Noble Gold is one of the most popular companies for gold IRA rollovers. But what exactly does that mean? People have been rolling their retirement accounts into gold, but the process involves a lot of paperwork and red tape. Noble Gold helps make that process easier and connect you with the right gold products for your account.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

About Noble Gold

Noble Gold is a gold dealership that sells gold coins and other products. Their main expertise involves helping with gold IRAs. The executives behind the company have well over 20 years of industry experience with precious metals. They believe that precious metals are a vital way of buying secure assets that aren't tied to the main stock market.

According to the company's website, Noble Gold's mission is to make it easy and safe for people to buy precious metals. They are committed to providing friendly and honest information, so that people get the best understanding regarding how they can increase the value of their own investments.

The company focuses on education as well. They teach clients about how precious metals are important to wealth preservation, as well as how the precious metals industry works. Their ultimate goal is to help clients benefit from precious metals not just now, but also for years into the future.

Noble Gold is based out of Pasadena, California, like many gold IRA companies. California is often considered the center of the precious metals industry in the US due to its historical importance during the Gold Rush.

There is a free investment kit available through the company website. It comes with information about the precious metals industry, gold IRA options, and the products available through Noble Gold. The material doesn't use sales pitches or complex terminology. It's meant for people without much background in precious metals or general investing.

Every employee working at the company has a strong background in finance, precious metals, or both. They also all take a customer-centric approach to the business. You don't have to worry about hidden fees or commissions. Instead of having ulterior motives, the people at Noble Gold genuinely want to help connect you to the best solutions.

Noble Gold also makes it easy to get started with the gold IRA process. The application to open your gold IRA account only takes five minutes to fill out. While the rollover paperwork takes a few more minutes, it will consume barely any of your time. The vast majority of the situation is taken care of by your company representative.

In addition to being precious metals dealers, Noble Gold has a vast network of financial partners and consultants. When it comes to IRAs, they work with IRA custodians and storage depositories. In addition, they can consult with estate planning attorneys, certified public accountants, and financial agents to help with planning your financial future.

About the CEO

The CEO and president of the company is named Collin Plume. He has built his entire career around caring for the wealth of various clients, including giving them advice on how to manage and diversify their assets. In the past, he has gained more than fifteen years of experience working with commercial real estate, property insurance, and precious metals.

While Plume was working as an insurance agent for industrial retail properties, he became aware of how important it is to protect the wealth of his clients. Throughout the last recession, he helped investors to guard their savings.

After doing a significant amount of research on economic recessions and how they affect everyday Americans, Plume got his first job in the precious metals industry. It didn't take long for him to become one of the most successful precious metals brokers in the United States, selling over $28 million in gold within a year.

Today, Plume lives with his wife in the San Fernando Valley. He enjoys basketball, hiking, and playing board games with his friends and family.

About Gold IRAs

Individual retirement accounts are tax-advantaged accounts that can hold a variety of assets. You can't take money out of them without penalties until you reach retirement age, though. If you have a self-directed IRA, then you can hold alternative assets, including precious metals.

Most IRAs are not self-directed. They are set up as traditional accounts with an investment manager who chooses where the assets go. Self-directed IRAs don't have an investment manager, so you choose how the assets are divided and invested yourself. This can be daunting if you don't have a financial background, but self-directed IRAs are the only type of retirement account that can hold gold.

There are two types of gold IRA: regular and Roth. With a regular IRA, you won't pay any taxes on your contributions, giving them as much room to grow as possible. But you will pay taxes when you take distributions. Meanwhile, with a Roth IRA, the opposite is true. You'll pay taxes on the contributions, but you won't have to pay any additional taxes when the time comes for distributions.

Regular IRAs are usually the most recommended if you're going to invest in precious metals. The more money you have to put toward gold, the better. Roth IRAs are more commonly used in accounts that have the potential to undergo exponential growth, since that way you don't have to pay taxes on a large amount of money.

Precious metals have two major economic advantages when it comes to saving for retirement. One is that they perform well when the stock market isn't performing well. The other is that they help you to hedge against inflation. Usually the benefit of owning precious metals comes after several years of holding onto them.

There are only certain products that can be kept in a gold IRA. You need to buy gold coins made by a sovereign mint like the US Mint, and they need to be at least 99.5% pure. Gold bars need to be certified and crafted to the same purity standards, though they can come from any refinery. You can't put scrap metal, jewelry, or numismatics into your gold IRA.

It's also possible to hold silver, palladium, and platinum in a precious metals IRA. They can be kept in the same vault as your gold.

Noble Gold doesn't deal in platinum or palladium, but they do have several silver products available for purchase. Silver is much more inexpensive than gold, so you can invest in a great deal more products. Sometimes there are also more silver options available in a company's inventory, due to silver being a more abundant metal overall.

The Gold IRA Rollover Process

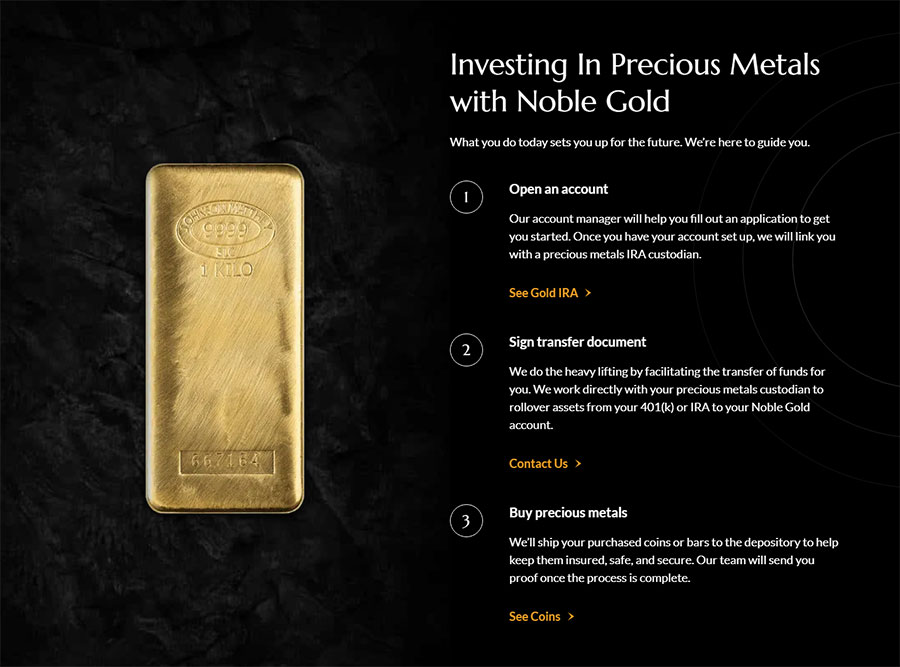

If you already have a retirement account like a 401(k) or traditional IRA, you can roll some of it over into a gold IRA. Noble Gold assists with this process by walking you through the paperwork and connecting you with your custodian. Your custodian is in charge of maintaining the account and making reports to the IRS about your holdings.

Noble Gold has partnered with trusted IRA custodians and can take you through the paperwork. The initial application typically takes just five minutes. You'll talk on the phone with a representative to make sure that everything is completed correctly. Then the application will be filed, and the account will be opened in your name.

The account will be empty until you fund it, though. That's where the rollover comes in. In the first 60 days after you create the account, you can roll over any amount of funds from your existing retirement account into the newly created account.

You'll need to go through some transfer paperwork with your Noble Gold representative. This includes information about both accounts, both custodians, and the amount of funds that you intend to transfer. If you work with Noble Gold, they ask that you invest a minimum of $5,000 in precious metals to use their services.

Your Noble Gold representative will make sure that the paperwork is filed appropriately and that the transfer goes through. They may be able to chase down your custodian if need be, so you don't have to spend a lot of time on the phone to make sure that the transfer is completed in time.

After the money has been rolled over to your account, you can buy IRA-approved precious metals. Noble Gold will help you select the right ones to suit your needs. For example, they might help you pick the ones with the best ounce-to-dollar value, or they might help you pick traditional options with a high liquidity value.

There's also a robust buyback program. That means that once you're ready to take distributions from your retirement account, you can call Noble Gold for a buyback price. Then you can sell your gold back to them. That way, you don't have to deal with the stress of looking for a buyer.

Once you've chosen your items, Noble Gold will send them to whatever depository you've chosen. Your custodian will receive the package and place the products in the vault. Every depository has a full insurance policy in case of theft, loss, or natural disasters. They will also undergo regular auditing to make sure that the account statements match the actual contents of the vault.

Is Noble Gold a Scam?

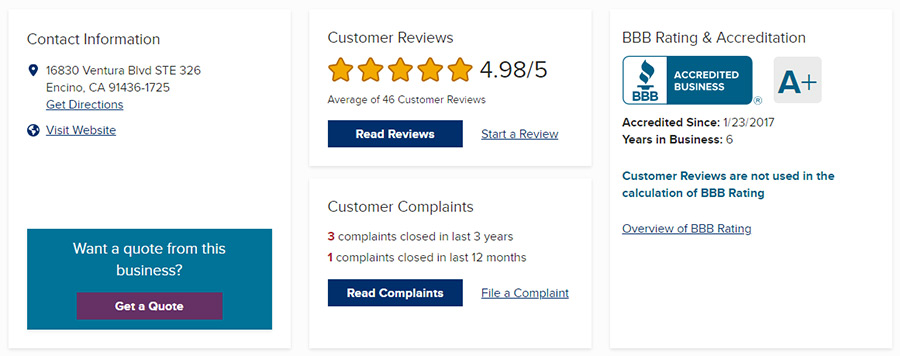

Noble Gold isn't a scam. There are thousands of people who have bought gold from this IRA company, and they have excellent reviews. Scam Risk gives them an A+ rating, indicating that they are a trustworthy and transparent business with a strong sense of ethics. The Business Consumer Alliance gives them an AA rating, one of the highest on their scale.

The Better Business Bureau website also shows consistently positive ratings from past customers. The customer reviews have an average of 4.8 out of 5 stars. Many customers say that they worked with Noble Gold as first-time gold investors, and they were very impressed with how the company helped them through the process.

People also specifically praise the IRA rollover process. They say that the process of transferring funds from one account to the other went very smoothly. The staff at Noble Gold handled the majority of the process for them so they didn't have to.

There have only been three complaints filed with the BBB in three years, only one of which was in the past year. The company has responded to each one and arrived at a solution to the customer's satisfaction. Since all of the complaints have been resolved, they are no longer published on the BBB website.

Pros & Cons of Noble Gold

Pros:

Cons:

Final Thoughts

Noble Gold is one of the best options on the market for people who are considering rolling over their IRA. They have an entire team of experts who are all qualified to help you on your journey. All it takes is a single phone call to get started, and your company representative will handle the majority of the process for you.

We do recommend this company overall because of its highly reputable nature. Organizations and consumer review websites across the internet all show significant scores for customer satisfaction. People have written reviews praising the employees at Noble Gold for helping with the IRA transition process specifically.

The only potential drawback of Noble Gold is that the company does not appear to be partnered with any international storage depository options. For this reason, if you want to store your IRA holdings offshore, you might want to work with another one of our top companies instead.

Don't forget to check out our top recommended companies before investing!