Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Hard Assets Alliance is a gold investment company that provides a marketplace for people to find precious metals. Instead of being a single firm with a clear chain of command, the alliance is made up of hundreds of businesses and organizations. There aren't any clear answers about who is in charge.

The lack of transparency regarding the management is a potential issue, but is the marketplace worth it? We've taken a look at how the platform works, how HAA operates, and the risks and benefits of investing through this service.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if Hard Assets Alliance made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

About the Company

The entities that are part of HAA include precious metals dealers, financial forecasters, financial advisors, investment experts, retirement planners, and some third party organizations. Basically, anyone with reason to be interested in precious metals has a stake in the business.

The alliance has licensed a trading platform called SmartMetals. Instead of being their own dealership, this platform allows other dealers to compete to offer better pricing. This makes it easier for people to scroll through offerings and compare the prices of different dealerships.

That is an effective model, somewhat similar to travel sites that let you compare different hotel rates and airfare. The principle has just been applied to precious metals instead.

It might be easier if there were more dealerships competing, though. As it is, the marketplace doesn't tend to have the lowest prices in the industry, even at the lowest bids available. We've found that other dealerships and mints often sell gold and other metals at less of a markup.

So the system presents itself as a way of finding the best price for gold. But since the dealerships listed are limited, you're not actually finding the best price for gold. It's all an illusion to get you to buy at a slightly less-high markup than some dealers offer.

Dealers have incentive to keep their prices low, so they show up first in the listings. But they also have incentive to price higher than market value, because that's how they turn a profit. Since you have to do extra market research on other dealerships to find the best prices, it sort of defeats the purpose of the marketplace.

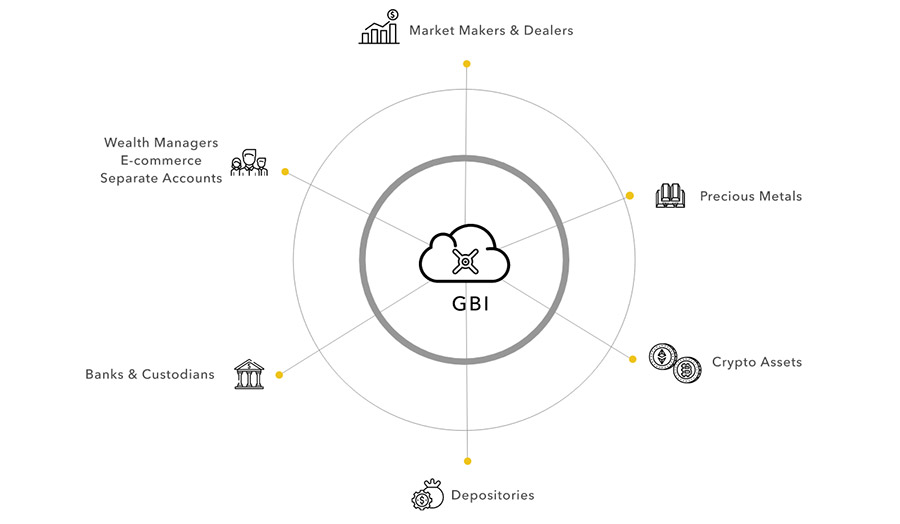

The platform uses technology created by Gold Bullion International. The people at HAA haven't actually programmed their own platform or created any new technology. Instead, they're using existing technology and combining it with their financial expertise.

Gold Bullion International, commonly abbreviated GBI, is a company that aims to give private investors and corporations access to precious metals. They allow dealers to list platinum, palladium, silver, and gold that's stored in vaults. HAA functions as a financial advisor to GBI.

HAA and GBI work together to provide the marketplace. When you purchase through the platform, you can ask that your holdings are delivered to the area of your choice. You can also have them stored in a secure place. There are regular audits of the precious metals to make sure that customers are getting an accurate picture of their vault.

The account that you set up to use the marketplace is called a SmartMetals account. You can also participate in the Metalstream savings plan.

The main focus is on clients in the US. But with that said, you don't need to live in the US to invest. You can create transactions at any time from any place in the world with an internet connection. There are even options for international storage in Sydney, Zurich, Singapore, and London.

If you want to store your metals internationally, you must invest a minimum of 10,000 dollars. For those who want to have their metals shipped to a US address or stored in the US, the minimum is just 5,000 dollars.

Security

The company employs a variety of security measures to make sure that people's assets and accounts are protected.

Gold Bullion International states that they are the most reliable company that facilitates the sale of precious metals through third-party vendors. They are partnered with Brinks and Via Mat, companies that provide expert vaults. Each company has an accreditation from the London Bullion Market Association.

GBI also conducts regular audits by bringing in third-party auditors from independent companies. Right now, the company that conducts the audits is called KPMG. The vault partners also conduct daily audits of the holdings to make sure that nothing is ever lost, damaged, or stolen.

GBI's auditing firm conducts a full audit at the end of every quarter. They compare their numbers to the daily audit numbers to make sure everything matches up. Customers can find out about their investments and holdings through their account dashboard, which is consistently updated with new information.

GBI also works for financial institutions including Wells Fargo and Prudential.

Fees and Costs

As mentioned, you must make a purchase of at least 5,000 dollars if you're in the US. For international shipping and storage, the minimum purchase threshold is 10,000 dollars.

To keep your account open, you must pay at least 5 dollars every month. This allows you access to the marketplace and to your dashboard, where you can find out about your holdings.

The exact cost of precious metals changes on a daily basis. Different dealers compete to offer lower prices. Gold tends to have a markup of anywhere from 1.3 to 3.8 percent, depending on both the day and the type of product.

You will also have to pay 0.70 percent of your holdings on an annual basis in order to cover your insurance and storage fees. The percentage structure is unusual. Many other companies offer flat fees no matter how many assets you have. That way, you aren't penalized for adding more to your account over time.

HAA claims that they will buy precious metals as well. But they don't publish their buying price online. You have to call and ask for a quote. Presumably the purchase price changes daily alongside the market price of precious metals, but it is odd not to publish it on the website.

Red Flags

The precious metals industry is filled with potential scammers. Most people want to make sure that they're working with a legitimate business before they invest.

HAA is a legitimate alliance made up of legitimate organizations. They do legitimate business, and they provide all of the services that they say they do. With this in mind, the company doesn't quite qualify as a scam.

That said, "not a scam" is not necessarily a ringing endorsement. Companies need to do a lot more than that to be worth working with. And HAA has some transparency issues and complaints that make it difficult to trust them.

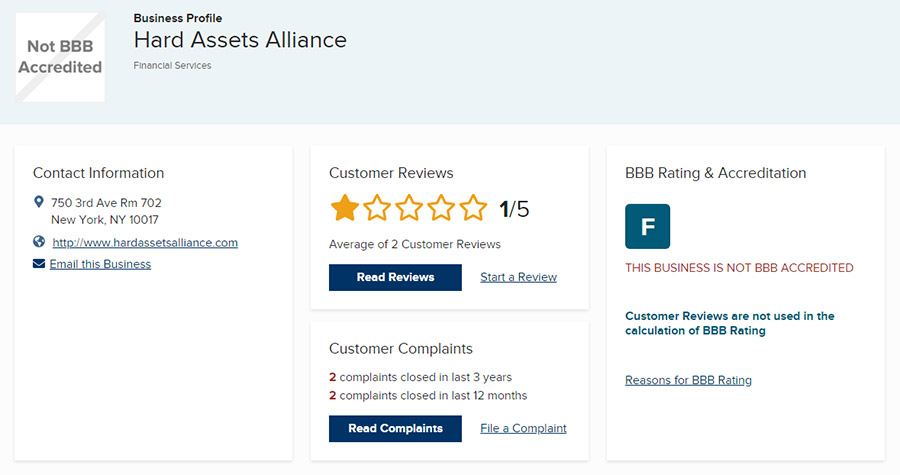

HAA has not been accredited by the Better Business Bureau. They have an F rating due to their refusal to address customer complaints, and both customer reviews have given them 1 out of 5 stars.

On Trustpilot, they do have mostly positive reviews. But there are a few negative reviews that give us pause. There have not been any Ripoff Reports filed about the company, which is a good sign.

Customer Reviews

Let's take a look at some of the specific negative feedback from customers.

On the Trustpilot website, one review says that the customer's withdrawal was stalled for no reason for weeks, as though the company didn't want them to get their money back. The customer called the company and was told they'd be emailed a confirmation of their finalized withdrawal.

Instead of getting that email, the customer had no follow-up whatsoever. They waited several more weeks, logged into their account, and found the withdrawal cancelled. This was after they had been explicitly told that their request was approved. They had completed all of the necessary paperwork and steps to make the withdrawal, so there was no reason for this.

This particular customer was also not happy with the response they received from the company. They said that the company was trying to save face by pretending their customer service wasn't as bad as it was.

Another Trustpilot review raised some serious security concerns. It was written by a customer who works in internet security. Apparently HAA's policy is to request serious personal information like photos of checks and SSNs over email. Email transfers do not have the confidential data encryption to be safe.

One Trustpilot review singles out the customer service in particular. The customer says that it's impossible to get a hold of anyone through email or the phone. They were trying to get in contact with an agent to close their account.

This person stated that they were worried they'd never be able to get their money back. They said they regretted ever working with the company.

One person said that they were suddenly locked out of their account because their password stopped working for no reason. There was no way to get a link to reset their password. Upon calling the company, the customer waited ten minutes and then was hung up on. They did this several times, until the system began automatically hanging up on them instead.

Another Trustpilot review had issues with just about everything. The customer service replies were too slow, there were too many hidden fees, the orders took too long to ship, there was a bank account validation issue, and the shipping fees were absurd.

Essentially, there wasn't a single part of this customer's experience that they didn't find fault with. They concluded by pointing out that other precious metals companies have no issues with prompt customer service or fast shipping.

One complaint stated that they were charged a 60 dollar annual fee, which the company deliberately misled them about. This seems to be related to the 5 dollar monthly account fee. The customer reminded people to do their research prior to investing with any company.

The two BBB complaints appear to have been removed from the website since being resolved, so there's no details on exactly what they were or how the company responded. However, both complaints were related to a problem with a product or service.

Lack of Transparency

One major issue with the company is the lack of transparency. If you have a problem, there's no way to find out who to get in touch with. There's no physical address for the place, and there's no CEO or founder listed. There aren't even individual contributors named on the website.

Instead, everyone involved hides behind their organization's names. So you can't find out who created the company, who runs it, who makes the policies, who is in charge of shipping, or who is in charge of customer service.

If you have a question that you need answered, you can reach out to customer service. But their responses are slow and won't necessarily be helpful. And if you have an issue with the response, you won't know who to follow up with.

This lack of transparency is so complete that it has to be deliberate. It's like no one wants to take responsibility for anything that goes wrong with the company. And if no one is willing to take responsibility, why would you want to invest your money with them?

The transparency issues extend beyond individual personnel. There's also a lot of confusion about the organizations themselves. The website lists out every organization involved, but it doesn't explain the role any of them play. What does anyone bring to the table? Customers sure don't know.

There might be a reason for that, too. They outsource their platform to GBI and outsource their account programming to other parties. Basically nothing they offer has been created themselves. Instead, they're a group of financial industry people who have banded together to create one of the greatest branding schemes in modern times.

We really aren't sure that HAA offers anything you can't find elsewhere. Other companies leverage all of their so-called "expertise," plus they're actually honest about who runs the show.

Final Thoughts

Hard Assets Alliance looks impressive on the surface. It's a group of hundreds of expert organizations that provides a competitive precious metals marketplace.

But it isn't everything it seems to be.

For one thing, the precious metals are not the cheapest in the industry. For another, there are hidden costs and percentage-based fees that add up exorbitantly.

Another issue is the lack of transparency. The business has many reviews stating that the customer service team makes no effort to solve problems. At the same time, there's no information about who is actually in charge of the alliance, so there isn't anyone to complain to.

Although we do think that Hard Assets Alliance is a decent company, we believe that there are better companies out there to make your investment with.

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Or, continue with Hard Assets Alliance...