Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Do you want to diversify the assets in your retirement portfolio? Maybe you want to invest a portion of your assets into stable ventures, so you have a cushion if the stock market crashes. Maybe you want to experiment with riskier returns, like Bitcoin and other cryptocurrency.

There are tons of ways to save for your retirement using alternative assets. These assets have been IRS-approved for use in self-directed IRAs, as long as you comply with regulations. Broad Financial is a company that aims to help people open their self-directed IRAs using a variety of different assets.

So is Broad Financial a legitimate company? What do people have to say about them? And how do they perform when compared to other providers of self-directed IRAs?

We've taken a look at everything you need to know. Here's what we've found.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if Broad Financial made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

About Broad Financial

Broad Financial has been in business since 2004. The financial services and investment company has a headquarters in New Jersey. When the firm first started, it was based around private real estate investments. But today, they've branched out to cover much more.

In addition to specializing in real estate, the company specializes in investment areas such as:

They are one of the premier services for people who want to use Bitcoin in their retirement account. Their main partner is the Madison Trust Company. When you open a self-directed IRA of any kind, Madison will work alongside you as the account custodian.

Cryptocurrency is a decentralized type of currency that only exists digitally. There are different types of cryptocurrency on the market, with Bitcoin being the most well-known. Different cryptocurrency is mined in different ways, and the price can fluctuate wildly.

Certain investors believe that cryptocurrencies like Bitcoin are important for diversification. Digital currencies are not subject to the same fluctuations as the global market. However, they are also a high-risk investment, as they can lose a lot of their value very quickly.

If you are interested in investing in bitcoin for your retirement, you can use the Bitcoin IRA services set up by Broad Financial. You'll pay a basic fee for setup, along with annual fees for account maintenance. From there, you can buy and sell cryptocurrency based on your budget and retirement needs.

Bitcoin IRA Information

The IRS has recently approved cryptocurrency as an alternative type of retirement asset. If you already know what type of crypto you want to invest in, Broad Financial might be the company for you. They're one of the top rated companies for people who want to invest independently of official financial advice.

In addition to purchasing Bitcoin, you can also use the company's platforms to trade in a variety of other cryptocurrencies. You also have a choice between a Roth or traditional IRA setup. Roth IRAs allow you to pay taxes now so that you don't have to pay them on distributions. With traditional IRAs, you don't pay taxes until you take distributions.

Roth IRAs are ideal for people who have a high net worth. They will allow you to avoid paying taxes on investments that grow exponentially. Traditional IRAs are a good choice if you want to be able to save all of your income without worrying about taxes until you're taking distributions.

Before you make a decision about your cryptocurrency investments, you should also get familiar with the IRS rules about cryptocurrency taxes.

You can invest in virtually any cryptocurrency using Broad Financial. Though Bitcoin is the best known cryptocurrency in the global market, some people prefer to speculate with lesser known alternatives. The company will create an LLC that allows you to invest in whatever crypto you want.

Once you have your LLC, you can create an investment account. This will be used to fund cryptocurrency purchases through either a digital Bitcoin wallet or a more diversified online exchange.

There are some significant differences between Broad Financial's setup and the setup of other brokerages. This company's setup allows you more complete control over your assets. But it might not be the best choice if you're looking for someone to advise you on what to purchase.

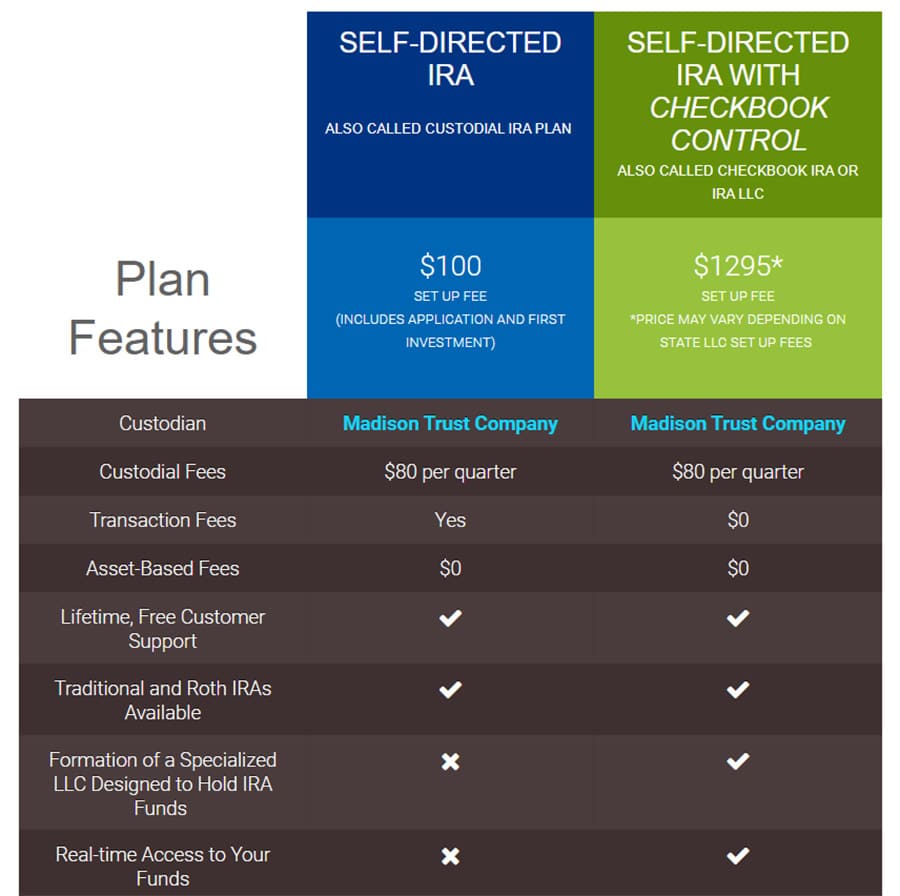

Fees and Pricing

Let's take a look at the fees, pricing, and general account setup of the company. In particular, let's compare it to other brokerage setups.

With Broad Financial, you will need to pay a flat setup fee of 1,295 dollars. There will be an ongoing annual maintenance fee of 320 dollars, which includes access to your account and quarterly reports.

With other brokers, the setup fees and annual maintenance fees tend to be a percentage of your holdings. They might take up to 15 percent of your portfolio's value. So if you're planning to invest a lot, that 1,295 dollar setup fee might actually be cheaper.

You have a significant amount of control when you use a Broad Financial self-directed IRA. For example, you'll be the only person with access to the funds. You'll have full control over your investments and cryptocurrency exchanges.

Another important note is that since Broad Financial specializes in many different alternative assets, you can also include real estate and stocks in your self-directed IRA. If you want a diverse range of different investments all in the same account, you don't have to look any further.

With traditional brokerage setups, the broker is the one who accesses your funds, chooses your investments, and decides what cryptocurrency to exchange. Traditional companies also only allow you to invest in bitcoin, rather than adding other cryptocurrencies or real estate.

How to Invest

If you want to get started with your own self-directed cryptocurrency IRA, it's best to call a Broad Financial representative and talk about your options. You'll learn about the setup process, the legal ramifications, and the fees you can expect to pay.

In most cases, an account will take anywhere from two to three weeks to get set up. You'll just need to follow this basic six step process:

Once all of this is done, you're ready to buy, sell, and trade cryptocurrency however you want.

Is Broad Financial a Scam?

Broad Financial is not a scam. In fact, this is one of the best-rated companies for DIY cryptocurrency investment. It's also a good choice for people who know exactly what alternative assets they want to invest in.

With this company, you get a lot more control over your assets than with competing brokerages. You'll be able to choose exactly what you invest in, when you make trades, and whether you make exchanges. You'll also work closely with Madison Trust Company instead of communicating with them through Broad Financial.

The company will go to the trouble of setting up an LLC for you. They're experts in the required paperwork, so they can streamline the entire process. They can also advise you about the legal and tax ramifications of this action.

However, they don't offer much investment advice regarding what cryptocurrency or alternative asset is best for your portfolio. If you're looking for a company to tell you what to invest in, this might not be the best one for you.

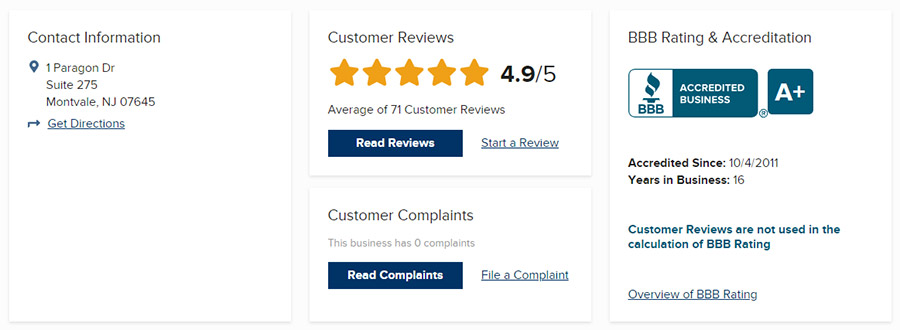

Consumer Reviews

Broad Financial has largely excellent customer reviews. They are accredited with the Better Business Bureau and have an overall grade of A+. In addition, there are 71 customer reviews of the company, with a total average of 4.9 out of 5 stars. This indicates that people have had overwhelmingly positive experiences.

One of the only complaints about the company indicates that the person was not given the right type of account for their ideal investment. When they asked for a refund, the company refused. This person says that the company made the process too simple and did not understand what they wanted or needed.

This complaint seems to be related to a lack of personal knowledge. If you're going to set up a cryptocurrency IRA, you should do research beforehand to make sure you understand what you're signing up for. There are complicated regulations in place for different investments, so the type of investment will affect the account that's best for you.

Pros and Cons

Pros:

Cons:

Final Thoughts

Broad Financial is an excellent choice if you want to have complete, independent control over your self-directed IRA. You can use their platform to invest in any cryptocurrency you want, as well as to exchange and sell your assets on the open market.

In addition to specializing in cryptocurrency, Broad Financial will also allow you to invest in real estate, stocks, bonds, precious metals, and any other assets that can be held in an IRA.

If you're determined to create your own independent investment portfolio, this company will give you all of the assets to do it. But if you want more dedicated advice about different cryptocurrency and precious metals investments, you should go with a more traditional brokerage option.

Although we do think that Broad Financial is a solid company, we believe that there are better companies out there to make your investment with if you are investing in precious metals.

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Or, continue with Broad Financial...