GoldStar Trust IRA is a retirement savings plan designed to help individuals accumulate wealth for retirement. It is an excellent option for those looking for a convenient and cost-effective way to save for the future. This comprehensive review will take a deeper look at the features and benefits of GoldStar IRA and provide an in-depth analysis of its offerings.

We will examine the investment options, the fees associated with the account and customer service quality. Furthermore, we will explore the potential drawbacks of this plan and how it compares to other retirement savings options. With this review, investors will better understand whether GoldStar IRA is the right choice for their retirement savings needs.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

About GoldStar Trust Company

GoldStar Trust Company is a premier IRA custodian, managing over $2.7 billion in assets for over 60,000 individual retirement accounts. In 1989, it was founded as Colonial Trust Company and in 2004, it initiated talks to merge with Happy State Bank as a trust department.

Regarding financial institutions, Happy State Bank is a major player in the Texas Panhandle. After acquiring American Church Trust Company in 2006, GoldStar Trust Company established its current offices in Canyon, Texas the following year.

The website provides limited details about the company's upper-level management. However, their website features images and bios of the company's top managers. They have all worked with real estate investments and self-directed IRAs, two alternative investment vehicles.

In January 2020, Jeff Kelly, who has been in the IRA Trust market since 2004, became president of GoldStar Trust. For nearly a decade, Jeff Kelley served as a senior vice president of Equity Trust. Kelley received a BA in Economics and Finance from Baylor University in 1988.

With so many IRA custodians hiding their ownership details, it's excellent that this one isn't hiding its own. It gives us even more faith in the company's ability to deliver on its promises.

Because of its status as one of the country's lesser IRA providers, GoldStar Trust Company employs a relatively modest number of managers and administrators. When compared to the larger firms we examine, they fall short. However, GoldStar Trust Company's management is incredibly proud to provide individualized service to its customers, as is the case with many other small businesses.

Why Invest in Precious Metals IRA?

Before we go deeper into a GoldStar IRA review, remember that investing in a Precious Metals IRA can be an excellent way to protect and grow your retirement savings. Here are some potential benefits of investing in a gold or other precious metals IRA.

Diversification

Investing in Precious Metals IRA is a great way to diversify your retirement portfolio. Including gold, silver and other precious metals in your retirement savings can reduce the risk of investing in stocks and bonds. With precious metals IRA, you can invest in physical metals like gold, silver, platinum and palladium. This allows your portfolio to guard against the stock market's volatility and potentially increase long-term returns.

A precious metals IRA also allows you to diversify your asset mix. Gold and silver have historically outperformed stocks during periods of market volatility. Diversifying into physical metals can provide additional stability and protection for your retirement savings.

Tax Advantages

Investing in precious metals can be a great way to build long-term wealth and financial security, especially when you take advantage of the tax benefits of a gold IRA.

With a precious metals IRA, your investments are tax-deferred, meaning the money you contribute is not subject to current taxation until you withdraw it. This can be a great way to maximize your savings, as you can use compounding without paying taxes on your earnings.

You may also be eligible for a tax deduction on the amount you contribute to your Precious Metals IRA each year. The money you save in taxes can be reinvested in your Precious Metals IRA, helping you build your wealth even faster.

Hedge Against Inflation

In times of economic uncertainty, such as those caused by the COVID-19 global pandemic, having some of your savings invested in tangible assets can help protect your investments from being wiped out due to rising prices. Precious metals, like gold and silver, are considered haven investments because they tend to retain their value better than other assets.

Furthermore, when the value of currency decreases, the value of precious metals increases. This is why including precious metals in your retirement portfolio can provide you with a layer of protection against inflation.

Long-Term Investment

Gold is a long-term investment that can yield high returns. The price of gold has been steadily increasing over the years and as a result, investing in gold can be a wise decision if you're looking to maximize your retirement savings.

Precious metals are also excellent long-term investments that can provide security and stability during market uncertainty. The low correlation of precious metals to other investments means they can reduce overall risk while still providing potential growth potential.

Liquidity

With a Precious Metals IRA, you can tap into the power of physical gold, silver, platinum and palladium and reap the rewards of their fluctuating market prices. As the price of these metals fluctuates, you have the potential to benefit from increasing values. These investments are liquid and can easily be converted into cash if you need to access your funds quickly.

Hedge Against Market Crash

By diversifying your portfolio with physical gold and silver, you can reduce the risks associated with stock market volatility. The value of gold and silver are not directly linked to the stock market, so they're less likely to be affected by market crashes.

These metals tend to hold their value during economic uncertainty, making them an excellent choice to protect your retirement savings. You'll also have the peace of mind from knowing your retirement savings are protected from market fluctuations.

Types of Self-Directed Accounts IRA Accounts Offered by GoldStar Trust

GoldStar Trust Company provides a range of investment alternatives for investors across four distinct types of self-directed IRA accounts. First, let's go over the types of accounts that exist.

Traditional IRAs

This account allows you to contribute pre-tax dollars that can accumulate and grow tax-deferred until you withdraw the funds in retirement. That means you don't have to pay taxes on the contributions until you withdraw them in retirement.

When it comes to when you can withdraw funds from your Traditional IRA, there are certain rules and regulations you should be aware of. Generally, you can start withdrawing from your Traditional IRA at 59 ½.

Withdrawals before this age may be subject to an early withdrawal penalty, so it's best to wait until you reach this age before taking any money out. If you withdraw funds before you reach age 59 ½, you will likely have to pay taxes and a 10% penalty (unless you qualify for an exception).

When you reach retirement age and begin taking distributions, you may be subject to mandatory distributions if the value of your Traditional IRA is over a certain amount. At that point, you'll need to pay taxes on the money you withdraw. Your taxable distributions will depend on how much money you've withdrawn and your current tax bracket.

Roth IRA

With a Roth IRA, you pay taxes on the money you contribute now, but all earnings on your contributions and all qualified withdrawals are tax-free. That means you won't have to worry about taxes when taking money out at retirement. Plus, you can withdraw your contributions anytime without tax or penalty.

The Roth IRA is an excellent choice for young investors who don't expect to be in a higher tax bracket in retirement, as they can benefit from paying taxes on their contributions today and having the potential for tax-free growth and withdrawals down the road. And you can add to your Roth IRA throughout your working years or invest your annual contribution.

The main thing to remember when considering a Roth IRA is that you must wait until you reach age 59 ½ to make any withdrawals from your Roth IRA without incurring a penalty. Any withdrawals before age 59 ½ will incur a penalty unless it is for a qualified medical, educational or first-time homebuyer expense.

SEP IRA

A SEP IRA (Simplified Employee Pension Individual Retirement Account) is an employer-sponsored retirement plan that allows employers to contribute to a retirement account for themselves and their employees. It's an attractive option for small businesses because contributions are tax-deductible and the money grows tax-deferred until it's withdrawn.

SEP IRAs have the same tax implications as traditional IRAs. Contributions are tax-deductible up to the amount allowed by law and the money in the account grows tax-deferred until it is withdrawn. That means you don't pay income taxes on the money until you make a withdrawal from the account.

You can withdraw funds from your SEP IRA anytime, but you may face taxes and penalties if you take out money before age 59 ½. If you decide to withdraw early, you'll owe income taxes on the distribution. You may also be subject to a 10% early withdrawal penalty unless you meet one of the exceptions outlined by the IRS.

SIMPLE IRA

A SIMPLE (Savings Incentive Match Plan for Employees) IRA is an employer-sponsored retirement plan designed for small businesses and their employees. It's a great way to save for retirement with tax benefits and allows employers to contribute to their employees' accounts.

With a SIMPLE IRA, employees can contribute up to $15,500 per year and employers must make matching contributions or provide a 3% contribution regardless of how much the employee contributes.

The tax implications of a SIMPLE IRA are that contributions are tax-deductible and any earnings on those contributions are tax-deferred until you withdraw them. When you withdraw money from your account, you will be required to pay taxes on the amount withdrawn and on any investment gains.

As with other retirement accounts, you may be subject to a 10% early withdrawal penalty if you take money out of your SIMPLE IRA before age 59 ½.

You can withdraw money from your SIMPLE IRA anytime, but there are some restrictions. You must hold the account for at least two years before you can begin taking distributions and pay applicable taxes and penalties. Additionally, if you withdraw funds before age 59 ½, you may be subject to a 10% early withdrawal penalty.

GoldStar IRA Investing Options

GoldStar Trust, like other providers of self-directed IRAs, aspires to give clients a wide range of investment opportunities beyond the more conventional mutual funds, bonds and equities. Listed below are all of the services that this business provides:

Many of the choices above, such as the idea of earning a return by contributing to churches or charter schools, aren't always advocated by other IRA firms. The company intends to offer a variety of unique or unusual choices that its rivals do not. Surprisingly, they don't focus on the business and residential real estate markets.

At the end of their sales pitch, they state that customers who want to put their money into something that isn't on the site can get in touch with them to learn about the various ways they might do so. This is a novel method of addressing client concerns.

While GoldStar offers some good investment options, we highly recommend IRA companies that can provide better investment products. These companies are well-respected, reliable and have years of experience when it comes to investing.

Our top-rated companies offer various options, including Roth IRA, Traditional IRA and SEP IRA, which can be tailored to meet your individual needs. Plus, they provide 24/7 customer support, so you can always get answers to your questions quickly and easily.

GoldStar IRA Fees

All of GoldStar's fees are detailed on their website. There is a $25 setup cost and a $65 annual maintenance fee for mutual funds, money market funds and other typical securities traded on public exchanges.

In addition to the standard brokerage fees, the business levies an annual asset holding fee of $50 per hedge fund and a per-trade trading fee of $25. There is a wide range of fees, but they are all competitive with the market average.

When investing in conventional assets, annual fees charged by smaller IRA providers range from $100 to $200.

GoldStar Trust Company's prices for non-traditional services begin to vary once they decide how to handle the transaction. Listed below is a summary of their charge administration practices across their many different asset classes:

Church Bonds

IRAs of GoldStar are qualified to hold church bonds and loans. To the best of our knowledge, no other self-directed IRA providers advertise this particular investment. GoldStar charges a flat annual fee of $45 to maintain this investment. Keeping an account open or closing it down due to a transfer or in-kind exchange will cost you $25 to $50, respectively.

Real Estate

The fee to get started is fifty dollars. The minimum annual maintenance cost for properties with a value of less than $200,000 is $200. If your investment value is over $200,000, you'll pay a $300 annual fee. You'll have to pay a $100 fee when you buy or sell property through GoldStar. Any paperwork that needs to be examined or hurried incurs an additional administrative-legal fee of $50 to $100 on top of the regular document processing fee.

Perth Mint Certificates

Perth Mint Certificates include a one-time setup charge of $50. Afterward, you'll be charged $40 for each purchase or sale made within the account, $75 for account maintenance each year and $150 for keeping assets for another year.

Precious Metal IRA

The initial cost to open a precious metals IRA is $50. Accounts valued at $100,000 or less are subject to a $275 maximum yearly maintenance fee. In addition, there is a $100 minimum depository storage cost. However, purchasing and selling assets within the account is free of charge. Any distribution of precious metals carries a $40 fee and the associated shipping fees.

Bank Accounts Outside of the US and Annuities

GoldStar Trust Company allows IRA assets and monies to be kept in foreign accounts. Fees range from $50 to $75 to surrender annuities or sell assets, with an annual maximum of $275, dependent on account value.

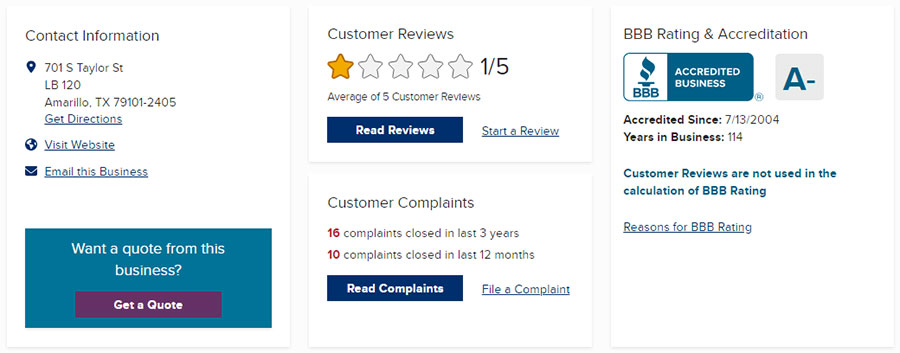

GoldStar Customer Reviews

GoldStar Trust Company has not received official accreditation from the Better Business Bureau. However, it continues to hold an A+ grade.

There are few customer evaluations of the company online, making it hard to determine what people who have done business with them think. However, based on customer ratings, the company's Google Business Page only receives a 1.9 out of 5 overall.

The Bottom Line: Is GoldStar IRA Worth Investing In?

When it comes to investing in an IRA, GoldStar is an excellent option to consider. They offer competitive rates and a wide range of investment options. But that said, if you're looking for the best IRA products and services available, we highly recommend you look beyond GoldStar.

We understand that everyone's financial goals and needs are different. If you're looking for a solid IRA option, GoldStar is a good choice. But if you're looking for the best overall IRA experience, we recommend you explore the many excellent options available from our highly recommended companies.

Don't forget to check out our top recommended companies before investing!