Noble Gold is a popular choice of gold IRA dealer for people who are nervous about the future. The company is built on the principle that precious metals provide important stability when the economy is in shambles. Many customers have chosen to use their services because of the unpredictability of the economy, especially with the recent pandemic and global unrest.

But precious metals dealers are notorious for preying on the worried. There have been entire companies toppled in the past for targeting consumers with scaremongering tactics. You want your assets to be secure, but you also want to make sure that you're working with an honest company that provides all of the relevant information.

We know that Noble Gold has precious metals available to buy both with retirement funds and with personal savings. We know that they have grown significantly over the past six years, and we know that they have thousands of customers.

But are those customers actually happy with the services? Can Noble Gold be trusted to see you through the entire gold investment process, from purchase to eventual liquidation?

We've done a deep dive to find out about this company's services, costs, and industry reputation. Here's what you should know before you decide whether to spend your money.

Is Noble Gold a Reputable Company?

Noble Gold is a reputable company. It is one of the top industry leaders when you're looking at companies that recommend precious metals for emergencies. The Noble Gold philosophy is that gold and silver retain their value and are easy to liquidate, even if the government collapses, you're in the midst of a natural disaster, or you don't have any access to a central banking system.

The company's services are structured around this principle. For people concerned about their retirement, they have gold IRA services. There are also packages of easily-liquidated gold and silver that can be bought with cash to take care of you in a personal emergency.

There is a high level of transparency regarding the company's management. They operate out of an office in Pasadena, California, with an address that's part of the public record. The founder and CEO is highly involved with the company's direction and has posted information about his background on the website.

The company is staffed by a mix of different finance professionals from many different backgrounds, including the precious metals industry, Wall Street, financial analysis, and other disciplines. The combined expertise allows them to answer whatever questions customers have about their retirement, their purchased products, or the impacts of the broader economy.

On top of all of this, Noble Gold also has a vast network of contacts outside the company. When a customer's financial planning needs go beyond Noble Gold's scope, they are able to connect you to accountants, estate planning attorneys, and financial agents who offer investment advice. That's a much larger range of professional contacts than most precious metals dealerships have.

You can go to several different third party websites to see how customers and professional organizations rank Noble Gold. This helps give you a sense of the real satisfaction levels of the consumers, once you get past all the marketing jargon.

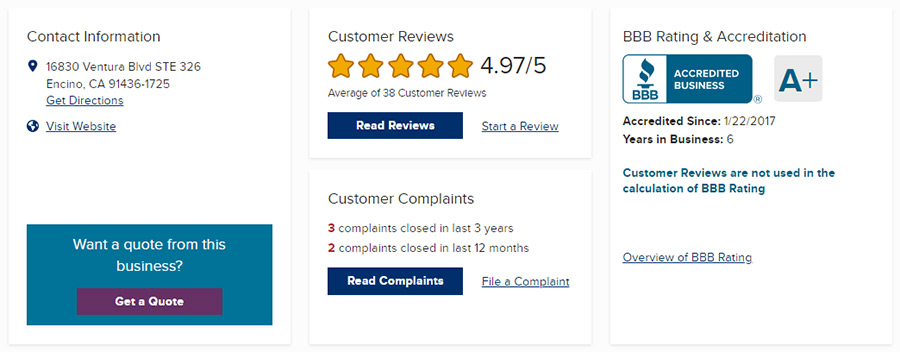

On the Better Business Bureau website, Noble Gold has an A+ rating and is accredited. The A+ shows that they are responsive to customer complaints and try to resolve the issues. There have been three complaints in the last three years, two of which were in the last year.

None of the complaints are available to view on the BBB website, indicating that the customers asked for them to be removed after having their problems resolved. While it would be nice to see how Noble Gold responded, it's also good to know that they're able to handle negative feedback professionally and discreetly.

There are many more customer reviews than complaints on the BBB website. The statistics show that 39 customers have left reviews, with an average of 4.97 out of 5 stars. That shows that the praise for the company has been nearly universal, with a satisfaction rating of over 98%.

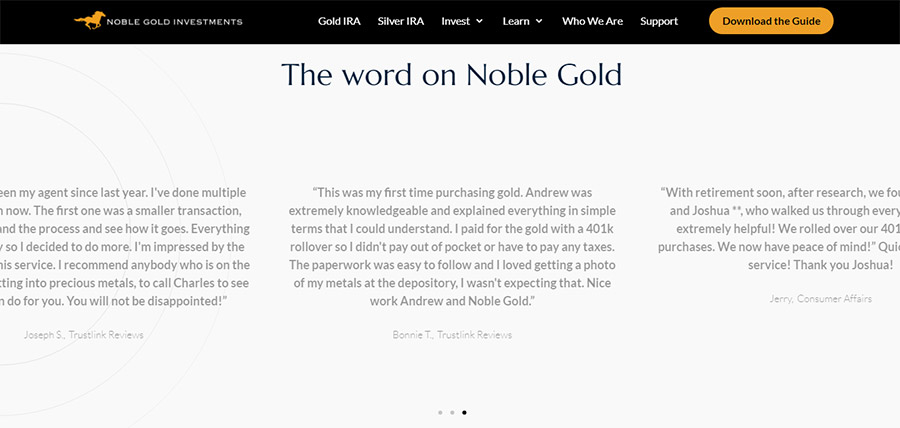

On the Consumer Affairs website, Noble Gold has 4.9 stars as an average of 156 reviews, once again indicating universal praise. Trustlink gives a perfect 5 stars based on 123 ratings and reviews from past customers. Noble Gold is also on the employment website Glassdoor. There is only one review from an employee, but it gives the company 5 stars, saying that it's an excellent place to work in every regard.

Positive Customer Reviews

Let's take a look at a few of the specifics that customers had to share when they wrote their reviews.

One customer left a review saying that it was simple and easy to roll over her IRA and purchase gold. She said that she worked with a representative named Micah, whose knowledge and patience helped her to be more confident in her choices. Throughout the process, he would promptly return phone calls and get invested in the client's future. She said she'd happily recommend the services.

Another customer named Mandi as her representative. She said that Mandi's expertise helped to create a sense of total confidence in the decision. Her retirement account was funded and managed very quickly, and the sales representative ensured that she was a major priority. She also said that she would highly recommend working with Noble Gold.

Many of the other reviews on the BBB website mention Mandi by name, with all of the customers saying that he was patient and thorough in his work. Every customer who worked with him appears to be extremely pleased with his service. There are also a handful of additional reviews that mention Micah as well, reiterating the patient and helpful work that he does.

All of these reviews seem to demonstrate that the customer representatives are consistently helpful and professional with their clients. They don't try to "hard sell" products, they don't work on commission, and they don't treat you like just a dollar sign. They really take the time to find out about you and what you want, and then they help you take the steps to get it.

The confidence is a big factor that keeps coming up in reviews. Many customers say that they went to Noble Gold with no prior investment experience and a lot of anxiety about the process. Because of how streamlined and courteous the IRA process is, they all ended their transactions feeling much more confident in their choices.

IRA Fees and Setup

An individual retirement account is a tax-advantaged way to save money for when you're older. There are multiple types of IRAs, all of which adhere to slightly different regulations. A self-directed IRA is an account that is completely managed by the holder, instead of being managed by an investment professional.

With this kind of account, you are given full control of every single purchase that you make. But you must buy products that are compliant with the IRS regulations. Self-directed IRAs differ from traditional accounts in that they can hold alternative assets such as real estate, cryptocurrency, gold, and silver. Traditional accounts can only use traditional investment options.

Noble Gold can help you create a self-directed IRA and connect to a custodian. They'll assist with rolling over funds from your existing retirement account or multiple accounts. Then you'll buy products in their inventory using the funds, and the company will ship them to a secure depository. Your custodian will put the package in a secure vault and audit it regularly.

There are certain costs that you'll have to pay up front, as well as ongoing fees for however long you decide to hold the account.

Noble Gold does have minimum investment requirements if you want to use their services. If you're funding the account with a contribution from your personal cash savings, then the minimum is $2,000. There's a cap on personal contributions per year at $7,000, so you won't be able to exceed that.

The more common option is to use a rollover, since you likely already have savings in your other retirement accounts. Most people have larger retirement accounts than personal bank savings. But the paperwork for a rollover is taxing, as is communicating with both involved custodians. There's a strict time limit of 60 days to complete everything, or else you'll be financially penalized by the IRS.

Because this method requires so much more coordination and time, people who use a rollover will need to commit at least $5,000 to a purchase. While this is significantly lower than the minimum requirements at some companies, it is still a fairly large chunk of change.

You'll have to pay annual fees to your custodian and to your storage company. While custodian fees can vary depending on which partner you choose to use, the majority of Noble Gold customers end up paying $80 per year. That's on the lower end of the maintenance cost spectrum.

Meanwhile, no matter which partnered depository you pick, there will be a flat cost of $150 every year. Many depositories offer non-segregated storage for $100, and the extra cost of segregated storage can add up. But Noble Gold doesn't offer any non-segregated storage options. They believe that it's important for your items to be kept separated from those of the other investors.

With segregated storage, the exact coin that is shipped to the depository is the one that you'll remove when you want to take distributions. With non-segregated storage, all of these items are mixed together. Your account will hold the same coins from the same year with the same purity and quality, but they might not be the precise coin that Noble Gold sent.

Noble Gold believes that it's best to take precautions and separate your items to protect against potential fraud. This goes hand in hand with the company's policies about using precious metals to prepare for an emergency.

But it's important to note that non-segregated storage is still fully insured and subject to regular audits. There's very little way for fraud to be committed, and even if it somehow was, you could recoup the losses with an insurance claim.

You are required by federal law to store your IRA in a depository instead of in your home. These depositories are actually much more secure than your house, even if you like the security of having your metals close by. It's important that your holdings are maintained and audited by a third party custodian.

There are three main depositories that Noble Gold works with. One is the Delaware Depository, an extremely common option. The Delaware Depository holds more precious metals than any other US depository, and it's been in operation for more than 200 years. Then there's the Texas Depository, which offers tax-advantaged storage for investors in the South.

The final storage depository is located in Ontario, Canada. This is an option for people who want to keep their precious metals over the border. It's difficult for the federal government to seize anything that's in another country.

While the Ontario depository is the only international option partnered with Noble Gold, there are dozens of other international depository choices that meet IRS guidelines. Not only can you find storage facilities in Canada, but you can also find them in safe tax shelters like Singapore as well.

Regardless of which depository you choose, your items will be completely insured against all risks through Lloyds of London. Lloyds of London is the biggest and most successful insurance company in the world, covering the vast majority of precious metals in the US and outside of it.

Noble Gold does have a buyback policy for when you decide that you're ready to start taking retirement income distributions. You can contact them for a buyback price. Once you've agreed to the transaction, they will contact your custodian to liquidate your holdings. The products will be shipped back to Noble Gold. Once they arrive and are inspected, the liquid funds will be deposited into your account and can be withdrawn.

There are no additional fees to use the buyback policy, and the buyback offers are reasonable based on the spot price of the gold. You should always look up the going spot price for your products to compare it to the offer, so you can make sure that you're satisfied with the deal.

Final Thoughts

Noble Gold is a company that focuses a lot on the importance of precious metals in an emergency. They sell investment products that help people prepare for times of economic turbulence, disaster, or great instability. You can either buy their survival packs with cash, or you can buy their bullion using your retirement funds.

Despite being based around preparedness and disaster planning, the company doesn't scaremonger. In fact, many customers have named their account representatives in their reviews, stating that the service was so good it made them feel confident in the future. People consistently report that their representatives were knowledgeable, patient, quick to return phone calls, and able to answer all questions and concerns.

Ultimately, Noble Gold is a solid company to invest with if you want precious metals for retirement or for a potential disaster.