Goldline IRA is a precious metals IRA provider with a long history of providing retirement planning services to its clients. As with any investment, it's important to research and understand all the facts before committing.

This comprehensive review will examine this provider's pros and cons and determine if it's the right choice for you. We'll explore the various account types available, their fees and commission structure, their gold-backed investments and the customer service they provide.

We'll also discuss the benefits and drawbacks of investing in gold through Goldline IRA. By the end of this review, you'll have all the information you need to decide if Goldline IRA is the right option for you.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

Goldline IRA Background

Goldline began in Los Angeles, California, in the year 1960. Over more than 60 years, the firm has supplied buyers with gold, silver, platinum and palladium. Customers who wish to invest in a Precious Metals IRA can choose from a wide variety of popular coins and bars offered by this firm.

As a bonus, the catalog also features various rare and valuable coins that collectors and investors will appreciate.

Goldline offers a service they call "Express IRA®," which guides customers through opening a Precious Metals IRA in three simple steps. Further, free bullion coins on qualified purchases to assist in covering IRA account maintenance fees are offered to customers who spend a certain amount. In addition, delivery to the client's preferred depository is on the house.

Additionally, the organization facilitates a buyback plan for customers who seek to liquidate their coins and bars. The three-step process is straightforward and once Goldline has received and authenticated the precious metals, payment is usually sent within three business days. The organization stresses that they do not buy precious metals in any other form other than coins and bars. This includes jewelry.

Goldline Management Team

We looked all over the internet but could not find any information about Goldline's top management. There is no mention of Goldline's founders or executives anywhere on their website or any other platform we could access. This is unsettling because you can't know exactly who you'll be working with.

Goldline Products

Goldline has an extensive inventory of coins and bars made of precious metals that are eligible for IRA accounts. The American Gold Buffalo and the American Gold Eagle are the only gold bullion coins in the collection.

The American Silver Eagle and the Australian Kookaburra Silver coin are two of the most well-known silver alternatives. The American Platinum Eagle is one such platinum alternative. The company provides a one-ounce palladium bar to investors looking for a metal that may be held in an individual retirement account.

Why Invest in Gold with Your IRA?

If you want to diversify your retirement portfolio, adding gold to your IRA is an excellent option. Not only does it provide greater stability and security in uncertain economic times, but it can also help you maximize the growth potential of your investments. Here are some of the key benefits of adding gold to your IRA:

By taking advantage of the benefits gold provides, you can maximize your retirement savings and protect your wealth in the long run.

Goldline IRA Custodians and Storage

Goldline is a direct marketer of rare and collectible coins, bullion and other rare and valuable currency to the collector and investing communities. Goldline is a fully vertically integrated precious metals business, handling everything from product creation to customer support in-house, including shipping, delivery, valuation, pricing, lead generation, account management and storage.

Goldline's alliance partners are GoldStar Trust and Equity Trust. These are two of the most prominent IRA trustees. Surprisingly, it is unclear whose secure storage vault service the company has used in the past. The website states that customers can choose three locations in Las Vegas, Zurich, Nevada, Singapore and Switzerland.

Goldline IRA Education

The website for Goldline is packed with useful resources. Their primary objective is to show people why they should place their money in precious metals.

The decline of the currency and the evolution of inflation are two more topics that get extensive coverage. This is a fantastic read for anyone just getting started in the world of precious metals.

Even if you have some experience in the financial markets, it's still worth reading this since you may learn something new about a topic you have only looked at before.

They do a wonderful job educating their customers, especially compared to other precious metals dealers. Goldline is the first of only a few companies to go this far.

Goldline Business Setup and Marketing Campaigns

The company mainly sold jewelry made of precious metals to customers through retail stores. In addition to the usual gold, silver and platinum, they also offered a wide variety of collector coins and other currencies.

In 2009, the company earned over $800 million in revenue and employed over 300 people. The company was among the fastest-growing in all of Los Angeles, USA.

The firm launched numerous advertising campaigns. The company promoted its products via the then-nascent internet and more conventional media like television and radio. The former US Mint director served as their spokesperson back in 2009.

Goldline promoted its products on widely viewed television shows broadcast on networks like Fox News, CNN and CNBC. They also sent money to many right-wing shows on TV and radio. Glenn Beck, a radio host who advocates for the United States, was one of the company's radio sponsors and was frequently mentioned as a favorite client.

The company received criticism in 2010 for airing services during conservative radio and television programs.

Goldline IRA Controversies

The company's prices fluctuate widely depending on the product's nature and the market's state. They were blamed for boosting the price of precious metals and antiquities by as much as twofold.

The company ran into legal trouble in 2006. An elderly couple claimed they were coerced into a contract, but they negotiated a voluntary agreement to return almost $200,000 to them. The couple received all of the precious metals they had purchased.

Consumer Reports investigated Goldline and found that the publication had forced some journalists to sell off their possessions. Staff members should not be legally delivering investment advice; hence, part of the investigations included in Goldline's 2006 voluntary agreement was to establish if the company's salesperson had functioned as a financial advisor without a license.

In 2010, Congress held a hearing over public disclosures of precious metals. In the hearing, Congressman Anthony Weiner led the charge against the corporation. According to the complaint, the corporation knowingly misled consumers with the aid of conservatives.

Many witnesses at the congressional hearing testified that existing common law standards adequately addressed the disclosure issue. Because of this, Goldline was not punished once the hearing concluded. The legislation was introduced in the House of Representatives about the company's credibility, but it went unheard because no one sponsored the bill.

However, a second probe into the corporation got underway at the same time. Over a hundred customers in the US have reportedly complained about Goldline's deceptive advertising and products, as reported by several news outlets. However, this time was different since another precious metals merchant was involved in the scam. As a result, keeping track of the total number of customer complaints lodged against Goldline was challenging.

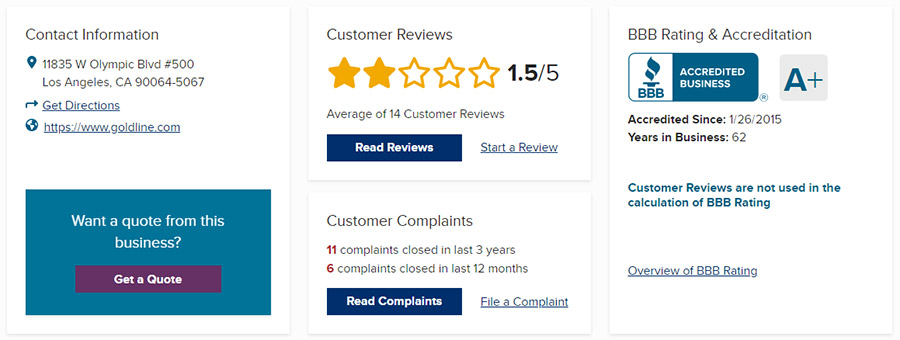

Interestingly, by this time Goldline had an A+ rating with the Better Business Bureau (BBB), whereas the other company involved in the scam had an F rating.

According to the media outlets, the corporation pays its employees unfair sales commissions, incentivizing them to sell inferior products at inflated costs. Media outlets have reported that Goldline's upper management actively discouraged its sales staff from promoting bullion in favor of coins.

For instance, ABC News cited a consumer who said a sales representative pressured him to buy $5,000 coins. Some time passed and the buyer learned that the coins' actual value was $2,900. Since the corporation did not want to disclose the salesperson's huge commission markup, the markup was kept secret.

Another buyer claims she was sold gold coins from the company that was worth $13,000 but turned out to be only $6,000. Even though the price of gold had practically doubled in just three years, she was still unable to sell the items for $13,000. As far as she was concerned, she had been taken advantage of.

Consumer Reports have highlighted repeated issues with Goldline's pricing. Specifically, the corporation once put up a set of Gold Eagle coins on its Goldline website for $6,000. Customers who looked up the same coins on the websites of competing dealers found such businesses selling them for roughly $3,000.

Goldline appeared to be using hosts and guests from various talk shows to gain the confidence of naive investors. Newcomers to the gold and silver market who lacked the knowledge to investigate coin values helped the company earn a tidy profit. Celebrities were Goldline's only hope for gaining the trust of the consumers.

Goldline offered reasonable prices on various items, as stated by Consumer Reports. Because of this, it appeared to be time- and product-specific.

Goldline defended its decision to charge more for its collectibles than for bullion when it was challenged on its pricing.

According to the company, the high prices are warranted by factors such as the scarcity of the products, the expense of transporting them and the salaries of the company's compliance officers and salespeople.

In addition, Goldline said that it provided honest product descriptions to customers before they made purchases. All costs and commissions were spelled out in the contract and the company followed up on every consumer complaint with an individual inquiry.

Goldline IRA Complaint Website

About a decade ago, the City Attorney of Santa Monica launched a formal online grievance system. Because of this, the city could gather proof of any wrongdoing by the company. With the investigation still ongoing, the company's assets were frozen in December 2010.

The following year, 2011, the city of Santa Monica filed official complaints against the business. The lawyer has accused Goldline of 19 charges of theft and fraud. An attorney who filed charges against Goldline claimed the corporation dupes its customers by employing "bait and switch" techniques.

Goldline settled with the attorney one year after the initial accusations were filed, in February 2012. As part of an injunction settlement, it agreed to change how it conducts business in certain areas. A reliable third party would now check if Goldline had told clients about all commissions and markups during phone conversations.

As part of the deal, Goldline also committed to reimburse $4.5 million in products to 43 consumers who had lodged complaints. After that, the corporation successfully negotiated the dismissal of all criminal accusations against it. Therefore, no more legal action was taken against Goldline.

However, by this time, the company's reputation was irreparably damaged. They had tarnished their reputation to the point where they could never regain their former clout. Goldline is no longer an independent business. However, its previous website is still active. Policies that brought about its demise are no longer under its control.

Goldline IRA Fees

The agents we spoke with at Goldline justified the company's higher prices by saying that Goldline provided a higher quality of service for its consumers. Clients can contact the company's "Client Concierge" service and "Price Guarantee Program" for questions about any short-term alterations. Customers can choose between delivery and storage services offered by the organization.

However, customers must pay spreads, sales fees and commissions to the corporation. Calling the company's main number and speaking with a customer service agent is your best choice for obtaining these details before purchasing since we advise our clients to do this.

Goldline provides free shipping and enough shipping insurance to all of its customers. When products are delivered from Goldline, customers must sign for a receipt.

After experiencing some difficulties, Goldline has decided to be more open about its prices. The corporation has also improved its transparency by providing detailed disclosures. For orders over $10,000, the company offers a 7-day price guarantee.

Pros & Cons of Goldline IRA

Pros:

Here are some of the benefits of Goldline IRA:

Cons:

The Goldline IRA presents several disadvantages for customers:

The Bottom Line: Should You Invest with Goldline IRA?

It's understandable if you feel hesitant about investing with Goldline IRA due to its past scandals and complaints. When you add in the legal problems they've had and the negative feedback they've gotten from customers, you can see why it would be best to search elsewhere.

We certainly don't want you to miss out on the potential benefits of investing in a gold IRA, so we highly recommend looking into our other top-rated IRA companies.

These companies have earned their reputation for providing excellent customer service, a wide range of investment options and competitive fees. They have a strong track record of delivering positive returns and keeping their clients' funds safe from market volatility.

Choosing the right IRA provider is essential to ensure you get the most out of your retirement savings. Researching and comparing your options can ensure you get the best possible services and value for your money.

Understand us; we're not saying Goldline is a scam or an illegal business, just that we don't like how they handle their clients. Said, our highly recommended companies are more desirable choices and we advise you to find out more about them if you're interested in investing in precious metals IRA.

Don't forget to check out our top recommended companies before investing!