Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

EXTREMELY IMPORTANT: Since writing this review, Regal Assets has had a TON of negative feed. Over the second half of 2022 there have been many extremely negative and disturbing reviews about the Regal Assets company. We will be stripping ALL links to Regal Assets and we DO NOT recommend them at all. It's very obvious that something big changed with this company (the owner has disappeared). IGNORE all information about Regal Assets in this review until we are able to change it. Again, do NOT do business with Regal Assets.

Diverse retirement accounts are a key part of maintaining your livelihood. And precious metals have become more important than ever, thanks to the volatility of the economy. There are some precious metals dealers that sell items that can be stored in your IRA. These companies also help you with the legal paperwork to make a new retirement account.

Regal Assets and Augusta Precious Metals are two of these. But what do you need to know?

Regal Assets vs Augusta Precious Metals

About Regal Assets

Regal Assets focuses on two types of legal alternative asset: cryptocurrency and precious metals. They have created an entire IRA streamlining process that allows people to buy precious metals and cryptocurrency in the same transaction. People who are interested in cryptocurrency retirement accounts report that Regal has some of the best services in this entire industry.They also have crypto and precious metals that you can buy with cash. In fact, some of their offerings include pre-made portfolios that blend thousands of dollars worth of gold and Bitcoin.

About Augusta Precious Metals

Augusta Precious Metals is one of the best-reviewed and most reputable gold dealers online. In addition to their retirement services, they occasionally sell historic coins and numismatics to collectors.

Augusta is best known for having a customer-first approach that involves incredible care. Customers continue to have a relationship with their account executive for as long as they hold that account, which is typically years.

Services and Products

Regal Assets

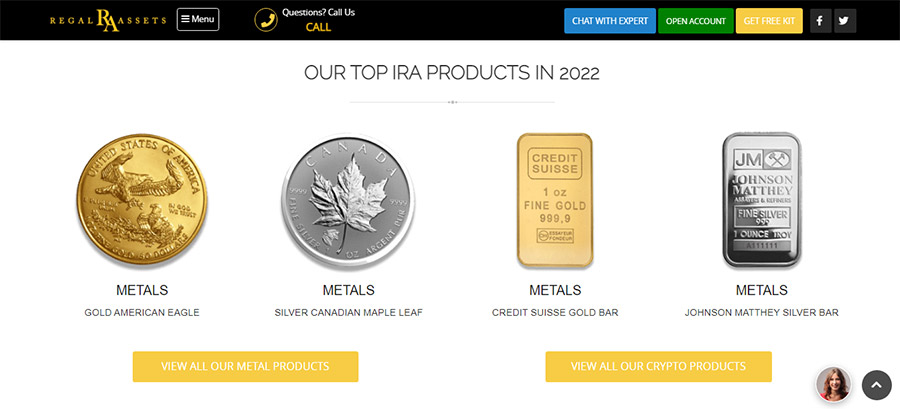

Regal Assets has combined cryptocurrency and precious metals into their main flagship product, the Regal IRA. They help you with all the legal paperwork and storage, then they sell you both metals and crypto. While their precious metals inventory is relatively limited, they have a robust selection of over 20 different cryptocurrencies. There's something for everyone from the cautious hedger to the reckless risk taker.

There are basic steps to getting started that have been written out on the website. These remain the same no matter whether you want to buy gold, silver, Ethereum, Bitcoin, or some combination of all of these.

That's all pretty simple and straightforward. It's a little odd that you can't just call and get started immediately over the phone, but that might just be so that the staff aren't constantly tied up on the phones.

If you buy precious metals without using your IRA, you can ship them to your house. Regal Assets has completely free shipping to both the depository and to your residence. There's also full insurance coverage.

In the past, the company ran a promotion that stated that they would offer a free Silver American Eagle to anybody whose package arrived late at their home. But it's hard to say whether they continue to run this promotion today.

Their cryptocurrency IRAs are significantly different from most IRAs in the precious metals sector. Cryptocurrency is an entirely different asset with different regulations, risks, and storage needs. Because the price fluctuates so constantly, each transaction comes with a 1% fee calculated based on the overall cost. That's a relatively low markup where crypto is concerned.

There are technically hundreds of cryptocurrencies, but Regal Assets offers more than 20 of the most promising. One of their experts can talk to you about exactly what each option is, how it functions, and what type of people are investing in it. There are also crypto guides that teach you the basics of things like Ethereum, Bitcoin, and the blockchain.

Finally, Regal Assets sells premade portfolios. If you pick a certain investment tier, you can get a combination of crypto and precious metals that have been designed for growth potential alongside stability. The more you invest, the more specific and customized the profiles become. There's a minimum buy-in of $10,000 for this service.

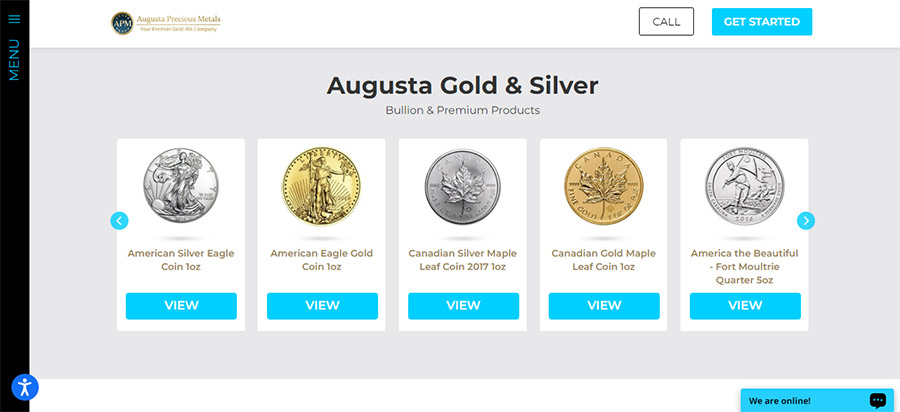

Augusta Precious Metals

Augusta has a fairly robust suite of services. Unlike Regal, though, they only focus on gold and silver. There aren't any cryptocurrency options, so they won't be the best choice for people who want to invest in other alternative assets as well.

If you want to open an IRA and store precious metals in it, then Augusta can walk you through the process. Every person is given a personal agent for their case. This individual will ask questions, learn about you, and guide you through the process. They will develop a rapport with you along the way.

These are the steps listed to opening your account and purchasing the metals that are listed on the Augusta website:

Augusta lists about 10 depositories that they can work with, which are located in every region of the US. But they do state that their default option is the Delaware Depository. This company has two depositories: one in Delaware and one in Nevada. Augusta generally works with the original Delaware location, since it's larger, better known, and has more advantages as far as taxes go.

Sometimes people can make purchases of precious metals without an IRA. Not all of Augusta's inventory is IRA-safe. They occasionally have historic coins and numismatic options that have been evaluated by the NGC. These graded coins can't be kept in an IRA due to their speculative value, but you can buy them with cash if you want.

Following an investment, Augusta provides ongoing customer care. You will have an online account that will display your holdings and how they've changed in value over time. If there are any important economic happenings going on, your team member will alert you. You can also ask for new insights and answers to new questions at any time, even if you aren't planning to make another purchase.

Buyback Options

Regal Assets

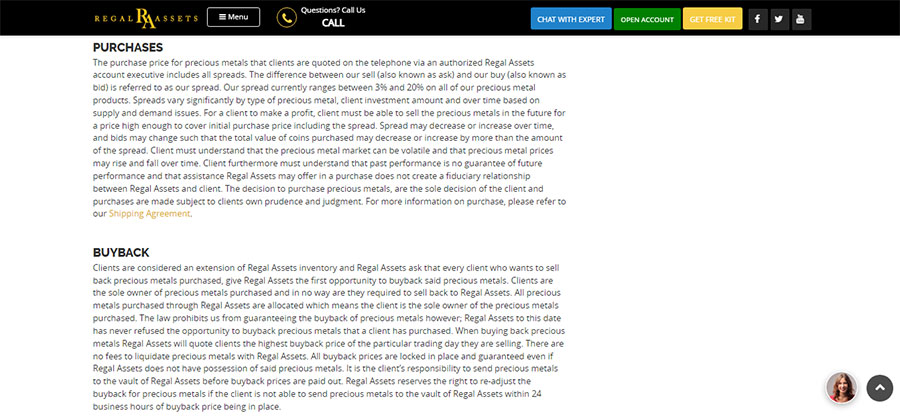

Regal Assets does have a solid buyback program. If you want to take distributions and sell your gold and silver, they will make you an offer that's centered on the current spot price. They don't explain exactly how they calculate the cost.

Buyback programs are a way to mitigate some risk for the customer. They make it easy to transfer your holdings into liquid assets. That way, you don't run the risk of needing to take a low offer from an unethical gold dealer just to get some cash in an emergency.

There aren't any transaction fees to sell your gold and silver back to Regal Assets. However, you do need to send the package out in the 24 hour period after confirming the price. Otherwise, you are technically in breach of contract. You may be given an adjusted price that includes market losses and a cancellation fee.

Augusta Precious Metals

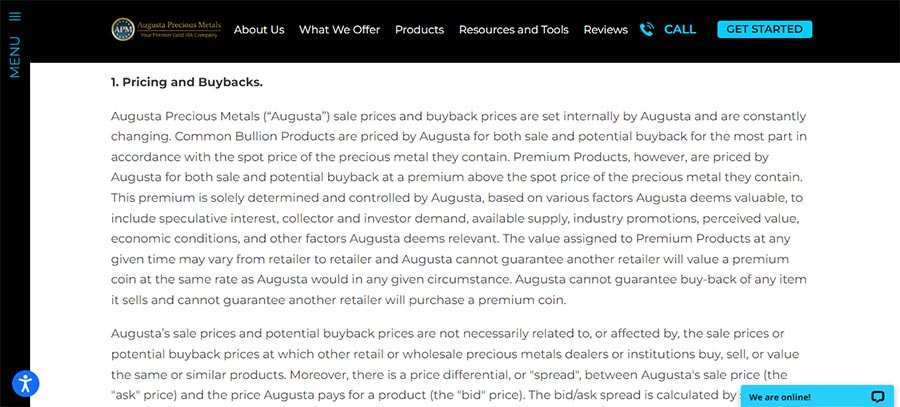

There is a buyback program with Augusta to a point. They are willing to buy your assets when you decide you're finished with them. They have never had a situation in which they've refused to buy back a customer's holdings. But they make it very clear on their website that they can't guarantee a buyback.

Now, the chances that you'll get a buyback offer are extremely good. So far for every other customer, those chances have been 100%. But the lack of a guarantee helps to protect Augusta from potential liability in case they ever run into financial trouble. They can't be legally obligated to purchase your metals if they don't have money.

The company seems to be doing well enough that that's a distant concern, though. There's no reason to think that they might be going out of business or dealing with difficult finances.

If you decide that the price you're quoted from Augusta is not to your liking, you can also have your metals physically shipped to you. But you should keep in mind that you can only do this with an IRA and not be penalized if you're 60 years old or more. That said, many customers have noted that they were given fair buyback terms from Augusta and were happy with the price they received.

Fees and Promos

Regal Assets

Some fees depend on which of Regal's services you're using. Are you buying crypto? Are you putting precious metals into a retirement account? Are you getting a pre-made portfolio?

Cryptocurrency transactions cost 1% of the total transaction cost. That's pretty standard.

The precious metals options use flat fees, though. The investment tiers for the pre-made portfolios range from $10,000 to $500,000. People who want to invest more can, but they will need to create a customized portfolio.

If you're using an IRA, the annual cost will be $100 for your custodian and $150 for your storage. Regal Assets only offers segregated storage options, so they're slightly on the pricey side. There are other companies that have combined maintenance and storage costs of around $150.

To use the IRA services, you must spend $15,000 or more. But you can combine the cost of crypto and precious metals to meet that minimum, if you want to buy both. It's also entirely possible to buy one or the other if you prefer.

Augusta Precious Metals

Augusta has flat fees as well, but they're lower than Regal's. You'll pay $80 for your custodian and $100 for your storage, for a total of $180. Keep in mind, though, that you will need to add $50 to this for the first year because of a one-time setup fee. After that, though, the cost of maintaining your account will only be $180 per year.

People who buy IRA metals with their retirement savings need to have $50,000 set aside for Augusta. Otherwise, the company will not offer their services. There are other companies with lower basic minimums, but none of them have the same level or depth of customer service that Augusta does. When you invest with Augusta, they become part of your financial journey for life.

There's not much information available on whether you need to meet a minimum amount if you're investing with your savings. You can buy bullion and collectible coins alike using cash instead of IRA funds.

Customer Service

Regal Assets

Regal Assets is similar to Augusta in that there is a chat agent installed on the website. You can type a question at any moment and receive an answer. You can also get in contact with the company by phone, and it seems like these hours are not as limited as Augusta's.

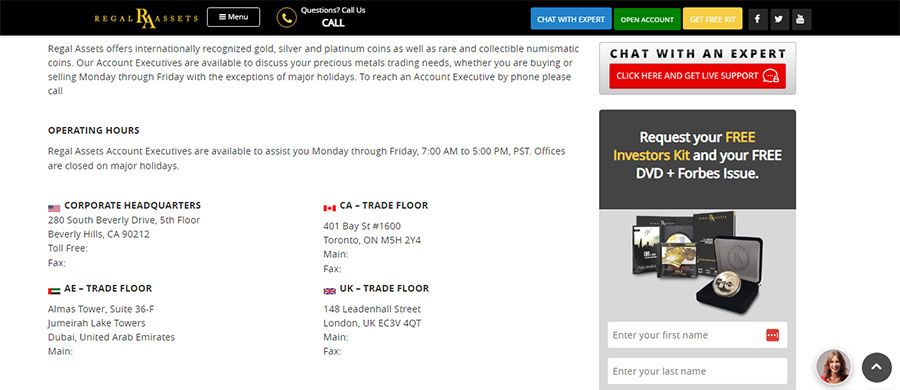

One potential advantage is that Regal Assets has several international offices. On top of their US office, they have offices in Canada, the UK, and Dubai. So it's generally possible to get in contact with someone no matter what timezone or time you're in.

However, it is worth noting that the company's customer service seems to have suffered a little lately. There has been a sudden influx of complaints over the past year, many of which are about customers feeling ignored or deceived. Though Regal has responded to all of these issues, it begs the question of what's going on behind the scenes with the company management.

But the company's reputation remains largely good. A few complaints aren't enough to erase years of amazing reviews and great scores from evaluations.

Augusta Precious Metals

As mentioned, Augusta Precious Metals has an incredible ongoing care policy for customers. They will handle your entire account setup, connect you with your metals, and then continue to check in. You're not just buying a few precious metals -- you're buying years upon years of service.

The company also has a variety of other things that help set it apart in terms of customer service. If you visit the website, there is a chat agent available to help no matter what. The phone hours are limited, but you can talk to them at any time between 9 AM and 8 PM EST.

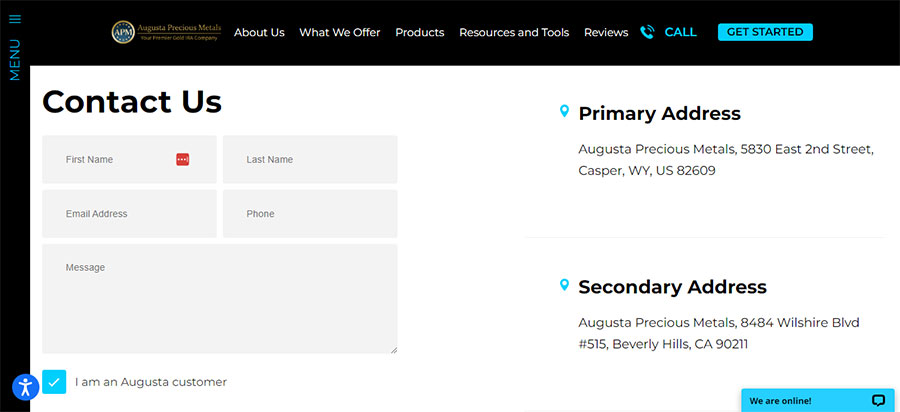

Additionally, it's possible to send messages to Augusta using the form on their Contact Us page. Or you can send an email. Their main office headquarters has a listed address on the site.

Similarities and Differences

Here are some of the most important overlapping features of Regal Assets and Augusta Precious Metals:

But here are some of the biggest advantages and differences of Augusta Precious Metals:

And here are the main advantages to Regal Assets:

Who Wins?

The final prize in the battle between these industry leaders has to go to Augusta Precious Metals. That goes double if you just want to invest in precious metals for retirement. They have the best IRA streamlining setup, and they have amazing service after you've created your account. Rather than seeing you as just a transaction, they cultivate a lifelong relationship.

Some people might consider Regal Assets if they can't afford Augusta's minimums. And it's true that Regal does have a pretty good reputation. But this company will work best for people who want to use their retirement funds for a mixture of crypto and gold. Regal Assets has such a strong focus on crypto that using their services for precious metals alone might seem silly.