Have you decided that you can’t keep watching all the market volatility without doing something about it? Are you ready to diversify your portfolio by adding gold and silver to your retirement account? If you answered yes to these questions, then it sounds like you’re ready to get started with a Gold IRA.

One of the companies that you may be looking at is Monex. Today, we’re here to help you learn more about Monex, the level of customer service they offer, and the different gold and silver bars and coins that you could add to a Gold IRA. Read on to find the answers to your questions so you can determine whether Monex is the right company for you.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

About Monex

In 1967, Louis Carabini founded Monex after learning more about economics and becoming more concerned with the devaluation of the dollar. It didn’t take long for his business to grow due to increased demand. In 1970, just a few years after it was started, the first expansion took place, with the company’s space doubling in size. Since this first expansion, the company has continued to grow in size over the years.

Today, Monex is still a family-owned business with Carabini, his son, and two grandchildren operating the company. In addition to these family members, Monex also employs a knowledge team of precious metals experts, some of whom have been with the company for over two decades.

What is a Gold IRA and Why Open One With Monex?

If you’re here, you probably already have at least a general understanding of what Gold IRAs are. But, it never hurts to take a quick review before getting into more detail about how to set one up.

Gold IRAs are Self-Directed IRAs that make it possible to add gold, silver, and other precious metals to a retirement account. That means that you aren’t limited to investing in only stocks and bonds as you prepare for retirement, contrary to what some may believe.

With a Gold IRA, your holdings are taxed much like that of a standard IRA. That means that with a traditional Gold IRA, your contributions will not be taxed when they are added to your account. They can grow without incurring any taxes, and then when you are ready to retire and want to take distributions from your account, you’ll pay taxes. You could also open a Roth Gold IRA, which works the same as a Roth IRA.

For this account type, your contributions are pre-taxed before they are added to the account. After that, they can grow without incurring any other taxes, and you’ll also be able to make withdrawals once you retire without having to pay any taxes on the funds. Depending on your current tax bracket and where you think you’ll be when you retire, you can determine which of these IRA types is best for you.

Tax benefits are only one of the reasons to open a Gold IRA. The other reasons relate to the value of gold, silver, and other precious metals and why many experts see them as a smart investment option. Throughout history, gold has been a highly prized possession.

Many countries have used it as the basis for their currencies. To this today, it continues to be highly sought after around the globe. By investing in gold, you’re getting the opportunity to hold this highly treasured precious metal.

Moreover, there is not an infinite supply of gold on Earth. With its limited supply and high demand, the price of gold is more likely to continue to rise than if anyone could simply get as much as they wanted without ever depleting the supply.

Because the value of gold is not tied to the dollar, it offers the added benefit of serving to hedge against inflation. With the current state of our economy and inflation what it is right now, this is a very big benefit to keep in mind when you’re deciding how to invest your money.

Another huge reason to consider investing some of your money in precious metals through a Gold IRA is diversification. If all of your money is currently invested in stocks and bonds, what do you think will happen if the stock market crashes one day? Your entire portfolio will take a huge nosedive, that’s what. Consider how absolutely detrimental this will be to your overall net worth and your retirement prospects.

Now, if you have a more diversified portfolio with some of your funds invested in gold, you’ll be in a different situation following a huge market crash. Of course, you still won’t be happy to lose the value of your stocks, but it won’t be your entire portfolio that is affected by the drop.

The value of the gold in your portfolio is actually more likely to increase when the market is not performing as well. This means that your Gold IRA and other gold investment can actually help balance your portfolio and keep you from being as negatively impacted by the stock market.

Opening a Gold IRA through Monex

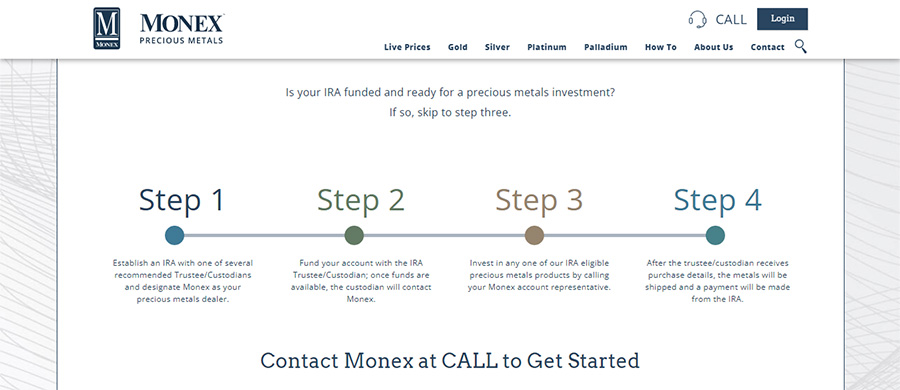

If you are interested in opening a Gold IRA, Monex can help. The company has worked hard to break the set-up process down into four manageable steps. You’ll find that these straightforward steps help keep the process from becoming too overwhelming and that they’ll help you make the best decisions for your account.

The first thing you need to do is to work with one of the Monex’s recommended Gold IRA custodians. The custodian you work with you help you open your new Gold IRA and will ask you to choose a precious metals dealer. Simply share that you’ll be working with Monex during this step.

After the account is opened, you will need to fund it. Again, the Gold IRA custodian you’re working with will assist you with this step. They’ll help initiate a transfer of some/all of the funds from your existing retirement account. This step may take a few days since the money needs to clear, but it shouldn’t involve too much on your part.

After the funds have cleared and are in your new Gold IRA account, you will work with a Monex advisor to select the bars and coins you want to add to your new IRA. Share any questions you have about which coins or bars are right for you, or ask questions to help you make the best selections; the representative you work with is there to help you.

Finally, after all of the precious metals you want have been purchased using the IRA funds, they will be packaged and shipped to an IRA-approved depository for storage.

Now that your account is set up, you’ll be able to continue making yearly contributions to increase your balance and make sure you’re saving enough for retirement. The IRS just recently raised the yearly contribution limit for 2023 to $6,500 for individuals under 50 and $7,500 for anyone 50 or older.

IRA Approved Coins and Bars

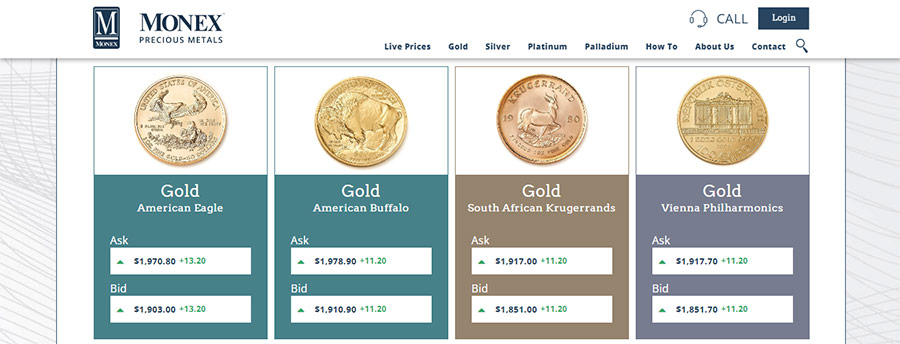

As mentioned above, one of the things you’ll need to do once your account is funded is to choose with coins or bars you’d like to hold in your account. If you’ve looked around some at other companies, you know many only offer the option to invest in gold or silver.

If you decide to work with Monex, you will also be able to add platinum or palladium to your account. These additional coins and bars offer greater opportunities to diversify your portfolio and make sure you’re more protected against market volatility.

In the next few sections, we’ve listed some of the various gold, silver, platinum, and palladium bars and coins available through Monex. All of these meet the purity requirements established by the IRS:

Gold

Silver

Platinum

Palladium

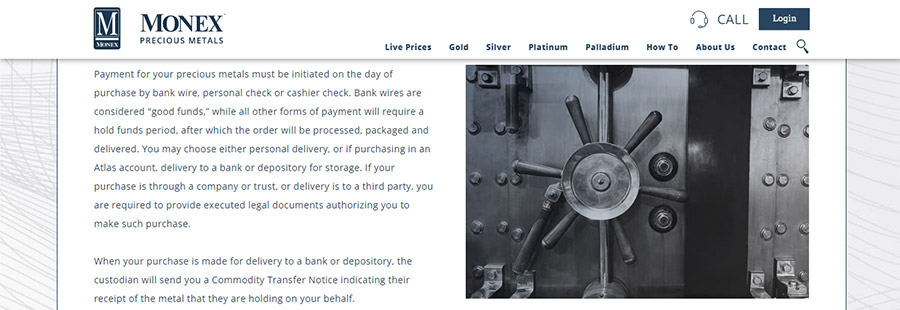

Storage

Precious metals for IRAs cannot be under your custody until you reach the IRS’ minimum retirement age of 59 ½. Before this time, they must be stored in a depository that has been approved by the IRS. Failing to follow these regulations can have serious consequences; any metals you hold will be added to your taxable income, and you’ll also face some lofty fees.

The good news is that only top-notch depositories earn the seal of approval from the IRS. This means that whichever one you choose will be a safe space to store your precious metals. They all offer secure vaults, monitoring, full-coverage insurance policies, and a wide array of other safety measures.

After you’ve made your selections, Monex will send your precious metals to the depository that the IRA custodian company works with. Depending on which custodian company you choose to work with, that could mean that your metals will be stored at the Delaware Depository, Brink’s Global Services, International Depository Services, or with another approved location.

Monex Referral Program

You’re excited about investing in precious metals, right? What would you do if you tried and loved a new restaurant in town? Tell all your friends about it, right? And, chances are, you wouldn’t even be receiving any form of compensation from the restaurant, you’d just want to tell your friends and family about the amazing food you had and why they should give it a try.

Why should it be any different with investing in precious metals. Share your excitement about all the promise that precious metals hold with your friends and family, and you may be eligible to earn a bonus from Monex. If you refer someone to the company and they make a purchase, you will get two free 1-ounce Silver Vienna Philharmonic coins for free.

You can earn even more if your friend or family member spends $10,000 or more. In this case, you’d get a 10-ounce silver bar for free! That’s a pretty impressive deal and is certainly one that will help you build your precious metals investment portfolio even quicker.

Features

Pros:

Cons:

Closing Thoughts

Choosing who to work with as you begin (or continue) your precious metals investment adventure is a big decision. You want to find a precious metals provider that not only has a good selection of coins and bars to add to your account, but you also want to find someone that will provide you with the attention and service you deserve and expect when making such a large investment.

Now that you’ve learned more about Monex, do you feel like they are the right company for you to work with? Or, do you think you’re going to continue to do some more research to look for Gold IRA company that checks all the right boxes based on your needs and goals?

Don't forget to check out our top recommended companies before investing!