Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Mint State Gold is a precious metals wholesaler specializing in gold and silver coins. Mint State Gold was established in 1960 and is one of the industry's oldest precious metals traders.

Additionally, through its cooperation with IRA custodian New Direction Trust Company, it serves as a Gold IRA company, assisting consumers in establishing Precious Metals IRAs. Depending on the client's preferences, vault storage choices include the Delaware Depository, A-M Global Logistics, CNT Depository, Dakota Depository Company, International Depository Services Group, and Money Metals Depository.

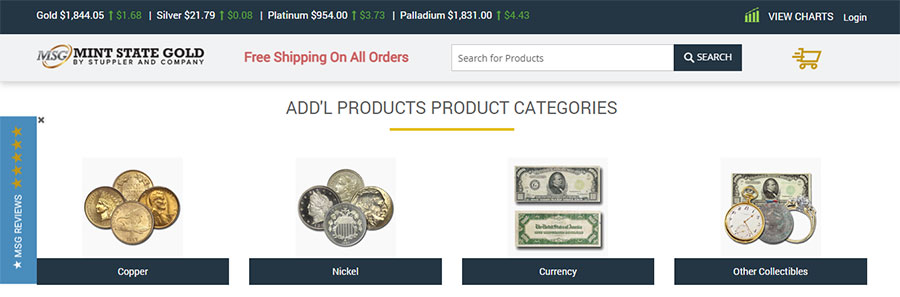

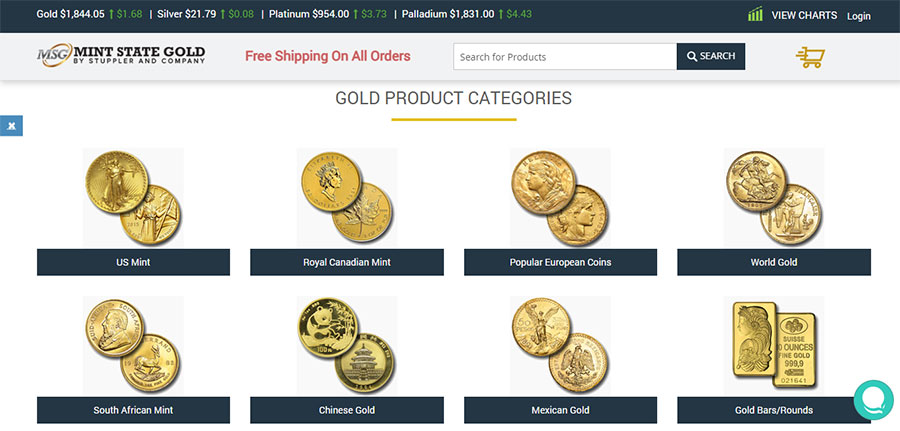

The product selection is massive, with gold, silver, palladium, platinum coins and bars, and copper and nickel items. The Mint State Gold catalog includes IRA-eligible bullion, rare coins, and collectibles.

Gold and silver coins are available in various conditions, ranging from rusted scraps to specimens excellent enough to get a mint state grade, with the proof coin serving as the apex. No wear is seen on a mint state coin. It has never been seen before. The coin also closely reflects its state at the time of striking, which can be over a century old, giving investors and collectors a window into the past.

Before we continue with this review, we had to show you this!

Our #1 recommended precious metals company is currently running a limited time offer where they will match dollar for dollar up to 10% of your order in free silver!

For example, a $50,000 order would get you $5,000 in free silver!

>> Learn More About This Limited Time Offer Here <<

There's a reason this is our #1 recommended precious metals company:

- Over $1 BILLION in retirement savings protected

- Over 1,000 5 star reviews

- Thousands of happy customers

- A+ BBB rating

- AAA customer rated

- 5x Inc 500 winner

Mint State Gold Custodian and Products

Mint State Gold has a strategic collaboration with New Direction Trust Company for custodial services. Clients can choose Delaware Depository, A-M Global Logistics, CNT Depository, Dakota Depository Company, International Depository Services Group, and Money Metals Depositor as storage facilities through New Direction.

The Mint State Gold collection is a sight to behold. Consumers can choose from a large variety of silver, gold, platinum, and palladium goods. Rare and collector coins from around the world, as well as IRA-approved bullion, are all offered. In addition, the company's portfolio includes a variety of nickel and rare copper coins for prospective buyers.

The Gold American Eagle, Gold American Buffalo, Silver Canadian Maple Leaf, Silver American Eagle, Gold Canadian Maple Leaf, Platinum American Eagle, Platinum Canadian Maple Leaf, Palladium American Eagle, and Palladium Canadian Maple Leaf are all examples of bullion that can be held in a Precious Metals IRA.

The Mint State Coin Grading Scale

Understanding the basics of coin grading is helpful before purchasing precious metal coins. The physical condition, rarity, interest factor, and liquidity of a coin are all determined during the grading process.

Understanding the coin grading scale can help coin collectors and investors do just that. Coin grading services such as the Numismatic Guaranty Corporation (NGC) or the Professional Coin Grading Service perform this service.

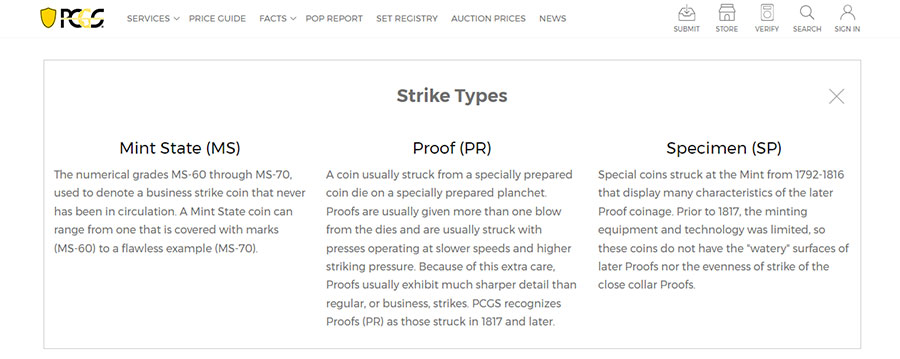

Dr. William Sheldon, a well-known numismatist, invented the Sheldon Scale. Coin grading agencies have adopted the Sheldon Scale since its debut in 1948, including the Professional Coin Grading Service (PCGS). Mint state (MS) coins are rated between 60 and 70 on the scale.

We'll concentrate on grading uncirculated coins, which have never been used in the money supply. If managed properly, they should be in the same condition as when they were first minted. However, this is extremely rare.

They come in a case, and buyers and sellers are encouraged to maintain them in the case at all times to avoid losing value. Consider it the equivalent of amassing a collection of valuable action figures and never removing them from their original packaging. Coin grading determines how near a coin is to its ideal post-minting condition.

You could be wondering why all uncirculated coins aren't given the highest rating. While it is common knowledge that mint state coins aren't worn, they differ in other respects. Even though they are uncirculated, certain mint state coins, for example, exhibit bag marks, weak striking, or other flaws. As a result, there is a complex hierarchy of mint state ratings.

The Uniqueness of Mint State Coin Grading

Even with the most trained eye, slight grade deviations that significantly impact a coin's market value might be challenging to discern. Mint state coins sit on a spectrum that needs meticulous attention to a coin's minor highlights, ranging from the MS/PR-60, which has a lesser aesthetic appeal, to the MS/PR-70, which has a high luster and great visual appeal.

What distinguishes the MS/PR-69 mint state coin from the MS/PR-70 mint state coin? A high-grade coin has a lot of visual appeals. Extraordinary luster, excellent contrast, and exquisite color contribute to a higher grade.

The dullness of an over-dipped coin or an inconsistent tone will detract from the grade. The aesthetic appeal of high-end coins for the grade cannot be negative or below average.

Spots on gold coins, spots on copper coins, and "milk spots" on silver coins are not part of the eye appeal, but they are part of the grade, and grade adjustments are made in the same way that grade deduction is done for markings or hairlines.

We have minimum/ maximum grade standards for places in all three cases mentioned above. It's worth noting that spots can occur after grading in some cases. Spots on copper coins would result in a grading deduction.

Because environmental conditions are often beyond our control, PCGS cannot guarantee that spotting copper coins would not result in deterioration.

The Essence of Precious Metal Coin Investment

Before buying gold and silver coins, you should learn the fundamentals of precious metal coin investing. The gold content of some coins determines their worth, while rarity and history determine the value of others. When discussing precious metal coins, numismatic, semi-numismatic, and bullion come up frequently.

Precious metals, such as gold and silver, are excellent investment vehicles because they are one of the few commodities that can be physically stored while maintaining or increasing in value over time. Purchasing gold or silver coins is one of the easiest ways to invest in precious metals.

The value of a numismatic coin exceeds its face value. It usually comes with a hefty price tag attached. Condition, grade, scarcity, and demand play a role in the numismatic coin market. Numismatic coin values can increase, but they can also collapse in value. Two of the most reputable grading services have given them a grade.

Bullion coins aren't intended for everyday use. They have a minimal premium and are designed exclusively for those who want to invest in precious metals. Furthermore, their weight, rather than their face worth, is the most critical factor to consider. Bullion coins are valued based on the spot price of the precious metal they contain and dealer profit. Semi-numismatic coins are a hybrid of numismatic and bullion coins.

Even though they are primarily valued for their precious metal content, they are frequently overvalued owing to speculation. They include precious metals, which cause the value of the coins to fluctuate depending on the spot price of the precious metal content. Still, their value is also influenced by external variables such as demand.

The Process of Obtaining Gold

Gold is one of the world's most well-known and valued commodities. Gold has fulfilled a multitude of tasks throughout history, ranging from cash to crucial components in electronics to handcrafted jewelry, and it has transcended cultural divides. Gold continues to entice investors as a one-of-a-kind commodity that offers an alternative to typical financial markets.

The precious metal is considered a haven asset, with demand peaking during times of extreme volatility. Gold can also be used to protect against inflation. Gold prices rise in lockstep with the cost of goods. This is partly due to gold's scarcity, allowing gold owners to maintain their purchasing power better even if interest rates remain low.

Today, an investor can acquire gold through a variety of methods. They don't all require the possession of the precious metal, nor do they all need large sums of money upfront. As a result, we will learn how to buy gold in this post.

The most common approach to investing in genuine gold is to purchase gold bullion. Gold bullion is investment-grade gold that is generally found in the shape of bars, ingots, or coins.

Physical gold is available for purchase from some institutions and brokers. Always make sure you're getting your gold from a reputable dealer. Buying gold bullion from a reliable local dealer is preferable to buying it online. In Singapore, gold is especially advantageous because it is regarded as an IPM and hence exempt from the Goods and Services Tax (GST).

Pros & Cons of Mini State Gold

Pros:

Cons:

Why Mint State Gold

Mint State Gold's founders have been involved in this prestigious sector since 1960. Many of our clientele are top-tier investors, numismatists, rare coin collectors, and ultra-rare coin collectors.

Mint State Gold has assisted in the creation of some of the world's most prestigious collections and the sale of some of the world's most valuable coins, with values in the billions of dollars in both cases.

Our clients benefit from our knowledge, experience, and track record of accomplishment at Mint State Gold. We're backed by an industry-leading network of clients, dealers, organizations, and resources. Nobody beats Stuppler's Mint State Gold in the field.

Get Your Free Silver & Learn How To Protect Your Money With Precious Metals

We highly recommend that you at least check out our #1 recommended company's special offer they currently have going on where you can get 10% of your order in FREE silver.

You can also learn how to use your precious metals purchase to get major retirement and tax savings!

>> Get More Information Here <<

Or continue below!