Noble Gold is a popular company that sells precious metals to Americans, both inside and outside of their retirement accounts. There are dozens of these gold IRA companies on the market, and choosing the right one can be difficult. Plenty have unscrupulous business practices and poor reviews. Is Noble Gold one of them?

We've compiled everything that you should know about Noble Gold before you decide whether or not to invest with them.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

About Noble Gold

Noble Gold operates out of Pasadena in California. It was originally founded by two people, but now is owned and managed by just one of the co-founders, Collin Plume. Collin got his start in the real estate and insurance businesses, but he realized during the 2008 recession that precious metals were vital to the stability and financial health of his clients.

Collin now has more than 15 years of experience in the precious metals sector, plus his prior experience in other financial investing industries. This has given him the unique ability to oversee the creation of gold IRAs. Similarly, the other employees at the company tend to boast a long background in precious metals.

Fees at Noble Gold Investments

The fees that you can expect to pay depend partially on which services you use. You will not need to pay certain fees if you're buying gold and silver with your personal savings. However, if you use a tax-advantaged retirement plan to make the purchase instead, then you will need to pay certain fees.

Noble Gold asks that you have at least $5,000 to spend if you want to open a gold IRA. They will then help you with rolling your funds over into your account and making your purchase. Since they handle the paperwork and connect you to your custodian and depository, you don't need to do any of the research or hassle yourself.

Their IRA fees are extremely reasonable. You will pay $80 to your custodian for annual maintenance, which is a flat fee that never changes. Some custodians charge percentages of your holdings, but that's not the case for Noble Gold. You will also pay a $150 fee for your storage account. Noble Gold typically deals in segregated storage, so your items remain separate from those of other people.

Noble Gold works with two main depositories: the Delaware Depository and the Texas Depository. Both are located in states with major tax advantages, such as no sales tax on bullion or bullion storage. The Delaware Depository remains the largest bullion depository in the entire United States, while the Texas Depository is the only accredited depository in the state of Texas.

According to some sources, you will pay an extra storage fee each year if you store silver in the account along with your gold. Some storage companies have additional fees for silver because it's cheaper than gold, so it takes up more space inside the vault.

Noble Gold does not charge transaction fees when you buy or sell gold within your IRA. There isn't any kind of hidden fee structure that you'll need to worry about.

Gold and Silver IRAs

When you go to the Noble Gold website, you will find separate pages for gold and silver IRAs. However, you can buy both gold and silver and hold them in the same retirement account. The fee structures for each precious metal are slightly different. If you're confused about what you can expect to pay, you can ask your Noble Gold representative about your obligations.

The account will be a self-directed IRA that holds precious metals. If you need to move funds from one retirement account to the new one, Noble Gold will help you do that. Many of the company's positive reviews come from customers who say that they've been extremely helpful in this regard.

Noble Gold works with the Delaware Depository and the Texas Depository. Rather than having multiple custodians that they work with, they mainly partner with Equity Trust. Equity Trust is largely considered the best custodian in the industry when it comes to precious metals IRAs, having extremely transparent policies and great reviews.

While Noble Gold's website does state that platinum and palladium can be held in an IRA, they don't seem to have any of this type of product available for purchase.

Reviewers say that the representatives for Noble Gold are friendly, encouraging, and helpful. They are able to answer each client's questions and quickly return their calls.

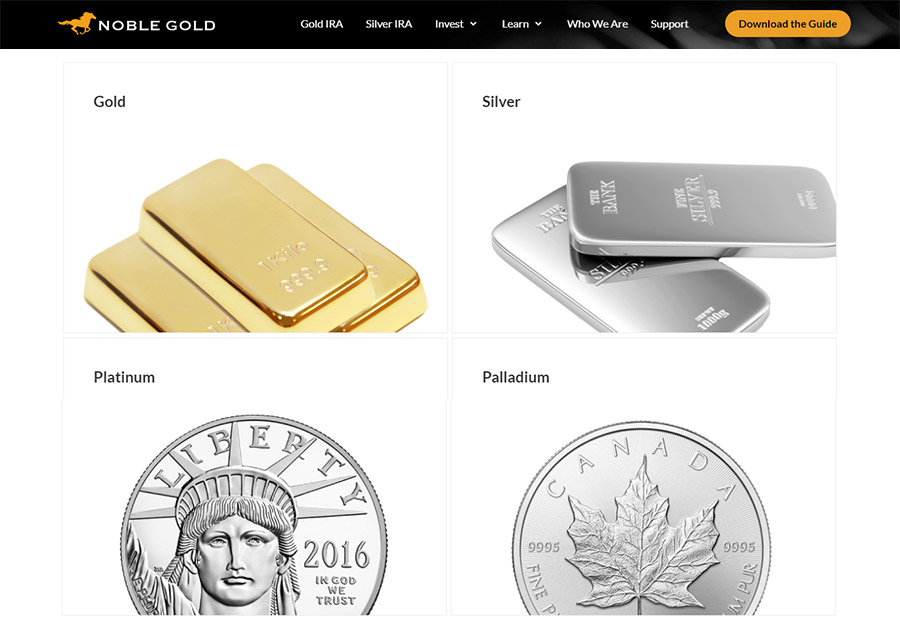

Noble Gold Products

Not all of Noble Gold's inventory is eligible to be kept in an IRA. If you are using their retirement services, then your representative will give you suggestions and guidance based on the IRA-eligible products. But if you're making a purchase with cash, then the full inventory is open to you.

There are some rare coins in the company's inventory. Rare and historic coins are not eligible for a retirement account, since their price is based largely around speculation. Noble Gold doesn't have very many of these rare coins, but they do have a few 19th century historic US coins that might appeal to collectors.

There are also some "junk silver" coins. Because these coins have only a small amount of silver, they don't meet the IRS standards for purity. So they can't be put into an IRA. The junk silver coins available will vary depending on the day, so it's best to ask your company rep about them. There's not much information listed on the website regarding the types of coins or what quantity they're sold in.

The most detailed listings are for the IRA-eligible coins, though you need to call and speak to someone to get a price quote. Each of the coins is listed with identifying information and its denomination.

In addition to the coins, Noble Gold sells some bullion bars and rounds. There is only one round currently listed on the website, which is the Highland silver round weighing one ounce. On the other hand, there are quite a few gold and silver bars. They come from a range of different refineries and sovereign mints including the Perth Mint, Rand Refinery, Highland Mint, Baird & Co, Credit Suisse, and Pamp Suisse.

Is Noble Gold Investments Legit?

Many companies in the precious metals industry operate dishonestly. It's vitally important that you work with an honest company, especially with something as important as your retirement account. So is Noble Gold a legitimate business, or are they a scam?

We're happy to report that Noble Gold Investments is a legitimate company. Not only that, but it's one of the top companies on our recommendation list. Their honesty and general policies make them difficult to compete with, with only a few other firms edging them out.

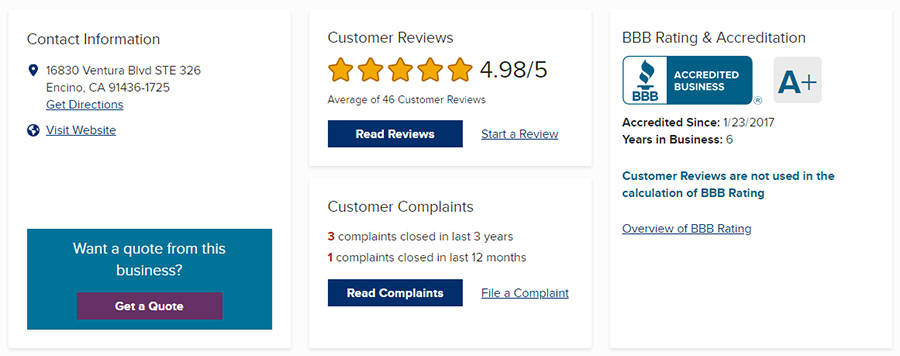

You can find hundreds of verified reviews of the company online, the vast majority of which are positive. Customers often name their representatives and thank them for making the IRA setup process super easy.

On Consumer Affairs, the company has 159 ratings with an average of 4.9 stars. The Better Business Bureau has accredited the company and given them an A+ rating. There are 46 customer reviews on that website with an average of 4.98 stars, indicating universally positive acclaim. Only a few complaints have been filed in the past three years, and all have been resolved to the satisfaction of the customer.

On Glassdoor, Noble Gold only has two ratings, but the average is 4.5 stars. That indicates that this is a positive place to work overall. Noble Gold does seem to be slightly smaller than some comparable companies, but it still serves clients across all 50 states.

Customer Reviews

Let's take a look at a few of the reviews that have been posted online by Noble Gold's past customers.

One customer left a review in January of 2023 saying that he and his wife had retired a year before. They had wanted to secure their 401(k)s because the value of the accounts kept going through massive ups and downs. Upon deciding that precious metals were their best bet, they connected to Noble Gold. A friend of theirs also recommended Noble Gold.

The customer said that he and his wife were initially apprehensive due to their lack of experience with precious metals. However, their representative was extremely friendly and professional. He said that talking to him was like speaking to an old friend.

The customer concluded by saying that he and his wife had recently gone back to Noble Gold to purchase more gold for their retirement, with additional plans to add more in the future. He and his wife were very pleased with their overall experience.

Another customer wrote a review in the same month, saying that he was watching the value of his original retirement account drop every day. It was apparent to him that he needed to open a precious metals account. However, figuring out how to open a gold IRA seemed overwhelming. So he reached out to the team at Noble Gold.

He worked with a representative named Jake, who offered patient guidance and expertise. The customer said that Jake's guidance helped him to feel confident in exploring the precious metals market. Jake answered questions, walked the customer through everything, and quickly processed the paperwork. The customer was extremely impressed by the overall customer service and the speed of the transaction.

Another customer left a review in November of 2022 saying that she worked with Micah at Noble Gold. She was able to roll over her current IRA into a gold IRA easily and efficiently. She added that Micah was quick to return her calls, answer her questions, and make sure that she made the right decisions for her needs. To conclude, she said that she was happy with the service and would easily recommend Noble Gold to her friends and family.

There was a review from July of 2022 from a customer who bought silver for personal purposes, rather than investing it in an IRA. He said that the products had arrived that day, and that he was extremely impressed with the quality of the bars and the discs. In fact, he said that the products were much more beautiful and finely crafted than he had anticipated.

He had heard of Noble Gold through Seth Holehouse, the Man in America. As soon as he contacted the company, he was impressed by how friendly and professional the staff were. All of his questions were answered patiently. He also said that he was given excellent advice about mixing one ounce discs with ten ounce bars, making him confident that the silver would retain its value better than his paper dollars.

Pros & Cons of Noble Gold Investments

Pros:

Cons:

Final Thoughts

Noble Gold Investments is a legit company with a great reputation. The people behind the company have been in the business a long time, with a founder who decided to get into precious metals during the 2008 recession. Their customer service and general policies are good enough to put them on some of our top recommendation lists.

There are only a few potential drawbacks. For example, the company doesn't partner with any international storage companies, so you'll have to store your gold in the US. Another example is that the company doesn't sell any platinum or palladium products, though they have a robust catalog of silver and gold options.

Overall, we do recommend Noble Gold. They treat their customers well and have reasonable pricing. As long as you can meet the $5,000 investment minimum, they're an excellent company to work with. That minimum is also lower than comparable minimums set by top companies like Goldco.

Don't forget to check out our top recommended companies before investing!