Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Have you heard of investing in digital precious metals? When you invest in digital metals, your investment is still backed with physical precious metals, but you don't need to worry about storing the metals in your home. OneGold is a company that offers investors this opportunity.

They allow investors to choose to invest in gold, silver, and platinum from four different respected countries. The digital metals you invest in are kept safe in a vault, and you can always check on your holdings. If this sounds like something you may be interested in, keep reading to learn more about OneGold so you can decide if you'd like to work with this company.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if OneGold made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

About OneGold

OneGold is a partnership that was formed was APMEX and Sprott designed to optimize the precious metals buying experience for customers. APMEX, which was founded in 1999, is a well-known and trusted online precious metals dealer. APMEX offers customers a large selection of bullion and is committed to offering the best experience for each customer.

Sprott specializes in managing alternative assets, specifically precious metals and real estate. The company has subsidiaries in the United States, Canada, and Asia and operate brokerage and merchant banking businesses within the United States and Canada.

When APMEX and Sprott partnered up to create OneGold, they wanted to combine the services they offer to help users invest in precious metals, conduct secure online transactions, and save for retirement.

How OneGold Works

OneGold offers digital assets that are backed by physical precious metals through their online platform. The company takes care of choosing highly valuable, liquid, and secure assets and ensuring secure vault storage of the precious metals.

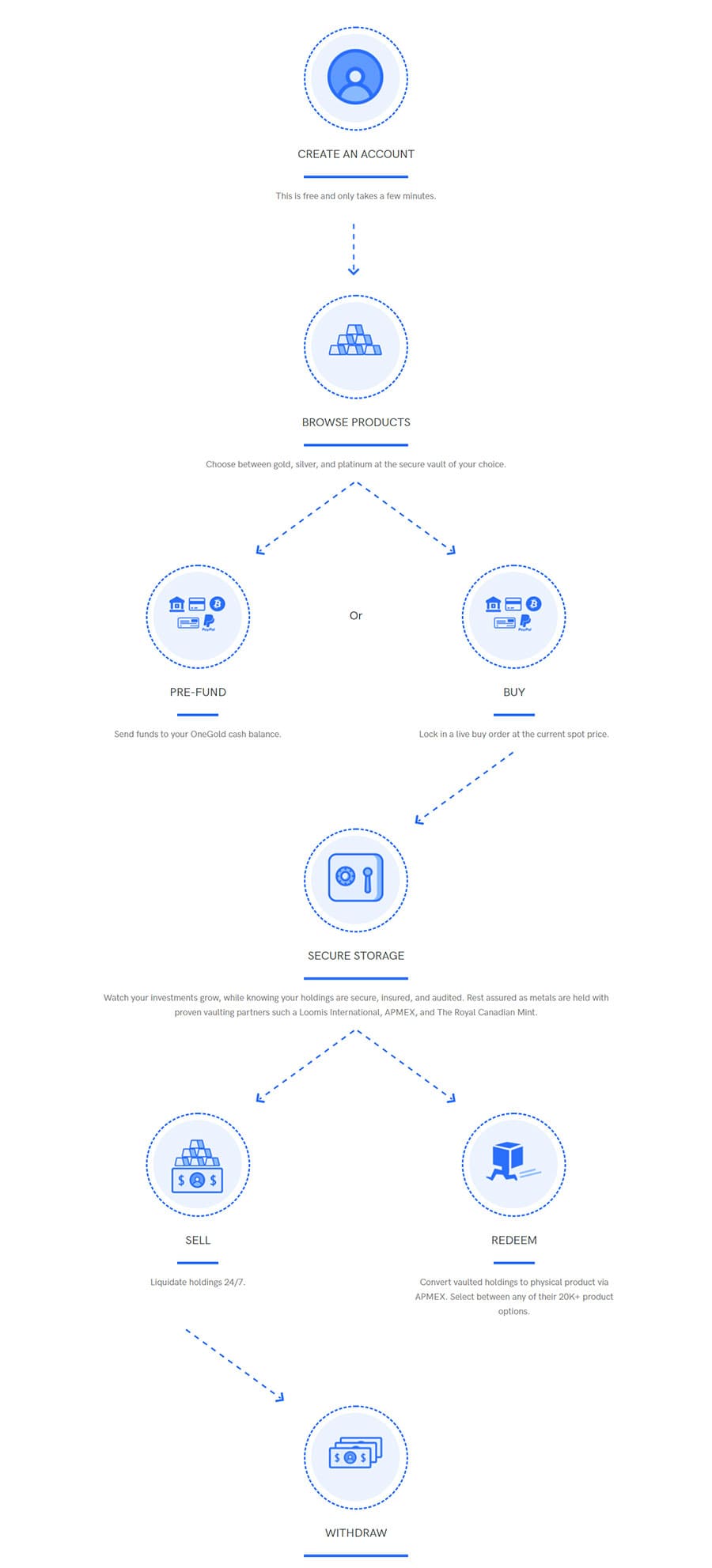

If you're interested in taking advantage of what OneGold has to offer, the first step is to create an account through the website. Then, you can begin investing in precious metals using a variety of payment options include debit card, credit card, check, PayPal and Bitcoin.

You can set up an amount to be auto-invested at a frequency that works for you. Alternatively, you can designate a number of ounces that you would like to purchase at a set interval.

When you invest with OneGold, you're investing in a portion of a large bullion bar. The bullion you invest in remains in a secure vault and are fully insured. You can log in into your investment profile on OneGold's website whenever you want to check on your account status and the value of your investment.

If you are ready to liquidate your assets, you can either sell some or all of your holdings to receive cash or redeem the digital holdings for physical precious metals (more on this below).

Redeeming and Taking Possession of Precious Metals

As we mentioned above, when you invest in OneGold, you're investing in a small piece of a large bullion bar. If and when you decide you'd like to hold physical precious metals, that is something OneGold can help you with. You can convert your digital vault holding to physical gold, silver, or platinum through APMEX, one of the partners in OneGold.

To make this conversion, you sell the digital precious metals that are being stored in the box and select the physical precious metals you'd like to own. In most cases, a redemption order is shipped within just one business day, and shipping is free to United States addresses.

Vault Audits

Inventory reports are compiled each month to officially report the precious metals held by OneGold and their customers in each of their vault locations. These vault audit reports are shared by OneGold to help customers see that their investments are indeed backed by physical precious metals. If you're interested in viewing any of the reports, they're available under the Vault Audits page on the website.

Regardless of which vault your precious metals are stored in, you can rest assured knowing your investment is secure. Each vault is fully insured against theft, damage, or loss. The vaults in the United States, United Kingdom, and Switzerland are insured by Lloyd's of London, and the vaults in Canada are insured by the Royal Canadian Mint.

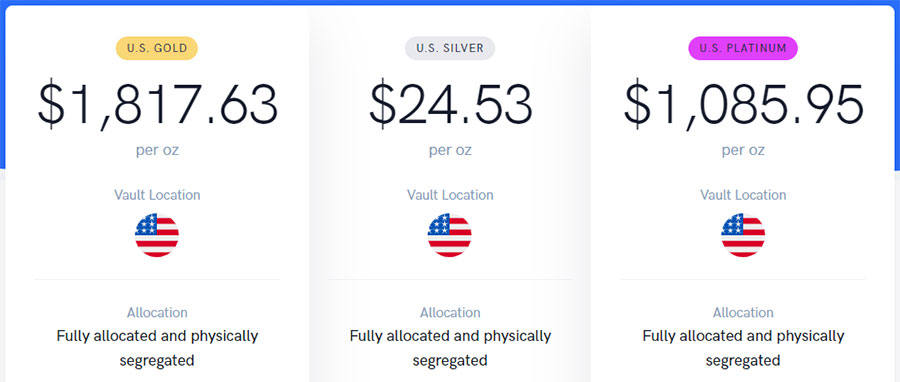

United States Gold, Silver, & Platinum

One option investors can choose is to purchase United States precious metals. If you invest digitally in US gold, silver, or platinum, your precious metals will be vaulted in one of OneGold's Loomis International, COMEX, or APMEX vaults. Each digital investment is backed by physical precious metals.

OneGold's storage partners offer fully allocated and physically segregated storage. Storage fees are billed yearly at a rate of 0.12% for gold, 0.30% for silver, and 0.30% for platinum. And, as we mentioned above, all investments are fully insured by Lloyd's of London.

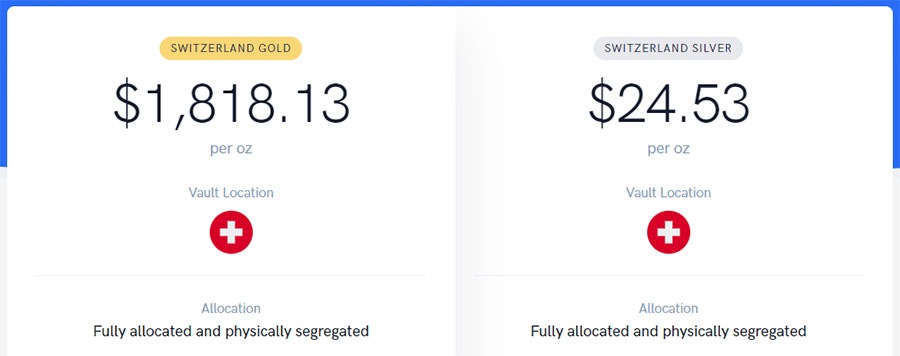

Switzerland Gold & Silver

Another digital investment option is to invest in Swiss gold and silver. Holdings may include coins, bars, or rounds, and again, each investment is backed by physical gold and silver.

Storage fees are the same as with US vaults: 0.12% for gold and 0.30% for silver. Each investment is fully insured by Lloyd's of London.

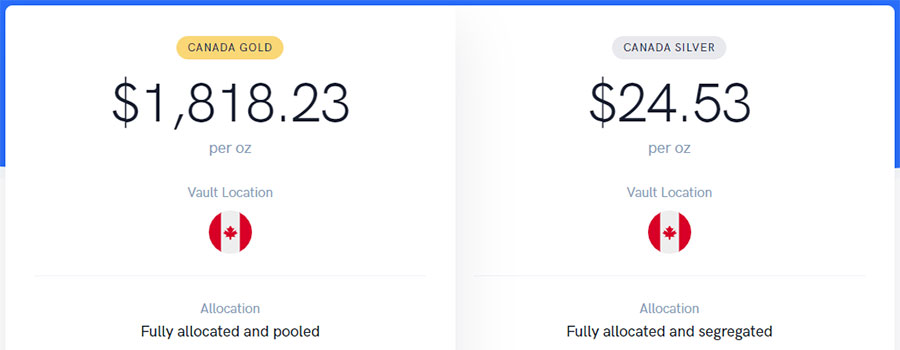

Canada Gold & Silver

You may also be interested in investing digitally in Canadian Gold or Silver. If you choose this option, your precious metals will be stored at the highly secure Royal Canadian Mint. All items are also fully insured by the Royal Canadian Mint as well. Storage fees remain the same for the Canadian vaults: 0.12% for gold and 0.30% for silver.

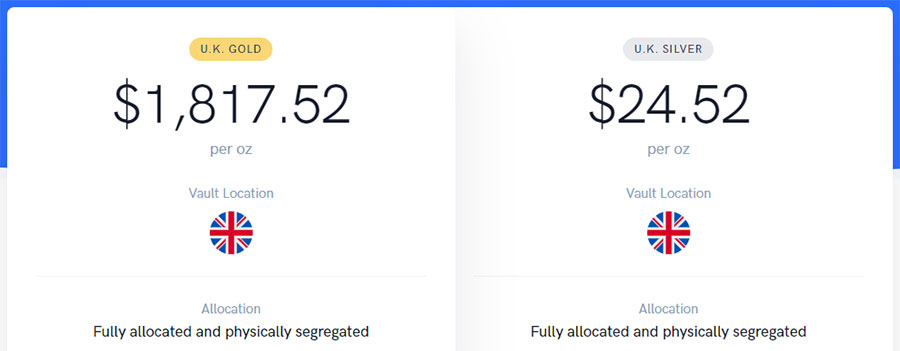

United Kingdom Gold & Silver

If you'd like to feel secure investing in gold or silver from the United Kingdom with its centuries-long history with precious metals, that is also an option with OneGold. All investments stored in UK vaults are fully insured by Lloyd's of London to offer even greater financial security. Again, storage rates remain the same: 0.12% for gold and 0.30% for silver.

Precious Metals IRAs

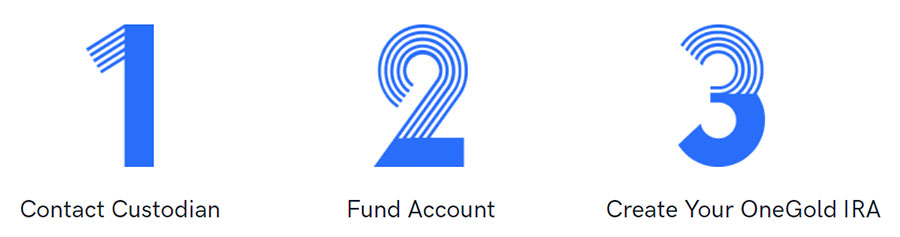

OneGold can also help you set up a Precious Metals IRA. They are not an IRA custodian company, but offer a list on their website of IRA custodian companies that you can choose from, or you can work with your own desired company. After you contact the IRA custodian company and open your Precious Metals IRA account, you'll work with the custodian to fund the account (either through a bank transfer or rolling over funds from an eligible existing retirement account).

After your account is funded, you can work with your custodian and OneGold to add precious metals to your account.

Are There Any Red Flags for OneGold?

Taking a little time to really check out a business is important when making any purchase, but even more so when you're talking about a large purchase like investing in precious metals. One of the best resources you can use to validate a company and learn more about them is by looking through reviews from previous customers.

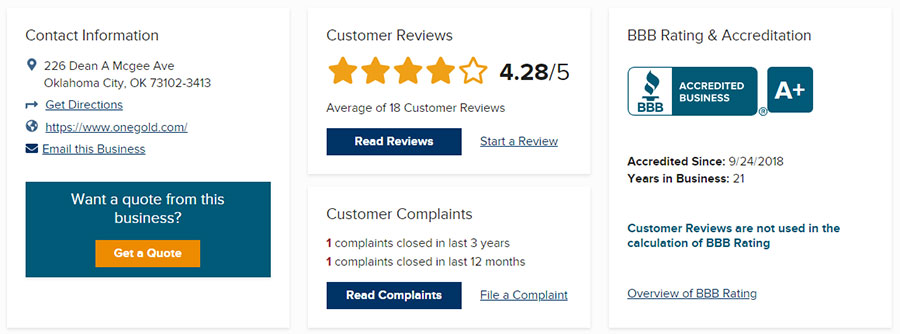

Unless you personally know several individuals who have worked with OneGold, the best way to check on these past customers and what they had to shared about their experiences working with the company is by visiting well-respected review sites. Some of the most trusted review sites include the Better Business Bureau, TrustLink, Trustpilot, and the Business Consumer Alliance.

We look up OneGold for you on these four sites. As you can see from the information below, there were no reviews available from either the Business Consumer Alliance or TrustLink. While there were only two reviews on Trustpilot, the average of these two reviews was quite low.

Limited reviews about a company can make it more challenging to really trust them with your business. You're just taking more of a gamble than you would be if you were to choose a different gold investment company that has more reviews. And, there are plenty of gold investment companies that have hundreds or thousands of reviews from customers.

Is OneGold a Scam?

So, now the big question: Is OneGold a scam? No, OneGold is not a scam company. They are a legitimately run company that has been in business since 2018.

However, we would not recommend giving your business to OneGold for a few different reasons. First, the company has only been in business since 2018. Their relatively young age makes them inexperienced.

While it may sound nice to help a younger company get started, this may not be your best move when you're talking about such a large purchase as investing in precious metals.

OneGold also doesn't have many online reviews. This can probably be attributed to the fact that they haven't been in business very long, but it still makes you wonder about the service you'll receive. When you aren't able to check on how the company treats its customers through reading reviews, you are taking more of a gamble regarding the services you'll receive.

There are a few reviews for OneGold on Trustpilot. However, the two reviews that are there are not positive at all. The two reviews mentioned poor customer service, nickeling and diming customers, and other poor business practices.

OneGold's website is not as easy to navigate as some other gold investment companies. They don't clearly list all the available precious metals you can invest in. Rather, they offer precious metals from different companies store in vaults within those countries. This may work well if you're only interested in holding precious metals from one specific country, but not as well if you'd like to hold precious metals from different countries within the same account.

OneGold's website also states that while you remain the direct owner of the precious metals in the vault, you typically own a fraction of a larger physical product, such as a kilo bar. When you want to redeem your holdings, thereby, you won't be able to receive the exact precious metal being stored in the vault. Rather, redemptions are completed through APMEX.

You convert your holding into a physical precious metal the APMEX will deliver to you. The precious metal in the vault is sold at the market rate and the money from the sale is used to purchase metals through APMEX that you can physically hold. However, the price you pay will be the current spot price minus 0.30%, so it may not be that great of a deal. To be used for redemption, the funds for your account also must be with OneGold for at least 60 days if you pay with PayPal, credit or debit cards, or ACH transfers.

With all of this information about OneGold, they just don't seem like the best choice out there if you're looking to invest in precious metals. We'd recommend looking for a different precious metals investment company that has more experience and that you'll feel more confident working with.

Features

Pros:

Cons:

Final Verdict

If you'd like to invest in precious metals, we wouldn't recommend working with OneGold. This newer company just has a few too many red flags and doesn't seem to offer a simple and straightforward investment solution. As you do a bit more research on precious metals investment companies, we think you'll find that there are many other companies that have been in business for a long time, are highly reviewed by customers, and offer a large selection of gold, silver, platinum, and palladium bars and coins. One of these other companies would be a better choice than OneGold.

Although we do think that OneGold is possibly a decent company, we believe that there are better companies out there to make your investment with.

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Or, continue with OneGold...