With the volatile stock market and the ever-changing landscape of the global economy, many people are looking for a reliable and secure way to protect and grow their wealth. The Orion Gold IRA is one financial product that has become increasingly popular, as it offers a unique and innovative way to invest in gold, silver and other precious metals. But is the Orion Gold IRA worth investing in?

In this comprehensive review, we'll look at the features and benefits of the Orion Gold IRA and its potential drawbacks to help you make an informed decision about whether or not it is a suitable investment.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

History and Background of Orion Metal Exchange

In the precious metals industry, Orion Metal Exchange stands apart. It was established in 2017 and has its headquarters in Los Angeles. You can buy rare collectibles and an excellent variety of IRA-eligible precious metal coins from this vendor.

Similarly, the firm's IRA division helps customers open Precious Metals IRAs. Customers can choose between several secure vault options when storing metals with Orion Metal Exchange. It does not work with a depository bank.

When it comes to precious metals investing, Orion Metal Exchange pays close attention to its customers' needs for information. The website features a "News" section and a "Free Investors Kit," which provide information about the company. Furthermore, a ticker displays the current prices of gold, silver, platinum and palladium.

Investors outside the United States are also welcome to take advantage of the company's offerings of precious metals and IRAs. The firm provides each investment with a dedicated account representative to better serve its clients. This person will be your point of contact during the whole investment process.

You can ask them anything and get advice on which precious metals would be best for your investment portfolio. Your account manager will also maintain regular communication with you, keeping you apprised of any developments in the economy or on the stock market that may have an impact on your portfolio.

Trust Pilot has given the company a perfect score of five stars. Additionally, Orion Metal Exchange has been named a Top Gold IRA Precious Metals Company by Consumer Affairs for both 2017 and 2018. With over half a century of experience, this firm is dedicated to finding its clients the best precious metals investment opportunities.

The Professional Coin Grading Service (PCGS) has also certified Orion. Both the Numismatic Guaranty Corporation (NGC) and the Industry Council for Tangible Assets (ICTA) have approved it, so you know it's legit.

Products and Services

Orion Metal Exchange is a platform for investing in precious metals and a resource for managing precious metals IRAs.

Precious Metals IRA

Orion Metal Exchange can help you form a precious metals IRA if you wish to invest in gold, silver, platinum, palladium and other precious metals while saving for retirement.

Tax benefits to using an IRA to save for retirement make IRAs a unique retirement account. By reducing your taxable income in the tax year(s) in which contributions are made to a traditional IRA, your tax bill will go down. Instead, you will pay taxes on withdrawals from the account in retirement when your tax rate is likely lower.

When it comes to precious metals in an IRA, Orion Metal Exchange can be a valuable resource for buyers, sellers and storage. You can fund your Orion Metal Exchange account with cash and use their services to acquire the metals of your choice.

Gold, Silver, Palladium and Platinum Products

You can still use Orion Metal Exchange to purchase coins even if you don't form an IRA to store your precious metals. You can diversify your holdings in precious metals by purchasing silver, gold, platinum and palladium from the company.

Available coins have been minted in Canada, Australia, the United States and the United Kingdom. However, most of the company's coins come from the United States.

The inability to examine the prices of various coins and to place orders online are two critical drawbacks of Orion Metal Exchange. To acquire a quote or to make an order, you must contact a live agent by phone.

Orion Gold IRA

A gold IRA is a retirement account that allows you to invest in physical gold, silver, platinum and palladium. It's a great way to diversify your retirement portfolio and protect your savings from the stock market's volatility. With a gold IRA, you can buy and store precious metals at an approved depository, just like any other IRA.

The primary benefit of a gold IRA is that it allows you to take advantage of the potential appreciation of the value of gold while still taking advantage of the tax benefits of a traditional IRA. You can also have peace of mind knowing that your retirement savings are backed by a tangible asset that has historically held its value.

When handling Gold IRAs, custodians must adhere to the IRS's strict regulations on safeguarding assets, accounting and reporting. Regarding Gold IRAs, Orion Metal Exchange is among the most trusted names in the industry.

Why Investing in a Gold IRA Is Worthwhile

Investing in a gold IRA can be an excellent way to diversify your retirement portfolio and gain additional financial security. Here's why:

Stability

A gold IRA offers increased protection against market volatility and other economic risks. The price of gold is historically stable and has held its value over time, making it a great long-term investment option.

Tax Benefits

When you contribute to a gold IRA, your contributions are tax-deductible up to certain limits. Your contributions to your gold IRA can reduce your taxable income for the year. Furthermore, any returns you earn from your investments are not taxed until you withdraw them, meaning you can defer any taxes on those gains until retirement. That can be an attractive benefit for anyone looking to protect their wealth.

Another key tax benefit of investing in a Gold IRA is rolling over funds from other retirement accounts without incurring any taxes or penalties. This allows you to easily move money from a traditional IRA or 401k into a Gold IRA, taking advantage of the potential tax savings while building your retirement savings.

Diversification

Investing in a Gold IRA is worth it because it helps diversify your portfolio. Diversification is an important part of any investment strategy, as it ensures you're not putting all your eggs in one basket. A Gold IRA allows you to spread your investments across multiple asset classes, which can help you manage risk and optimize returns.

Hedge Against Market Crash

Gold is a precious asset and has been proven repeatedly to retain its value throughout economic turmoil, making it a smart and reliable investment for those seeking stability.

Investing in gold helps to protect your retirement funds from the volatility of the stock market and can help to ensure that you have a secure financial future. Plus, since gold isn't subject to inflation or devaluation, you won't have to worry about losing your hard-earned money in the event of a market crash.

Preservation of Wealth

Gold has been a traditional long-term store of value for centuries and remains one of the most reliable ways to preserve your wealth over time. Gold is a tangible asset, meaning its value is not tied to any government, currency or stock market. Therefore, it can't be devalued due to market fluctuations or geopolitical instability. It retains its purchasing power over time, while other investments such as stocks and bonds may rise and fall in value.

Liquidity

Gold IRAs allow investors to access their money quickly and easily. Instead of waiting weeks or months to liquidate other investments, one can instantly access the funds in their Gold IRA. This allows investors to take advantage of market opportunities quickly and efficiently.

Additionally, many gold IRA custodians will allow you to borrow against your account, allowing you to use your gold as collateral for a loan if needed.

Types of Gold IRA Accounts Offered by Orion Metal Exchange

Orion Metal Exchange offers a variety of gold IRA accounts, including the following:

Traditional Gold IRA

This tax-advantaged retirement account allows you to invest in gold, silver and other precious metals. With a Traditional IRA, your contributions are typically tax-deductible and the assets you store in it grow tax-deferred. You'll pay taxes when you're ready to start taking distributions from your account.

With a Traditional IRA Gold account, you can store your gold in a secure, insured facility, giving you peace of mind that your gold is safe and sound. You can store your gold at home or in an approved depository.

In addition, you can easily transfer funds from your existing IRA or 401(k) into a Traditional IRA Gold account. This makes it easy to start investing in gold without liquidating your current investments.

Roth Gold IRA

A Roth IRA allows you to invest your retirement dollars in gold and other precious metals. With a Roth IRA, you can contribute up to the annual maximum amount and your contributions will grow tax-free over time. You can take advantage of the tax benefits associated with the account, including tax-deferred growth and tax-free distributions when you retire.

A Roth IRA also offers you more flexibility than other types of IRAs. You can withdraw money from your account without penalty if you meet certain conditions, such as using it for educational expenses or a first-time home purchase.

SEP Gold IRA

A SEP IRA or Simplified Employee Pension IRA is an employer-sponsored retirement plan for self-employed individuals and small business owners. It's similar to a traditional IRA but allows for greater contribution limits and flexibility.

With a SEP IRA, the employer can contribute up to 25% of the employee's annual salary (up to $66,000 in 2023). A SEP IRA is an excellent option if you're self-employed, own a small business, and want to invest in gold.

You can choose from various gold coins and bars when investing in gold with a SEP IRA. Many investors opt for gold bullion coins, such as American Eagles and Canadian Maple Leafs, which are popular, easy to trade and widely recognized.

You can also select gold bars in various sizes and weights. With a SEP IRA, you can store your gold at a third-party depository, giving you the peace of mind that your investment is secure.

How Orion Gold IRA Works

In a tax-deferred manner, Orion Metal Exchange Gold IRA account holders can store bullion bars and coins made of gold, platinum, silver and palladium.

Setting up the IRA is simple with the help of the company. A gold IRA can be opened with either a cash deposit or a rollover from another retirement plan. Popular goods like Silver Eagles and American Gold are among the many IRS-approved precious metals available from the company.

The tax treatment of an Orion Gold IRA is identical to that of a conventional IRA. Consequently, you can claim a tax break for the amount you put into your IRA when filing your federal return.

Withdrawals from your account are not permitted until you reach the age of 5912. If you take money out of a retirement account before it's time, you'll have to pay taxes and a 10% penalty.

After reaching the age of 70½, you are required to start taking taxable withdrawals from your traditional IRA.

Withdrawals from a Roth Gold IRA are not subject to taxation because the investor has already covered the tax liability associated with the contributions made to the account. Withdrawals do not need to start at age 70½ if you don't want to.

Orion Gold IRA Pricing and Fees

Orion Metal Exchange is the preferred broker for many investors because of its low fees. Depending on where your precious metals are stored, the annual storage price might range from $75 to $100.

The insurance premium in that storage price is already included. Precious metals investments can be made for as low as $5,000. But if you want to take advantage of discounts and special offers, you should spend at least $30,000.

If you spend $30,000 with Orion Metal Exchange, you will receive free storage, insurance and a custodian for a year. Not having to pay an annual agreement fee is a major perk.

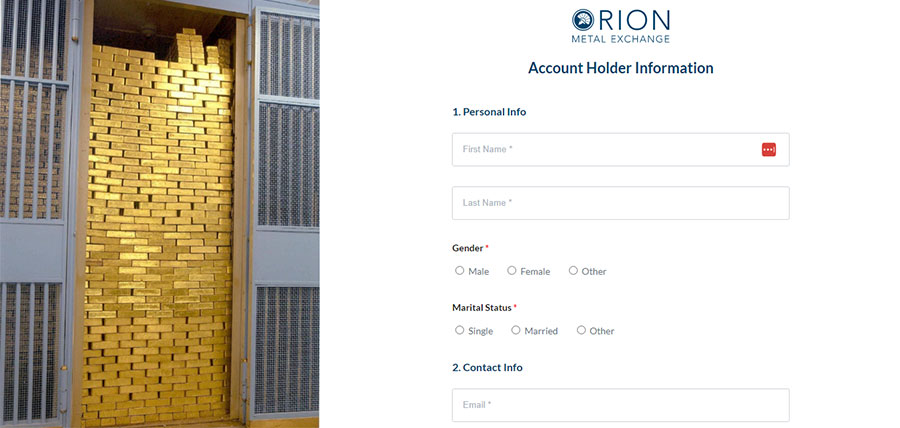

How To Open a Self-Directed Gold IRA with Orion Metal Exchange

Opening a self-directed gold IRA with Orion Metal Exchange is quick and easy and you can be on your way to investing in gold and other precious metals in no time. Here are the steps you need to take:

1. Choose An IRS-Approved Custodian

When opening a gold IRA, you need first to choose an IRS-approved custodian. This is the financial institution that will manage and store your gold. Orion Metal Exchange makes this step easy by providing access to top-tier custodians.

2. Set Up Your Gold IRA

Once you've chosen your custodian, you'll need to complete the paperwork to set up your Gold IRA. This includes completing the appropriate forms and providing any required documentation. Orion Metal Exchange can provide you with all the forms and resources you need to complete this step.

3. Fund Your Account

The next step is to fund your account. You have several options for funding your account, including transferring funds from another retirement account and contributing cash.

4. Choose Your Investments

Once you've funded your account, you're ready to begin investing in gold and other precious metals. You can choose from a wide variety of gold coins and bars offered by Orion Metal Exchange. The Gold IRA can be invested in precious metals such as gold, silver, platinum and palladium. Metal deposits must have a purity level of at least.995.

5. Make Purchases

After you've chosen your gold, it's time to make your purchase. You can place an order online with Orion Metal Exchange and your gold will be shipped directly to your custodian's secure storage facility.

6. Monitor and Adjust Your Investments

Once you've purchased your precious metals, it's important to monitor your investments regularly. You should also adjust your investments as needed to align with your goals.

Pros & Cons of Orion Gold IRA

Pros:

Orion Metal Exchange is an excellent investment choice because of its wide selection. With Orion, you can find stocks, bonds, mutual funds and more, giving you plenty of options to diversify your portfolio. Additionally, many users have given Orion positive reviews, citing the helpful customer service team and easy-to-use website as highlights.

However, some of our recommended companies may be a better fit if you're looking for even more features and services. For example, you can access advanced trading tools, tax optimization strategies, and more with these companies. Plus, they often have lower fees than Orion, so you can keep more profits.

Cons:

While Orion may offer some attractive options, there are a few drawbacks that you should be aware of before investing with them.

First, Orion Gold IRA does not partner with an IRA service provider. This means you won't have access to the full spectrum of services that a reputable IRA provider would bring to the table, such as tax-deferred contributions, qualified distributions and more.

Another major drawback is that the firm is a relatively new company, so its reputation and track record are still being established.

For these reasons, we recommend you go with a company with a proven track record of providing quality services and maximizing returns. They will be able to provide you with the services and support that you need to ensure that your retirement savings are well taken care of.

Final Thoughts

When it comes to investing in gold, Orion Gold IRA has some attractive features that make it an appealing investment option. They provide investors with gold options, easy access to their accounts and competitive rates. However, we have identified other highly recommended companies that offer better services for investors looking to invest in gold.

Our recommended companies have the expertise, experience and resources to ensure that your investments are managed responsibly and with great care. They provide a personalized service that makes it easy for you to understand your investments and make informed decisions. These companies also have an excellent track record for customer satisfaction, so you can trust that your investments are in good hands.

We understand that Orion Gold IRA is a viable option, but we encourage you to use our highly recommended companies to ensure that their investments are secure and managed correctly. With these companies, you'll have access to reliable advice, dedicated customer service and the peace of mind that comes from knowing that your investments are in the hands of true professionals.

Don't forget to check out our top recommended companies before investing!