Augusta Precious Metals is a company that was founded in 2012 and has grown significantly in each year since. They provide precious metals IRAs to customers, streamlining the whole process and managing the paperwork for you. They'll also connect with your custodian and depository on your behalf.

But you want to be sure that you're working with a company that has your best interests at heart. So what is Augusta's industry reputation like? And what should you know about their services before deciding whether to invest?

Is Augusta Precious Metals a Reputable Company?

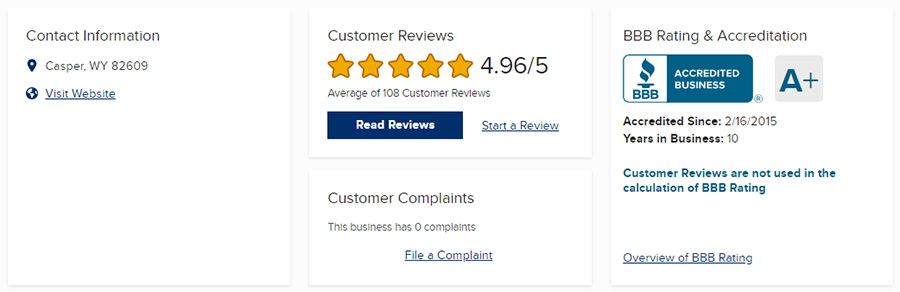

Augusta Precious Metals is a reputable company with one of the most solid presences in the industry. They stick to their policies and have a great deal of transparency regarding their setup. Past customer reviews indicate that people have been very satisfied, and there is almost no negative feedback online at all. In fact, there are zero complaints with the BBB.

The BBB gives Augusta an A+ rating and has accredited them. Their website displays 108 reviews from past customers, with an average of 4.96 out of 5 stars. That indicates that the majority of consumers are extremely happy. There's also a number on the page that you can call if you're dissatisfied with a purchase. Based on the lack of complaints, this number seems to work wonders.

Trustlink gives the company 5 stars with over 270 reviews, indicating perfect feedback. Augusta Precious Metals has also been featured on this website's list of the best precious metals IRA companies.

Google has recorded over 220 reviews with a 4.9 star average rating. Some of these reviews don't say words, but simply evaluate different aspects of the customer's experience with numbers.

The Business Consumer Alliance gives Augusta an AAA rating, which is the top possible score. This rating is only given to businesses that surpass expectations using the BCA's complicated formula. It indicates that a company is well managed, has good policies, is well established in the industry, and has created a good rapport with its customers.

Facebook has about 80 reviews with a 4.8 star rating. These customers have left a basic evaluation of their experiences, along with an explanation of whether they'd recommend the services or not. The vast majority of Facebook reviewers enthusiastically recommend the services, and negative reviews are hard to come by.

Consumer Affairs shows a 5 star rating with over 50 reviews. This is one of the most highly trusted independent websites for evaluating businesses. Augusta is also considered an authorized partner with Consumer Affairs, indicating that the platform considers them reputable enough to recommend to others.

Augusta is a registered member of Ethics.net, as are several individual members of the management and leadership. This ethics association is built around helping customers connect to businesses that use the top ethical standards. There's a strong commitment to transparency and integrity.

On top of all of this, Augusta Precious Metals has been given two Stevie Awards, one of the highest honors in the business world. One award was for customer service, and the other was for distinctive sales. In order to win the Stevie Awards, a business must be judged by a variety of finance professionals, executives, educators, and entrepreneurs.

IRA Gold Advisor has named Augusta as their top most trusted company to use for a gold IRA. Their website exclusively deals with precious metals IRAs, so they've evaluated a lot of fierce competition. It takes a lot of work and good service to make their number one spot.

About Augusta Precious Metals

Augusta Precious Metals has been in the industry for a decade and served thousands of customers in states all across the US. While they do offer some products for cash purchase, their main focus is on IRAs. There are several factors that have helped to set Augusta apart from the competitors, making it one of the most praised and highly recommended firms in the industry.

One key factor is the highly personalized service. Augusta acknowledges that every investor is different. People have different savings, different goals, different concerns, and different dreams. Some people might be nearly retired already, while others may be just starting on the savings path. When you make a purchase, your sales representative will make an effort to learn about you, so they can make recommendations that truly reflect your unique needs.

Augusta also has a significant focus on education. The best gold IRA companies encourage education because a customer should feel confident in what they're buying. There are tons of free resources available through Augusta's website, like articles, blog posts, FAQs, and videos. There are even monthly seminars hosted where you can work one-on-one with the company leadership and ask your questions.

Another major detail that sets Augusta apart from the competition is the offer of a lifetime of support. You'll be given an account where you can log in and view your exact holdings. There will be information about the current price of your items, as well as the change in price over time. If you decide that you want to liquidate your holdings, you'll be able to receive a buyback offer from Augusta without any hassle.

The lifetime of support continues even if you decide that you don't actually need any more precious metals. Just an initial investment is enough for Augusta to keep working with you for decades. But if you do want to buy more metals, you can talk to your representative. This single person will handle all of your needs, so they'll develop a personal relationship with you over time.

There are no hard sales tactics. Since none of the company's representatives work on commission, there are no ulterior motives for selling you things. They truly just want to connect you with the best gold products for your needs. Many of the customer reviews note the names of the representatives who helped them, stating that the service was very friendly and personalized.

Augusta also staffs experts in every step of the process. There are five different dedicated departments, all of which focus on a different aspect of precious metals IRAs. If you have a question or concern that your representative can't immediately answer, they'll be able to find an expert and get back to you extremely quickly. This allows Augusta to offer more in-depth experience and information than you'll get with the vast majority of other businesses.

Storage and Custodians

One of the requirements for a gold IRA is that the precious metals must be stored in a depository that complies with IRS security guidelines. Another requirement is that your account is maintained by a licensed custodian, similarly to how traditional IRAs are managed by an investment manager. Since gold IRAs are self-directed, though, you have full control over where you put your investments.

Augusta Precious Metals is not a licensed custodian and does not operate a depository. But they have partner companies that can help with this. They'll connect you to one of their partners and help you open the account and roll over the funds.

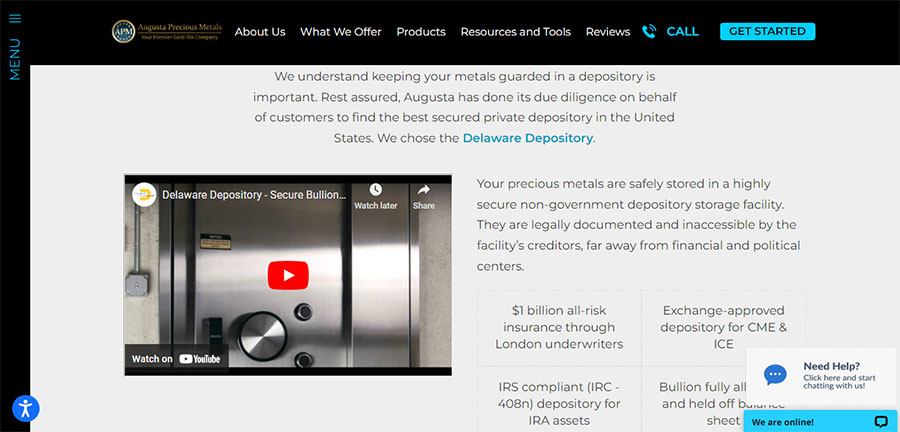

The default depository used is the Delaware Depository, located in Delaware. This massive depository is outfitted with unbelievable security and excellent insurance policies. It is the largest precious metals depository in the US and has been in operation for more than 200 years, gaining security upgrades along the way.

A big advantage of storing your precious metals in Delaware is that you won't be subject to sales taxes. There also won't be taxes when you decide to liquidate the assets. Many states do have sales taxes or bullion taxes that can greatly increase the cost of a purchase at checkout.

If you don't want to use the Delaware Depository, though, you have a host of other options scattered through other regions of the US. Augusta offers depository options in Texas, Utah, North Dakota, Idaho, California, Nevada, and New York. So whether you're on the East Coast, West Coast, or somewhere in between, there's a regional storage option that can fit your needs.

Augusta Precious Metals has three different custodians that they most commonly work with.

One of these custodians is Equity Trust. Equity Trust manages billions of dollars worth of assets for thousands of customers throughout the US. They have been in business for over three decades and have tons of positive reviews from past and current clients.

GoldStar Trust Company manages almost 40,000 self-directed IRAs for individuals in the US. They are a subsidiary of the Texas Happy State Bank. Over time, they have maintained an A+ and positive ratings with the Better Business Bureau.

Kingdom Trust is the third company. It is the biggest and oldest precious metals investment firm for consumers in the US, focusing chiefly on gold and silver. The company manages over $12 billion worth of consumer assets and has partnered with Augusta for a long time. There are more than 100,000 customers that have all received their own custody solutions for their accounts.

Some customers might worry about the security of their investments. But these depositories have extremely high levels of security. They are monitored 24/7, have security guards, and have limited access to the vaults. In addition, they are frequently audited by third parties to make sure that the vaults actually reflect the amount on the paper statement.

You can also expect to have a full insurance policy when you keep your metals at one of these places. Most depositories are insured by Lloyds of London, which is an incredibly large and wealthy insurance firm that covers thousands of clients internationally. Should anything go wrong with your account, you can be reimbursed through a simple insurance claim.

Once you decide on the best storage location for your items, the products will be shipped there and handled by your custodian. Augusta can handle the majority of this coordination for you, so you don't need to worry.

Augusta Precious Metals Fees

You will need to pay the cost of the precious metals when you invest. Augusta doesn't publish their prices online, so you have to call to get a price quote. Past customers do say that the pricing is reasonable, and they state that they only mark their prices up a few percentage points past the spot price. You should always double check the spot price of precious metals before you finalize a purchase.

There's a flat fee of $50 to set up your account. Your representative will answer all of your questions, lend their expertise, and walk you through the paperwork. They will pare down a confusing process to something that only takes about twenty minutes, if that.

The storage fees might vary slightly depending on which depository you decide to use. However, most customers can expect to pay $100 annually for their storage. Your package will ship to the depository completely for free. For the first year, you'll pay $250 for custodial maintenance, and then just $100 with every year after that.

If you invest a certain amount, Augusta Precious Metals might be willing to waive the fees for your first year or so. They might also be able to work with you to find solutions to things like fees and penalties, depending on the type of account you're using.

These flat fees are among the lowest in the industry. You're also getting a lot in exchange, including the free education and the ongoing lifetime of support.

In order to invest, you do need to have a minimum of $50,000. That's one potential drawback, as many people don't have this much to comfortably invest in precious metals, even when using their retirement savings. The high minimum investment is part of why Augusta's other prices are so low. They're working with clients who have a significant amount to spend in bulk.

There are other companies that have lower minimum investment thresholds while offering many of the same things that Augusta does. Goldco is an example of this.

Final Thoughts

Augusta Precious Metals is a highly reputable company that garners a lot of respect in the industry. They have received awards and accolades from a variety of business publications and organizations. Watchdogs like Consumer Affairs and the BBB give the company perfect ratings overall.

We believe that Augusta Precious Metals is one of the best companies that you can invest with. They have zero recorded complaints with the BBB and a dedicated customer service line to resolve issues. When you invest, you're given your own account where you can contact your representative and monitor your holdings.

The educational materials also can't be beat. Augusta Precious Metals offers a huge number of educational tools to suit all different learning styles. You can read up on different aspects of the industry, learn about retirement, read blog posts about current events, or talk to someone about your questions on the phone.

There are even monthly seminars where customers can work directly with a Harvard analyst and other leadership in the company. You'll be able to ask questions and gain insights about not just your own retirement, but also how the global economy affects your future.