Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Gold Alliance Capital functions as a dealer of precious metals and gold. Their main focus is helping people invest in a retirement account, which allows them to claim tax deferrals along the way. Gold IRAs are a type of long-term investment that you can get involved in with a US retirement account.

But are they the best choice of gold IRA dealer on the market? And are there any red flags you should be aware of? We've taken a look at the company's offerings so you can decide what's best for you.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if Gold Alliance Capital made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

About Gold Alliance Capital

Gold Alliance Capital has been in operation since 2017. The company's main specialty is in silver and gold. The experts at the firm work with clients throughout the US to help them invest in their retirement. You can get advice on what precious metals to allocate to your retirement account.

A gold IRA is a type of self-directed IRA. That means that you choose what items go into it, rather than having it managed by a third-party investor. You must choose items that comply with IRS regulations regarding substance and purity. In addition, you must store the items in an IRS-approved facility.

Though the firm mainly specializes in gold and silver, you can also get platinum and palladium for your precious metals IRA. It's possible to purchase the items in the form of bars, bullion, and coins. You cannot add collectible numismatic coins to a precious metals IRA.

When you first get set up, you will need to pay a fee for your account. This allows the company to streamline the process so that you can fill out the paperwork more easily and avoid interacting with multiple people. Then you will either make a contribution or roll over your existing retirement funds.

The company uses the Delaware Depository to store your items. This depository complies with IRS regulations regarding the storage and distribution of gold IRAs. It is located in Delaware. Some other companies might have access to depositories in other regions of the US, so that's more ideal if you want easy access to your metals.

Getting Started

It's easy to get started if you want to open a gold IRA with Gold Alliance Capital. As mentioned, you'll need to pay an account fee to get set up, but other than that, the fees are relatively low.

The first step is to get in contact with the company. You'll need to call and talk to a company representative. This individual will then send you an application. It will take about ten minutes to fill out the information required for the application, and then you'll mail it to the company using the provided prepaid envelope.

After the company receives your application, you should have your account activated within 24 hours.

This is a little more cumbersome than some application processes. There are other gold IRA providers that allow you to complete the entire process online or over the phone. That helps to take out the hassle of snail mail.

After the account has been fully activated, you will talk to your representative again. If you want to roll over funds from your existing retirement account, they'll help you do that. You can also use a bank wire transfer to get your account funded using your savings.

Usually, it takes around five business days for the account to be funded. Again, this time frame is a little longer than with some competing services. If you're looking for a quick setup process, this particular company might not be for you.

The final step is to work with your representative to choose your investments. You'll learn about the pros and cons of different precious metals, including their risk level and opportunity for growth. Your representative will make different recommendations based on your goals and risk tolerance.

Different Goal-Based Options

Your investment representative will talk to you about the different types of investment that work best based on your time, goals, and the amount you have set aside to invest.

Some people might want to invest their money as a stable hedge against inflation. Instead of trying to earn large returns, you're just trying to make sure that you have a cushion if the stock market fails. Economic uncertainty has become a very common part of modern life over the past few decades.

In this case, you'll want to invest in products that keep their purchasing power over time. Your investment representative might encourage you to invest in:

All of these things tend to remain stable. Though there is the same risk that you take with any investment, history shows that you're less likely to lose money.

If you want to invest in precious metals for the sake of price growth, you'll want to look for products that tend to have their base price increase quickly. However, these products will come with a higher amount of risk. Just as the base price can increase, it can also decrease quickly.

For those looking for quick growth, the Gold Alliance team often recommends investing in pieces like the 1904 twenty-dollar Liberty gold coin.

This investment might be paired with an investment that has protection against price loss. For example, you might want to look at something whose base price remains stable. That way, if you suffer a loss with your riskier investment, you still have a cushion keeping you stable.

One example of a risk protected investment would be the silver peace dollar from 1922. This investment has had a relatively stable base price point since its inception.

Some people also state that they have concerns about privacy. They want to invest in a product that can be exempt from disclosure and extensive reporting requirements with regards to taxes. Your investment representative can advise you about the best choices to meet these requirements for you.

Storage

One of the big draws of Gold Alliance Capital is that they cover the storage fees for your account. When you invest with other companies, you typically have to pay an annual storage fee to keep your gold. Gold Alliance Capital works with the Delaware Depository, which is IRS-approved for gold IRAs.

It's important that you store your IRA assets with an IRS-approved facility. You are not allowed to store the items by yourself. The facility must be licensed by the IRS for use in retirement accounts, which means they adhere to rigorous storage standards.

If you decide that you want to purchase precious metals outside of an IRA, you can do that. In this case, you can ask the company to ship the metals to your home or another storage area of your choice.

After your assets are stored, you will receive ongoing quarterly reports regarding the value of your items. You'll also have access to an online account where you can get information in real time about the value of the assets.

Selling Metals

One of the concerns people have with purchasing gold for their retirement account is selling it. When you're ready to take distributions from your account, you want to make sure that you can liquidate your assets at the market price. Otherwise, you might have to sell your items at a loss.

Gold Alliance Capital takes care of this with their buyback program. Once you're ready to liquidate your assets and take distributions, they guarantee that they will buy your metals from you at the current market price.

You can start taking distributions from a gold IRA without being penalized once you reach 59.5 years of age. You have to take distributions once you reach at least 70.5 years of age, or you will be financially penalized.

Costs for Investment

When you get set up with Gold Alliance Capital, you can expect to pay 180 dollars per year in fees. This covers the fees for storage, account maintenance, and access to online statements.

Overall, these fees are lower than with a lot of the competition. That's because the company covers the storage and maintenance fees that come with your account.

You will also need to pay for the metals that you purchase. The price of precious metals varies from day to day. Because of how the price fluctuates, you won't be able to see the exact prices for items on the Gold Alliance site. Instead, you will need to call to find out about the prices.

One of the big potential drawbacks of Gold Alliance Capital is the markups for precious metals. When you purchase precious metals through the service, you might pay higher than market price. Companies like Gold Alliance tend to say that their prices are marked up at up to 33 percent higher than market price.

That means that if you want to sell the metals back, you might end up selling at a loss instead of a gain. There are companies on the market that sell gold and silver for much closer to the market price. They make their money through account fees instead.

Gold Alliance doesn't have any minimum investment. Many other companies do have minimum investments, so you need to reach a certain threshold to make a purchase.

Aside from the yearly fee for account maintenance and the costs of the metals themselves, there aren't any hidden transaction fees.

Consumer Reviews

Gold Alliance Capital is a relatively new business, which means that it can be a little difficult to find reliable reviews of the services.

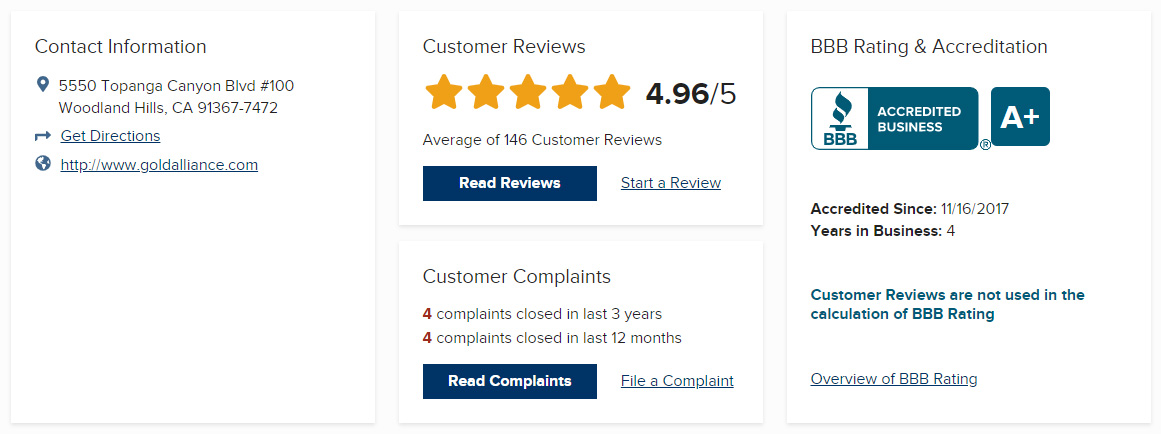

On the Better Business Bureau, the company's reviews are relatively good. They have an A+ rating and are accredited with the third party service. In addition, of the 145 customer reviews on the website, there is an average of 4.96 out of 5 stars.

There have been four customer complaints in the past twelve months through the BBB. All four have been closed. An alert on the BBB website says that people who wish to file a complaint should send an email to the company.

Is Gold Alliance Capital a Scam?

Gold Alliance Capital is not a scam. They are a business that allows people to invest in precious metals both inside and outside of an IRA. If you open a self-directed IRA with them, they will help streamline the process so that you can open your account more easily.

The company's BBB page indicates that they have an A+ rating and overwhelmingly positive customer reviews. Of all the complaints opened, they have closed all of them within the last twelve months.

There are a few potential drawbacks of working with this company, though.

One of the biggest drawbacks is the markup of the precious metals prices. The company covers your storage costs to keep annual maintenance fees lower than the competition, but they also mark up their metals. You can expect to pay anywhere from 17 to 33 percent higher than the market price.

It might be better to work with a company that makes their money in fees while selling metals at market price. Depending on how much you're investing, that can save you money in the long run.

Another potential drawback is the application process. Many companies allow you to get signed up over the phone or fill out an online application. But with this company, they will mail you the application through the physical mail.

Though the application itself only takes a few minutes to fill out, you will then need to put it into an envelope and send it back to the company. At the very least, the company does provide a prepaid envelope, which makes it easier to send your precious metals over.

All in all, though this is a reputable company, we believe that you might have a more convenient and inexpensive experience working with a different precious metals broker.

Pros and Cons

Pros:

Cons:

Final Thoughts

Gold Alliance Capital is one of many investment companies that allow you to invest in precious metals. If you want to open a gold IRA with them, you'll pay lower annual fees than with a lot of the competition. You can also purchase gold and silver for your own non-retirement investment portfolio.

It's true that the company's maintenance fees are relatively low. But they manage to do this by marking up their precious metals to higher than the market value. You can expect to pay significantly more for the metals than you can sell them for.

When you are ready to sell the metals, you'll be able to give them back to the company at the market price. You do get some protection against inflation if you hold the metals for a long time, but you can expect to suffer a loss if you liquidate your holdings quickly.

There are alternative options for investment that make it easier to hold gold without suffering losses. We recommend going with one of these. But if you're looking for a company that has low ongoing costs and no minimum threshold for investment, Gold Alliance Capital does have excellent consumer reviews.

All in all, this isn't a bad company. And it certainly isn't a scam. But there are enough companies that will give you the same services faster, more conveniently, and more cheaply. For this reason, we can't wholeheartedly recommend this service.

Although we do think that Gold Alliance Capital is a decent company, we believe that there are better companies out there to make your investment with.

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Or, continue with Gold Alliance Capital...