Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

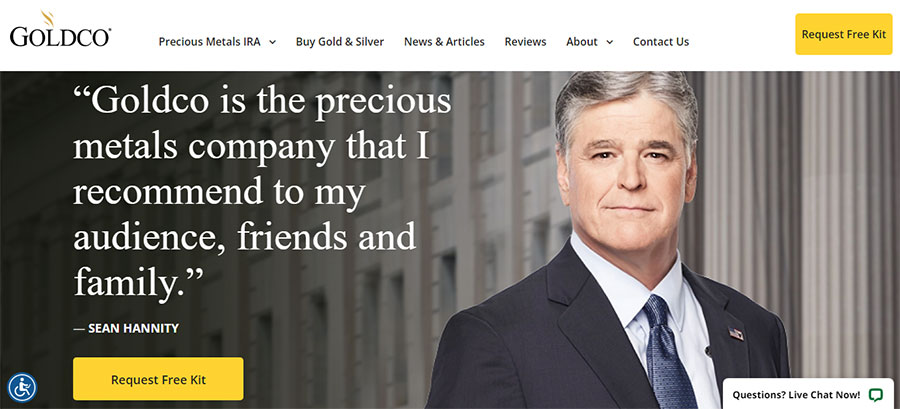

When you search for the best gold IRA dealers in the precious metals industry, you'll frequently see the names American Hartford Gold and Goldco. Both of these companies are industry leaders nationwide. Not only do they have solid reputations, but their advertising campaigns have helped open precious metals investing to thousands of new customers.

Both companies operate with roughly the same philosophy. They believe that it's important to invest part of your savings into precious metals, since these hedge against both inflation and economic crashes. With the different economic issues that have happened over the past 15 years, more and more people want the security of gold and silver.

Even though the companies both have the same philosophy and similar products, there are also stark differences between them. Those differences might make or break an investment. We've broken down the key points that you should know as you consider which company is right to invest your hard earned money with.

Goldco vs American Hartford Gold

About Goldco

In 1997, there was new legislation passed regarding taxes and retirement accounts. As part of this massive act, people could now use self-directed IRAs to hold gold and silver. In 2006, Goldco was created with the main purpose of helping demystify the paperwork process for these accounts.

While Goldco was not the first company to offer gold IRA services, it is one of the longest-running and most successful today. Since its inception, it has grown to service tens of thousands of customers in every state in the US.

In addition to selling the usual silver and gold, Goldco also often has platinum products available. Sometimes palladium is available as well, although this metal is much rarer. If you want to discuss a specific palladium product that you want to acquire, you can speak to someone about it by calling the customer service line.

Goldco has an incredible reputation not just with third party watchdogs, but also with past customers. There has been a nearly universal indication of satisfaction. Many customers have written reviews that cite their representatives by name and thank them for all of their help.

Before you even decide whether to invest, you can get a free investment kit shipped to your door. This kit contains tons of resources and materials to help you learn about the industry. It's a super hands-on and simple setup.

About American Hartford Gold

Though American Hartford Gold hasn't been part of the industry for as long as companies like Goldco, they have grown exponentially. Since starting, they have begun to serve customers in all 50 states and amassed hundreds of reviews online. Past customers have largely good things to say.

The company has a Los Angeles headquarters and has existed for seven years. There are many policies that have helped it to gain an edge in the industry. For example, they have a very transparent commitment to buy back a client's items. (Goldco also makes this commitment.) AHG also doesn't have some of the common fees and requirements that are charged through the more well-established precious metals dealers.

Like Goldco, American Hartford Gold has incredible reviews. Their main specialty is in helping new investors navigate the complex world of self-directed IRAs. While their services aren't quite as streamlined as Goldco's, they are ideal for beginning investors without a lot of capital to spare.

Rollover Services

Both of these companies offer a variety of comprehensive rollover services. In fact, they arguably specialize in rollover services. Many people can't buy bullion with their savings, but you also might have growing retirement funds sitting untouched. You can roll those funds over into a new account and then buy precious metals with them.

Regardless of which company you work with, a representative will help with rolling over the funds. First, they will take you through each page of the application to create a self-directed IRA. As soon as that account is created, they will help you do the paperwork to transfer over the funds. You'll just need to have basic information about your current account and its custodian.

The best thing about the rollover process is that as long as you do it within the appropriate time frame, there aren't any withdrawal penalties from the IRS. You have about two months between when you create an account and when you file your rollover paperwork. When you work with American Hartford Gold or Goldco, that turns into just a few days.

The time that it takes for the funds to roll over will depend a lot on the custodian that you use, the custodian you currently have, and what the average processing time is. There are some times of the year when you might have to wait longer than others. You can ask your company expert about the best times to start the process.

You can choose how much of your existing retirement account to roll over. In Goldco's case, you will need to roll over enough to meet the minimum requirements for an account. But American Hartford Gold doesn't have minimums like that.

The vast majority of retirement accounts can be rolled over into your new self-directed IRA, provided you have all the required information. That includes employer accounts like 401(k)s, individual accounts like traditional IRAs, and even special tax-advantaged setups like Roth IRAs. If you have multiple retirement accounts, you can roll over funds from more than one of them.

Since precious metals can only be held in a self-directed IRA, you are in full control of your assets. There is no investment manager who makes decisions on your behalf. You are the sole arbiter of what is held in the account and how your different funds are distributed.

Products

Each company has a number of IRA-eligible coins and bullion bars in their inventories. They also both have several products that cannot be purchased using retirement funds. Since the products aren't compliant with the rules and regulations that the IRS has created, they must be bought with cash.

Both of these companies have product inventories that are too large to explore in full. Instead of going over every single item, we'll just examine a few of the highlights.

Goldco

All of Goldco's products are investment grade. That's why they have a minimum requirement not just for IRAs, but for purchases with cash. If you want to invest in their products, you need to show that you're putting a substantial amount of your funds toward this.

There is a buyback program for past customers who want to sell their holdings. All you have to do is pick up the phone and give Goldco a call. The person on the phone will tell you about what the current offer is for your holdings. Assuming you agree, they will help you get the items packaged up and sent.

Some of the most popular choices for investment with Goldco are the Gold American Eagles. There are two versions of this coin, both of which were minted recently. The American Eagle is one of the official coins created by the US Mint. Because it is so easily recognizable, it is one of the most popular choices.

There are also offerings like gold coins showing the Independence Hall. These coins celebrate the day that the Declaration of Independence was signed in the US. While these coins are less common, they are a popular choice since they celebrate the American spirit and American history.

You can also get pure gold coins from international mints in countries like China, the UK, Australia, Canada, and more. Then there are gold bars available in multiple weights and sizes through a number of different refineries. Unlike the coins, bullion bars don't need to come from a sovereign mint to be compatible with IRA legislation and regulation.

American Eagles are also available in silver. The silver coins are significantly less expensive, and people often choose to buy them in bulk. Some people also prefer silver investments because silver is used in industries like technology and manufacturing. Because the demand might go up, it has more potential to grow than other traditional metals investments.

Another silver option with Goldco is the Silver Mayflower. It's another coin that specially celebrates the landing of the Pilgrims. Unlike IRA-eligible coins, this item is actually a collectible numismatic. As such, it needs to be purchased using your normal savings.

American Hartford Gold

American Hartford Gold has many of the same coins available as Goldco. Like Goldco, there are American Eagles available in silver and gold. But unlike Goldco, most of the coins available through AHG were minted several years ago. They appear not to have been circulated, though.

This might be part of the way that American Hartford Gold keeps their costs down. By getting coins that were minted several years in the past, they are able to receive discounts that other companies can't. In addition, they can always ensure that they have the products in their inventory. Some other companies sell items they don't have, and end up with the products on back order.

This is also the natural trade-off of the company not having any barriers for entry. Since you don't have to meet any minimum investments, you will need to be prepared for an inventory that isn't fully up to date. Because the sale value of US bullion coins tends to be based more on the weight than the year minted, the difference with these things is negligible.

It's possible to have AHG match the price if you find any lower offers online. However, it might be difficult to find coins from the same year that have never been circulated. Even if you do, it will be difficult to find lower offers than AHG's, as they craft their offers directly around the spot price of the product.

Fees and Promotions

Each of the companies has its own fees to keep in mind. Though not all of these are listed through the company websites, they can be found through other sources. There are also promotions and advertisements that each company runs in order to give new investors an advantage.

Goldco

Goldco has straightforward fees, and you don't have to worry about hidden transaction costs. The price that you're quoted is what you'll pay. You need to commit to spending $25,000 on precious metals in order to make an IRA purchase. To make a non-IRA purchase, you need to spend $3,500 or more.

Whether you're paying using cash or your retirement savings, your package will ship for free. Cash purchases can be stored in a depository for free, since Goldco believes that a personal investment portfolio should be kept out of the banking system. Depositories are safer than home storage because home storage is especially vulnerable to break-ins and natural disasters.

Storage through Goldco's partnered depositories costs either $100 or $150. The Texas option costs $150 because all of the vaults are segregated. Since the products are kept separated from all of the other items, you pay extra for the security. The Utah and Delaware depositories only cost $100 because their storage isn't segregated. But you can ask about segregated options at these vaults.

If you use Goldco's partnered custodian, you will pay $80 with each passing year for maintenance. There's a single setup fee of $50 to cover the time it takes to handle the paperwork and communicating with the depository and custodian you've chosen. This also covers the convenience of using Goldco's trade network instead of handling everything yourself.

Goldco's promotions vary, but they will often waive the setup and maintenance fees for at least a year if you invest $50,000. There's another promotion in which you can get a maximum of $10,000 in free silver by being reimbursed 5% of your IRA investment.

American Hartford Gold

American Hartford Gold is somewhat unusual in the industry. Unlike the vast majority of gold IRA firms, they actually don't have any fees to get set up. In addition, they don't have any investment minimum requirements. That means that you can use their services even if you only have a few hundred dollars to invest.

This is part of what has made American Hartford Gold so popular. The company is accessible to many people who haven't yet saved enough in their retirement accounts to use the more expensive services offered by places by Goldco.

According to the company website, the storage fees for customers are usually a flat cost of $100 every year. Then there is usually a custodian fee of $80 for yearly maintenance, but this might vary based on which custodian you pick. You can ask on the phone about the expected custodian fees.

American Hartford Gold has a price matching program. If you find the same product in the same condition, but you're offered a lower price, then they will match it. All you need to do is get the offer in writing and forward it. You can also talk to one of the employees about exactly how this process works.

There are several active promotions with American Hartford Gold at any time. As of writing, the main ones are:

However, the website doesn't explain exactly what qualifications you need to meet in order to take advantage of these promotions. So that's another question that you would need to ask your specialist.

Who Wins?

Both American Hartford Gold and Goldco are well reviewed by past clients. They have celebrity endorsements and accreditations from the BBB. They have been given high ratings by organizations including the Business Consumer Alliance and Consumer Affairs. Third parties that track businesses all seem to agree that both of these companies operate honestly and fairly.

Both companies come with their own pros and cons. The right one for you might just depend on the kind of investment needs that you have. But ultimately, we do recommend Goldco to anyone that can afford the minimum investment.

Goldco simply has a level of customer service that's hard to beat. They have streamlined their process down to a science. Though American Hartford Gold is convenient, Goldco is even moreso. You'll work with the same representative for the duration of your relationship with the company, even after you've made your initial purchase.

That said, AHG is still a pretty good option for those on a stricter budget. Sometimes people find that they can't meet the multi-thousand dollar minimums of the top IRA companies. In these cases, AHG's services are super accessible. You just need to be aware that you'll probably be purchasing items that are several years old, rather than the latest minted coins from this year.