Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Are you concerned about having enough saved for retirement? Have you wondered about the potential benefits of investing in precious metals? Precious metals provide a hedge against inflation and remain stable during economic downturns. But finding the right company to purchase from is hard.

Monetary Gold is one of many precious metals dealers that aim to help investors secure their future using gold. Are they legit, or are they out for your hard-earned retirement? And how do they compare to the competition? We have everything you need to know.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if Monetary Gold made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

About Monetary Gold

Expert investors recommend allocating a small portion of your portfolio to precious metals. Precious metals tend to perform inversely to the stock market, so when the stock market crashes, you'll have a buffer. With economic uncertainty becoming the norm, many people are turning to precious metals for security.

Monetary Gold helps people plan for retirement by investing in a valuable retirement plan. Their plans involve gold, silver, and other precious metals. The company sells the metals straight from the source, so you don't need to suffer through any annoying markups.

Diversified Investments

When it comes to precious metals, the name of the game is diversity. You don't want to put all of your funds into gold.

But you also don't want to put all of your funds into a volatile market like the stock market or real estate. The more you spread your assets out, the more stable your retirement will be.

Investing in a single real estate property or a single company isn't enough. It's okay to take big risks with some parts of your portfolio. But you shouldn't gamble away your entire future. Gold offers stability when the global economy is in shambles.

Products and Services

Monetary Gold deals with both IRAs and regular cash purchases. Gold IRAs are individual retirement accounts that can be filled with gold and silver. You must purchase this gold and silver through a brokerage, and you must use items that are compliant with IRS regulations.

Companies like Monetary Gold take the hassle out of the IRA setup. They streamline the process, setting you up with a storage vault and helping you with the paperwork. When you make contributions to the account, taxes are deferred until you start paying dividends.

Fees and Minimums

If you sign up for a precious metals IRA, you will need to pay custodial fees. These will vary depending on the custodian you use. Since Monetary Gold works with several different custodians, you can compare the different options and pick the one that works best for you.

Monetary Gold requires a minimum investment of 10,000 dollars for an IRA. If you're making a cash purchase out of pocket, the minimum investment is 5,000 dollars. Since cash purchases don't require any special paperwork or regulations compliance, they don't have any extra fees.

When you get your IRA account set up with the company, you will have to pay a 290 dollar fee. That's significantly steeper than a lot of the competition. Depending on how large your investment is, the company might cover your custodial fees for up to five years.

After you've funded your account, you will need to pay a 30 dollar fee for delivery. The metals will be shipped to the Delaware Depository, which is an IRS-approved facility that holds IRA assets. Meanwhile, if you make a cash purchase, you can have the items shipped to your house.

Every package is fully insured and comes in discreet wrapping. There is no way to identify the content, and the risks are minimal.

When you're working with the Delaware Depository, you'll need to pay storage fees. These cover the cost of both insurance and maintaining your vault. You'll pay 100 dollars for up to 100,000 dollars in gold. After that, the cost will go up one dollar for every 1,000 additional gold dollars.

Promotions

The company's main promotion is offering a maximum of 5,000 dollars in free silver and gold when you make a qualifying purchase. You have to spend a lot of money to get that bonus, though.

Similarly, if you're going to make a huge deposit, you can get anywhere from one to five years of your custodial fees waived. When you reach out to create your account, you can ask about whether you qualify for these offers.

Unique Features

Gold IRA dealers are a dime a dozen. It's one of the most competitive niches in an already-competitive industry. But Monetary Gold does have a few key things that make it stand out from the crowd.

Some of the features that you'll rarely find with other brokers include:

With all of this said, there are other brokerages that offer many of the same things Monetary Gold does. They also do it much more inexpensively. So while the company's policies and practices are commendable, they aren't our top pick for a gold IRA dealer.

Getting Set Up with Monetary Gold

So if you choose to use the company's services, how easy is it to get started?

It's not difficult to register and create your account. You can actually register right from their website by preemptively filling out the form. Prior to being approved, though, you will need to speak to a representative on the phone.

The specialist you speak to will take you through the paperwork, choosing a custodian, and setting up an account rollover for funding. The account should be fully set up anywhere from 48 to 72 hours following the start of the process.

With your new account, you'll complete the gold IRA paperwork, transfer funds into the account, and purchase the metals. Monetary Gold will arrange to have them shipped to a depository.

The entire account setup is handled by the company. Your specialist will talk to your custodian and the depository for you, so you never have to speak to more than one person. They'll explain exactly what paperwork you need to sign and what it means. It's a lot faster than trying to figure out IRS regulations by yourself.

They will also give you guidance on choosing the right bullion and coins. You'll need to pick precious metals that comply with IRS regulations. But the metals you buy and their value will vary depending on your risk tolerance, the current market, your desire for growth, and your overall assets.

One potential drawback is that the company only works with the Delaware Depository. This is one of the most popular depositories for IRA assets, but it is located on the East Coast in Delaware.

Some people prefer to work with companies who give you a choice of several vaults. That way, you can choose the one closest to your region. There are even some companies that have international IRA storage options in Canada, Europe, and Asia. If you need to store your assets overseas, Monetary Gold isn't your best bet.

The Delaware Depository is subject to tax advantages. Delaware has no sales tax, personal property tax, commercial net worth tax, or inventory tax. Depending on the way your assets are distributed, these tax benefits could be hugely beneficial.

In addition, the depository has no imposed taxes when you pay storage fees. New York, on the other hand, does.

Is Monetary Gold a Scam?

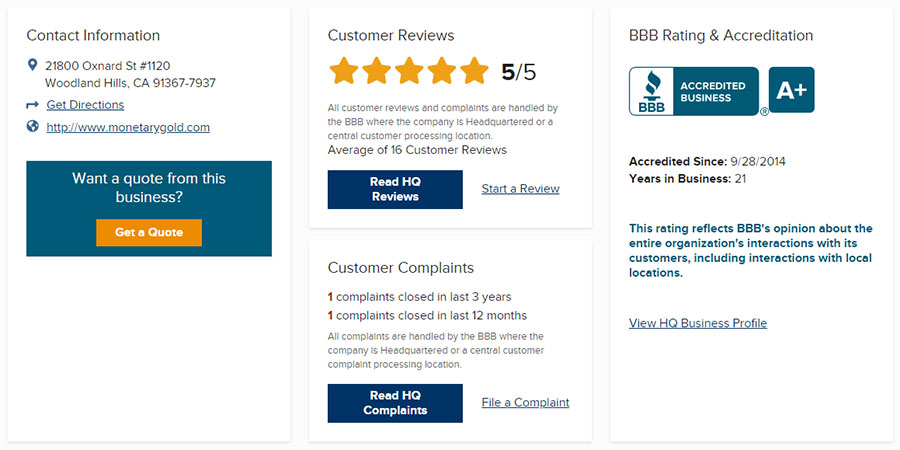

Monetary Gold is not a scam. They are accredited with Consumer Affairs and the Better Business Bureau. On the BBB website, they have 5 out of 5 stars and an A+ rating. Only one complaint has been filed in the past three years, and it has since been resolved.

The company has all the hallmarks that you want from a good gold IRA investment firm:

Basically, you know you'll be purchasing gold at a decent price. And you know that you won't be mislead about your investments.

But all of those facts do overlook one glaring flaw: the setup fees. Competing gold IRA brokerages offer account setup services for 50 to 100 dollars. The 260 dollar price is absurd, especially since it doesn't cover storage and custodial fees.

Third Party Ratings

To get an objective look at a company, it's best to look at third party websites rather than testimonials on the company's website. This will give you a good sense of what other people are saying about their lived experiences.

The company is accredited with the Better Business Bureau and maintains an A+. The average of the customer reviews is 5 out of 5 stars, meaning that everyone who reviewed reported a perfect experience.

On Trustlink, the total star rating is 5 out of 5 with a total of eight reviews. Again, that indicates that everyone had a perfect experience with the company. The Consumer Affairs star rating is 4.8 out of 5, or almost perfect.

Now, it is important to note that the number of reviews left with these organizations is limited. Because of how few customer reviews there are, it's been difficult to find complaints. When companies have hundreds of reviews, we have an easier time analyzing the content.

Customer Reviews

As noted above, the customer reviews of the company are glowing. They have sixteen 5-star BBB reviews, eight 5-star Trustlink reviews, and a 4.8 average out of 22 reviews on Consumer Affairs.

One review says that the company made it easy to transfer IRA funds and purchase the metals. The customer thanked their precious metals expert by name.

Other reviews also thank their experts by name. They say that the customer service representatives are honest and informative. Instead of upselling, they seem to truly care that the customer makes the best investment decision for them. Several customers thanked the experts for their patience and education.

Some reviews say that the customer would happily recommend the company to their friends and family. The onboarding process was so convenient that it completely demystified the retirement process.

On Consumer Affairs, the one website where the company doesn't have a perfect score, all of the reviews are 4 and 5 stars. There are no 1, 2, or 3 star reviews. The only complaint we found was that the person did not feel Monetary Gold had adequately explained why the precious metals industry was so important.

Lack of Complaints

A lack of complaints isn't always a good thing. We do believe that Monetary Gold offers excellent customer service; there are enough detailed stories about the help that specific individuals provided. But complaints tell you a lot about a company.

When you read through company complaints, you learn things like:

Now, nothing indicates any kind of malicious mismanagement happening at Monetary Gold. Quite the opposite, in fact. But it would be nice if we had some more data to go on.

There's also a slight possibility that the company has made an effort to bury bad reviews. That said, we don't see evidence that there are a lot of secret complaints. On the company's BBB page, there has only been one complaint in the last three years, and it was resolved.

So take the glowingly positive reviews with a grain of salt. Just because everyone else has had a perfect experience doesn't mean that's a guarantee.

Final Thoughts

Monetary Gold is a precious metals IRA dealer with two decades of experience and a great reputation. It's difficult to find any concrete complaints. Consumer issues are all addressed swiftly and satisfactorily.

If you're looking for a place to invest your retirement savings, this is not a bad choice. You'll get advice from experts with knowledge about your unique situation. The process will be streamlined and convenient. You'll have ongoing help with managing your investments until you're ready to pay dividends.

There is nothing bad about Monetary Gold at all. The company is run by a team of experts who do their jobs well. You're likely to have a good experience if you work with them. But we'd be remiss not to point out that other gold IRA companies offer all of these same benefits for a fraction of the setup cost.

Think about it. You pay 260 dollars for the account to be set up. That just involves picking a custodian, filling out paperwork, and funding your purchase. Then you need to pay an annual maintenance fee to the custodian, plus you have to pay an annual maintenance fee to the depository for storage.

Sure, the initial account setup is just a one-time fee. It's not like you'll be spending over 500 dollars on account maintenance every single year. But you absolutely do not need to spend more than 500 dollars to set up a gold IRA. There are easier, cheaper plans.

Although we do think that Monetary Gold is a solid company, we believe that there are better companies out there to make your investment with.

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Or, continue with Monetary Gold...