Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Self-directed IRAs are becoming more and more popular. Many people have lost faith in traditional investments, so they want to build their own portfolios with alternative assets. You can open a precious metals IRA by investing with a specialized company.

You have to be careful, though. Plenty of companies just want to take your retirement assets without giving you anything good in return. Where does Strata Trust Company fall on the spectrum? Are they worth investing in?

We've taken a look at everything you need to know before getting involved with this company.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if Strata Trust Company made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

About Strata Trust Company

Strata Trust Company has been working with self-directed IRAs since 2008. Now the company has more than two billion dollars in managed customer assets, and there are more than 50 employees. The company president is a woman, something that's rare in retirement planning.

Overall, the company has a good reputation for caring about their customers. In addition, they are extremely transparent about their fees and pricing. You don't need to worry that you'll be hit with any hidden costs. You don't even need to worry about keeping up with quarterly payments, since everything is billed annually.

The transparent fee structure does have a downside. The company charges for things that most other IRA companies don't. You'll need to pay an annual charge to have the company handle aspects of your investment like transactions, record keeping, and administrative duties.

Management Team

The President of the company is Kelli Click, who has led the company since 2009. Before joining this company, she worked as a Vice President of Sales at a large trust. Her strongest background is in real estate, which serves her well when helping with self-directed real estate IRAs.

The Chief Operating Officer is Jeff Thompson, a man with 29 years of self-directed IRA industry experience. Any large investors are given his custodial services.

The CFO is Michelle Maruri, a woman with over three decades of self-directed IRA experience. Over the course of her career, she has managed information technology and accounting teams alike.

There are three more executives along with five managers. These people make up the upper management. More than 50 people are employed in total.

Investment Options

Strata Trust Company works to help people establish self-directed IRAs. These are retirement accounts that hold IRS-approved alternative assets, such as precious metals, real estate, and cryptocurrency. All of these accounts must abide by strict IRS guidelines.

Strata is one of many trust companies that provide IRA solutions. However, they don't provide 401(k)s. If you're looking for a company to manage a major corporation, you might want to go with someone else. But if you're just an individual or small business investor, an IRA has significantly fewer fees.

The company handles multiple different types of IRA. The right one for you will vary according to your needs.

If you want to invest in a traditional IRA, you can do so with Strata as your custodian. Traditional IRAs are managed by an investment advisor, similarly to how 401(k)s are managed. With these, instead of choosing your own assets, your investment manager will allocate a diverse portfolio for you.

You can also get a Roth IRA. This is a type of IRA that doesn't let you deduct taxes when you're still contributing. Since you've paid all your taxes straightaway, you don't have to worry about taxes once you start taking distributions. Roth IRAs work best for people with a high net worth.

If you want your small business to offer IRAs, you might consider SIMPLE or SEP options. Both of these let a person's employer contribute to their retirement account. You and your employer both get tax advantages. However, you can only use these accounts when you're working with companies that have a maximum of 100 employees.

Because IRAs are exclusive to retirement accounts in the US, Strata does not work on an international level. They focus only on managing IRAs for people in the US who need to open them. You can also transfer custodianship of an existing IRA to them if you find yourself unsatisfied by your previous custodian.

Storage

Strata does not operate their own vaults, so you can't store items with the company. However, they do have partnerships with two of the top depositories in the US. Both meet IRS standards for precious metals IRA storage.

This means you can choose between Brinks Global Services and Delaware Depository, whichever you prefer. Delaware Depository has just one location in Delaware. Meanwhile, Brinks has more West Coast locations including Los Angeles, California and Salt Lake City, Utah.

You can choose between commingled and segregated options. Segregated storage is more expensive because it gives your items a vault of their own. With commingled storage, you save money, but more people will have access to your items. All items will be fully insured for their value.

If you purchase silver, you must keep it in commingled storage. Segregated storage is only an option for gold, palladium, and platinum.

Is Delivery an Option?

You cannot have your materials delivered to your house if you work with Strata. This is because Strata exclusively works as an IRA custodian. Since IRAs are retirement accounts, they are subject to strict rules and regulations from the IRS.

Every IRA must have a licensed custodian. This is the job that Strata does. The assets in the IRA must be in the care of the custodian rather than the care of the personal holder. That way, you know that your items aren't vulnerable to theft or damage. It also helps hold everyone to the same standard regarding their assets.

Is There a Buyback Program?

Strata is not in the business of buying or selling precious metals. They simply act as the custodian for your goods.

When you fund your account, you will need to buy precious metals from a brokerage. Many brokerages do have buyback programs, where they will purchase the metals they sold you once you're ready to start paying dividends. This allows you to liquidate your assets without any hassle.

If you're concerned about asset liquidation, make sure you work with a brokerage that has a buyback program. Many gold IRA brokerages will happily work with Strata to streamline the process of setting up your account.

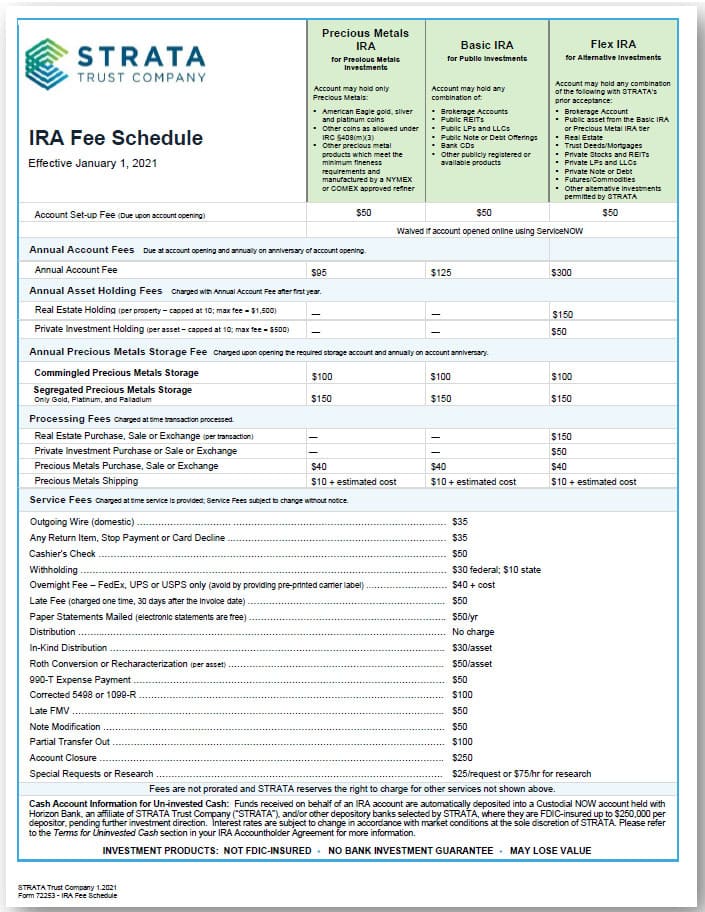

Company Fees

There is a 50 dollar fee to set up a flex IRA, basic IRA, or precious metals IRA. You'll pay different annual fees depending on the type of account you open. Precious metals accounts cost 75 dollars per year. Basic IRAs cost 100 dollars, and flex IRAs cost 250 dollars annually.

Basic accounts cover public investments. These are the types of investments you're used to seeing in a retirement portfolio: limited liability corporations, certificates of deposit, brokerage accounts, and real estate investing trusts.

A flex IRA is for alternative assets. These are not public investments. Precious metals are on the list of allowable assets for a flex IRA, as are several other assets. You can put real estate, private stock, private notes, commodities, and futures in the account as well.

Precious metals IRAs are the cheapest because they focus exclusively on precious metals. Your account will be made up of precious metals that adhere to strict IRS regulations.

If you open a flex IRA, you will need to pay 100 dollars annually to hold real estate and 50 dollars annually to hold private notes. If you store precious metals in this account, you'll need to pay 100 dollars per year. You also have the option of segregated storage for 140 dollars per year.

With segregated storage, your items are only available to you and your custodian. No one else has access to the vault. Some people like to pay for this option because it makes them more comfortable.

The annual account fees are relatively low when compared to a lot of the competition. However, you will also need to pay 50 dollars for record-keeping and wire transfers. It's just a matter of whether the fee structure will work for your particular accounting needs.

Customer Support Options

Strata's website is clean and easy to navigate. It answers most questions that you might have about the types of accounts offered, the process of opening an account, what assets are allowed, and how much you can expect to pay.

You can open an account through Strata's website in just a few minutes. All you need is an email address, your driver's license number, and your Social Security number.

Once you open that account, you'll be taken to a vast library of resources. These will teach you about different investment strategies, assets, and the pros and cons of each one. You'll have a chance to consider different types of portfolios and learn how to tell which is best for you.

The ServiceNOW resource on the website functions like an online concierge. While it isn't a full chat service, it will help you find answers to frequently asked questions. You can also use the resource center to look at regulations, learn tips about account protection, and use a return calculator.

Unlike many other trust companies, Strata allows you to pay your fees online through their payment portal. That makes it super easy to stay up-to-date on your annual billing.

If you have any questions, you can fill out an online form and submit it. The company will get back to you with an answer soon. You can also call their customer support line at 1-866-928-9394 if you need to speak to someone directly.

The website lacks an online chat feature, but other than that, it has everything you could want for solid customer support.

Is Strata Trust Company a Scam?

Strata Trust is definitively not a scam. They have a long history of working to manage people's IRAs. Their team of experts is well-versed in IRS guidelines and regulations. They meet all the necessary requirements to function as a custodian for an IRA.

Their annual fees are lower than much of the competition, but you will have to pay 30 to 50 dollars for minor paperwork processing and transactions. If you intend to have a lot of transactions, this can add up quickly. Despite the transparent fee structure on the website, some people have been blindsided by this.

Are There Red Flags?

There are a few potential red flags when it comes to this company. The biggest one is that there are very mixed reviews.

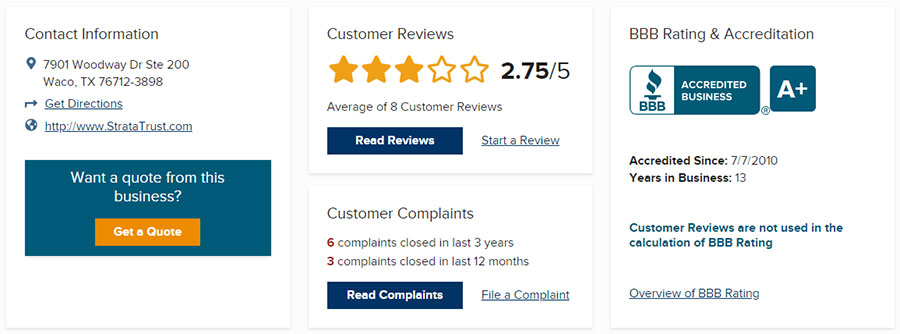

With the Better Business Bureau, the company has an A+ rating and a total score of 4 out of 5. But there are only six consumer reviews counted.

Trustpilot has over 860 reviews, which gives you a better sample size. The rating is 4.4 out of 5 stars. Not terrible, but middling enough to indicate that some people have had bad experiences.

With the 53 reviews on Yelp, the company averages 3 out of 5 stars. Again, it's a very mixed bag. It seems like people have either wonderful or terrible experiences when working with this custodian.

There are other IRA custodians who have a better track record. People find that they charge less, have more transparent customer service, and make it easier to communicate. If you don't want to choose a custodian, you can also work with a brokerage who already has an established relationship with a trust company.

Customer Complaints

Customers are often disgruntled about the fees. In particular, real estate holdings tend to accrue significant fees. There's a lot more paperwork and transaction processing with these than with precious metals. Some customers say they're spending hundreds of dollars a year just to maintain a property.

Because of this, Strata probably isn't the best go-to if you have real estate in your self-directed IRA. Their fee structure simply isn't built for real estate management. It's much better pointed toward precious metals.

Another customer mentioned that the company took more than three months to process one single transaction. He said he was ready to sue. While we can't know what caused the holdup, this complaint is concerning. You want your IRA custodian to be prompt and responsive with anything regarding your assets.

Final Thoughts

Strata Trust Company is an IRA custodian that can manage self-directed and traditional IRAs. Their annual fees are competitive, and their fee structure is clearly printed on the website. But there are some serious drawbacks as well.

To make up for the low annual fees, there are charges of 30 to 50 dollars per transaction, paperwork process, and other mundane activities. Many other trusts do not charge for these tasks, since they're part of typical custodial duties. Those fees can add up quickly, especially if you're holding real estate.

In addition, some customers have complained about slow processing times with their transactions. If you're going to pay extra for every transaction, it seems like it should at least go quickly, right?

You might not have a bad experience with Strata. They are fully accredited and licensed to act as IRA custodians. Every IRA account needs a custodian to comply with IRS regulations. But you might want to shop around and look at the fee structures of different custodians.

Another option is to work with a precious metals brokerage. Some precious metals dealers specialize exclusively in precious metals IRAs. They help streamline the setup process, connecting you with a custodian and handling all of the communication for you.

The best brokerages have buyback programs. When you're ready to start paying dividends, they will pay market price for the metals. Since you aren't allowed to fund an IRA with metals you already own, you'll need to work with a brokerage either way.

Although we do think that Strata Trust Company is a solid company, we believe that there are better companies out there to make your investment with.

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Or, continue with Strata Trust Company...