Disclaimer: Some or all of the companies listed here may provide us compensation. This is a part of how we maintain our free service for consumers. Compensation, along with hundreds of hours of in-depth research determines the results of our reviews.

Setting up an IRA to secure your retirement years should be a priority for American. Did you know that IRS rules also enable you to invest in alternative assets, such as precious metals, cryptocurrencies, or real estate, in your IRA? IRA Financial Group is an IRA custodian company that can help you add these alternative assets to a retirement account.

In the next few sections, we'll share more information about IRA Financial Group and how the company works. We'll also let you know what reviews from other customers and review sites say to help you make the right decision about whether you'd like to use IRA Financial Group to invest in alternative assets in your retirement account.

Important! Before we go on with this review...

Picking the right company to invest with is a huge financial decision. We understand this and we take pride in providing accurate and reliable information. We are always continuing to research and update our recommendations!

===> Click here to see our current top 5 recommended companies

See if IRA Financial Group made our list this year by checking our updated list of top 5 precious metals investment companies above!

Or you can get a free precious metals investment kit from our #1 recommended company right now!

About IRA Financial Group

IRA Financial Group is an IRA custodian company that can help individuals invest in alternative assets for an IRA. The company was founded by Adam Bergman, who previously worked as a tax and ERISA attorney at well-known and respected law firms.

Bergman wanted to create a company that would give individuals greater freedom in choosing what assets they wished to hold in their retirement plan. The company prides itself in the numerous investment opportunities they are able to offer to their clients. They employ a team of tax specialists and ERISA professionals who ensure that the company follows the guidelines set out by the IRS. IRA Financial Group also offers full audit guarantee for their clients.

How IRA Financial Group Works

One of IRA Financial Groups main goals is to make investing in alternative assets for a retirement account as easy as possible for their customers. They offer an easy-to-use app that allows customers to set up, manage, and track their investments. This is drastically different from other companies which have a much more complicated process investors must follow to get started.

IRA Financial Group charges flat fees for their services. There are no minimum investment amounts or balance requirements like you'll see with many other companies. The fees are displayed on the website to remove the mystery.

These fees include:

You can sign up online to easily open an account with IRA Financial Group. If you still have questions about would like to speak to a member of the team, you can fill out the form online or call the company directly.

Self-Directed IRAs

IRA Financial Group can help you set up a Self-Directed IRA. With a Self-Directed IRA, you're able to hold alternative assets in your IRA other than the traditional stocks and bonds. These alternative assets may include precious metals, real estate, and other options that we'll explore below.

You can either open a standard Self-Directed IRA or a Self-Directed IRA LLC. With a Self-Directed IRA LLC (limited liability company), you become the manage of your account and can make your own financial and investment decisions for your IRA. With a standard Self-Directed IRA, investment decisions will require consent from your IRA custodian. If you don't foresee a large number of transactions, a standard Self-Directed IRA may be best.

Solo 401(k)s

A Solo 401(k) allows you to contribute up to $58,000 in contribution each year. With IRA Financial Group, these contributions can be in the form of alternative assets to help you build your wealth and diversify your portfolio. One benefit of a 401(k) is that you're able to borrow up to $50,000 from your account to take care of other expenses that come up.

401(k)s do not require a custodian, so you will be able to make investments on your own. Also, unless your account is worth more than $250,000, there aren't annual filing requirements for 401(k)s. IRA Financial Group does not charge any transaction fees; there is only one flat fee to worry about.

ROBS Solution

A ROBS Solution is a legal way that you can invest in an existing or new business with your retirement funds. To do this, you'll need to set up a C Corporation, have the C Corp adopt a 401(k) plan, and choose to participate in this new plan. You can then rollover your 401(k) from your previous employer into this new plan.

Next, purchase the stock for your new C Corp with your 401(k) and the C Corp can leverage the proceeds from your stock purchase to buy the necessary assets for the business.

If you think this solution sounds like a good fit for you, reach out to IRA Financial Group to learn more!

Investment Opportunities

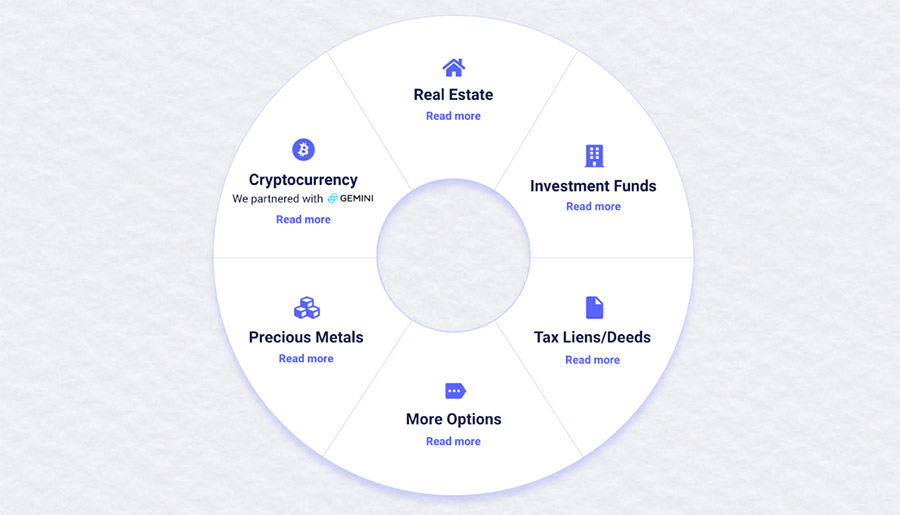

Most other IRA custodian companies only allow individuals to invest in stocks and bonds. However, with IRA Financial Group, you'll enjoy many more investment options. Their Self-Directed retirement plans allow you to add alternative assets to your account, grow your wealth through the income those assets generate, and take advantage of the tax-free investing for retirement accounts.

Some of the many assets you can hold in a Self-Directed plan include:

Are There Any Red Flags for IRA Financial Group?

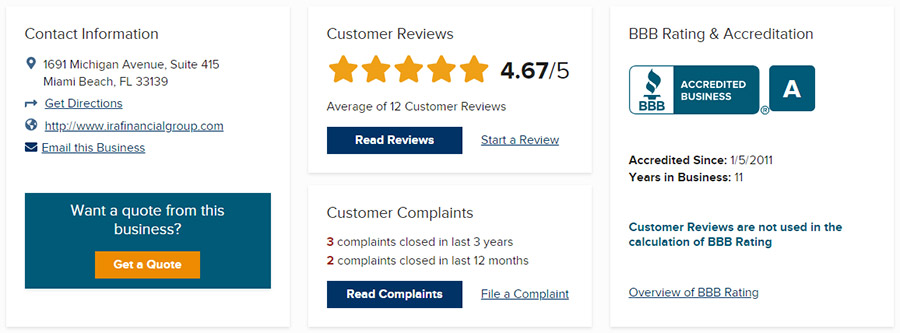

We looked through trusted online review sites for ratings and reviews for IRA Financial Group. We listed the ratings we could locate from the Better Business Bureau, Business Consumer Alliance, TrustLink, and Trustpilot.

Reading through reviews from other clients to see their interactions with the company and what they thought of their experiences is important when making such a big decision as choosing the custodian for your retirement account.

As you can see, where IRA Financial Group has reviews, the reviews are overall positive. However, there just aren't that many reviews out there. This could just mean that few customers have taken the time to review them, but for such an important decision as who to choose to be the custodian of your IRA, this is a bit worrisome.

You can do further online searches to read through reviews from other review sites if you'd like to see what other customers say about IRA Financial Group.

Is IRA Financial Group a Scam?

IRA Financial Group is not a scam. The company has been in business for over 10 years and has a physical address and location. They actually offer the custodian services described on their website.

Now, the choice is really yours as to whether you want to give your business to IRA Financial Group. Personally, we would not advise you to do so. As we mentioned above, there just aren't many reviews from previous customers and clients out there. There are other companies that have significantly more online reviews.

Customer reviews really tell the story of a company and how they do business. Choosing one with so few reviews could work out in your favor, but it is a huge gamble.

There have also been three complaints against IRA Financial Group over the past three years. This isn't a ton, but again, there are other companies out there who don't have any complaints against them with the BBB. Two of these complaints were related to billing and being charged for services that were not requested. The third complaint was about the company's sales and advertising practices.

IRA Financial Group has an A rating from the Better Business Bureau. This may sound high, but it is not the company's highest rating of an A+. This isn't necessarily a reason to go with another company, but combined with the small number of available reviews and the fact that so many other companies do have that A+ rating, it definitely adds another important piece to your decision.

Features

Pros:

Cons:

Final Verdict

IRA Financial Group is an IRA custodian company for individuals looking to hold alternative assets, such as precious metals or real estate in their IRA. If you're looking for this type of service, we would not recommend choosing IRA Financial Group. The lack of reviews from customers and the fact that they only have an A rating, not an A+ rating, from the BBB tells us, and should tell you, that there are other better options out there for you.

Although we do think that IRA Financial Group is a decent company, we believe that there are better companies out there to make your investment with.

Or you can get a free precious metals investment kit from our #1 recommended company right now!

Or, continue with IRA Financial Group...