Hartford Gold, also known as American Hartford Gold, is a popular choice for people who want to buy precious metals. They sell bullion bars and coins to people across the US. Oftentimes, people find them through their television and internet advertising campaigns. But there's the question of whether their services are any good.

One of Hartford Gold's big focuses is on IRAs. They help people open self-directed retirement accounts and then buy gold. Gold is considered by many of the world's leading investors to be an important piece of your portfolio. But the question is whether Hartford Gold's services are helpful or a hindrance.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

About Hartford Gold

American Hartford Gold operates out of Los Angeles, California. Despite being relatively new to the industry, the company's executives have a long history with precious metals. They worked in precious metals trading and finance prior to creating the company, learning everything about the industry before they took on their own company.

Many of the company's clients are everyday Americans with families. They might be younger office workers concerned about saving for the future, or they might be nearing retirement themselves. Precious metals help to hedge against inflation when you're younger, and they hedge against stock market crashes when you're older.

No matter how you want to protect your retirement, Hartford Gold is there to help. There isn't any fee for setting up your account, nor is there a minimum requirement to invest. You can just get on the phone and file the paperwork. Your representative will even take you through each step of the rollover process to make things even easier.

Opening an IRA

If you want to open an IRA with Hartford Gold, it only takes a few steps to do so. You'll first need to get in contact with one of the company's specialists. They will help to answer your questions and guide you through the paperwork. When the account is created, they'll then guide you through the paperwork to transfer funds from your current retirement account to your new one.

Then you'll use those funds to buy your precious metals. American Hartford Gold has a large inventory of coins and bars, although the selection may be limited if you're looking for specific pieces. For example, they might not have the most recently minted American Eagles or American Buffalos, but they will have those coins from earlier years.

By acquiring older bullion, Hartford Gold is able to keep their pricing low and competitive. At the same time, investment grade bullion is priced based on its melt value, so you don't need to worry that you're losing the value of your dollar. If you're younger, then the year that the coin was minted will be negligible by the time you retire.

Your specialist will explain what items are available right now. They will explain the benefits and risks of each of the choices. Though there's no way to guarantee an investment's performance, they can answer questions about how different products have changed in pricing and demand over the years.

Hartford Gold has a customer satisfaction guarantee. Though they do not publish their prices online, they say that they try to give each client the lowest price in the industry. In fact, they will match any lower offer that you're given for the same product. You just have to get the other offer in writing. It's important to research the price of different products when you receive your quote to make sure you're getting a good deal, no matter what company you work with.

Fees

American Hartford Gold doesn't have many of the fees that you'd expect from a high end gold IRA dealer. This makes them a more accessible option to the average American. Plenty of people don't have thousands and thousands of dollars lying around to invest, even in their retirement accounts.

So you don't need to commit to any minimum to open your account. You can choose whatever gold and silver products are within your budget range. If you want to continue to grow your account in the future with more purchases, then Hartford Gold will be happy to accommodate that.

In addition, you don't have to pay any setup fees. Other top companies will typically have a small fee for helping you with the paperwork. This helps to compensate the company for the employee's time. But since Hartford Gold doesn't have this kind of fee, you save extra money.

You will need to pay storage and custodian fees. That's something that you can expect with every single gold IRA, regardless of what company you buy from. Your custodian will have an annual fee for maintaining your account, and your depository will have an annual fee for storing your items. These fees will continue to be paid every year until the account is empty.

Fees vary widely depending on the depository and the custodian. But if you work with Hartford Gold's most common partners, then you can expect to pay about $180 total per year. This is on the lower end of the spectrum when it comes to annual account costs.

On top of that, Hartford Gold will sometimes run promotions for new customers. If you invest a certain amount, they might forgive your fees for several years. You can ask about the requirements to have your fees covered when you're getting started.

Another promotion that they sometimes run involves free silver. If you invest a certain amount in certain gold products, then a percentage of that purchase will be sent back to you in silver. These silver products will be outside of your IRA, meaning that you can store them however you want. You can even liquidate them immediately and save the money for a rainy day if you want.

It's also possible to buy products from Hartford Gold that are not in an IRA. Some of their products aren't even IRA-eligible. In these cases, home storage is an option. You won't need to pay for anyone to maintain your account. If you do decide to store your items in a depository, you will discuss the pricing with the depository management instead.

Hartford Gold Client Commitment

Hartford Gold has a strong commitment to their clients. They state that they always put customer service first and strive to ensure that every client is 100% satisfied. Judging by the positive reception that they've received online, this strategy is working. They do seem to live by the codes of ethics that they've set out.

There are multiple ways that the company sets itself apart when it comes to customer service.

One service is the monthly conference calls. If you want, you can have a monthly call to learn about the executives' insights into the market. They will analyze the different global factors at play and tell you what you should be on the lookout for. If you have questions about current events or your account holdings, you can get them answered.

It's also easy to get in touch with your company representative. During typical business hours, you can generally expect that someone will answer the phone. If no one is available, they will return your call quickly once you leave a message. They will give you transparent pricing quotes without any hidden fees or commissions, and you can research the quote before deciding whether or not to accept the sale.

They believe that it's vital to have a transparent and clear pricing model. As mentioned, there aren't typical setup fees or minimums. The fees from their partnered companies are incredibly low as well. You always know exactly what you can expect to pay. If the price changes for some reason, you'll be informed before you finalize the sale. As soon as you confirm the sale, your price will be locked in.

Another important factor to keep in mind is the buyback program. American Hartford Gold is willing to purchase your metals again when you decide that you want to liquidate your holdings. The price will be based around the spot price of the metals at the time. There is always some distance between buy and sell prices, but Hartford Gold aims to give a better buyback offer than you'll find with most other companies.

Several customers have said that they've gone through the liquidation process upon reaching retirement age, and they were happy with the offers made. There isn't an official guarantee that your items will be bought back. However, the company makes a good faith effort to buy back the items of as many customers as possible.

If you make a purchase and have it shipped anywhere within the United States, you're entitled to free shipping. It doesn't matter how big the order is or how heavy the packaging is. Not only will they ship your items for free, but they'll also give your package a free insurance policy. This policy lasts until you sign for the package when it arrives at your door. If the package gets lost or damaged, you can be compensated.

Privacy is also a strong value when it comes to customer service. Many people invest in precious metals because they want a more private way of securing their wealth. American Hartford Gold upholds strict confidentiality rules when working with clients, and they don't disclose information unnecessarily to third parties.

Overall, they have an excellent track record with communication, and they help connect customers to the tools they need to feel secure.

Is Hartford Gold a Scam?

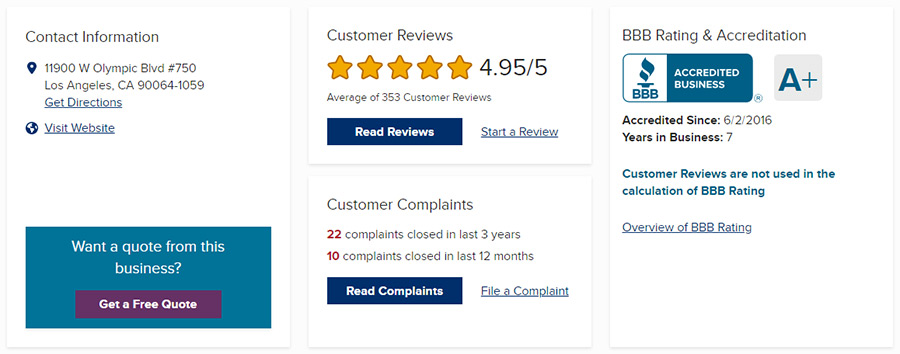

Hartford Gold isn't a scam. The company has several thousand online reviews, most of which are positive. On Trustpilot, they have a rating of 4.9 stars with over 1,100 reviews. On Consumer Affairs, they have a rating of 4.8 stars with over 60 reviews.

In fact, this is one of the most trustworthy companies in the industry. They have made gold IRAs accessible to many people who otherwise haven't been able to invest in them. Because they don't have account minimums, you don't need to have a lot saved in your retirement account to get started.

Many people found the company through their advertising campaigns on various television networks and websites. Others found it through word of mouth from friends and family. There have been a few negative reviews and complaints, usually related to technicalities in the company policies. For example, some people have been disgruntled about the requirements to get a price match offer or to qualify for certain promotions.

In all of these cases, though, the representatives from Hartford Gold have immediately responded. Sometimes they clarify the company policy and explain where the miscommunication happened. Sometimes they offer to come to a separate resolution with the customer to fix the issue. In the majority of cases, they are able to solve the problem in a satisfactory way.

Pros & Cons of American Hartford Gold

Pros:

Cons:

Final Thoughts

Hartford Gold is a great gold IRA dealership with knowledgeable, experienced professionals. They do a good job working with customers from all backgrounds, and they don't have the prohibitive requirements of many other IRA companies. In addition, even when there is negative feedback, the company's executives do everything they can to resolve it.

Overall, we can recommend Hartford Gold. The only potential drawback is that their inventory is slightly limited. Most of their products are from various previous years, rather than being the most currently minted items. While this doesn't make a huge difference with bullion, some customers might want the latest available products. If that's the case, you'll be better off working with another one of our top gold IRA companies.

Don't forget to check out our top recommended companies before investing!