The Entrust Group is a company that creates and maintains self-directed IRAs for customers. These are the only types of retirement account that can hold gold. If you want to secure some of your retirement in gold, you might be wondering whether the Entrust Group is a good choice.

We've taken a look at what the Entrust Group offers and what past customers have said about their service.

If you are interested in investing, make sure to take a look at our highest recommended companies for this year!

>> Click Here For A List Of The 5 Highest Recommended Precious Metals Investment Companies <<

About the Entrust Group

The Entrust Group is a large financial institution that's one of the more popular options for people opening self-directed IRAs. They also have a referral program that allows you to reap financial benefits by referring friends and family. However, their online reputation is questionable.

The company has been in the business for more than three decades. According to their website, their main goal is to help clients gain the information necessary to open their retirement accounts. They also help to educate clients about tax advantages, tax filing, and how maintaining a self-directed account works.

Today, the Entrust Group manages more than four billion dollars worth of assets. While some of these are held in gold, that's a small percentage of the overall accounting. There are self-directed IRA offices scattered all over the United States, meaning that you're more likely to find a local branch.

There are some non-retirement services offered as well, such as Health Savings Account management and Education Savings Account management. As with any licensed IRA custodian, the Entrust Group is subject to regular auditing and regulatory oversight.

The company's founder and CEO is Hubert Bromma, whose main background is in mergers and acquisitions, real estate, financial consulting, and alternative assets. Precious metals are a type of alternative asset, according to their definition by the IRS. The current president of the company is named Jason Craig.

Is Entrust Gold IRA a Scam?

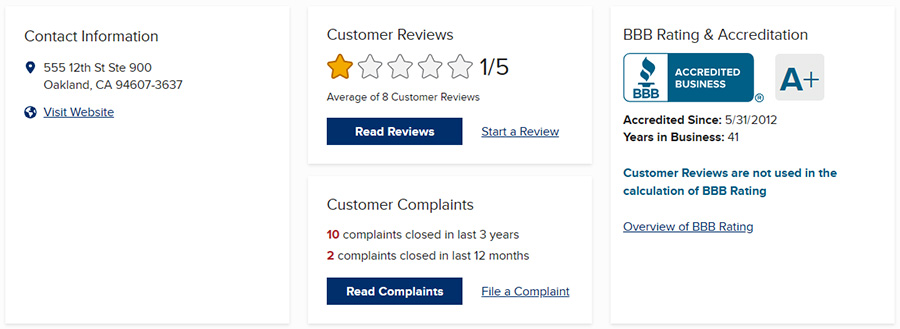

The Entrust Group's gold IRA does not appear to be a scam. They are an actual business with legitimate operations, as determined by the Better Business Bureau. The BBB gives them an A+ rating and has accredited them. But there are major issues when it comes to the company's customer reputation.

For one thing, the Entrust Group has just two stars on Yelp with over sixty reviews, indicating overwhelmingly negative feedback across the board. With the customer reviews on the BBB website, there are seven available to read, all of which give the lowest rating of 1/5 stars. A whopping nine complaints have been filed over the past three years.

Customer Complaints

Let's take a look at some of the customer feedback to see what's going on with the Entrust Group. While we won't be able to explore every single bad review online, we can examine a couple recent ones and see how the company responded. The Entrust Group has responded to 100% of the complaints filed against them.

Refusal to Close Accounts

One complaint was written in November of 2022 by a customer who had opened two accounts with the company in December of 2015. The goal was to hold a few private stock shares. Two years later, in 2017, the customer created paperwork to move the funds out of the Entrust account because they did not want to pay the fees any longer.

It had been five years since filing that initial paperwork, and the account still had not been closed. In that time, the Entrust Group was able to collect around $5,000 in ongoing fees to keep the account open. The customer said that the accounts were empty and that their Entrust representative was not able to find the stocks at all.

They further went on to say that their account was fully deleted after the representative could not find their assets. However, their wife's account held assets and was being continually charged. During the entire debacle, they had only received a one sentence email from the Entrust Group saying that the company was not liable for any of the issues.

The customer said that when they were sold the stock, the paperwork was filed incorrectly. But they were never warned about this possibility or about the regulations. They said that they should not have been permitted to create the account without having proper registration paperwork, especially since the Entrust Group charged them fees.

The business responded a few weeks later to say that somebody had been in touch with the customer about the active account. They attached paperwork and email communications stating that the Entrust Group had never committed any errors in how they had handled either account. Furthermore, they stated that they couldn't close the wife's account because there were still assets inside.

The customer said that they found the response totally unacceptable. It had been five years without any assistance from the company, and the account was continuing to accrue fees. They also said that the company had baited them into signing a contract while knowing that they didn't have a full understanding of what the contract entailed.

That's not a great look overall for the Entrust Group.

Double Charged Credit Card

Another complaint was also filed in November of 2022 by a different customer. Like the first complaint, this customer was trying to transfer the funds from their Entrust Gold account to a different custodian.

In the customer's original letter, they said that the whole balance should be transferred and the account closed. The transfer and closure fees should have been paid out of the balance. But instead of doing that, the Entrust Group transferred the funds and then charged the fees when there were zero dollars in the account.

The customer gave the company their credit card in order to pay the fees. This charge properly went through. However, the credit card was given a charge of twice the amount that the customer had been quoted. The customer was disgruntled by this but relieved about the account closure.

But it turned out that the account hadn't actually been closed. Not only that, but the customer didn't have any other way to close the account. So the Entrust Group continued to charge fees to the customer for an account with zero dollars in it.

The Entrust Group responded to this to apologize. They said that they had erred in charging the customer twice, and that they had refunded the additional fee. The customer said that they found this resolution to be satisfactory enough. However, there were no comments on either side about all of the red tape and difficulty in closing the account in the first place.

Struggling with Account Management

One client left a complaint in February of 2021 regarding a Roth IRA that he had opened with the Entrust Group. He initially opened the account with the help of one customer representative, who then transferred him to another account manager.

The first representative had handled everything fine. But the customer began to have trouble with the second representative, as she was repeatedly asking him to make document changes each day. He informed her that he was too busy to change the contract every single day.

The customer was then told that another account manager would be assigned to the account instead. However, since that conversation, the customer had not ever been contacted by a new manager. He did not believe that his account had been transferred to another representative.

The company responded to say that they care a lot about customer service, so they had changed the customer's account manager. They gave the customer the new manager's name and said that he would reach out to the customer soon.

A week later, the Entrust Group followed up with a second response. They said that the client wasn't happy, but that the new account manager had been prompt and courteous in his responses. Then they encouraged the customer to get in contact with their direct Client Services Department.

The customer said that they were rejecting the response because it contained falsehoods. They said that there had been several times that the account manager had failed entirely to return calls and emails. The business never responded again, so the complaint is still considered unresolved.

All of the other complaints have not been published on the website, either because the customer asked to keep their grievance private or because the complaint was removed after being resolved. But there are several negative reviews as well.

Years of Misfiled Paperwork

One customer left an irate review in June of 2021 regarding her husband's retirement account. Her husband had passed away two years earlier. As the beneficiary of his retirement account, his wife had been trying to transfer the account into her name. She had filed all of the necessary paperwork more than a year prior.

When she called the company to ask about the status of the account, she was told that her paperwork had been lost or misfiled. So the account was still in the name of her deceased husband. As such, she was unable to manage or benefit from the account. Again, it had been two years since her husband's death.

Because these reviews do not contribute to the BBB's score, the Entrust Group is not obligated to respond to them. And indeed, they chose not to respond to this one. That doesn't look great for them, but neither does anything else on this page.

Difficulty Communicating

One irritated customer left a review in May of 2021 stating that the Entrust Group is the worst IRA company that he has ever worked with. Whenever he would try to get in direct contact with the company, he would be kept on hold for long periods of time. The company's advertisements would play repeatedly while nobody ever picked up the phone.

The customer also noted that the company website says that they charge comparable fees to their competitors. But this isn't true. The Entrust Group's fees are significantly higher than those of other companies, and they aren't transparent. The customer said that he was overcharged for poor service and would never wish his experiences on anyone.

The company did respond to this review. They said that they were sorry that they hadn't met his expectations, and that the feedback had been given to the Customer Service team. Furthermore, they said that they would use the feedback to grow and do better. But given the state of all of the reviews and complaints since, it doesn't seem like that has happened.

Pros & Cons of Entrust Gold

Pros:

Cons:

Final Thoughts

There's no doubt that the Entrust Group is a legitimate company. They are a licensed provider of self-directed IRAs with offices throughout the United States. While they don't focus exclusively on gold, they do have several billion dollars in managed assets.

However, their reputation is so poor that we absolutely cannot recommend them. The vast majority of online customer feedback is negative. Customers report spending literal years trying to close and transfer accounts. They have complained about poor customer service, lack of responses to emails, misfiling of paperwork, purposefully misleading policies, and high fees.

On top of this, you'd have to do your own depository research and choose a depository. Then you'd have to find a gold dealer to work with the Entrust Group.

We recommend working with a company like Goldco or Augusta Precious Metals instead if you're looking to open a gold IRA.

Don't forget to check out our top recommended companies before investing!