Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

EXTREMELY IMPORTANT: Since writing this review, Regal Assets has had a TON of negative feed. Over the second half of 2022 there have been many extremely negative and disturbing reviews about the Regal Assets company. We will be stripping ALL links to Regal Assets and we DO NOT recommend them at all. It's very obvious that something big changed with this company (the owner has disappeared). IGNORE all information about Regal Assets in this review until we are able to change it. Again, do NOT do business with Regal Assets.

Regal Assets and Goldco are two major companies that focus on self-directed retirement accounts. Both also sell IRA-approved precious metals, as well as having the option for cash portfolio purchases. But the offerings from each are slightly different. Which is better?

Similarities

These are the key similarities between the companies:

Differences

These are things that Goldco alone offers:

Regal Assets, meanwhile, offers:

How the Company Works

The setup and operation of the companies differs from place to place. While Goldco and Regal Assets have a significant amount of service overlap, there are also areas in which they don't overlap. It's important to understand how each company functions so that you know which has the services that are ideal for you.

Goldco

Goldco has a very simple setup. The company focuses on exactly one thing, and one thing only: gold IRAs. They have a range of precious metals that you can put into your retirement account, along with a few collectible items that must be purchased using cash. Unlike Regal Assets, they only deal in precious metals.

You can invest with the company using your savings if you want. When you buy the items, they'll be shipped to your door in a plain package. The parcel will have full insurance, so you'll sign for it when it arrives. That way, you don't have to worry about it being left on the porch.

With the IRA services, you'll simply call and talk to a representative. Once you get started, you'll have one dedicated service rep who handles absolutely everything. They'll take care of your paperwork, custodian, depository, and final purchase. Unlike with other competitors, you don't have to speak to your custodian at all. You can just sit back and relax.

After opening your account and making your purchase, Goldco continues to work with you. Your account expert can answer questions and provide updates and guidance. When you're ready to start taking retirement distributions out of the account, you simply need to call Goldco and ask for a buyback quote. They'll tell you how much you can get for your holdings, and past customers say they give extremely fair choices.

Regal Assets

The biggest and most striking difference between Regal Assets and Goldco is that Regal Assets has cryptocurrency IRAs. If you want to invest in cryptocurrency with Goldco, they do have a sister company that offers this. But their setup isn't quite as streamlined as the Regal IRA, which combines both crypto and precious metals into whatever setup you decide on.

Both cryptocurrency and precious metals are alternative assets that can only be held in self-directed IRAs. There is no way to legally include these assets in a regular IRA. But there is specific legislation stating that they can be put into a retirement account as long as you follow the correct instructions and guidelines.

There are multiple similarities between crypto and precious metals, but also several key differences. When you understand how each affects and is affected by the economy, you understand more about your future potential options for investment.

These are some of the most important similarities in these assets:

But people invest in precious metals and crypto for extremely different reasons, at least as far as their investment portfolios go. Here are some key points to keep in mind:

By mixing precious metals and cryptocurrency together, you get the growth potential of a high-risk portfolio. But you also get the "cushion" of a stable asset that tends to perform well during times of intense economic issues. So you're hedging against crypto and global economic crashes. Given the way the economy has been for the past two decades, that kind of safety net is vital.

Regal Assets offers a diverse range of both precious metals and crypto. Their precious metals span the range of silver to gold to palladium to platinum, though the availability may fluctuate. The vast majority of the company's precious metals are easily-liquidated and popular IRA-eligible assets. This isn't the kind of company that you want to use if you're looking for numismatic collection items.

With cryptocurrency, on the other hand, Regal Assets has an extremely broad range of items available. There are all of the basics like Ethereum, Bitcoin, and Bitcoin Cash. But then there are about 20 different altcoins like Dogecoin and others. The company's guidance can help you to invest in cryptocurrency while staying totally within the IRS guidelines.

You can talk to one of the specialists at Regal Assets about the different types of cryptocurrency available. They'll be able to answer your questions about risk, past performance, growth potential, and versatility. Many people choose to invest in the heavy hitters that always have value, while others might decide to take a risk and pick a less popular coin in case it goes through a surge.

The great thing is that you can create an IRA portfolio that's based entirely on your risk tolerance and future goals. If you're older and want security, maybe you take mostly precious metals with a little crypto to see what happens. If you're younger and more interested in rapid growth, maybe you lean heavy on the crypto and stash away some gold for just in case.

Regardless of how you set up your personal account, Regal Assets will set you up with a custodian. The custodian will help you complete the paperwork to roll over the money in your current retirement account, and then your Regal specialist will take over to determine your final purchase.

The other option is to make a purchase with your savings. There are multiple packages, all of which are crafted from a blend of cryptocurrency and precious metals made to suit your needs. Each "tier" has a unique advantage. The more you spend, the greater both the security and the opportunity for growth.

The lowest tier of "package" is worth $5,000. But then the portfolios increase up to $500,000. If you invest that much, you will have special planning sessions with the company's experts so they can create a complex plan for your future. You can even pay more than $500,000 if you have extra wealth to secure, with a package that will be 100% customized for you.

Fees, Promotions, and Minimums

Goldco

Goldco has a somewhat steeper barrier for entry than several competing companies, including Regal Assets. If you want to make a purchase using their IRA services, they request that you invest at least $25,000. When you invest $50,000 or more, you become eligible for certain promotions.

For example, people who invest a qualifying amount can get a portion of their purchase returned to them in silver. Your chosen products will all be stored in an IRA, but then there will be silver bullion shipped personally to you. You'll sign for the package when it arrives. Since the bullion is not part of your IRA, it's yours to do whatever you want with it.

On a convenience note, new customers who meet the right requirements will have all of their setup fees waived. That means no payment for the paperwork, no custodial payment, and no storage payment for a year. Once the annual payments kick in, it's $100 for storage alongside $80 for Equity Trust Company's custodian services. If you want your storage to be segregated, it's $150.

Setup itself has a flat cost of $50. But as mentioned, if you invest enough at once, you can have that covered. Most competitors have percentage-based setup fees calculated based on your investment, or they cost over $100. Regal Assets is one of the rare options that doesn't charge a setup fee.

When you buy precious metals to keep in your own portfolio, you have to pay $3,500 at least. It's encouraged to invest as much as you comfortably can in order to hedge against inflation. Goldco states that they will pay for you to store your metals for free if you have a non-IRA investment. That way, you don't have to worry about the risks of bank or home storage.

Regal Assets

With Regal Assets, you can combine crypto and precious metals into one IRA purchase. You don't have to buy both, but if you're interested in investing in both, then you'll appreciate the convenience. It's also perfectly possible to buy just precious metals or just cryptocurrency.

The cost of the cryptocurrency is 1% of the total transaction. That's an extremely reasonable markup, especially considering how volatile crypto prices can be. As part of that cost, Regal Assets will help you to store your items on a digital wallet where they're compliant with IRS retirement regulations.

Regal Assets has a minimum purchase threshold of $15,000 when you are investing in a Regal IRA. This can be the combined cost of both the cryptocurrency and the precious metals. So if you want to invest $10,000 in metals and $5,000 in crypto, this is one of the easiest ways to do it.

When you first get signed up for an IRA, you don't actually need to pay any setup costs. In fact, Regal Assets may be willing to waive the first year of fees for you. But after that, you'll need to pay the fees to your storage and custodian companies. The fees are typically $100 for the custodian and $150 for the storage. You'll pay this each year on either a quarterly or annual basis.

Part of this is due to the segregated storage style. Segregated storage tends to be more expensive than other storage options. Above, Goldco has a less expensive non-segregated storage choice for just $100.

If you invest in one of the company's hand-crafted portfolios or packages, then you need a minimum of $5,000. This will get you the lowest tier of package, called the Merchant Package. Once you get into the $25,000 range, you will start to receive an actual diverse portfolio with highly tailored recommendations.

There is a free investment kit available through Regal Assets. It comes with detailed information about the company's product offerings, services, and costs. In addition, there are educational DVDs. You'll even get an anniversary coin that celebrates the company's 10 year anniversary.

Reputation and Satisfaction

Goldco

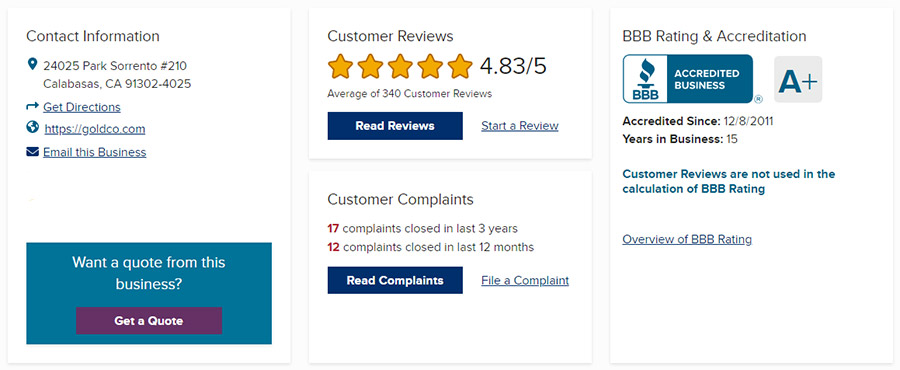

Goldco has an amazing reputation. They've managed to stay on top of the competition for over 15 years by constantly refining their customer service and upgrading their approach. Though they do advertise to new customers, many of their clients are referrals from past satisfied people.

There have been a couple of complaints over the years, which is expected considering the thousands of customers. In every case, Goldco has responded promptly and thoroughly. The customers have generally been satisfied and chosen to withdraw their complaints after the resolution. It's good to see that Goldco is managed so well and handles negative feedback so gracefully.

You can read thousands of customer reviews across Consumer Affairs, Trustpilot, Trustlink, and the BBB website. The BBB itself rates Goldco with an A+ and an accreditation, which shows that they listen and respond to all of their feedback. The BCA gives Goldco its top score possible, which is a sign of significant ethics and overall transparency.

There are basically no red flags when it comes to Goldco investments. The company is run by experts who know exactly what they're doing, and it shows.

Regal Assets

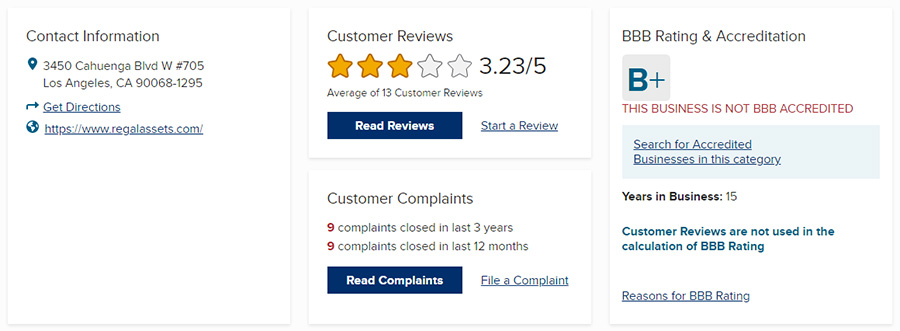

Despite still being one of the best companies for cryptocurrency investing, Regal Assets has had their reputation slip somewhat over the past year. They have received a fair few complaints, all of which were filed this year. Though the company has made an effort to fix the problems, the customers seem displeased.

In addition, Regal Assets was taken to court by Minnesota because they didn't comply with Minnesota's laws about selling bullion. Instead of rectifying the issue, Regal Assets never showed up to court or responded. So they were fined a maximum penalty of $15,000, along with the cost of investigating the issue.

It's concerning that they never even responded to the legal action. The issue had nothing to do with fraud or malice, and it could be handwaved in some cases. But a well-managed company would at least respond to the allegations and try to settle the issue.

Still, they have great feedback from most past customers. Their ratings on sites like Consumer Affairs and Trustpilot show that at least 98% of customers are satisfied.

Who Wins?

Ultimately, we have to consider Goldco the winner overall here. They may not have the same cryptocurrency options as Regal Assets, but they also have a better reputation. They're accredited with the BBB, don't have any government action against them, and haven't fielded a sudden influx of complaints.

In addition, Goldco does have a sister company that will let you purchase cryptocurrency. Your Goldco rep can work with your rep over there. It's just a slightly more complex process than rolling everything into a single purchase like you can with Regal.