Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Accuplan is a company that specializes in self-directed IRAs. They offer a variety of different alternative assets that comply with IRS regulations, including real estate and precious metals. It's unusual for a company to specialize in both real estate and precious metals for IRAs.

However, Accuplan also lacks transparency with their customers. They have confusing information on their website that's meant to deliberately mislead people. They refuse to work with the Better Business Bureau. Every single one of the fifteen Yelp reviews online is just one star.

This is not the kind of company that you want to invest money with. They're one of the worst-reviewed companies on the market, made worse because of how hard it is to find any positive feedback whatsoever. Basically, no matter how bad the customer service is at another company, it's functionally guaranteed to be better than Accuplan.

We've examined how the company works, what they offer, and what people have to say about them.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if Accuplan made our list this year by checking our updated list of top 5 precious metals investment companies above (if precious metals is what you are after)!

About the Company

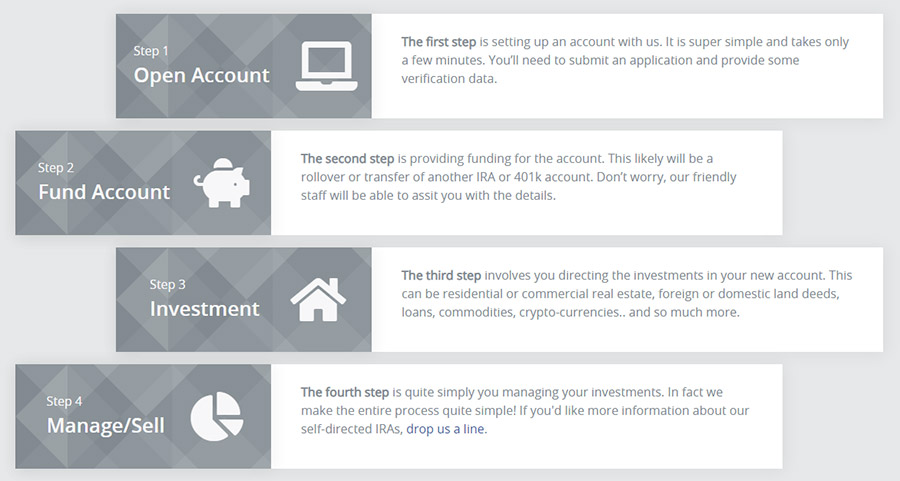

According to the company website, the goal is to help people create self-directed IRAs and purchase real estate or precious metals with them. They offer some free tools regarding real estate investments, which are meant to help people plan for retirement.

The company also partners with media personalities like HGTV stars to host workshops. Unfortunately, they seem to use these workshops as a tool to rope people into fraudulent investments. (More on that in the Customer Reviews section.)

Accuplan has been around since 1993 and is based in Utah. While they originally worked with local clientele, they have since branched out, largely by using their celebrity partnerships and workshops to interest people across the US.

Self-Directed IRA Confusion

To understand what the company offers, it's important to understand what a self-directed IRA is.

An individual retirement account is one that you have without an employer. Most people use managed IRAs. These are handled by a financial advisor or investment broker who allocates your assets based on your risk tolerance.

Self-directed IRAs are ones that you manage yourself. You have the freedom to choose each of your investments, as long as you comply with IRS regulations.

Accuplan says that they cannot offer advice on self-directed IRAs. They can't give you guidance on what real estate you should buy or how much you should invest in precious metals.

This is a confusing statement.

For one thing, plenty of other self-directed IRA brokers do offer advice. Precious metals dealers can explain the advantages and risks of different metals, make suggestions based on your risk tolerance, and help you finalize purchases.

Accuplan claims it's illegal for them to do that. If that's the case, why are so many reputable companies managing just fine?

Another puzzling thing is that if you don't have any outside advice, you need to be an investment expert to make the right choices. You have to do a lot of research and have a firm financial background. You need to understand the real estate and precious metals markets inside and out.

If that's the case, why does the company prey on elderly people who don't have an investment background? The customer service representatives confuse older people into making massive credit card purchases and rolling over thousands of dollars of their retirement.

Shouldn't Accuplan be looking for experienced investors who are already prepared to take control of their own accounts?

This whole setup reeks of manipulation. It seems obvious that the company is just making excuses for why their service is so abysmal. That kind of predatory misinformation is a huge red flag.

Customer Reviews

The customer reviews of Accuplan are basically universally bad.

That's pretty difficult for a company to achieve! So we have to give them points for consistency. They have managed to alienate every single person who's ever worked with them, while providing absolutely no good customer experiences.

Accuplan is not accredited with the BBB. And the company has indicated that it will not work with the BBB at all anymore. That means that there is no way for anyone to receive a refund or resolution by using the BBB service.

The BBB is an important third party watchdog. They help customers get resolutions for their issues, and they post company reviews so that people can see whether a business is worth it. Many companies work hard to have a good BBB rating. Accuplan isn't even pretending to care about their reputation.

Ripoff Reports

There are two ripoff reports on the internet. Ripoff Report is another watchdog organization that allows people to lodge complaints and raise awareness about scams. They also give businesses a chance to respond to the complaints.

One report says that the person first heard about the company through a mail flyer. They were invited to a free workshop to learn about wholesaling real estate. Once they'd gone to the workshop, they were told to spend two thousand dollars to learn how to wholesale real estate without needing to invest their own money.

The client did this. At the event, every attendee was asked to purchase a package costing 42,000 dollars. After they used their credit card to make this purchase, the customer's credit dropped by over one hundred points. The company treated the client to a stay at the Luxor Hotel, paying for all expenses.

The client was then asked to transfer their retirement money into a self-directed IRA handled by Accuplan. Accuplan would then invest in real estate on the client's behalf. The idea was to bring in rent income by using the Deed of Trust.

Accuplan priced the properties at much higher than their market value. The client agreed to purchase their Deed of Trust at over 45,000 dollars. They were supposed to receive at least 10 percent in returns every month for the next three years.

The client did receive their dividends for the beginning of this time period. In August of 2016, two years in, they stopped receiving payments. The company then asked the client to stop paying interest so their loan could be refinanced and returned.

That process was supposed to take six weeks at the most. A year later, the client had still not received their money back. The last message they got indicated that Accuplan would make no more efforts to get their money back.

The other report is also related to real estate investments. The author is a 72-year-old woman. She is not able to use electronics or a computer, so her son typed the complaint as she dictated to him.

The customer told the company that she could not use electronics. They said they would handle things over the phone. They talked her into making 30,000 dollars in credit card charges. After attending a seminar, they also talked her into transferring her entire IRA to the company.

The company then bought real estate with the money, as they had been hired to do. Several months after this, they told the client that there were 15,000 dollars in property damages. The company had given the property manager 7,000 dollars and wanted the client to pay the rest.

The company presented the client with a settlement. The agreement stated that they would not post about their discontent on social media or talk to a lawyer. The client refused to sign.

Following the incident, the client did her best to get in contact with the manager of the property. She asked the company to give her pictures explaining what had been done to the property with her money. She asked for the contractor's name.

The company did not help her. Once she made these requests, they stopped calling her altogether. They refused to pick up her calls. Then they began sending threatening letters about taxes and bills that the client supposedly owed on properties she had never invested in.

The client said that she could not pay off her credit card debt or pay the charges the company had filed. She said that she spent most of her time crying, that she struggled to sleep, and that she had developed high blood pressure and constant anxiety.

Yelp Reviews

As of writing, there are fourteen reviews of Accuplan on Yelp. All have one star. Not a single person gave the company anything better than the worst markings possible. Many reviews say that they would give the company zero or negative stars if they could.

It's also worth noting that since Accuplan refuses to cooperate with the BBB, these people may not have had another choice but to turn to Yelp.

The most recent review says that the company purposefully stalls, obfuscates, and confuses people. They have inconsistent information, and their "experts" prey on elderly people. Their service reps bully and frighten people into compliance.

Given the ripoff reports about the company, this seems disturbingly credible.

Another review says that the company is completely useless at helping with the self-directed IRA process. They're supposed to make it easier to manage your real estate and precious metals transactions. But if you try to make any transactions, they'll charge a fee, overcomplicate the process, and leave you to do the work yourself.

Many people say that the company representatives are friendly, encouraging, and helpful... until after you invest. If you want to get your money back, receive the returns you were promised, or get information about your investments, they become bullies who refuse to help.

People have also noted that even when the company does as asked, they take an absurdly long time. They stall for days to weeks on tasks that should be done within minutes or hours. They cost people buyers and potential sales because of their malicious incompetence.

Several individuals have suggested starting a class action lawsuit because of how similar their complaints are. Some people have lost all of their retirement savings. There's no information right now on whether a class action is being filed, but it seems like only a matter of time.

The degree of stalling is significant enough to be considered malicious. Multiple customers have said that they will stall on every single part of the transaction, transfer, or closure. For example, one person had documents mailed overnight to the company. Accuplan didn't process them until a month later.

Every time people try to go through the process of closing an account or transferring funds, Accuplan makes it more complicated than it needs to be. Instead of simplifying the transaction like they're supposed to, they make it more difficult than if a person was working on their own.

People have also stated that Accuplan never follows through on their projected timelines. The customers are told that a transfer or closure will take 48 hours to finish. After 48 hours, they've heard nothing from the company. Any attempts to call just result in rude agents refusing to offer information.

Final Thoughts

In theory, Accuplan provides valuable services. They help people set up self-directed IRA accounts with real estate and precious metals, so they can earn dividends and have a stable source of income.

But they are not a good company. Their practices are so awful that many people have discussed the possibility of starting a class-action lawsuit. Every review of them online is universally terrible, with some people saying that they were treated so poorly they've developed anxiety attacks about it.

The company will do everything in its power to hold onto your money. Once your initial purchase is done, they will make no effort to assist you in transfers of funds, account closures, or other important details. In addition, the agents are dishonest about their motives, and they misuse the funds they're given.

Even when people haven't tried to close their account, they've reported that the company has invested in faulty properties, sent threatening letters, refused to provide investment information, and offered paltry settlements to keep people from speaking to lawyers.

These practices are extremely disturbing. We cannot recommend a company that does this. Considering the mixture of misinformation on their website, refusal to cooperate with the BBB, and abysmal reviews elsewhere, we have to give this place a resounding "NO."

If you want to invest in real estate or precious metals using your IRA funds, you can do so! There are many companies that can help with exactly that. These companies provide actual advice about investments, have transparent pricing, and foster good customer service throughout your relationship with them.

You want to entrust your money to a place that won't misuse it. Accuplan is not that place.

We don't really think that Accuplan is a great company, and we believe that there are better companies out there to make your investment with if you are looking to invest in precious metals.

===> Click here to see our top 5 recommended companies

Or, continue with Accuplan...