Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Today's world is rife with economic uncertainty. There have been multiple major global market crashes in the past few decades, the latest of which was caused by a global pandemic. With stocks and bonds seeming so volatile, many people are turning to the security of precious metals.

Precious metals provide protection against inflation. They also perform well during times of economic turbulence. If you diversify your portfolio to include them, you will have more stable income sources no matter what the economy does.

In addition to buying tangible gold and silver, there are other ways to get invested in the precious metals industry. One is to buy shares in mining companies, which make their profits based on the market value of the metals. Many mining companies have seen significant growth since the start of the COVID-19 pandemic.

Barrick Gold is a mining corporation with shares available on the stock market. If you're considering investing, it's important to understand what this company does and what concerns you should be aware of before making a decision.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if Barrick Gold made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

About Barrick Gold

Barrick Gold operates sixteen mines in thirteen countries around the globe. The company headquarters is in Toronto, Ontario. The overall goal of the company is to extract gold and copper from the mining sites, where it is sold on the market and refined into bars, bullion, coins, jewelry, and other items.

Barrick Gold is the most basic source of the metals. They are not a refinery, a mint, or a dealership. You won't be able to purchase physical gold and silver assets from them. But if you want to invest in the precious metals industry on the ground floor, you can buy a public share in their stocks.

Prior to the COVID-19 pandemic, in the fiscal year 2019, the company produced a total of 5.5 million ounces of gold alongside 432 million pounds of copper. By the end of that year, the company had documented that they owned at least 71 million ounces of probable and proven gold in their mining reserves.

There was a period of time during which Barrick was the largest mining operation in the world. That changed with the merger of the companies Goldcorp and Newmont Corporation in 2019.

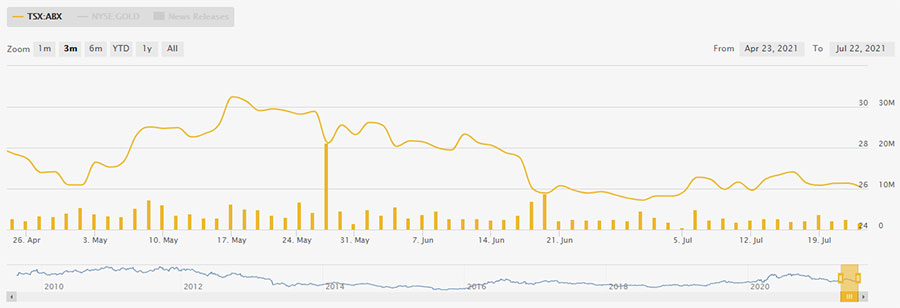

Right now, the company stock trades on the Toronto Stock Exchange, since this is where the firm is based. They are also now on the New York Stock Exchange (NYSE).

Company Values

The company abides by certain strict values at all of their mining sites. They aim to create ethical working conditions and sustainable mining.

The first and foremost value is a workplace that doesn't cause any harm. There are strict safety standards and protocols regarding work in the mines. This principle allows the company to protect both its own employees and the natural areas that they mine in. The company works hard to reduce or eliminate potential hazards prior to new projects.

Responsibility and accountability are the next most important values. Every person in the company is part of the team. The upper management takes responsibility for the projects, company performance, and value off their work.

The company also creates partnerships with stakeholders, shareholders, and employees. They want to make sure that they create sustainable growth for their shareholders. Meanwhile, they aim to partner with the communities and countries that they mine in, which is another aspect of doing no harm.

There is also a strong principle of economic sustainability. The company aims to manage the environmental and social impact of operations while also creating economic growth. Their goal is to lead the industry in healthy, environmentally friendly practices.

Projects, plans, and acquisitions are all based on results. The executives never make a decision for the company without having an end goal in mind.

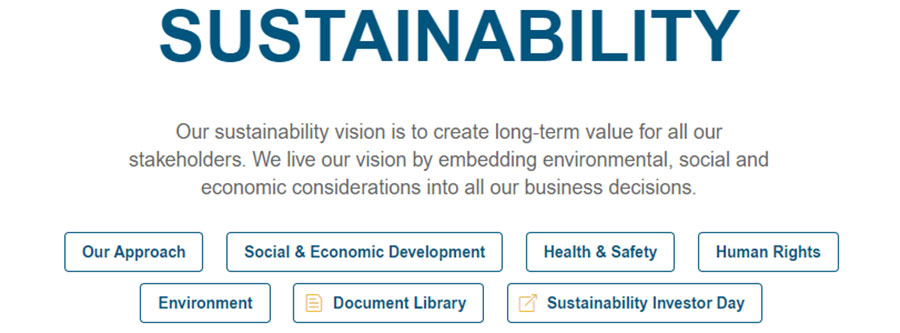

Sustainable Practices

Sustainability is threaded through everything that Barrick Gold does. Their policy is to make sure that their mining operations have modern considerations for social issues, environmental issues, and economic impacts.

In addition, this sustainability strategy affects the stakeholders. When people have stakes in the company's mining operations, the goal is to show them long-term growth and value.

Whenever the company begins mining in a new area, they use community-led investments to stimulate the local economy. They also use international best practices to protect the environment and the people who live in it.

Barrick supports local businesses, schools, infrastructure, and economics around its mines. It also does ongoing environmental impact monitoring to adhere to strict standards.

Locations of the Mines

The company owns 100 percent of the gold mining operations in Hemlo, Canada; North Mara, Tanzania; Bulyanhulu, Tanzania; and Buzwagi, Tanzania.

They own more than 50 percent of the operation in the gold mines in Nevada, US; Veladero, Argentina; Tongon, Ivory Coast; Loulo-Gounkoto, Mali; and Pueblo Viejo, Dominican Republic.

In the Kibali gold mine in the Democratic Republic of the Congo, the company owns 45 percent of the shares. The Porgera gold mine in Papua New Guinea includes a 47.5 percent share.

There are three main sites for copper mining operations. Both the Zaldivar, Chile and the Jabal Sayid, Saudi Arabia mines have a 50 percent company ownership. The company also owns 100 percent of the copper mining operations in its Lumwana, Zambia mine.

In the past, the company operated at sites that they have since vacated. These include three mines in the United States, three mines in Australia, a mine in Peru, and a mine in Tanzania.

Warren Buffett

Barrick was the largest gold mining company on the planet until a merger in 2019. Now they're the second-largest. Despite not holding the crown for the biggest mining operation, they're still one of the first places that potential precious metals investors look.

Gone are the days when only "gold bugs" used precious metals in their portfolios. You don't have to believe in the market sanctity of gold to see its usefulness. Many investment experts from all walks of life recommend getting involved in precious metals.

Warren Buffett is one of the most influential investors in the world. He used to be famously anti-gold, stating that the substance didn't have any utility or inherent worth. Several decades ago, he made it clear that he would not invest in something he felt lacked value.

But that's not the case with the Warren Buffett of today. Economic turbulence has changed the outlook of even the most hardened investors. When the COVID-19 pandemic began spreading and the stock market crashed, gold prices soared to record highs. Warren Buffett's company, Berkshire Hathaway, took notice.

Berkshire purchased almost 21 million shares in Barrick Gold stock at once, a transaction worth more than half a billion dollars. Because of how anti-gold Warren Buffett used to be, this caught the attention of many seasoned investors. The action is proof that the economic game has changed.

When asked about the change of heart, Buffett seemed to prioritize the stability of gold. Since gold never changes or goes out of style, it's much more useful to have when the market is completely unpredictable.

Stocks Above Tangible Assets: The Best Solution?

So you're interested in diversifying your portfolio by getting involved in the precious metals industry. Physical gold assets typically perform opposite the stock market. Is it really better to buy stock in a mining company than to purchase actual assets?

The answer to that question depends a lot on your goals, needs, priorities, and time frame. Not everyone will get the same benefit out of a potential investment.

If you choose to invest in Barrick Gold stock rather than purchasing physical assets, you'll enjoy these benefits:

Some people prefer to buy shares in precious metals companies because they are uncomfortable holding physical assets. They prefer for all of their wealth to be calculated on paper instead of inside a bank vault. If that's the case for you, then buying stock in a mining company is a good way to take advantage of gold's stability.

Investing in Barrick Gold stock is a fairly safe bet given the current economic circumstances. As with any investment, there's no guarantee that you'll see returns. But as long as the global economy remains tense and uncertain, people will want precious metals for security.

But investing in the stock market means you're taking some risks you don't have with physical assets. For example, the company might have issues with one of their mining operations, their upper management, or some kind of PR scandal. You won't be protected from arbitrary market forces that govern the ups and downs of stocks.

Reasons to Invest in Gold

Whether you buy company shares or go to a brokerage to purchase tangible assets, it's important to understand why people invest in gold. Not only is it a more stable asset than high-risk stocks, but it protects you against inflation.

Gold has been traded as a precious metal for centuries. The price fluctuates depending on the supply and demand. Even though mining operations like Barrick Gold pull more gold out of the earth every day, the planet's supply of gold tends to hold steady.

There isn't a risk that there will be a sudden, random influx of gold on the market. Mining operations are small in comparison to the amount of gold available. In addition, for all the gold being traded on the open market, there's far more gathering dust in people's closets.

But the dollar does go through periods of influx. The more dollar bills that the Federal Reserve prints, the less the dollar will be worth. If you made a dollar at your job in 1965, it's worth less than 1/8th today what it was then. The price of gold, on the other hand, has risen to match inflation.

Volatile economic times lead to an increase in the demand for gold. People want to secure their assets with something that won't disappear or depreciate. The more people are willing to pay, the higher the price will be.

During the COVID-19 pandemic, precious metals went through a surge in their value. This coincided with the stock market crashes and mass economic uncertainty.

Is Barrick Gold a Scam?

Barrick Gold is not a scam. The mining company has been in business since 1983 and operates in 13 different countries. If you buy a share in the company, you will share in the dividends from their earnings. The more that gold is worth, the more your stocks will grow.

Any investment comes with risks, and the same is true of the stock market. There is no guarantee that a company will continue to hold the same value that they did when you invested. If the company goes bankrupt, you'll lose your money entirely.

But it's your job to become familiar with the risks as a consumer. If you understand the benefits and drawbacks of a potential investment with Barrick Gold, then you can make a more informed decision about the company.

Pros and Cons

Pros:

Cons:

Final Verdict

Barrick Gold is a global mining operation that extracts copper and gold from sites in 13 different countries. Their company trades freely on the open market, so you can purchase stocks to gain dividends from the profits.

The company does care about doing right by its shareholders. And the upper management seems to be good at handling changes in the economy. As the global economy goes through times of turbulence, precious metals increase in value. It makes sense to invest in this industry.

If you don't want to purchase tangible assets, buying company stock is a good idea. Barrick Gold is a multi-billion dollar operation that's been in business for decades. They're one of the most popular mining investment choices because they're unlikely to go belly-up anytime soon.

But there are some serious potential drawbacks with investing in company shares instead of actual precious metals.

One of the biggest issues is that your investment can be affected by a huge variety of factors. The biggest factor affecting Barrick Gold's growth is the market price of gold. But their profits also depend upon successful mining ventures, a good reputation, and plans to scale for further growth.

If the company mismanages their options in any way, your holdings might suffer, even if the market price of gold climbs. When you buy physical gold, you don't have to worry about anything except the actual value of the metal. There's no need to fret about market competition or global factors.

All in all, if what you want is to buy stock in a mining company, then we do recommend this operation. It's one of the most widespread and stable mining corporations that can be publicly traded.

But if what you want is to secure your assets by investing in precious metals, there are simpler ways. Simply buying your own metals will let you avoid the potential market pitfalls that come with stock brokerages.

Although we do think that Barrick Gold is a solid company, we believe that there are better companies and options out there to make your investment with.

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Or, continue with Barrick Gold...