Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Birch Gold Group and Goldco are two of the best-known companies for investing in precious metals. They strongly focus on helping people to place part of their retirement into precious metals. While both have great reputations and are highly recommended, which is actually the best option for investment?

Goldco vs Birch Gold Group

About Goldco

Goldco has 16 years of experience and is still going strong, having begun operations in California way back in 2006. Since precious metals IRAs have only existed since 1997, they've offered this service for more than half the time that it's been available.

The Better Business Bureau gives them an A+, and the Business Consumer Alliance provides a top score of AAA.

According to the Goldco website, the main goal of the company is to educate clients about how to diversify their retirement accounts for better security. Precious metals tend to perform well when the stock market is volatile, creating a hedge that can help people during economic downturns.

Though Goldco's main focus is on IRAs, that isn't all they offer. In fact, there are some products in their inventory that can't be held in an IRA. You can invest in these products using cash from your savings.

Clients who do use the IRA services are carefully taken through every step of the entire process. Since Goldco handles all third party communications, you never have to talk to anyone except your assigned representative.

About Birch Gold Group

Birch Gold has been operating for even longer than Goldco. They will be celebrating two decades in the industry next year, having begun their California operations in 2003. The company serves customers all over the country by helping them open IRAs and buy precious metals.

Like Goldco, Birch Gold has a massive focus on educating clients. They want to make sure that clients understand all the benefits and risks of a purchase before deciding. Instead of trying to sell as much as possible, they try to sell the right metals to the right customers.

The Birch Gold team is made up of finance and investment experts with a background in precious metals. In fact, many of the top executives at the company are members with the Forbes Finance Council.

Products

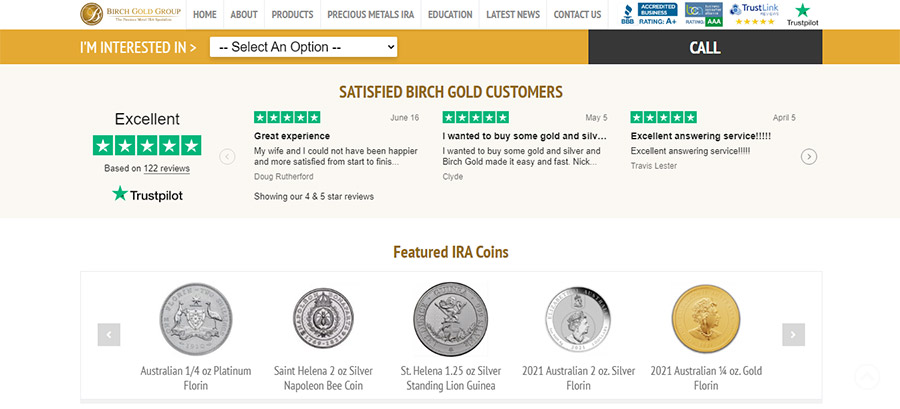

Both companies being compared have a key focus on precious metals. Though they may partner with companies that offer other assets, their main offerings are gold and silver. Platinum and palladium options may be available depending on the inventory, but most people focus on gold and silver first.

There are IRA-approved products available through both companies. Both companies also have general gold IRA services, meaning that they will help you with setting up an account.

You can also get educational materials for free through both companies. However, the exact items available vary by the company. For example, Goldco has a physical kit that they will send for free through the mail.

Goldco

Goldco's biggest focus is on individual retirement accounts. They help people to invest in precious metals. If you sign up for a kit, you can have gold investment educational materials delivered right to your door. The kit contains information about retirement, the economy, and the benefits of gold investment.

On top of Goldco's IRA products, they have investment products available to purchase with your savings. If you do this, the investment threshold is much lower than that of an IRA. You can make a purchase for less than $4,000 and still get the same ideal prices for investment-quality bullion.

The main non-tangible offering from Goldco is the company's IRA setup services. You can pay a low flat fee to have one person take you through all of the paperwork. They'll basically explain everything you need to do, fill out the information for you, and show you where to sign. Then they'll even talk to your custodian for you.

Precious metals are considered by many investment experts to be an essential part of a portfolio. They fill a niche that can't be replicated with any other asset. Unlike real estate, their value is often not speculative. They're more stable investments than cryptocurrency, and they're held outside of the banking system, so they can't be seized by the government.

If you use Goldco's IRA services, then you'll also choose a variety of approved products to buy. The exact products will depend on your budget, current pricing, and other factors. If you have questions about the best items for your personal investment needs, you can ask the company representative about them.

Goldco itself isn't an IRA custodian. They most frequently work with Equity Trust Company, which is one of the most highly rated and reputable custodians in the business. Since they communicate with Equity on your behalf, it's like having your dealer and custodian rolled into one.

When you decide that you want to liquidate your holdings, Goldco will buy them back. Gold and silver aren't generally accepted as currency for goods and services. But Goldco offers fair buyback prices that are much better than what you'd typically get from the average pawnshop.

Birch Gold Group

Birch Gold is another company that focuses strongly on storing precious metals within an IRA. Their inventory fluctuates depending on what is available at any given time. But they generally have a mix of silver, gold, platinum, and even palladium available.

Like with Goldco, you will purchase the physical products and have them shipped to a secure depository. Your account custodian will put the metals into your vault. It's possible that you will have to communicate with your custodian yourself, though. Birch Gold will help you get started with the application, but their approach is not streamlined to the same level as Goldco's.

With the company's self-directed IRA services, you will have complete control over your holdings. Instead of having an investment manager, you are the one who chooses how your assets are allocated. Many people choose to have a self-directed IRA just to hold precious metals and other alternative assets that can't be held in a traditional retirement account.

Birch Gold only has precious metals available for purchase. But you can use the account you set up to hold cryptocurrency, real estate, and even traditional stocks and bonds. It's all up to you. Some people relish the amount of freedom that they have, while others are more hesitant. If you don't have a lot of financial experience, you might be more comfortable deferring to an investment expert.

You can buy precious metals with cash from Birch Gold as well. Like Goldco, they have a buyback option for customers who decide that they're ready to liquidate their funds. You can ask your service rep about the buyback options and what you should know about the pricing when you get started.

IRA Rollovers

As gold IRA companies, both of these corporations have ample options available for IRA rollovers. But it helps to understand what exactly an IRA rollover is before you get started with anything.

An IRA is an individual retirement account. It is built around an individual, rather than being managed in a group like some employer retirement accounts. There are many different types of IRA, each of which has different regulations.

When you hear about IRA rollovers, that's referring to funding. People can have multiple different retirement accounts. In fact, there are lots of investors who have many accounts optimized for different tax and investment advantages.

If you open a new IRA, that account can hold assets for your retirement. With a basic traditional setup, the funds that you put inside will not be taxed until the time comes to take distributions. But there are also caps on the amount that you can put into an IRA from your savings each year.

What you can do, though, is transfer funds from your existing retirement accounts. This isn't the same as taking an early withdrawal. As long as you fill out the paperwork to transfer the funds between accounts within 60 days of creating your new IRA, then there aren't any financial hiccups.

Birch Gold Group

For those who already have retirement accounts with ample funds, Birch Gold has services to help roll over the funds. The main rollover process will be done through your custodian. It's difficult to say how much involvement Birch Gold will have with the rollover process specifically.

Once you do roll over the funds, then you can buy precious metals. In order to use Birch Gold's services to set up your account, you need to commit to spending a certain amount of the funds on precious metals.

You can roll over funds from a wide variety of retirement accounts, such as a simple IRA, SEP IRA, Roth IRA, traditional IRA, 401(k), or 403(b) plan that you receive through your employer.

Goldco

As mentioned, Goldco handles communication with your custodian. This also means that your Goldco representative is the one who will help you with the rollover process. They will explain all of the information that you need for your account. Once you have the required info, they will walk you through the application. Then they will file the paperwork for you.

Since Goldco is able to streamline and speed up the process, the funds transfer process is typically quicker than it would be if you worked with your custodian alone. However, you will still need to wait a few days for the funds to clear. Some of this will also depend on the company managing your existing retirement account. But if the process seems to be delayed, your representative can chase down answers.

Like with Birch Gold, you will need to commit a certain amount of your funds to precious metals. As soon as the account becomes funded, you'll be able to talk through your options. Since nobody works on commission, you can work with an employee who only cares about matching you with the best gold and silver items for your overall goals.

This process will also involve a discussion about where to store your assets. Goldco works with three main depositories, all of which are located in the US. Two are in tax-advantaged districts, with one in Delaware and the other in Texas. The right storage choice for you might depend on whether you need segregated storage, what tax advantages you need, and whether you want your items stored in the same region where you live.

Fees

If you use the IRA services, you will need to pay some fees. Not all of these go directly to your precious metals dealers. Some go to your depository and to the custodian that manages your account. However, if you work with companies like Birch Gold and Goldco, you can often get a better deal than you would working with the depository and custodian alone.

Both companies make use of flat fees. No matter how much you add to your account, the amount that you pay annually won't change. That's great news, since you can continue to accrue wealth without giving up a set percentage of it every single year.

Goldco

Goldco does not have a huge amount of information about their fees or pricing available through their website. If you want to get a price quote for their products, you will need to call and talk to someone at the company. The prices are calculated based around the spot price, but Goldco has not published their formula.

Because Goldco only sells valuable investment-quality items, you will need to spend at least $3,500 on basic cash purchases. If you invest your saved cash for your portfolio, then your items can be shipped to your house. Goldco also has a free storage option for cash investments. Depositories are a better place to keep precious metals because they are more secure than home storage and also not subject to banking system regulations.

If you are using Goldco's retirement account services, then the minimum is higher. You have to spend at least $25,000 in order to set up an account. But the account setup fee is just $50, along with a single $30 fee to transfer funds from your retirement account to Goldco's bank account.

If you use Goldco's preferred custodian partner, then you will pay $80 per year for your account maintenance. Non-segregated storage vaults have a cost of $100 per year, and segregated vaults have a higher price of $150. Though segregated vaults might seem more secure, both types of vault are monitored 24/7, frequently audited, and fully insured for the value of the account.

Birch Gold Group

Similar to Goldco, Birch Gold doesn't post product pricing online. You have to get a quote by giving the company a call. But past customers do say that they received fair pricing, and that they were happy with their overall purchases.

Also similar to Goldco, the company doesn't have a lot of concrete information about their account fees online. But sources show that you can expect to pay a fee of about $50 to set up your account. You'll need to make a minimum purchase of $10,000 whether you're investing with cash or with your retirement funds.

You can expect to pay about $200 in annual fees, combining both storage and maintenance. The storage costs $100, which includes vault insurance for your account's full value. The maintenance also costs $100. This pricing might vary slightly depending on which depository and custodian you choose, so you can ask your Birch Gold expert about it.

All shipping fees are totally free. The packages are also insured for their full value while they're in transit. So there's no point in the process during which your investment is in jeopardy. Should anything go wrong, the insurance company will reimburse you.

Who Wins?

Both Birch Gold and Goldco have great reputations. They have been endorsed by celebrities and seasoned financial investors. They have been covered in media publications and positively reviewed thousands of times. Any time there is negative feedback about the companies, they try their best to solve the problem with the customer.

Both companies are frequently praised for their high levels of customer service. They have also been given high marks from the Business Consumer Alliance and Better Business Bureau, showing that they adhere to their policies and have a strong sense of ethics and transparency.

Basically, both companies can be recommended based on their offerings and reviews.

However, if you can afford the investment minimum, we highly recommend working with Goldco. They have a similar promotion to Birch Gold for investments of $50,000, in which they may waive your fees. Their approach to IRA rollovers is significantly more streamlined, which means a quicker processing time and less headache for you.

Since Goldco has been around for such a long time, they're a key pillar of the self-directed IRA community. Their experts really know what they're doing, and their educational resources are super helpful.