Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

EXTREMELY IMPORTANT: Since writing this review, Regal Assets has had a TON of negative feed. Over the second half of 2022 there have been many extremely negative and disturbing reviews about the Regal Assets company. We will be stripping ALL links to Regal Assets and we DO NOT recommend them at all. It's very obvious that something big changed with this company (the owner has disappeared). IGNORE all information about Regal Assets in this review until we are able to change it. Again, do NOT do business with Regal Assets.

Alternative assets are all the rage these days. But to invest in alternative assets for your retirement, you have to manage your own IRA. And that can be overwhelming without a financial or tax background. Fortunately, there are investment companies built to help.

Both Regal Assets and American Hartford Gold sell alternative assets for clients to stow away in an IRA. Both have a strong focus on precious metals, while Regal Assets also adds cryptocurrency into the mix. Let's see which one works better.

Company Services

Regal Assets

Regal Assets sells gold and cryptocurrency. They say that they want to help customers secure their wealth and protect themselves from future economic harm. In addition, they want customers to have the growth potential that comes with cryptocurrency.

As such, they offer the following services:

The IRA rollovers involve having an expert fill out your paperwork and set you up with your custodian. They facilitate the entire process so that you don't have to deal with all the weird regulations and red tape. Then they use your funds to buy a combination of crypto and precious metals.

You can also skip the rollover process and just use your savings to make a purchase in cash. With this option, there aren't any major tax regulations or codes that you have to keep track of. You can simply have the items delivered to your house or stored in a digital wallet, and store them as you see fit.

Regal Assets has a somewhat limited selection of bullion, most of which is eligible to hold in your IRA. However, they do have platinum and palladium coins, something that many other companies don't bother to invest in.

The pre-made portfolios might be the most unique offering from the company. The first two package tiers are technically referred to as "packages" rather than portfolios. Because you haven't invested a huge amount, there's no way to custom craft an intricate and personalized portfolio. But you will receive a combination of precious metals and crypto that is optimized to suit your goals.

As you get higher up in the investment tiers, the packages become more and more complex. Eventually you'll be getting portfolios that are designed for massive stability, a source of income in case of disaster, and a portfolio that will maximize long term growth.

You can talk to your account rep about what you need, specifically. The ratio of metals to crypto will vary a lot depending on what your other assets look like, how old you are, how much you want to risk, how much you want to grow, and how much you rely on your current savings.

American Hartford Gold

American Hartford Gold doesn't participate in cryptocurrency at all. This company is focused exclusively on precious metals. But like Regal Assets, they do have platinum and palladium products on the shelves. The availability just varies depending on whether their inventory is fully stocked.

There are also a number of non-IRA coins available for purchase through AHG. Again, the availability fluctuates with the days. But you might find things like old circulated silver dollars, uncirculated historical coins, or classic minted coins that just aren't quite pure enough to pass the regulatory tests.

These coins must be purchased using cash, if you purchase them at all. You won't be able to hold them in your retirement account. You can still open a depository vault of your own and stash the items there. This is preferable to home safes, which are vulnerable to damage and robbery. It's also preferable to banks, which can have government ties and might be subject to searches by government agents.

IRA rollovers are a big part of AHG's business model as well. Because they don't have the same fees or requirements as many other companies, they have opened the floor to customers with less money. They're a great choice if you're dealing with a general lack of funds, but you know that precious metals are important to combat issues like inflation.

Cryptocurrency Versus Precious Metals

If you're already planning to invest in a combination of precious metals and crypto, then you also already know which company on this list is best for you. But what exactly is the deal with crypto? What are its benefits, and why is it paired with precious metals in a portfolio?

Essentially, crypto and gold are both non-traditional assets that retain a high value despite being decentralized. Neither is regulated by any internal body or government agency. While you can't generally use gold to pay for goods, some shops will accept crypto payments. While you can't hold crypto in your hands, you can hold gold.

Precious metals have historically been an investment that people make to feel safe. They perform predictably and have a high level of stability.

But on the other hand, this means that they don't have much potential to grow. They tend to gain value over time as natural inflation happens, and they can spike in value in response to economic unrest. But their value is intrinsically tied to their melted worth. You have to pay to store the metals, and you don't earn any dividends over time.

Cryptocurrency is the opposite of a safe investment. It is one of the riskiest investments you can make. The nature of the currency is all speculative, and it's totally subject to the whims of the market. Vague comments from politicians or tech CEOs can make or break an altcoin's worth.

But it also has explosive potential for growth. There are some people who invested in Bitcoin back when it was first introduced. Those people are now multi-millionaires, with some of them even being billionaires.

While that kind of explosive growth is unlikely to occur again, it has put crypto on the market as an interesting investment. But just as often, you'll hear stories about coins that lost all their value and disappeared overnight.

By combining precious metals with Bitcoin, you harness the stability of the precious metals for some kind of "cushion." But you also harness the growth potential of the Bitcoin, so your investment isn't stagnating and slowly losing value for years. At the same time, all of the assets are kept totally outside any government reach or central bank.

This tactic isn't for everyone. It's really only for people who are okay with the risks of crypto and who are intrigued by explosive growth. If all you want is the safety and stability of precious metals, then crypto will not be the right choice for you.

Storage and Custodian

When you put gold into an IRA, that gold needs to be stored somewhere. According to the IRS, it needs to be stored in a depository with a lot of security. And it needs to be managed by a financial institution that can act as a licensed custodian.

Finding the right custodian and depository can be tricky on your own. That's why so many precious metals dealers have partnered up with different depositories and custodians. That's true of both Regal Assets and American Hartford Gold.

Let's see what storage options they have available. With any of these companies, if you have a different depository or custodian in mind, you can just let them know. Most companies will be happy to accommodate you, although you might not get access to the special pricing that their partners offer.

Regal Assets

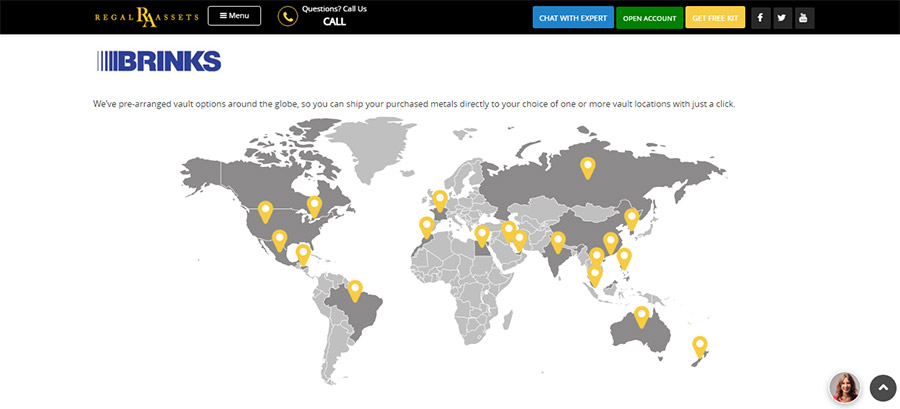

Regal Assets has done work with a number of different companies throughout the years. However, they currently have just one main custodial partner and one main storage partner. The custodian that they work with most often is CNB Custody, and their storage company is Brinks.

Now, it's important to keep in mind that Brinks has hundreds of depositories all located throughout the world. Most companies decide on two or three locations that they want to use. But Regal Assets makes a point of showing off how many international depository options there are. That's without even getting into all the Brinks depositories in every area of the US.

If your assets are valuable enough, they can even be directly delivered from Regal Assets to the Brinks depository using one of the famous Brinks armored trucks. Regardless of how your package is shipped, it will be insured for its full value. Regal Assets definitely has the most international depository options of any competing companies in this vein.

Just keep in mind that the people in charge of Regal Assets also believe that segregated storage is the most important. We don't necessarily agree with that. Non-segregated storage is still heavily audited and tested to prevent fraud. It is still insured, and you still receive items equivalent in value and quality to the ones that you initially stored inside.

American Hartford Gold

When you go to the American Hartford Gold website, they have an entire page where they talk about their main depository recommendations. They mention that you shouldn't keep your precious metals at home if they're part of an IRA, since there are specific IRS codes that prohibit this.

AHG says that they most highly recommend working with Delaware Depository or with Brinks Global Services. Even though Regal Assets also works with Brinks, AHG has a much more localized view. They don't work with dozens of different international depositories. Instead, they focus on a single large facility that Brinks has in Los Angeles, as well as one in Salt Lake City, Utah.

The Delaware Depository is a gigantic depository that's situated in Delaware. Since Delaware doesn't have any sales taxes or other taxes on gold and silver, it is one of the most popular places for people to stash their metals. The depositories exist completely outside of the federal banking system, so you don't have to worry about government seizures or thievery.

There is not very much information available online regarding the custodians that AHG works with most commonly. They do mention that the custodian fees will vary depending on who you choose as an account executive, as well as how big your account is. That seems to indicate that they often work with custodians that use percentage-based fees instead of flat ones.

Promos, Fees, and Minimums

Regal Assets

There are some sources that indicate that Regal Assets charges $15,000 in order to invest in a precious metals IRA. But other sources claim that the minimum is $10,000. It's possible that the company has adjusted their minimum over time. The minimum to invest in a package that isn't an IRA is $5,000.

The Regal Assets packages start with $5,000 and go up from there. These involve hand selected combinations of Bitcoin and bullion, as well as other cryptocurrencies. If you invest in one of the higher tiers, you'll be able to discuss your specific portfolio needs with your account handler. These packages seem similar to the survival packs created by the company Noble Gold, except that they're built for long-term growth rather than short-term survival.

If you're making a purchase for an IRA, then you'll need to pay $100 to the custodian and $150 for the storage. All of the storage options through Brinks are segregated. Regal Assets states that segregated storage is best due to the added layer of security. But if you want to save money, non-segregated storage is also very secure and costs a lot less.

There aren't any fees to create a Regal IRA, regardless of whether you're investing in crypto or gold or silver or some combination of these assets. You just have to meet the minimum requirements. There may also be promotions available if you qualify.

For example, there have been times in the past when Regal Assets would completely waive the first year of fees for new customers. They'd cover your storage and custodial duties. Another promotion is the company's Gold Investor's Pack, which is a kit that includes over $100 worth of precious metals educational resources.

If you're buying cryptocurrency, whether it's for an IRA or not, the fee is 1% of the value of your crypto. But precious metals all have flat fees.

American Hartford Gold

American Hartford Gold operates unusually in many ways. One of their unusual qualities is their fee structure, or lack thereof. You don't have to pay to set up an account with them, nor do you need to have a minimum investment. All you need to do is have a desire to use some of your current retirement funds to open a precious metals IRA, regardless of how little you can actually contribute.

If you do invest in bullion outside of an IRA, there may be an investment minimum of about $2,500. This is for packages that will be sent to your home or another location of your choice, rather than packages that are sent to an official depository.

The costs for storage and maintenance are fairly standard. According to the American Hartford Gold website, they cannot guarantee what the costs will be until you've chosen your custodian. But most customers end up paying $100 for their non-segregated storage and $80 for the custodian to maintain the account. Some custodians might charge percentage-based fees instead.

Since there's little information about American Hartford Gold's preferred custodial partners, you'll need to ask your representative who they most often work with. If there's no preferred company, then Equity Trust Company is a favorite choice of many other top IRA companies competing with AHG.

Shipping is not necessarily free through AHG. But there isn't an easy fee calculator, either. The shipping cost will depend on the weight of the package, the overall cost of the package and the insurance, and whether any of the expenses have been waived.

There are a few potential promotions that might be running through American Hartford Gold. As of writing, the specials are:

There's also the free toolkit available from the website, which comes with information about the precious metals industry. Sources seem to indicate that you can have your first annual fees waived for $50,000, and three years of annual fees waived for $100,000. With some other companies, these numbers are the bare minimum that you can invest.

Who Wins?

In general, these companies tie. They both have significant selling points, and whether one is better than the other really just depends on who you ask.

Regal Assets has cryptocurrency offerings along with pre-made cash portfolios. They also have international depository options in over a dozen other countries.

American Hartford Gold has very few fees to get started with an IRA. They make precious metals investment accessible to people who usually can't afford it.