When you browse the internet for information about the best gold IRA companies, oftentimes Regal Assets will make the top 5 or top 10. Articles from 2020 or before will often emphasize the company's great customer reviews, solid policies, overall transparency, and glowing evaluations from watchdog organizations.

However, there have been some changes in the online presence of Regal Assets recently. We've taken a look at what the company offers, how these changes came about, and how the new information affects the company's overall reputation.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

Is Regal Assets a Reputable Company?

Regal Assets has been in the business since 2007 and is run by a CEO with a strong background in finance. He wanted to help customers invest in alternative assets. The company began by offering precious metals and soon expanded into cryptocurrency, creating the Regal IRA, which is a combination of crypto and precious metals.

They were one of the first companies to recognize the value of cryptocurrency. Today, they have some of the most diverse crypto options available. You aren't only investing in staples like Bitcoin and Ethereum. If you're feeling more adventurous, there are over 20 other altcoins that are much higher risk, but with significant potential for growth.

Part of the appeal of Regal Assets is having experts who are knowledgeable about both precious metals and crypto. The two investments have a lot in common, and yet they are also wildly different. What works for one investor might not work for another. The right ratio of crypto to precious metals really depends on your age, risk tolerance, level of security, and how much growth you want to see.

For most of the company's run, they have had an excellent reputation. Customers have left positive reviews, talking about how the staff are super patient and knowledgeable, the products are reasonably priced, and the entire process is simple to navigate. In the past, there have been dozens of reviews that name certain employees directly to thank them for their help.

There's no doubt that Regal Assets began as a legitimate company and operated as one for well over a decade. But over the past year or so, there have started to be issues. The first problem cropped up in 2020, but it wasn't a huge deal then. Now that we're at the end of 2022, we're seeing tons of extremely serious complaints that have never been resolved.

Government Action in 2020

The first issue with Regal Assets was related to government action that occurred in 2020. Now, this action appeared to be related to an honest mistake rather than fraud. It's entirely possible for a reputable company to go through this exact scenario without sacrificing any integrity. But there were several strange factors in how Regal Assets handled the situation.

The state of Minnesota has different laws regarding the sale of bullion than any other place in the US. If you want to sell bullion over a certain dollar amount, then you have to file paperwork and become licensed to do so. Failure to do this can result in civil penalties.

Even if a company doesn't operate from a physical location in Minnesota, the law applies if they ship products to a Minnesota address. So sometimes national gold dealerships will offer their services to everyone in the US, all without realizing that Minnesota has extra compliance regulations. It's a sign that the company failed to do their research, but it doesn't indicate malice.

Regal Assets had an order brought against them by the Commissioner of Commerce in Minnesota on September 8 of 2020. The state government alleged that they had sold thousands of dollars in bullion without renewing their paperwork.

This is already very strange, because Regal Assets had been operating in Minnesota without issue for 13 years. The company's management is certainly aware of Minnesota's regulations and requirements for license renewal.

Regal Assets was supposed to appear in court through either a company leader or a lawyer representing them. But they never responded to the summons or came to the court hearing. The assistant attorney general of Minnesota represented the prosecution. Since Regal Assets did not respond at all, the prosecution defaulted to a penalty.

There is a process for appeals in these kinds of cases in Minnesota. Regal Assets was sent a letter in October of 2020 that explained that they'd missed the court date, that they were being issued a default judgment, and that they had a right to file an argument about the amount or to file exceptions.

One month later, in November of 2020, the assistant attorney general filed the prosecution's argument and exceptions. Regal Assets once again ignored the letter and did not send any arguments or representatives. A week later, the record was officially closed.

Since Regal Assets never responded to the allegations or the court date, they were automatically found guilty of the alleged issues. Legally speaking, they have been designated responsible for the situation.

The final outcome was that the prosecution had a default judgment issued for the maximum possible penalty. As such, Regal Assets was ordered to pay $15,000 to the state as a civil penalty. The order would become final unless Regal Assets responded to request a hearing in the first 30 days after the judgment.

Once the penalty did become final after 30 days, the Commissioner in Minnesota had the right to enforce the judgment using the same methods that a district court would. There would not be any need for further proceedings or notice, as all required notice and opportunity to engage had already been given.

As a final note, this civil penalty cannot be discharged if Regal Assets goes bankrupt. The BBB website does not have any information about whether the state of Minnesota was able to successfully collect the fine. There's also no information about whether Regal Assets renewed their paperwork and resumed sales in Minnesota legally.

It's extremely odd that Regal Assets wouldn't take part in any aspect of this process. Usually precious metals companies will acknowledge their mistake, apologize to the court, pay a penalty, and get their paperwork in order. When a business cooperates with the court, oftentimes the penalty is much smaller, such as only a few thousand dollars.

Sometimes accidents happen and paperwork lapses. Regal Assets had been selling in Minnesota for 13 years prior to this. It would have been so easy to fix the issue with an extremely minor fine. But instead, they ignored the court proceedings until it ballooned into a judgment costing thousands of dollars.

Recent Complaints

In prior years, Regal Assets had been one of the best reviewed gold IRA options on the market. There were glowing writeups from past customers, who talked about how confident and secure they felt. They also frequently stated that it felt like the people at the company really cared about connecting them with the best assets.

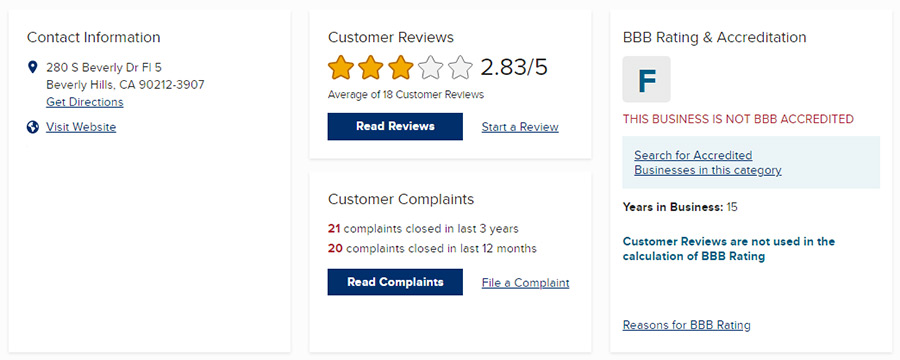

After the government action in 2020, the BBB changed the Regal Assets rating from an A+ to a B-. They also removed the company's accredited status. Regal Assets has yet to become accredited again and does not seem to be trying to do so. More concerningly, there has been a massive influx of serious complaints.

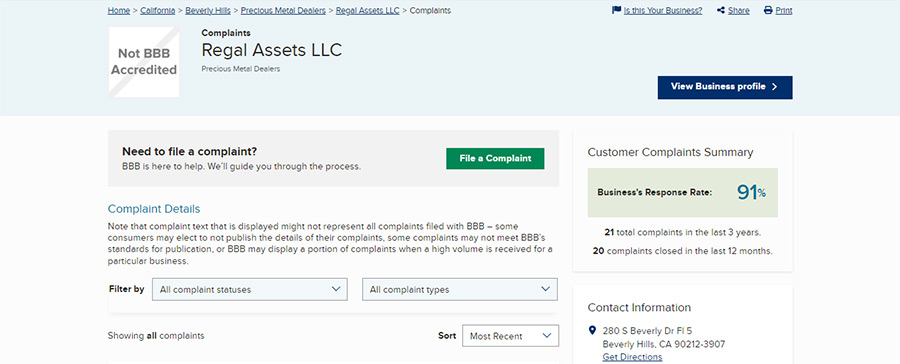

In the past three years, there have been 21 complaints. But here's the kicker: 20 of those complaints come from the past twelve months. In the two years before that, there was only one complaint in total against the company. That's a pretty alarming increase in negative customer feedback.

The company's customer rating has also suffered recently. Where they used to have unanimous praise, now the page shows 2.83 stars based on 18 reviews. A few customers have written about their satisfaction levels, but the most recent reviews are almost all from extremely disgruntled patrons.

Perhaps the most alarming thing about this isn't the influx in complaints itself, but the response from Regal Assets. Or perhaps lack of response is a better term. Regal Assets has been so absent that the BBB has changed their rating from a B- to an F. That reflects how they have failed to provide meaningful resolutions to most customers, and straight-up failed to answer a few at all.

Regal Assets has technically written a response to all but two of the most recent complaints. But the responses leave something to be desired.

Usually businesses respond to BBB complaints to clarify their policies, apologize for the poor customer experience, and offer to make things right. The exact resolution will vary depending on the company and the problem. Sometimes customers will leave truly unfounded complaints, and the company may refute them rather than offering a solution.

Regardless of how a company handles any specific scenario, their BBB page is generally a place where they can provide details and interact positively with their customers. But that isn't how the Regal Assets BBB page is being handled.

Almost every complaint with a "response" has just been given a single line about how the complaint was being forwarded to either the company CEO or the broader company team. There are vague statements about the company "investigating," but there are never any follow ups about the issue or a resolution.

In fact, several customers have taken to the BBB page to point this out. They have the opportunity to state whether they do or do not accept the response from the business. The vast majority have said that they do not. They say that after receiving the initial notification, the business never contacted them, offered a refund, explained anything that had happened, or tried to solve the problem.

Several customers accused Regal Assets of stalling with their canned responses. The company seems to have stopped interacting with clients altogether over the past several months. People have been left in limbo without any information about where their assets have gone.

When you read the complaints, you'll quickly notice a pattern emerging. Not every complaint is displayed on the website, but of the ones that are, nearly every one follows the same basic tale.

The customer will write about how they made a self-directed IRA purchase at some point in the previous months or years. They will detail the exact products that they bought and the sales representative they worked with, usually with a price tag of thousands of dollars. One customer noted that they had spent over $500,000 of their retirement savings.

Several of these customers stated that there was no issue with the initial transaction whatsoever. They say that they felt totally comfortable with the process, that they believed that their sales representative wanted to match them with the right products, and that the company had a strong core of integrity. This is unsurprising, as it reflects the reputation and policies that Regal Assets had prior to 2022.

Then the customers will detail how the products they bought had never been shipped to their depository, even though it had been weeks or sometimes months. Some customers say that they contacted the company and were told that their package simply hadn't been matched to their account yet. Others were told that their items hadn't shipped because they were on back order. Still others never received any email or call back at all.

Regardless of the excuse, the final situation was the same: Regal Assets was holding onto a portion of or all of the customer's purchase price, while not providing the products that were promised.

Customers say that they had to struggle to get anyone on the phone, and that it's impossible to speak to a manager. Some say that the company CEO directly reached out about the issue, but then after promising to fix things, he completely failed to follow up or return any more phone calls.

Many of these customers were demanding to have their money refunded, since the products were nowhere in sight. But Regal Assets just responded with a vague line about "investigating," and never followed up. This pattern remains consistent aside from the two complaints that Regal Assets never replied to at all.

These customers say that they have not received their funds back yet. At least one noted that the company's main partnered custodian, Kingdom Trust, was also trying to get the assets back on the client's behalf. Kingdom Trust appears to be having just as much trouble, even though they work professionally with Regal Assets and have a business partnership.

It's impossible to tell how much money Regal Assets has held onto without shipping out the consumer products. It's also impossible to tell why this has happened, whether the products ever will be shipped, or whether the customers will get their money back. There have not been any explanations from Regal Assets itself, and any potential civil litigation is likely to take a long time.

Final Verdict

Though this was undoubtedly one of the best gold IRA companies to work with five years ago, Regal Assets doesn't seem to currently adhere to that standard. They need to take responsibility, explain what happened to the management, and take proactive steps to get the promised products to their customers.

Don't forget to check out our top recommended companies before investing!