Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Rosland Capital is a precious metals dealer that works with clients in the US, as well as parts of Europe and Asia. For United States clients, they also offer gold IRA services. These allow you to invest in precious metals as part of your retirement plan.

Like with other retirement contributions, you can defer tax payments on your precious metals until you are ready to start taking payouts. At the same time, you must comply with stricter IRS regulations than with a regular investment. Rosland aims to streamline the process to make it easier for the average investor.

You can also invest in precious metals for non-retirement purposes. Many financial experts recommend investing in gold and silver because they provide a hedge against inflation. These make up a stable part of an investment portfolio. They are unlikely to increase significantly in value over time, though, so they should be supplemented with other investments.

In addition to dealing precious metals to an international clientele, the company also works with charities and organizations like the Red Cross. They help raise money to deal with disasters and humanitarian crises around the globe.

Precious metals are a competitive industry. If you want to edge out the competition, you need to have something new to offer. Rosland seems to offer most of what the competition does, but is that enough?

It would be - if their customer reviews were good. Unfortunately, there are enough complaints to give us pause.

We've taken a look at what Rosland offers and what customers have to say about them.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if Rosland Capital made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Company Basics

Rosland is headquartered in the UK, but has since expanded to serve clients in six international markets. They have also begun offering gold IRA services to people in the US. Since these are specific to US retirement accounts and tax legislation, they aren't available for international clients.

The company was first founded in 2008, and it has made itself a fierce competitor by using advertising campaigns and informative website copy. But it hasn't been a favorite of the customers who buy the services.

There's also something questionable about a UK company helping people navigate US tax codes. It's possible, of course, but most gold IRA companies are stationed in the US itself. That allows them to staff experts who are familiar with US tax law not just because they've studied it, but because they use it for their own taxes.

It's possible that they expanded into gold IRAs because those are the most lucrative options in the US. Most people don't have several thousand dollars lying around that they can easily convert into precious metals sales. More than half of the US lives paycheck to paycheck.

Fewer people have retirement accounts than ever before, too. But when Americans do have wealth, it tends to be tied up in their 401(k) or IRA. These accounts allow you to accrue a tidy sum over time. Since you can't access them without penalties until you reach a certain age, they aren't depleted. And they're specifically set up to grow as time goes on.

If you're looking for investors, you need people who have a retirement account. By rolling retirement funds into a gold IRA, these people purchase Rosland's items when they wouldn't otherwise have the means.

That's a fair way of doing business. But again, it's easier for US companies to specialize than UK companies. In fact, many US companies do specifically specialize in gold IRA setups. Many of them also have much better reported experiences than the majority of Rosland's customers.

Products Offered

With the US market, Rosland focuses hard on gold IRAs. They have quick guides that help you determine whether it's a good idea to invest in precious metals. Essentially, unless you already have at least 20 percent of your retirement tied up in precious metals, they'll recommend that you invest.

There are noted advantages to precious metals investment. These investments tend to be relatively stable. They also retain their value even when the stock market plummets. Many people are feeling uncertainty about their economic future thanks to the stock market's volatility. There have been too many economic downturns over the past few decades.

So Rosland is correct that it's a good idea for you to invest in gold. The question is just whether you should invest in gold with them.

Gold IRAs

After determining whether you can benefit from a gold IRA, Rosland can help you set the account up. This is helpful because the process of establishing a self-directed IRA involves confusing paperwork, communication with the IRS, communication with your custodian, and a lot of coordination of your purchases.

Rosland aims to streamline the process. Instead of having to talk to a million different entities, you just talk to them. They handle all the communication with other third parties. They also help you through the paperwork, and they make recommendations for purchases based on your assets, risk tolerance, and long-term goals.

Keep in mind that Rosland is not the only company to offer this exact service. Several others do, and their specialists tend to make the process much less headache-inducing, at least judging by consumer reviews.

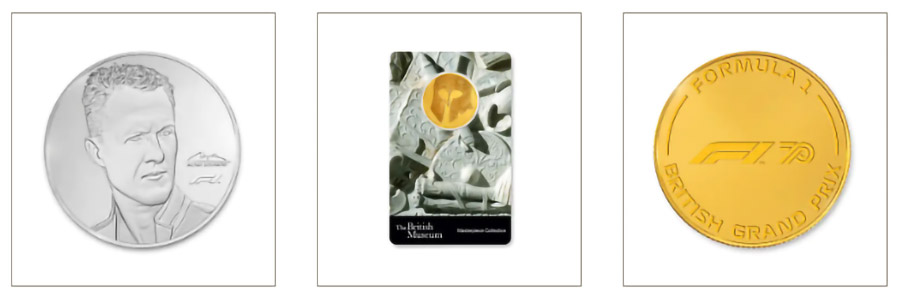

Coins and Bullion

Whether you're investing in an IRA or a nonretirement portfolio, you can buy coins and bullion. Both gold and silver coins in a variety of different currencies are available. You can also buy platinum bars. Palladium purchases are limited based on when the company has access to this precious metal.

If you are investing in a gold IRA account, you will need to comply with IRS regulations. This means that you can only invest in precious metals coins and bars that meet a certain purity percentage level. The percentage is different depending on the metal, but is always in excess of 99 percent.

The experts at the company can explain which of their products are compatible with a gold IRA.

Rare Coins

There are a variety of rare coins and collector's editions available through the website. Rosland claims that these have great potential for growth, but they're actually risky investments. Collectible coins are only worth as much as people are willing to pay for them.

That means that when the coin is popular, it might soar in value. But if you hold onto it for a few decades, only to discover that no one is interested in purchasing it, you might end up losing money overall.

That said, Rosland's rare coin collection is impressive if you're a numismatist who really likes coins. They price their collections using bids on the open market as their guide. Real coin collectors and experts are in charge of the process.

The company has worked with several organizations to create exclusive coin collections over the years. These cannot be found anywhere else on the market. They have to be purchased through Rosland.

Potential Red Flags

Unfortunately, this company has a lot of red flags. Though they are a legitimate business, they have a large number of complaints that are enough to cause concern.

The company has had a surprising number of complaints lodged against them with both the Better Business Bureau and the Business Consumer Alliance. As of writing, there have been 23 complaints with the BBB within three years. Five of them have been closed in the past year.

Several of these complaints say that the agents at the company were dishonest. They gave bad investment advice, upsold products that the client didn't need, confused the client about what they were purchasing, and charged more than market value for the items. Some people also report absurdly high commission rates.

This is a huge concern for us. When you invest in precious metals, you want to be sure that you're working with a company you can trust. That goes especially for gold IRAs, since you'll likely be working with them through retirement.

If the company is only in it for money, they might give you bad advice on purpose just to get their money's worth. It's better to work with a reputable dealer that offers genuine expertise and transparent pricing.

Specific Complaints

One recent complaint says that the customer bought precious metals in 2016. Four years later, they wanted to participate in the buyback program to liquidate their assets. Rosland wouldn't call back at first.

Once the customer did get in contact with the company, the information they received didn't make them happy. They had paid more than 30 dollars for each coin, at a time when silver was about half that price on the open market. Rosland offered to buy the coins back for only 24 dollars apiece.

The sales rep the customer spoke to was unsympathetic. They said that it would be better for the person to hold onto their purchase until the price of silver had gone up further. But even though silver had increased in value since the purchase, the buyback offer was significantly less than what they paid.

The customer suffered a loss of more than one thousand dollars over this. In addition, the same customer had bought more than 10,000 dollars in gold coins. They had reached out three times to the company to try to get a quote for the buyback program. Rosland never called back.

Rosland has resolve this complaint by calling the customer back and being more transparent about their buyback prices. But the person shouldn't have had to write a public review to get their attention. Customer service is important even when a company isn't making money off of it.

Another recent complaint states that their order was cancelled and returned. The customer followed the procedures and policies outlined on the website to have their money refunded. But they were not given a refund. The company also refused to respond to calls or texts.

The consumer cancelled the order themselves because they had lost supplemental income because of the pandemic, and they needed the funds. They followed the refund policy steps and also submitted a written notice of the cancellation.

Once the letter was received, a company representative instantly called the person. They tried to persuade them not to cancel the order. The customer said that they wanted to proceed with the cancellation. Boxes were sent to return the order without any issue.

The customer had a tracking slip to see when the return packages arrived. Once they got to the company's office, there was radio silence. The client did not receive any notification of the packages, nor did they get a refund. They also could not get an answer when calling the company.

As of when the review was written, the customer had waited for more than 30 days to receive a refund. They did receive one after writing the review. In addition, they stated that they were very satisfied with how the issue was resolved. But again, they shouldn't have needed to post a bad review to get attention.

Yet another recent complaint says that there were problems with the delivery. Even though the coins are usually supposed to arrive within two to three weeks, this customer had been waiting six weeks for their coins to arrive. Every time they called the company to get information, no one picked up.

When this customer placed their order, the representative they spoke to said that the products would be there within ten days. Once ten days had passed, that same representative changed the estimate to "soon." After several weeks, a "guaranteed delivery date" was given, except that the customer still didn't receive their metals.

The customer said that they'd called the company many times. Even when they'd gotten in touch with a representative, they'd been told that someone would call them back. No one ever did.

The company responded explaining the shipping delay. Apparently there were issues with the shipping company that have now been resolved. In addition, there was a shipping error that is unlikely to happen again. The customer did receive their metals eventually.

Final Thoughts

Rosland Capital is an international precious metals dealer that has poured a lot of money into advertising and company resources. But without investing in good customer service, that isn't enough.

There are too many complaints to give this company a ringing endorsement. Unless you're making a purchase, the customer service team is slow about resolving issues. The salespeople also upsell products and confuse clients about what they're buying.

You can work with another precious metals dealer instead. It's better to look for one that actually has good customer reviews.

Although we do think that Rosland Capital is a solid company, we believe that there are better companies out there to make your investment with.

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Or, continue with Rosland Capital...