Protection Against Market Downturns

Gold has been a reliable store of value for centuries and its price is usually less volatile than other investments such as stocks or bonds. Owning a portion of your portfolio in gold can provide you with a haven if the stock market takes a dip, as gold tends to hold its value better than other investments during economic uncertainty.

Gold also has the benefit of low correlation with other assets, which can help you diversify your portfolio and reduce risk.

Vantage Gold IRA Investment Accounts

Vantage IRA's website is clunkier than average. Vantage IRA doesn't provide a convenient way to view all available investment choices in one place.

Under the "Forms" menu item, you'll find a breakdown of all the details. The website might be more user-friendly with some tweaks here and there. The various Vantage IRA retirement plan options were eventually uncovered after diligent research. One can choose from the following investment account options.

Traditional IRA

This tax-advantaged account allows you to set aside pre-tax money for your retirement. With a Traditional IRA, you can make contributions each year up to the IRS limit, which will be tax deductible.

Vantage IRA makes it easy to open and manage a Traditional IRA. You can contribute to your IRA through various methods, including direct deposit, cash deposit, transfers from other accounts or mail. Your contributions must be made by the tax filing deadline each year to be eligible for that year's tax deduction.

When withdrawing funds from your Traditional IRA, you generally cannot do so until you reach age 59 ½. To avoid taxes and penalties, you must take Required Minimum Distributions (RMDs) once you reach age 70 ½. Early withdrawals are possible but may incur taxes and a 10% penalty.

Roth IRA

A Roth IRA is one of the most popular types of investment accounts offered at Vantage IRA. It's a retirement savings plan that allows you to make after-tax contributions with the potential for tax-free growth and withdrawals in retirement.

Contributions to a Roth IRA can be made with earned income (such as wages, salary or self-employment income) up to the annual contribution limit, which is currently $6,500 for those under age 50 or $7,500 for those age 50 and over.

Contributions must be made by the individual's tax filing deadline, typically April 15, but contributions for the prior year's taxes can be made up until the tax filing deadline.

Withdrawals of contributions can be taken out at any time without penalty. However, if you withdraw earnings before age 59 ½, you may be subject to taxes and penalties. Upon reaching age 59 ½, you can withdraw your earnings without penalty.

Roth IRAs also allow you to take a qualified distribution, meaning you can take out up to $10,000 without penalty or taxes to purchase a first home.

SIMPLE IRA

A SIMPLE IRA (Savings Incentive Match Plan for Employees) is a retirement savings plan for small businesses and self-employed individuals. It's an easy way to save for retirement while taking advantage of tax benefits.

At Vantage IRA, you can open a SIMPLE IRA and contribute with pre-tax dollars. When you contribute to the account, you get an immediate tax deduction on your contributions. Contributions to a SIMPLE IRA are made by both you, the employee and your employer.

The maximum contribution you, the employee, can make is $15,500 in 2023, plus an extra $3,500 "catch-up" contribution if you're 50 or older. Your employer's contribution is limited to matching your contribution up to 3% of your salary or a flat 2% of your salary, regardless of whether you contribute.

You can begin withdrawing funds from your SIMPLE IRA when you reach the age of 59 ½. Before that point, withdrawals are subject to a 25% early withdrawal penalty unless you qualify for a special exception.

This means you should think carefully before withdrawing money from your SIMPLE IRA, as any funds withdrawn before age 59 ½ may be subject to taxes and other penalties.

SEP IRA

A SEP IRA or Simplified Employee Pension Individual Retirement Account is a great retirement investment option offered by Vantage IRA. It's perfect for business owners, freelancers, and the self-employed who want to save for retirement.

With a SEP IRA, you can contribute up to 25% of your compensation or $66,000, whichever is less. Contributions are made with pre-tax funds, meaning they reduce your overall income taxes owed.

In terms of making contributions to your SEP IRA, it's easy. Just deposit funds into the account before filing your year's tax return. Remember, contributions are limited to the lesser of 25% of your compensation or the annual limit.

When withdrawing funds from a SEP IRA, you can do so at any time once you reach age 59 ½. You are required to start making withdrawals at age 70 ½. Withdrawals will be subject to income taxes and may also be subject to a 10% penalty if taken out before age 59 ½.

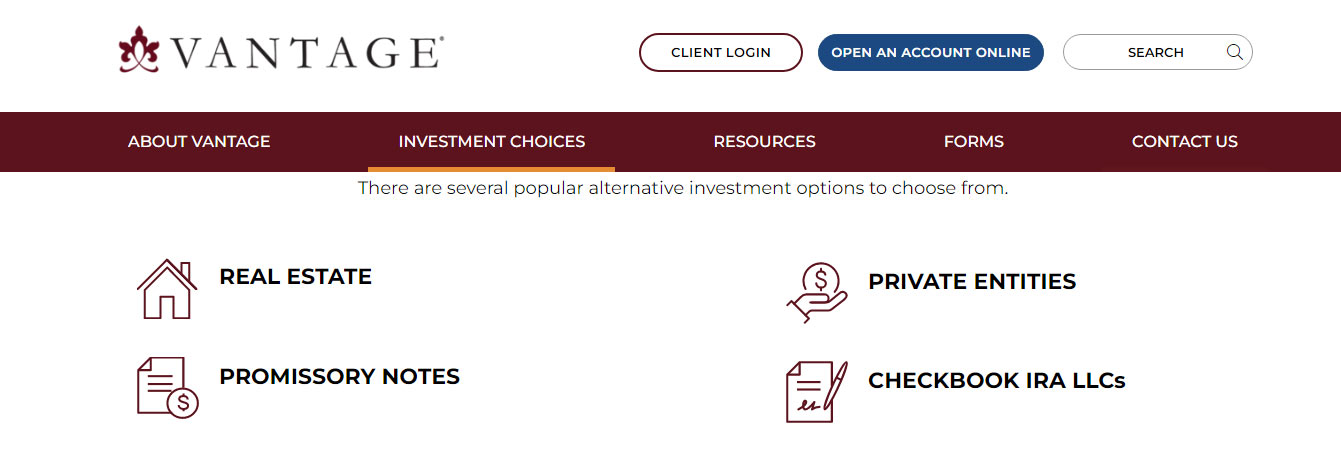

Vantage Gold IRA Investment Options

The Vantage Self-Directed IRA allows you to invest in alternative assets not available through traditional IRAs, such as real estate. Some of the most well-liked investment choices are listed here.

Private Entities

Private companies are available for investment. These businesses are private and are not traded on any public exchange. Startups and businesses of a similar size fall into this category. You can find these in various organizational forms, such as limited partnerships, limited liability companies, private placements, private funds and private stocks.

Investment capital for private firms comes from individuals and small groups. These can include individual retirement accounts, which can provide a welcome cash infusion to a young company. One perk is that your IRA won't have to pay any taxes on profits from these types of investments if and when they turn a profit.

Real Estate

This is the most common investment option for SDIRA holders. Commercial, single-family, multi-family, mixed-use, raw land, seasonal rentals and "fix and flips" are just a few of the many real estate options available to investors.

Real estate purchases made with an IRA are functionally equivalent to those made with other types of funding. You can pay cash, take out a mortgage, or use a company for a purchase. It is entirely up to you to decide.

Checkbook IRA LLC

A Limited Liability Company or LLC, is a legal structure that provides its owners with limited legal liability for their business actions and the resulting financial repercussions. In a Checkbook IRA LLC, the IRA serves as the sole proprietor of the business.

It has a wide range of advantages. It is common for investors to prefer the structure of an SDIRA because it allows them to act quickly on investment opportunities and accommodates their desire to hold a diversified portfolio.

Promissory Notes

The option to lend money is available for those with a Self-Directed IRA interested in a fixed-income investment. All sorts of promissory notes can be purchased with an IRA. Convertible notes, trust deeds, private credit funds and unsecured notes are all examples.

Managing your own IRA is entirely up to you. With the funds from your SDIRA, you can play the role of the lender if you like. You can use a self-directed IRA for private loans.

Opening A Gold IRA with Vantage IRA

Here's an overview of the steps you need to take to open a gold IRA with Vantage IRA:

1. Research

Do your research and make sure that a gold IRA is right for you. Make sure you understand the risks associated with investing in physical gold.

2. Open an Account

Register for an account with Vantage IRA. You will need to provide basic information, such as name and address, for identification purposes.

3. Fund Your Account

Transfer funds into your new account. This can be done through various methods, including check, wire transfer or direct deposit.

4. Choose Your Investments

Once your funds have been transferred, you can begin selecting the gold investments that are right for you. Vantage IRA offers a wide range of options from trusted and reputable suppliers.

5. Store Your Gold

Once you have made your purchases, you will need to decide how to store them. Vantage IRA offers a secure storage solution to store your gold safely and securely.

6. Monitor and Manage Your Account

Keep track of your gold IRA investments and monitor their performance. Vantage IRA provides you with all the tools and resources you need to do this effectively.

Vantage Gold IRA Fees

The Vantage Gold IRA setup fee is $50. This covers setting up and transferring your funds into the account. An annual maintenance fee of $100 covers the account's cost and any additional services you might need. The cost of holding precious metals IRAs begins at $225 per year.

If you choose to store your gold in an off-site storage facility, the storage fee is typically $125 per year. When buying or liquidating gold, you'll be charged a commission based on the value of the gold you're buying or selling.

The commission can range anywhere from 0.5% to 2%. In addition, there is a wire transfer fee of $30. If you need custom research or advice, there's a fee of $50 per hour. Finally, if you need to mail documents or gold, there's a fee of $30 per package.

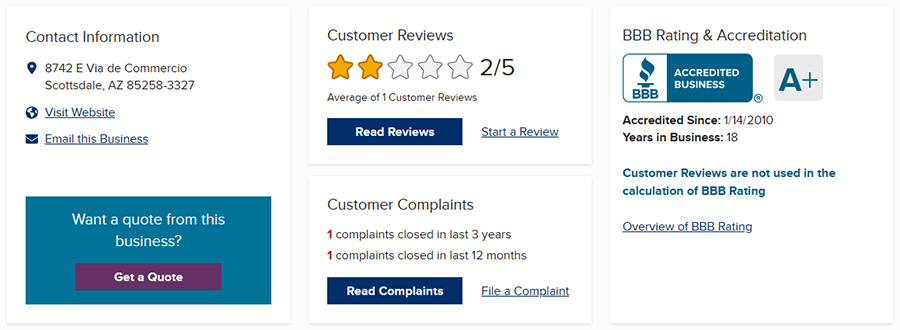

Vantage Gold IRA Ratings

Vantage IRA customer ratings are consistently high, with hundreds of verified customer reviews across multiple platforms. Customers praise the company for their knowledgeable staff, competitive pricing and speedy customer service.

The Better Business Bureau (BBB) currently rates Vantage Gold IRA as an A+, the highest rating. This reflects the company's commitment to excellent customer service and ethical business practices.

Final Thoughts

Vantage Gold IRA is an excellent option for those looking to invest in gold, but it has some drawbacks. On the plus side, Vantage Gold IRA offers various investment options tailored to your needs. However, the fees associated with these investments are quite high and there are also some hidden fees that you should be aware of.

We understand that the services offered by Vantage Gold IRA are appealing. Still, we highly recommend looking at our top-rated gold IRA companies before deciding on Vantage Gold IRA. These companies offer better services at lower costs and have a track record of success.

Our top-rated gold IRA companies offer a range of services to make investing in gold easier and more secure. These include opening and managing gold IRA accounts, providing gold IRA rollover services and offering gold purchasing advice.

Moreover, these companies provide access to a wide variety of gold products, including coins, bullion and bars. They also offer an extensive selection of precious metals and rare coins to invest in. Most importantly, our top-rated gold IRA companies provide excellent customer service, so you can be sure you're getting the best possible experience when investing in gold.

Don't forget to check out our top recommended companies before investing!