Gold can be a great way to diversify your portfolio and protect yourself from market volatility. The Equity Trust Gold IRA is a popular option for those looking to add gold to their retirement savings. With its secure storage, low fees and easy setup, the Equity Trust Gold IRA has a lot to offer investors.

In this review, we'll take a closer look at the Equity Trust Gold IRA and determine if it's worth investing in. We'll discuss the fees, setup process, storage options and other important details to help you make an informed decision. Whether a novice or an experienced investor, this review will give you the information you need to decide if the Equity Trust Gold IRA is right for you.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

Overview of Equity Trust Gold IRA

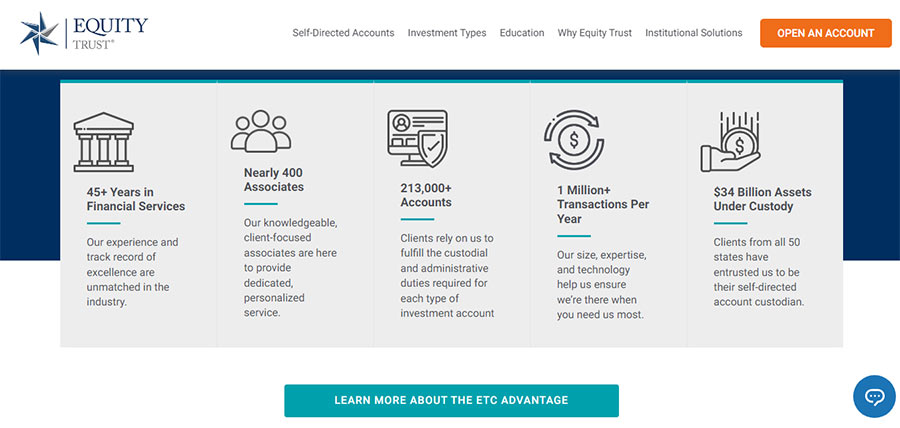

It's easy to understand why Equity Trust is one of the finest IRA account administrators with over $12 billion in assets under administration, more than 130,000 consumers and more than 10,000 financial adviser partnerships.

Managed futures, hedge funds, real estate and other investment vehicles are the firm's primary focus. The fact that they work with Augusta Precious Metals, one of our top-rated gold IRA administrators, is one of their best and most understated strengths.

When it comes to assisting their customers with self-directed IRAs, Equity Trust is the go-to financial institution. The holder of this IRA can diversify their holdings by purchasing precious metals, mutual funds and equities, real estate and promissory notes, among other investment options.

This company educates its clientele on the laws and procedures of self-directed individual retirement accounts (IRAs), guides them through the opening of an account and provides IRA custodians for the administration of financial dealings, documentation and tax filings. It also collaborates with people in the IRA industry to assist them in better serving their customers.

Equity Trust makes it easy to get started. You can open an account online or by phone; the process takes only a few minutes. Once your account is opened, you'll be able to purchase gold, silver and other precious metals with confidence, as all of Equity Trust's investments are held in safe, fully insured depositories.

You'll also receive ongoing support and guidance from a team of knowledgeable, friendly professionals committed to helping you reach your retirement goals.

With Equity Trust, you can rest assured that your investments are in good hands. They have decades of experience in the gold and precious metals industry and their customer service is always top-notch. Plus, they have some of the most competitive fees in the industry, so you know you're getting the best value for your money.

Why Invest in a Gold IRA?

Investing in a Gold IRA is a great way to diversify your retirement portfolio and ensure a secure financial future. Here are just a few of the advantages of investing in a Gold IRA:

Safety and Security

Gold has been a reliable way to store wealth throughout history and a Gold IRA offers the same security and stability as physical gold but with the convenience and flexibility of an IRA. With a Gold IRA, your investments are protected from market volatility and devaluation of currencies.

Tax Advantages

Investing in a Gold IRA offers several tax advantages that make it an attractive financial strategy. In fact, by investing in gold, you can save thousands of dollars in taxes each year.

You can move existing funds from other retirement accounts into a Gold IRA without paying additional taxes. This process is known as a "rollover" and is one of the main benefits of investing in a Gold IRA. It allows you to transfer funds from other retirement accounts, such as 401(k)s or IRAs, into your gold IRA without paying taxes on the money you are moving.

Another tax advantage of investing in a Gold IRA is that it is considered a long-term investment, which means you will not be taxed on any profits until you take them out of the account. This is a desirable benefit for those looking to invest in gold for the long-term.

Any dividends or capital gains you realize from your investments are taxed at the lower long-term capital gains rate, which is generally much lower than the ordinary income tax rate.

Finally, investing in a gold IRA also allows you to shield a portion of your retirement savings from taxes. Any contributions you make to your account are tax-deductible up to certain limits, so you can reduce the taxes you pay in any given year.

Diversification

Investing in a Gold IRA helps diversify your retirement portfolio by adding a valuable asset class largely unaffected by other factors, such as stocks and bonds. This will help protect your investments from potential market downturns.

Appreciation Potential

Gold prices have historically increased over time, meaning a gold IRA can provide excellent appreciation potential. This can help you maximize the return on your investments and ensure your financial security for years to come.

Stability

Gold has always been a reliable investment that performs well during economic turmoil. It is a stable asset that can help provide a sense of security and stability for your retirement savings.

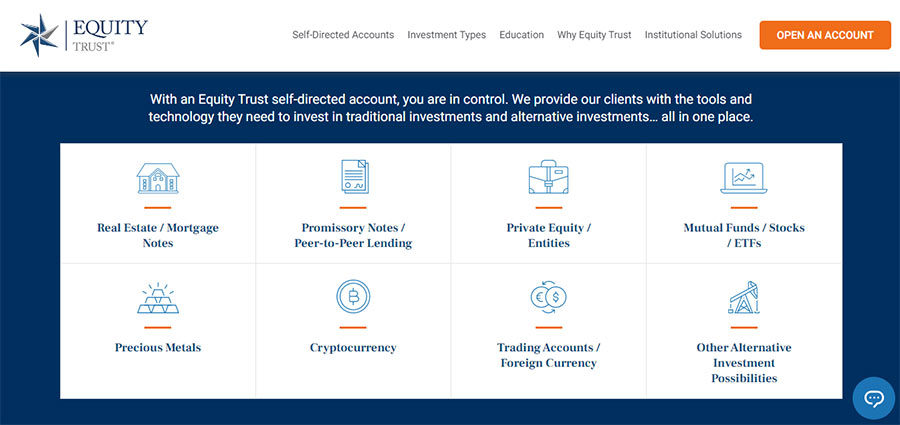

Equity Trust IRA Investment Options

When it comes to investing with an Equity Trust IRA, you have a variety of options available to you.

Equity Trust Gold IRA Features

Here are just a few of the features that make Equity Trust gold IRAs stand out:

Guided Opening Process

When customers choose to start a self-directed Gold IRA with Equity Trust, they are given comprehensive support every step of the way. Investment liaisons are on hand to assist new customers using the firm's online investment platform.

Investment Options

Self-directed gold IRAs offer far more flexibility than standard IRAs. Oil and gas, cryptocurrency, commodities, precious metals, real estate and mutual funds are some alternative investments that can be held in an individual IRA, in addition to the more conventional stock, bond and mutual fund alternatives.

Custodian Services

Individuals and businesses can benefit from Equity Institutional's custodial services for non-qualified accounts since it provides a centralized location to manage, monitor and report on their investment holdings. For qualifying retirement funds, Equity Institutional can act only as a custodian. If you already have a qualified retirement plan, you can diversify it with this service so you don't have to transfer your entire amount.

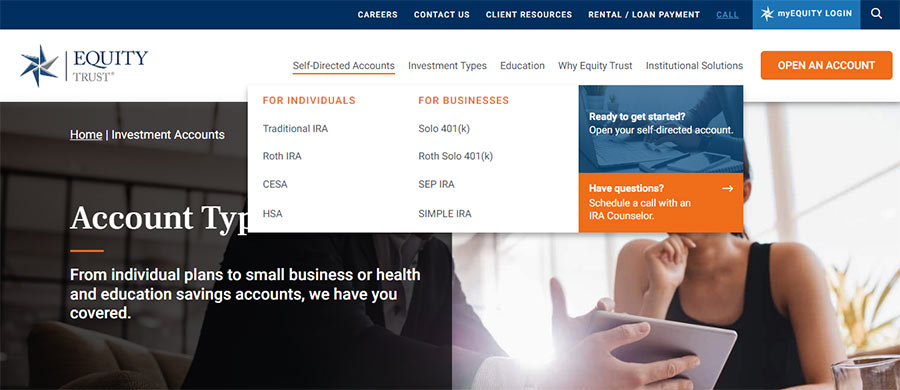

Coverdell Education Savings Account (CESA)

A CESA is a tax-advantaged savings account for post-secondary education costs. Investment gains accumulate tax-deferred and withdrawals are free of federal income tax if used to pay for certain expenses. These may be applied to the cost of registration, required readings and living expenses. Participants other than the account holder are welcome to deposit into the account.

Health Savings Account (HAS)

Equity Trust offers Health Savings Account (HSA) openings to its customers. Deposits can be made into the account and the funds can be used to pay for foreseeable medical expenses. One benefit is potentially reduced premiums, while another is tax savings.

Types of IRA Accounts Offered by Equity Trust

Equity Trust offers a variety of gold IRA options to meet the needs of investors.

Traditional Gold IRA

The Traditional Gold IRA is the most common type of gold IRA. It allows you to make contributions with pre-tax money, which can lower your taxes now while helping you save for the future. The money inside a Traditional IRA grows tax-free until you withdraw it in retirement when you pay taxes on the amount withdrawn.

With a Traditional IRA, you can contribute up to $6,500 per year or $7,500 if you're over 50. In addition, you can deduct your contributions from your taxable income, depending on your income level and other factors.

Your contributions also stay in the account until you're 59 ½ years old, at which point you can start withdrawing without penalty. This makes a Traditional IRA an excellent option for those looking to save for retirement.

Roth IRA

A Roth IRA is an individual retirement account (IRA) that allows you to save for retirement with after-tax dollars. This means that, unlike a Traditional IRA, your contributions to a Roth IRA are not tax deductible. Still, all qualified withdrawals from the account—including any earnings—are tax-free in retirement. In other words, you're already paying taxes upfront, so you don't have to pay them again when you retire.

A Roth IRA also allows you to take advantage of compounding growth potential; you can keep your money invested long-term and let it grow over time. Unlike a Traditional IRA, you also have more flexibility regarding when and how you withdraw funds. Plus, there's no required minimum distribution (RMD) from a Roth IRA, meaning you can leave the money in your account as long as you want.

If you're under 59 ½, you can still access your funds without penalty. Qualified withdrawals can be taken without incurring any taxes or penalties. However, you may need to pay income taxes on any earnings you withdraw before you reach 59 ½ (and you should always consult a tax advisor to ensure your withdrawal qualifies).

SEP IRA

A SEP IRA (Simplified Employee Pension Individual Retirement Account) is a retirement savings plan that allows employers to make contributions on behalf of their employees. It's easy to set up and maintain. It can be a desirable option for small business owners or self-employed individuals who may not have access to employer-sponsored retirement plans.

The contributions are made directly to the employee's retirement account and employees aren't taxed on the money until they withdraw it. Employers may contribute up to 25% of an employee's salary to a SEP IRA, up to a maximum contribution of $66,000 for 2023.

The contribution limit can change yearly, so it's important to check with the IRS to ensure you stay within the contribution limits.

SIMPLE IRA

A SIMPLE IRA (Savings Incentive Match Plan for Employees) is one of the most popular types of Individual Retirement Accounts (IRAs). It allows employers to set up a retirement plan for their employees and offer them tax-deferred savings with matching contributions.

SIMPLE IRAs are designed for small businesses or self-employed individuals who want to provide retirement benefits for their employees but don't have the resources or expertise to set up a more complex plan.

With a SIMPLE IRA, employers must make either matching or non-elective contributions to the accounts of eligible employees. The employer can choose to match their employee's contributions up to 3 percent of the employee's salary or make a non-elective contribution of 2 percent of each employee's salary, regardless of whether or not the employee contributes.

The maximum contribution to a SIMPLE IRA is $15,500 in 2023. In addition, employees aged 50 and over can contribute an extra $3,500 in "catch-up" contributions. Contributions are made pre-tax, reducing your taxable income in the year they are made. Earnings on the investments in a SIMPLE IRA grow tax-deferred until withdrawn.

Equity Trust Pricing and Fees

The firm's annual costs are laid out in a timetable and tiered list format on the company's website. Fees to open an IRA with Equity Trust range from $50 to $75, with the latter amount dependent on whether the application is submitted electronically or on paper. They also charge $150 for precious metals segregated storage and $100 for non-segregated storage.

The portfolio's value determines the subsequent annual fee, anything from $225 to $2,250. The first three months of the year are dedicated to handling these. Full and partial portfolio closures, asset reallocations and re-registration may all result in additional fees for the client.

There may be extra costs beyond what is outlined in Equity Trust's fee schedule, such as brokerage commissions, product-specific taxes and investing fees.

Pros & Cons of Equity Trust Gold IRA

Pros:

The Equity Trust IRA has many advantages that make it an attractive investment option. Here are some of the top reasons why you should consider an Equity Trust IRA:

Although Equity Trust is an excellent option for retirement savings, we highly recommend that you consider our recommended gold IRA companies. These companies offer better products and services, such as higher-quality gold bullion bars, a greater selection of metals, and a more comprehensive strategy to diversify your retirement portfolio. These gold IRA companies provide a higher level of customer service, with knowledgeable professionals that can answer your questions and provide helpful advice.

Cons:

Equity Trust can be a great way to invest in the stock market, but it does come with some potential drawbacks:

That's why we always recommend our clients consider other options which offer better services. Our highly recommended companies take pride in offering the best services with lower fees. They also provide more features and tools to help you manage your investments.

Bottom Line: Should You Consider Equity Trust Gold IRA?

Equity Trust is an excellent option for diversifying their retirement portfolio with gold. They make the process of investing in gold easy and accessible, even for those who are new to gold investing. They provide a secure and convenient way to store your gold and a variety of options for buying and selling it. Equity Trust also offers an IRA rollover to take advantage of tax-deferred savings.

Equity Trust does offer a good experience for its customers. However, the companies we recommend provide more comprehensive services with better customer service and transparent fees. If you're considering a gold IRA, look at our recommended companies first to ensure you get the best service and value possible.

Don't forget to check out our top recommended companies before investing!