Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

You can buy almost anything online these days, from retirement assets to real estate to precious metals. What happens when some of those assets are combined? There are certain companies that help people invest in alternative assets using their retirement funds. These alternative assets must be held in a special account called a self-directed retirement account.

Several companies focus exclusively on helping their clients put their retirement funds into gold, silver, and other precious metals. Two of the most popular are Augusta Precious Metals and Goldco. But popularity doesn't necessarily mean quality. What is the reputation of these companies?

To save you some time: Both companies are excellent to work with. But one has a slight advantage over the other. If you're torn, we ultimately recommend that you use Goldco.

Goldco vs Augusta Precious Metals

About Goldco

In 2006, Goldco began offering precious metals services to people throughout the US. While they mainly operate under the Goldco name today, they have also been known as Goldco Direct and Goldco Precious Metals in prior years.

The company founder has a family legacy of gold and silver. When he was growing up in South Africa, his family gathered gold coins that secured their wealth. He created the company in California to try to educate clients about how important precious metals are to a balanced portfolio.

The company CEO first started as Goldco's director of IRA services. She joined the company after an illustrious career in finance, including having taught multiple finance professionals about precious metals.

About Augusta Precious Metals

Augusta Precious Metals started in 2012 and also operates from California. While not quite as old as Goldco, they have still had a full decade to establish a reputation.

There is an extremely strong focus on education with Augusta. On top of all of their educational resources, they even give clients one-on-one seminars. People can ask whatever questions they have during these seminars.

The other big focus is on lifelong relationships with clients. When you work with Augusta, you have a personalized account and a portal. You can always log on and look at your holdings, as well as contact a professional with questions.

Company Setup

The company setup is important when you're deciding which company is the best to invest with. Augusta Precious Metals and Goldco have multiple things in common that help them outperform their competitors. Before we examine how the companies are different, we should consider their similarities.

The main purpose of both of these companies is to sell precious metals IRAs. Most investors don't have enough savings set aside to secure in gold. But they do have a retirement account that contains funds that can be allocated. As long as you move the funds in the first 60 days after creating the new IRA, you won't be subject to any penallties.

Each company has its own in-house team of people dedicated to IRAs. These people know everything there is to know about the setup and enrollment process. They can communicate with the custodian and depository for you. Since they handle this communication, you never need to talk to more than one person throughout the process.

This an advantage at both Augusta Precious Metals and Goldco. With most of the other options, they may suggest a custodian. They may even help you with the application for that custodian. But then when it comes to the rollover funds, they have you talk through the paperwork with the custodian. Depending on how quick the custodian is, this has the potential to cause delays and frustration.

With each company, you work with a single representative during your time with them. You'll talk to this person about your specific goals, and they will get to know you as an individual. You create a personalized relationship that continues even beyond your purchase. There's never a sense that you're "just a number."

Another advantage of these companies is that the salespeople aren't motivated by commissions. Since they don't work on a commission basis, they can really match you to whatever's right for you. You don't have to worry about deceptive tactics or dishonesty. That's part of why both companies so frequently end up on lists of the best precious metals IRA businesses.

Both Augusta and Goldco are run by experts with a background in finance, investing, and the metals industry. All of the employees are super knowledgeable about their niches.

With both companies, you also have the option to buy silver and gold for cash. Instead of storing the metals within an IRA, you simply put them in your personal investment portfolio. This might be stored in your home or anywhere else in the world. Many people choose to use a depository or safety deposit box at a bank.

Fees and Promotions

One big consideration when deciding which company to use is their fees. Both Augusta and Goldco have a basic $50 fee to set up an IRA with them. This also includes ongoing service after you make your first purchase. But you need to meet their minimum requirements for investing.

Both companies often run promotions to help give back to people who are investing for the first time. The promotions sometimes vary from month to month, so it's vital that you talk to the representative about which promotions are active. Some might only be available if you invest a certain amount or meet other qualifications.

Goldco

You'll have to pay custodian and storage fees. With Goldco, their preferred custodian will cost $80 every year. Storage will cost either $100 or $150 depending on whether you want a segregated option. The non-segregated vaults are more inexpensive because the items aren't kept walled off from everyone else's.

If you want to set up an IRA using Goldco's services, you must invest a minimum of $25,000. That's more than some of the competitors require, but it's significantly less than what Augusta requires. For those who want to buy gold or silver for their non-retirement investment portfolio, the cost is $3,500 at least.

Goldco also has some of the most solid marketing promotions in the industry. For example, if you place an order of more than $50,000, you might be qualified to get 5% of your purchase back in silver. This silver is shipped directly to you as part of a personal portfolio, rather than being held in an IRA.

You can also have your initial fees totally waived if your order meets a certain threshold. So not only will you not need to pay the $50 fee to get set up, but you also won't have to pay the first year of annual depository and custodian expenses.

Augusta Precious Metals

Augusta has a straightforward setup to their fees. You must meet the minimum requirement of $50,000 in order to utilize their IRA services. People do not need to worry about a maximum investment cap; you can put as much money into gold and silver as you want.

If you work with Augusta's preferred custodians and depositories, you'll pay $100 annually for each. That's a total of $200 per year. While that's a little more than Goldco (if you use non-segregated storage), it's still very reasonable. Most importantly, the flat fee setup means that you aren't penalized when you add more to your account.

With Augusta, there is the potential to have your fees waived for anywhere from one to three years. You need to invest a certain amount first. If you have a large amount to invest using Augusta's services, you can ask about which active promotions you might qualify for.

Storage Choices

When it comes to storage, Augusta and Goldco work with largely the same partners. But although they may work with similar partner companies, the actual depositories that they use might vary slightly. It's common for IRA companies to have preferred depositories in tax-advantaged regions.

Two of the most tax-advantaged regions for precious metals within the US are Delaware and Texas. Neither of these states has sales tax on precious metals that are shipped there. Therefore, you can use a depository in these locations to avoid potentially huge sales taxes in your home state. That's a great way of keeping costs down.

Both companies frequently work with the Delaware Depository. This is one of the biggest depository options in the entire country. It is outfitted with security above and beyond the IRS requirements to store people's IRAs.

Both companies also work with International Depository Services. This company is notable because they have a depository in Texas. Until a few years ago, Texas depositories didn't even exist. But now this depository offers a storage option for Southern customers who want a regional option with tax advantages.

The final company that these companies most frequently work with is Brinks. Brinks offers all kinds of security services and is known throughout the world. On top of having hundreds of depositories in the US itself, Brinks also has tons of international depository locations.

With both companies, the cost of shipping is waived. Your packages will be sent to their depositories without any fuss or hassle. The entire transaction will be handled between your custodian and the company itself, so you don't have to worry about coordinating anything. All of the packages are also given a full insurance policy for their value while they're being transported.

Goldco

Goldco works with three main depository options. While this is slightly fewer than Augusta, it is a solid selection. In addition, they can work with any other depository that you want to use instead. However, there is no guarantee that your depository of choice will have Goldco's low storage rates.

The following locations are your main options through Goldco:

The Delaware Depository and Brinks options both have segregated and non-segregated storage. Most people who use these options choose the non-segregated vaults, since these are more inexpensive. No matter what type of vault you choose, your account is fully insured. The Texas location only has segregated accounts available for purchase, which are more expensive.

If you're making a personal investment in gold using cash, these storage options are also available. Goldco may even cover the cost for free. The company believes that an official depository is much better than a safety deposit box or home storage. Safety deposit boxes can be seized by the government, and home storage is especially vulnerable to damage and theft.

Augusta Precious Metals

Augusta differs from Goldco in its storage options. Rather than having just three main locations, the company works with 11 different depositories. While most are located in various areas throughout the US, one is located in Canada. So if you want to store your precious metals outside of the country, this option will appeal.

With that said, there are no depository options in Europe, Asia, or any other global areas. The same is true of Goldco. So if you have a specific non-Canadian country that you'd like to use, then you might find that neither company has exactly what you need.

The Canadian option is located in Mississauga, Ontario.

In the north of the US, you can find a depository in North Dakota. The Midwest has a location in Nampa, Idaho. People on the West Coast will appreciate the choices in California, Utah, and Nevada.

On the East Coast, there are two locations in Delaware. There's also a location in Ohio, New York, and Massachusetts. The one that you will prefer will simply depend on proximity and other advantages. For example, many New Yorkers choose to store their items in Delaware instead of their home state because of the aforementioned tax advantages.

Augusta will send your items to whichever storage facility you choose. They should arrive in 10 days or less. That's a relatively quick turnaround time for this industry. However, if there are shipping delays with the USPS or other shipping service for some reason, Augusta will keep you up to date on the details.

If you do decide to make a cash purchase, Augusta can either mail the items to your home address or a depository. They recommend working with a depository because of the vulnerability of home storage. But they don't necessarily offer the free storage options that Goldco does.

Reputation

Goldco

Augusta Precious Metals

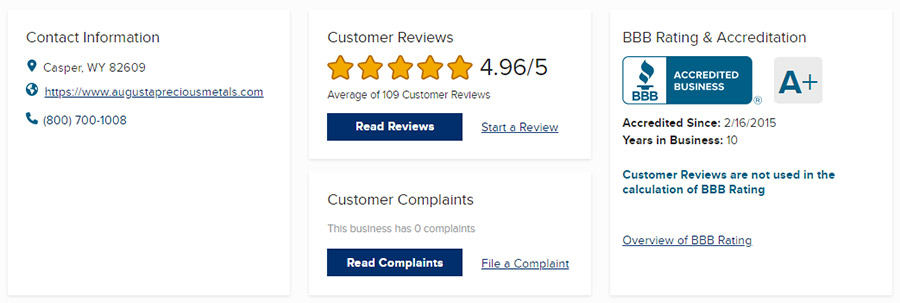

When it comes to company reputation, Augusta and Goldco are basically tied. The reputation of a company matters more than almost anything else, especially if you're making a major investment. Companies can have the best policies and marketing in the world, but that doesn't mean anything if the customers aren't satisfied.

Fortunately, in both cases here, the customers have been shown to be very satisfied. There are hundreds of trustworthy reviews for both corporations scattered all over the internet. You can look at sites like Trustpilot, Consumer Affairs, and the Better Business Bureau. Almost every customer has universal praise.

Goldco seems to have a larger clientele than Augusta, which might be partly due to their more accessible investment minimum. They have also received a small handful of complaints, which is expected with this kind of reach. Whenever a complaint has been filed, Goldco has gone the extra mile in order to help each customer.

Augusta has very little negative feedback. It seems like their customer service representatives quickly resolve any potential issues long before they're made public. This makes it a little difficult to determine how well Augusta responds to negative feedback. But judging by their outstanding reviews, they definitely have the customer's best interests at heart.

Both companies have been given top marks by the Business Consumer Alliance and Better Business Bureau. They also both frequently end up on industry lists of the top best gold IRA firms.

Who Wins?

These companies both have excellent policies and setups that allow them to put their customers first. They both have great reputations in the industry, reasonable fee structures, and a lot of transparency. Both are run by experts that know how to analyze the economy and the precious metals industry.

Each company has its advantages and disadvantages. With all of this information in mind, the winner we have to pick is...

Goldco.

Goldco is more accessible than Augusta, since you only need to invest $25,000 in a retirement account to get set up. If you invest the same amount as Augusta's minimum with Goldco, you could be eligible for promotions like getting silver back or having your fees waived. In order to make use of Augusta's potential promotions, you need to have a lot more ready to invest.

In addition, Goldco's storage fees are more straightforward. If you choose non-segregated storage, you'll pay less in fees overall than you will with Augusta. Just keep in mind that Goldco has a slightly limited range of partnered depositories in comparison to Augusta.