The stock market. Ugh. If that’s how you feel, you are certainly not the only one. Many of us have been less than excited, or even downright disappointed, with the performance of our investment portfolio. And, it is difficult to see when things are going to get better. If you want to get some of your money out of the stock market and explore alternative investment options, a Gold IRA may be the perfect fit for you.

Gold IRAs make it possible to hold precious metals in your retirement account. The coins and bars you add to your account will be able to grow without you needing to worry about paying taxes on them until you retire (or initially when you set up the account for Roth IRAs). Precious metals are in limited supply, which makes them a very appealing investment for many people. If you’re thinking about investing in precious metals, one company you may be thinking about working with is Oxford Gold Group. Read on to learn more about this company and the products and services they offer to decide if they’re the right fit for your investment needs.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

About Oxford Gold Group

Oxford Gold Group is an established precious metals investment company offering a range of services, including helping individuals open Gold IRAs. The company has an A+ score from the Better Business Bureau and has earned an AA from the Business Consumer Alliance. If you’re looking for the best company to help you on your precious metals investment journey, they are certainly one you’ll want to consider.

When you look at Oxford Gold Group’s website, you can view their mission statement. The company has broken their mission statement down into three main categories, which really demonstrate their priorities and commitment to their customers. The categories include educating their customers to help them learn the best ways to invest their hard-earned money, offering the right amount of support to help each client achieve a stable IRA that will help them enjoy their retirement years, and taking care to guide and offer assistance wherever it is needed to help each client make the right decisions.

Precious Metals IRAs With Oxford Gold Group

If you decide to work with Oxford Gold Group to open a Gold IRA, you’ll find that the team of advisors is attentive to your needs and available to share their insights and recommendations. As an Oxford Gold Group customer, you can open a traditional Gold IRA which holds gold coins and bars or a Silver IRA which holds silver coins and bars. The other option to consider is a Precious Metals IRA. In a Precious Metals IRA, you can hold bars and coins made from gold, silver, platinum, or palladium. Some experts recommend a Precious IRA (which can also just be called a Gold IRA) because it lets you hold a wider selection of products, further diversifying your portfolio.

In addition to the option to invest in different types of precious metals within your IRA, there are also different types of Gold/Precious Metals IRAs to consider. They are Traditional Gold IRAs, Roth Gold IRAs, and SEP Gold IRAs. Each type has its own set of tax advantages to consider and decide which is right for you.

With a Traditional IRA, the money you invest in your account it tax-deductible. In fact, you won’t be responsible for paying any taxes on the money in the account until you retire and begin taking distributions from the account. If you are in a higher tax bracket now that you think you’ll be in when you retire, a Traditional IRA may be the best choice for you.

A Roth Gold IRA is another option to consider. For this type, your contributions will be taxed up front before they are added to the account. However, after this initial tax, you will not be responsible for paying any more taxes on the funds as they grow or even after you retire and start withdrawing funds from your account. This may be the best Gold IRA type if your current tax bracket is lower than where you think you’ll end up after retiring.

Regardless of whether you choose a Traditional IRA or a Roth Gold IRA, you can only contribute the maximum amount allowed by the IRS. Currently, that amount is $6,500 (if you are under 50) or $7,500 if you are 50 or over.

SEP Gold IRAs aren’t for everyone. They are a special type of IRA designed for small business owners and those who are self-employed. SEP Gold IRAs work a bit differently than Roth and Traditional IRAs. You are able to contribute more money, based on your earnings. Like Traditional IRAs, however, the money you contribute is tax-deductible, and you will only pay taxes on your account when you start making withdrawals.

Converting a 401K to a Gold IRA

Did you know that your current 401K could be eligible to be converted into a Gold IRA? Well, it’s true. Many 401K plans can be rolled over or transferred to a new Gold IRA, giving you a more diversified portfolio. If you already have a 401K (along with some other types of retirement accounts), the first thing you should do is to confirm that your account is eligible for an IRA rollover. A representative at Oxford Gold Group can help you find the answer to this question.

If eligible, then you’ll need to work with a Gold IRA custodian who will help to move the funds from your current retirement account into a new Gold IRA account. After the account is set up and the funds have arrived, you will be able to add the coins and bars you would like to invest in.

Bars and Coins for IRAs

Oxford Gold Group offers a large selection of gold, silver, platinum, and palladium bars and coins. Many other precious metals companies only allow investors to choose from gold and silver, but with Oxford Gold Group, you’ll have the added options of platinum and palladium. This can help you achieve an even further diversified portfolio.

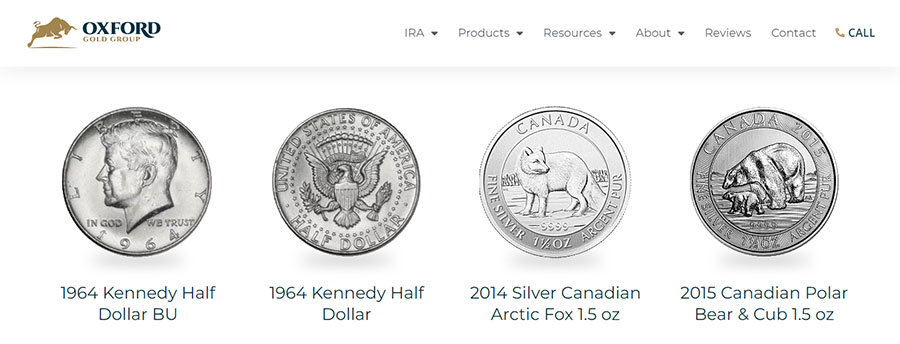

Unfortunately, you cannot simply add any piece of gold or silver to a retirement account. Purification requirements have been created by the IRS, and all coins and bars must meet or exceed their high ratings. Gold is required to be at least 99.5% pure, while silver must be 99.9% pure, and platinum and palladium must be 99.95% pure.

A few of the many options offered by Oxford Gold Group are featured below. All of these meet the minimum requirements for purity and can be added to a Gold IRA. As always, if you have questions about what you should invest in, contact your account representative. They’ll be able to provide you with some good advice.

Gold

Silver

Platinum

Palladium

Additional Ways to Invest in Precious Metals

Did you know that Gold IRAs are only one of the services offered by Oxford Gold Group? In addition to opening a Gold IRA, you can also purchase precious metal to hold outside of a retirement account. With this option, there are no restrictions about how you can store your precious metals, so you can keep them in your own house, a safety deposit box at a bank, or wherever you feel that they will be secure.

If you are interested in purchasing precious metals from Oxford Gold Group as a personal investment, you can buy any of the IRA-approved precious metals mentioned above. However, the company offers a few more options, too. Because the IRS’ minimum purity requirements do not apply to personal investments, you can also browse through the collectible coins available through Oxford Gold Group. These include:

Silver

Resources for Investors

As we shared earlier, one of the tenets of Oxford Gold Group’s mission statement was education. The fact that they have an entire section of their website dedicated to investor resources helps prove that they are indeed focused on educating each client. Hovering over the “Resources” tab at the top of the page will display the various categories of information available to you: Education, Charts, and Resources.

In these sections, you can find charts displaying the current value of each type of precious metal along with its performance over the past months and years, a wide array of articles designed to help you learn more about investing in precious metals, market news and updates, and much, much more. There is also a special gold qualification quiz developed by Oxford Gold Group that can help you determine whether investing in precious metals is the best financial move for you.

Free Investment Guide from Oxford Gold Group

Would you like to learn more about working with Oxford Gold Group to open a Gold IRA? Visit their website to request a free copy of their investment guide. The investment guide offers valuable information in an easy-to-understand format related to investing in precious metals. It can really help you make the best decisions for your retirement.

Features

Pros:

Cons:

Closing Thoughts

We shared a lot of information about Oxford Gold Group. Hopefully, you’ve found that information to be helpful and have found the answers to the questions you started with. Now that you know more about Oxford Gold Group, how they operate, and the type of products and services they offer, how do you feel about working with them. Do you think they are the right fit for your needs and goals? Or do you think you would be best suited by looking for a different Gold IRA company to work with?

Don't forget to check out our top recommended companies before investing!